Best Of

Re: ⭐️ 1 Star – Love almost everything… but this one flaw ruins it

@larenl ,

I don’t understand this post. You can already create Planned Expense series in the Spending Plan at any category level you wish. Also, like @RobWilk said, you can also do this using Watchlists.

Could you maybe provide some screenshots to help us better understand?

Flopbot

Flopbot

Re: Ability to auto-backup and restore data (edited)

@Flopbot I've definitely heard of them restoring one-user's backups here in the forums before.

I do not know what criteria they offer for deciding to restore.

I should've tried that after my May→Late July "Experiences". Too late now, i recreated everything fresh.

RobWilk

RobWilk

Re: TIAA Reporting Connection Issues

Hello @Gaboose and @ams-chicago

I would suggest following our Alert for updates moving forward for this issue you are seeing, since it is similar and most likely the same issue:

In the meantime, you can track your TIAA accounts manually by adding manual transactions, which will keep records up-to-date. Here are the steps to do so:

If the account is an investment account, the manual tracking steps are a little different:

- Make the account manual so you can add and edit Holdings:

- Add/edit your Holdings to keep accurate records: and

We appreciate your patience as this issue is worked on!

-Coach Jon

Re: Add 2-Factor Authentication/Multi-Factor Authentication to App [edited] (2 Merged Votes)

How is this acceptable for a finance app not to have proper MFA support in 2025? It's a big mistake switching to your app. It worked initially and got a SMS at least, and for any new logins from a different workstation or a different phone, it's not forcing MFA at all. Speaking with support hasn't been productive either and they are just saying they are aware and working on resolution. Please fix MFA first and add app based MFA instead of SMS.

Re: Income & Expense Report: Share your feedback here!

SUCCESS!!

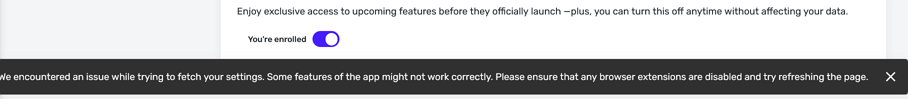

When i went to my "General" tab under "Settings", I saw this:

I turned early access to OFF, then saw the chart "Net Income" (instead of "Income & Expense") and it was working perfectly. Just to check, I tried toggling the Early Access on/off and verified that the reports changed names each time and that the failure only occurred when Early Access is set to ON.

THANK YOU FOR THE HELP!

Re: Ability to Exclude part of a split transaction [edited] (3 Merged Votes)

MrGood

MrGood

Re: Splitting a deposit

I'll add that if you want to do the reverse of what the category expects (for example, if you're getting a reimbursement for an expense and want it counted against that expense), you'll want to put either a plus or minus sign in front of the amount that you type in. It's a little counterintuitive until you get used to it.

Re: Subcategories are Grayed out When Parent Category is Checked in Reports (edited)

Thanks! In your situation of using the parent category for a catch-all, theoretically you might want to filter for transactions that just have that top-level category, so you can see the ones that need to be recategorized. That would be a good use case for this feature.

Re: College Savings Plan of Maryland FDP-106 error (edited)

@Ted F, we are back with an update!

It appears that our service provider is already aware of and working on this issue. We have an Alert that you can now follow for updates moving forward!

In the meantime, you can track the account manually to keep your records up-to-date. Here are the steps for adding a manual transaction:

Thank you for your patience as this issue is being worked on!