Best Of

Re: Persistent 324 error with Fidelity (edited)

I am experiencing more bugs than I would like…

Re: What is the correct accounting & category for sweep in after stock sale and dividends

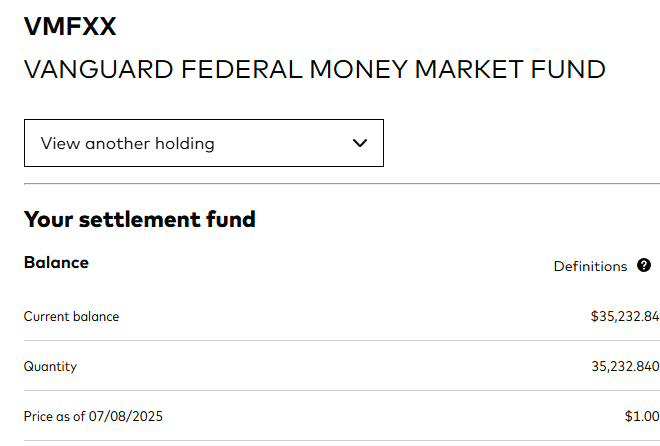

It's not entirely clear to me - the fund is recorded as $1 per unit (see screenshot) suggesting a buy action but the account type is cash.

For now converting them to "buy" seems to have sorted it as now those transactions don't show up in my normal spending reports.

I also noted that the other transactions in my screenshot were missing the security/payee field so I added those.

Thomas R

Thomas R

Re: Don't need badges (edited)

@virshu others have expressed the same feelings/view regarding badges. There may even be a feature request that would allow users to hide dashboard cards they don't want to see on the dashboard.

But gamification, I do believe, is here to stay.

Personally, I've had a lot of fun with these badges including a lot of teasing when they misfire! But then again, I'm only 73 and am known to get in a bit of trouble for not taking a lot of things too seriously. (My wife and kids and now my grandkids keep telling me to "grow up!" 🤣)

DannyB

DannyB

Re: Link from Transaction to 'take from' or 'add to' Savings Goal (1 Merged Vote)

Hello @HeyJaiBabyIGotUrMony,

Thank you for coming to the Community to provide your feedback! Since there is already an Idea asking for this functionality, I merged your Idea with the existing one. The Idea status is currently "In Review", which means that it's been submitted to our Product and Development teams for consideration. I recommend that you bookmark this Idea post, since any updates, once available, will be posted here.

Thank you!

Re: Recurring Transactions: Option to choose number of occurrences instead of end date (edited)

For things paid in installments, this would make it easier to ensure that the reminder goes the correct number of times, instead of setting a start date and end date and then checking the preview to make sure it looks right.

[ONGOING] 5/15/25: Target Red Card - Missing Transactions

We are currently seeing an issue with Target Red Card not downloading transactions in Quicken Simplifi. This is a known issue that we are working to resolve as quickly as possible. We currently have no ETA to provide on when a resolution can be expected, but will post updates as soon as we do.

If you're experiencing this issue in Quicken Simplifi, we recommend manually entering the missing transactions while the issue is being worked on to keep an accurate and up-to-date register: https://support.simplifi.quicken.com/en/articles/3348103-managing-transactions-in-quicken-simplifi#h_85ca9fed99

If you would like to be automatically notified of any updates regarding this issue, please "bookmark" this Alert by clicking the bookmark ribbon in the upper right corner.

Thank you!

CTP-13069

Re: Planned Spending "Last Six Months" Average is overinflated (edited)

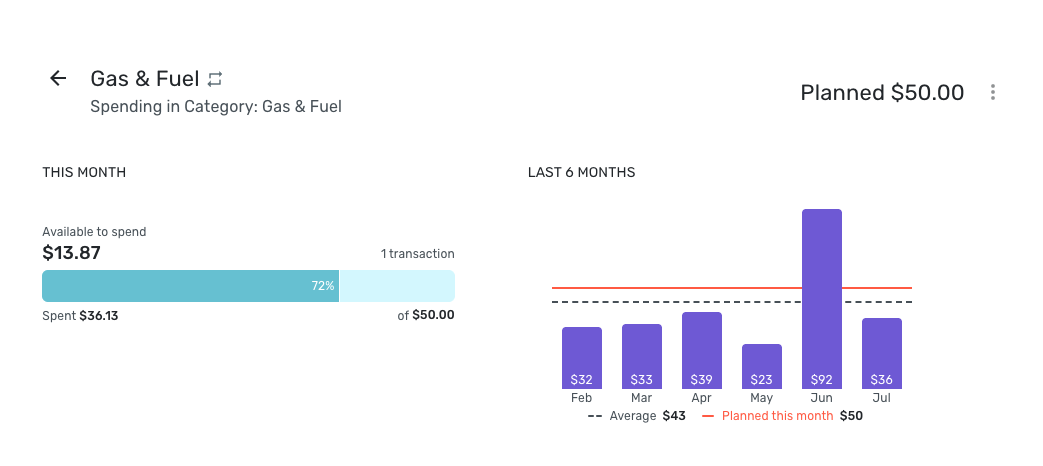

@DryHeat, the graph still shows the current month included —

Which means that this Idea post is likely still valid with the new design:

Re: College Savings Iowa 529 - FDP-106

Just checked. Looks to be working now. Not sure how or why.

Re: Is it possible to set up tracking for prior years for tax purposes? (edited)

I agree with the reply above. Importing transactions works best when you set up the tags or categories you want to track for tax purposes prior to importing. That makes it easier to assign to the imported transactions and the import file allows you to assign tags in it.

UrsulaA

UrsulaA

Re: Certain transactions always come auto flagged as "exclude from spending plan" (edited)

Simplifi excludes transfers between accounts and balance adjustments from the spending plan by default. Also, can you share some screenshots for us to understand your question better and help you?

UrsulaA

UrsulaA