Best Of

Workaround to connect CA, GA, OK, MI, WI 529 accounts to Simplifi AND avoid MFA

Workaround to connect CA, GA, OK, MI, WI 529 accounts to Simplifi AND avoid multi-factor authentication every time you log into Simplifi:

I have Michigan 529 accounts, but I hadn't been able to connect them to Simplifi because the institution wasn't an available option. As stated by @Dognose, "CA, GA, OK, MI, WI plus others all seem to share the TIAA 529 platform." This got me thinking. Even though the MI 529 isn't available as an institution on Simplifi, my hope was that I could connect my 529s through the New York 529 institution already available on Simplifi.

In short, you can. I successfully connected my Michigan 529s through the New York 529 aggregator without issue, so I'm optimistic this will work for other states that share the TIAA 529 platform. If you don't want to deal with multi-factor authentication every time you log into Simplifi, you'll need to create aggregator login credentials (which are entirely separate and different from your regular 529 login credentials). You do this online through the 529 site when logged in with your regular credentials. If you need help creating aggregator login credentials, please call the the 529's number for assistance.

Steps:

- When logged into Simplifi, go to Settings → Accounts → +Account [i.e. the add account button in the upper right corner].

- Type "New York 529" into the "Search all financial institutions" field. You'll see two available options: New York 529 College Savings and New York 529 College Savings Program Direct Plan - Non Aggregator.

- If you created the separate aggregator login credentials I mentioned above and wish to avoid multi-factor authentication every time you log into Simplifi, select the first institution option: New York 529 College Savings

- If you only have your regular 529 login credentials and/or don't mind multi-factor authentication every time you log into Simplifi, select the second institution option: New York 529 College Savings Program Direct Plan - Non Aggregator.

- Enter the applicable login credentials based on the institution you selected, and you should be good to go!

Re: Phantom Transaction in Register and Spending Plan - Transfers & Credit Card Payments

Okay, I'll stay tuned

Re: Pending Activity Updates disappear after new sync

Thanks for the extra information. I know that problems like this are hard to hunt down. I have some accounts that do some weird things and I have learned to anticipate them. But your situation sounds a bit different.

Normally, QS is designed to link automatically so I would start first by trying to make a rule for the payees and or categories, so that when these transactions come in QS will know to link them so you don't have to do it manually. That way if they do get redownloaded, QS will relink them again. (Again mine almost always link automatically so if they aren't, the dates are way off or the payees are.)

The second problem is that later they are redownloaded. Is it that the first time they are pending and then the second time, they are cleared? Or does your bank redownload pendings (as mine does, which is a problem for me sometimes)?

If you want to make a bug report, you'll need some screenshots for the coaches to send to the tech people so they can try to figure it out. So start making some screenshots showing the before and after.

Hope some of this helps.

SRC54

SRC54

Re: "Type/Action" field is missing when viewing Investment transactions in Reports on Mobile (edited)

Thank you @Coach Jon

Re: Spending Plan Redesign: Share your feedback here!

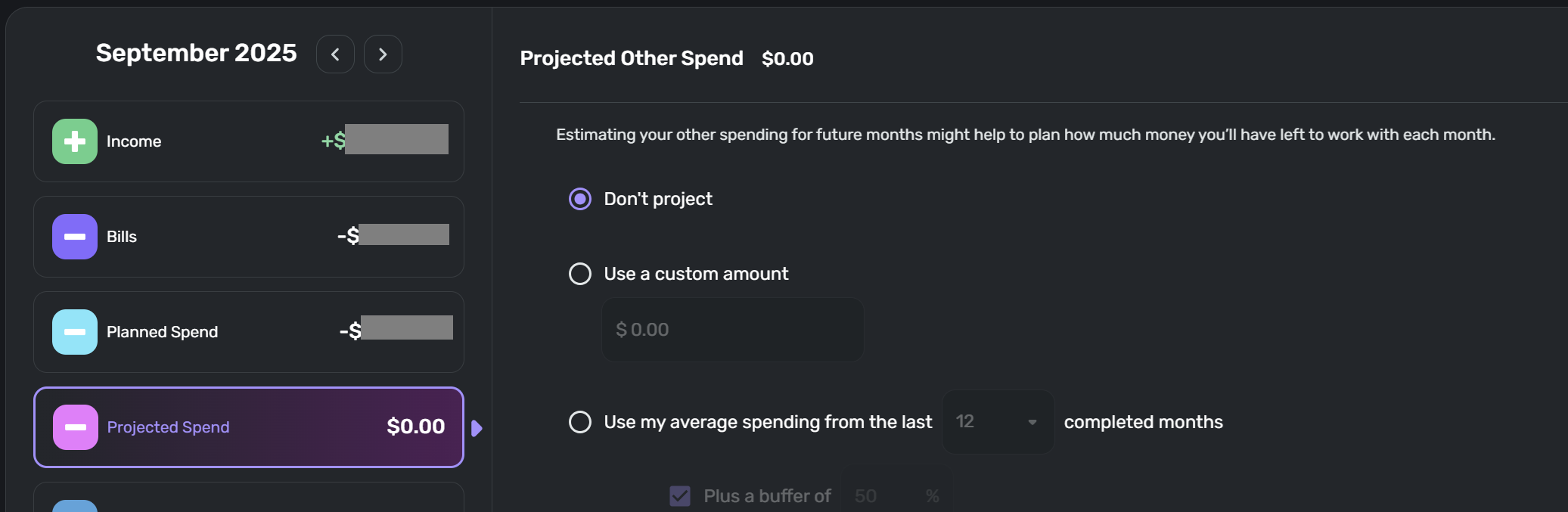

@WJB For your 2nd suggestion, this can be accomplished by setting a Custom or Average spending target (you can include a buffer too) in your Other/Projected Spending bucket for future months (see snip below). For current month, these expenses will be represented by the Other Spend bucket and can be monitored against your "Left this month" balance.

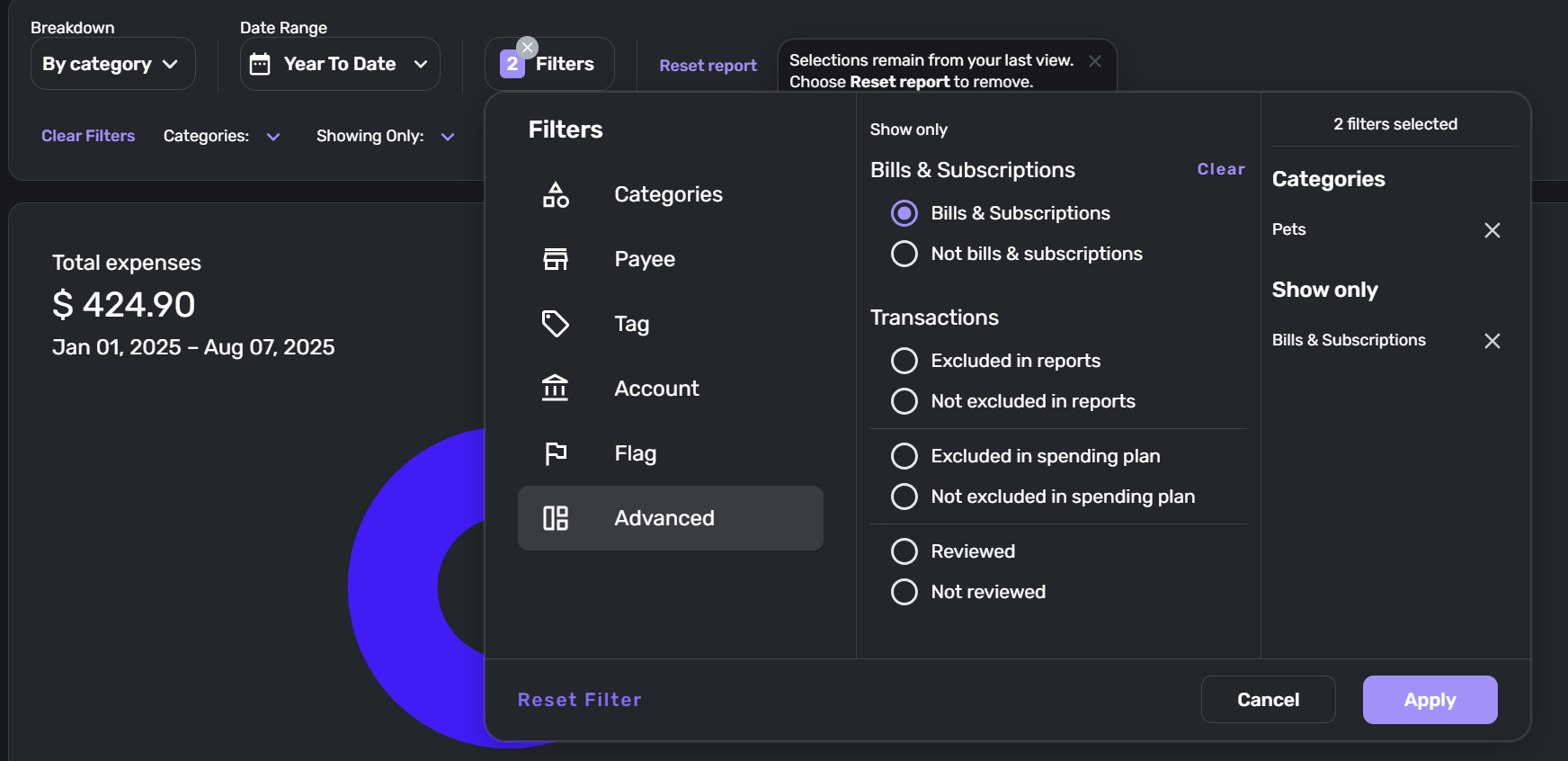

For your 1st suggestion, in Reports you can applies filters such as picking one category and then in Advanced Filters you can also apply a "Bills & Subscriptions" or a "Not Bills & Subscriptions" filter. This can be used for figuring out your burn rate in this category that are already setup as Bills versus how much you need to set as the Target in your Planned Spending section of the Spending Plan. See snip below for my example of that filtering in a YTD view with my Pets category.

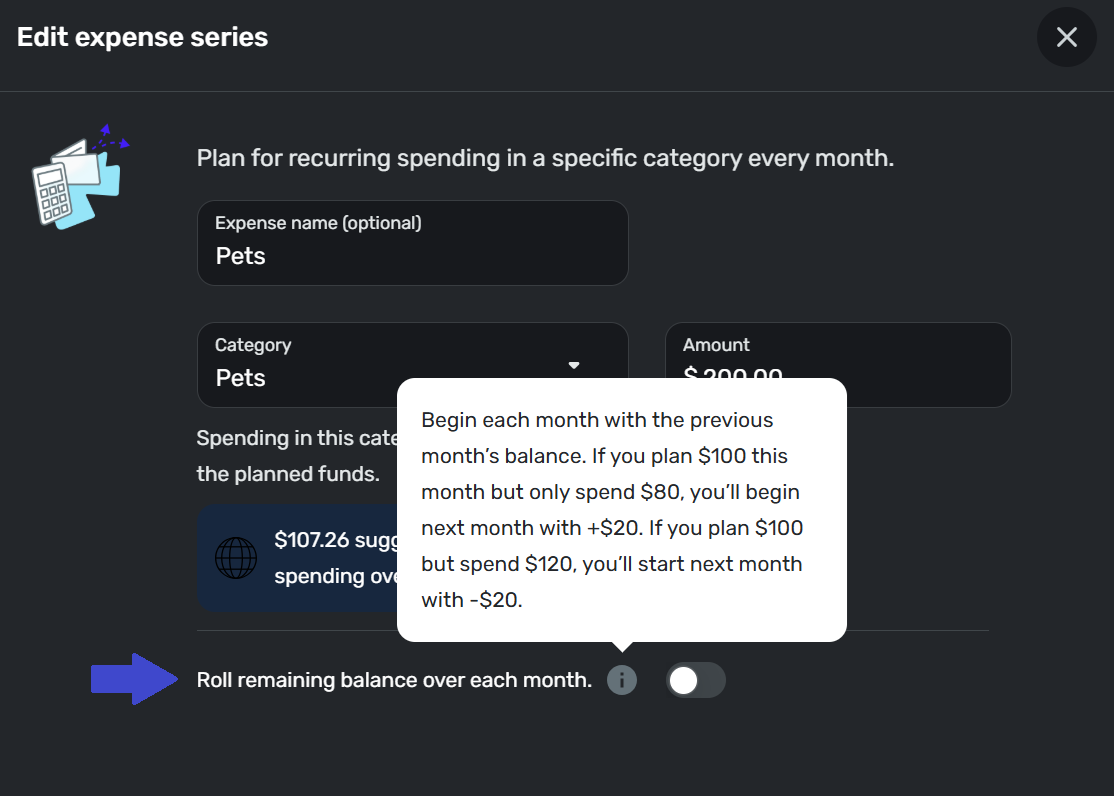

Also in your Spending Plan, you can set up the Planned expense series for that Category to roll remaining balances (see snip below). Having your recurring expenses setup as Bills/Subs for this Category of importance and accurately setting the target amount(s) for this Category in your Planned Spending will ensure your Spending Plan has accurately planned for the category.

And finally, you can set up a Watchlist for that category as a way to monitor the total category spend on a monthly and YTD basis. It'll even show you in the current month not only your total spend so far but also what upcoming Bills/Income for that Category are expected. Here's a snip from the Web app version. The mobile app view has a bit less information and less history and oddly enough shows an "Average" line as the angry red line and a almost invisible dotted line as the "Target" line on the graph. But both app versions do the job. Also in the Transaction register inside the Watchlist, you can click the 3 dots and apply a Filter that says "Recurring is True" and this is a workaround way to see how much was bills vs not bills in a month. Would be nicer imo if they'd just setup the graph as a stacked bar chart that automatically showed that Bills vs Not Bills split in each bar, but que sera for now I guess (would be a great feature add! but would also get complex for Watchlists with multiple Categories assigned…Tags may be a better workaround…). Using the Target in your Watchlist would give you the monitoring capability you are asking for and combine that with an accurate Planned Spending projection for that category and that should be a decent workaround to get you started with what you are aiming for. I can't save you from having to do some math. But I think this combo of tools may help make the math easier at least.

Re: Cannot Link Transaction to a Recurring Series

@housetr This has happened to me. If it doesn't show up in the reminder screen, I'll go to the transaction itself and select the "Mark as Recurring." and select the recurring series it should be a part of. that usually solves it for me.

Re: Spending Plan Redesign: Share your feedback here!

A few more thoughts on the layout:

I wonder if the Bills section shouldn't be named something like Payments, which would be broken down into bills, subscriptions and transfers (many of which are credit card payments). It would be more logical, I think. Also allow users the option to view those 3 sections in a list segregated as Bills, Subscriptions and Transfers.

Planned Spending ought to explicitly say (excluding payments) so that new users see immediately that it won't include those.

Other Spending ought to be Unplanned Spending. But most of us just mark those as one-time bills, which is what they often are.

SRC54

SRC54

Re: Phantom Transaction in Register and Spending Plan - Transfers & Credit Card Payments

Hello @EL1234,

Screenshots showing the same behavior would be the best, so that we can compare and establish that this is occurring on a monthly basis.

-Coach Jon

Re: Phantom Transaction in Register and Spending Plan - Transfers & Credit Card Payments

Hello @EL1234,

Thanks for following up! I would definitely clean it up this time and make sure to keep an eye on things going forward in case this happens again. If it does happen again, please provide screenshots so we can establish how this issue is continually occurring over time.

-Coach Jon

Re: Phantom Transaction in Register and Spending Plan - Transfers & Credit Card Payments

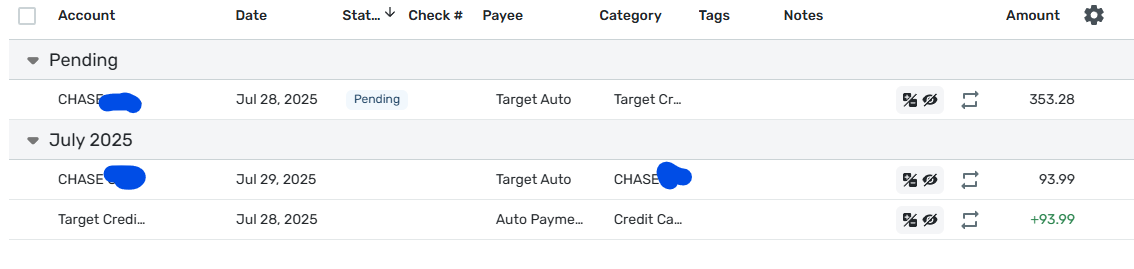

This happened to me just recently. When my target credit card's payment was due, I got a pending transaction with the wrong amount. Not sure where that amount came from. The Account is my checking account and the Category is Target Credit Card. Around the same time, I got a transaction on my checking account for the correct amount of the payment. The Account is my checking account and the category is ALSO my checking account! It's not supposed to let you create that but I didn't create it.

Then a few days later, my target credit card's transactions downloaded for the whole month of July. (This is how it's been working for the last few months, it's a known issue). I then got a transaction for the correct amount, the Account is my Target credit card and the Category is "Credit Card Payment".

This third transaction doesn't show that it's a linked transfer. The other two do, but when you click "go to the other side" nothing happens.

The first transaction, the one with the wrong amount, is still pending and the other 2 are cleared.

I'm sure I can delete/clean it up like I did last month, but I'm saving them for now in case you want any screenshots. I'm pretty sure this happens monthly but can't promise.

Here's one screenshot, let me know if you want more.

Hoping you can fix this!