Best Of

Split Transactions - Add "Note" field to each split (1 Merged Vote)

When splitting transactions, it would be nice to be able to add notes about that split, just like you can in non-split transactions. Adding "Tags" is nice, but I find "Notes" more useful than "Tags".

Add ability to mark discussions as "read" in the Recent Discussions list

I frequently check the Recent Discussions list for new posts. Conveniently, posts I have not looked at show up in bold. But there are many posts that I don't want to look at (usually because they deal with a specific institution that I don't use and where I know I cannot offer any meaningful advice).

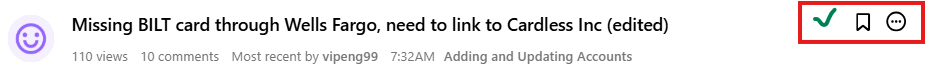

It would be nice if we could mark a discussion as "read" using the three-dot menu on the right hand side of the listing. It would be even better if there were an icon (like the green check mark I added below) so that we could mark items as "read" with just one click.

DryHeat

DryHeat

Re: Add support for BILT Rewards Mastercard

Hello everyone,

We will add Cardless to Quicken Simplifi, enabling users to connect their Bilt cards. I believe this connection option is available via our Plaid aggregator. We don't have an ETA yet, but we'll post an update here as soon as we have news to share.

Thank you all for your patience as we work to implement this!

Add a Cash Flow Report (edited)

I recommend expanding Simplifi's report options to include a Cash Flow report with the ability to select either the last 6 months or the current year. This feature would provide a comprehensive view of finances, similar to the reports available in Quicken Classic or QBO Profit & Loss reports. While Simplifi focuses on user-friendly management and simplicity, offering additional reports would greatly benefit many users.

Re: Add support for BILT Rewards Mastercard

This is a requirement for me, if we go too long without this, I'll have to look at alternatives.

Projected Cash Flow: One line that represents all selected accounts (edited)

Coming from Pocketsmith, the cash flow graph is essential for me. I would love it if the graph were customizable. What I am looking for is the ability to group accounts into 1 or more lines for forecasting, not just each individual lines. I use my rewards credit cards to pay for most items then fully pay off my credit cards with my checking account later in the month. I would like to combine those accounts (cards + checking) into 1 forecast to see the bigger picture.

Re: BILT Mastercard no longer supported via Wells Fargo API, Switched to Cardless Inc (edited)

Thanks for taking this seriously @Coach Natalie , this is huge issue for me.

Show number of transactions linked to a category or tag when viewing Settings > Categories & Tags

When in settings and viewing the categories (or tags) there is no way to see if the category is used or how many transactions are linked to it.

In Quicken there is this capability and I have found it very useful for determining lightly used categories or unused categories. It is very useful for consolidating categories and simplifying the list.

Please add a column that displays the number of transactions liinked to each category. And it would be great if that number was hot-linked to a filtered report that would filter and show all the transactions assigned to that respective category.

Re: BILT Mastercard no longer supported via Wells Fargo API, Switched to Cardless Inc (edited)

@ambronet, thank you!

I have gotten this issue escalated and will post back here with updates. I will let you all know if we need that screenshot to add additional examples, but for now, you all can hold off on providing that additional information.

Fingers crossed for a swift fix for you all!

CTP-16256

BILT Mastercard no longer supported via Wells Fargo API, Switched to Cardless Inc (edited)

I would like to participate in the escalation for developing the BILT 2.0 integration.

Ref: