Best Of

Re: We're looking for feedback on the Spending Plan!

ok, I don't particularly like it.

I'd rather have something different.

Now that you have the new Income & Expenses report, you would be great to have a version of that report that includes the budget. On a monthly basis.

How much do I budget per month on each category/sub-category?

Show that compared to actuals.

That would be all I needed.

Re: Understanding – Pending in Transaction Activity

@Dick_Davis I'm glad @DryHeat gave you that extra information. And just to show you more complications, there are some banks that download pending transactions twice and it often makes a duplicate! This happens with my local bank when we make Debit Card transactions. On the first day, it downloads the pending transaction with that day's date. On day 2, it downloads the pending transaction again with today's date. Then on Day 3, it clears it.

Since I tend to edit the transaction and split it, if necessary, on day 1, I end up having to delete the second downloaded pending. This doesn't hurt, because it's only the final transaction that matters. Pending transactions just help you keep up with your available balance. This can be important if you keep a small balance in an account as you don't want to overdraw.

My current policy is that I only enter manual transactions for accounts that don't download the pending transactions (Capital One, Fidelity Cash Management) but I wait for the downloads from banks that do download pending (Chase, American Express).

Once you get the hang of it, it isn't too complicated. Just be aware of your banks' peculiarities.

SRC54

SRC54

Re: Understanding – Pending in Transaction Activity

Thank you for the information and the reference.

Re: Understanding – Pending in Transaction Activity

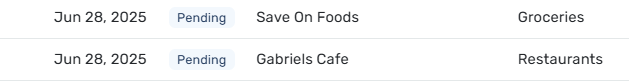

Not all "Pending" transactions are manually created. Some banks accounts and credit cards download Pending transactions and some don't. For example, my Amazon-Chase credit card downloads Pending transactions to Simplifi. If I look on the Chase website, I see that the same transactions are listed as Pending there. In Simplifi they look like manually entered transactions:

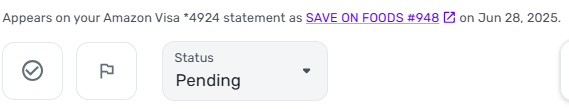

If you open the detail view for one of these you can see that they were downloaded because they show the original statement payee name:

Such pending transactions are later converted to cleared transactions both on the credit card website and in Simplifi — if all the downloading and matching goes well.

DryHeat

DryHeat

Re: Manage Credit Cards

@countrycloudboy just to be clear, are you inquiring about credit card management in Quicken Simplifi (QS) or Quicken Classic (QC)? These are two different apps that with two different ways of functioning. If you are asking about QC, you will need to go to the Quicke Classic forum for accurate input.

If you are referring to Quicken Simplifi, is this the support article you read?

DannyB

DannyB

Re: Support multiple currencies

As a user, I'd like the ability to handle both Canadian and US accounts, representing both in whichever base currency I choose like in Quicken for Mac.

Background: I'm currently paying for both Simplifi and Quicken subscriptions. I was hoping Simplifi could be, well, a simpler Quicken for me (not because Quicken is too complicated - I love the features - but because I don't have time to spend managing it). It's not too far off, but there are some pain points, this being of the more painful sort.