Best Of

Re: Allow users to classify an Investment Account as a non-investment account

More and more people use Fidelity's cash management accounts or regular brokerage accounts as checking accounts. The main reason I won't be renewing my subscription is that SimpliFi doesn't currently allow these accounts to be treated as checking accounts, which is a feature I am looking for. I hope to see this issue addressed by then, otherwise I'll be forced to cancel.

Re: Spending Plan Redesign: Share your feedback here!

Please bring back the easy to view feature of “available income after bills & subscription” - I do not understand why you would remove this? How would we change our spending plan each month to ensure adequate margin / savings? Now I have to go backward and do math myself and track the “available funds” separately.

I don’t mind the combination of subscription and bills but it would make sense to make the subs a subcategory within this menu. A $12 monthly subscription is different than the monthly mortgage or electric bill. Grouping these separately is useful to track which ones we can get rid of or do without temporarily.

Re: Unable to view attachments when clicking the paperclip in the register (edited)

@Coach Kristina, the logs have been sent as requested.

Re: Split transactions should be treated as separate transactions (2 Merged Votes)

If and when we are able to include splits in Reminders, I would like those Reminder splits to show up in the appropriate sections of the Spending Plan. For example, if I have a split Reminder for a paycheck showing:

- Income=$+1000

- Insurance=$-100

I would like those splits to show up Spending Plan like this:

- Spending Plan | Income — $+1000 (the Income)

- Spending Plan | Bills — $-100 (the Insurance payment)

In other words, I would also like to have a recurring split Reminder show up as separate reminders for purposes of the Spending Plan — before the actual transaction for that Reminder comes in.

(NOTE: This is slightly different from having split Transactions treated as separate transactions.)

DryHeat

DryHeat

Re: Unable to view attachments when clicking the paperclip in the register (edited)

Hello @Dick_Davis,

Thank you for letting us know about this issue. I see the same thing when I test in my Quicken Simplifi. I have forwarded this issue to the proper channels for further investigation and resolution.

If you would like to contribute to the investigation, please send logs. You can do that by following these steps:

- Log into the Quicken Simplifi Web App.

- Select Profile from the left-hand navigation bar.

- With the Profile menu open, hold down the Option key for Mac or the Alt key for Windows, and then click Send Feedback.

- Leave all boxes checked, add a brief description of the issue, and then click Send.

Thank you!

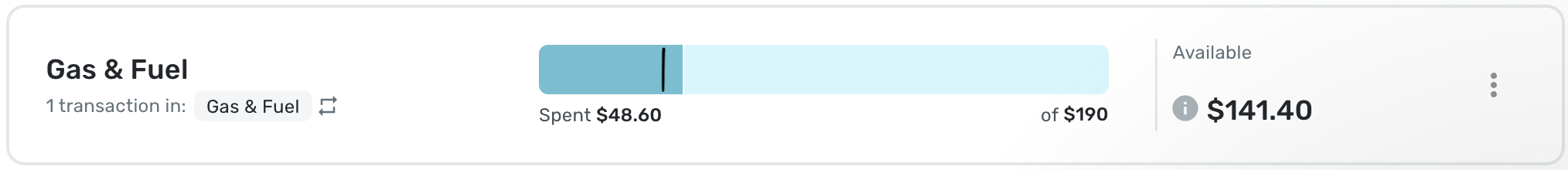

Re: Elapsed Monthly Duration Indicator in Planned Spending (edited)

It would be great to be able to compare the amount of money spent for a given budget line to the chronological progress through the month at the time of viewing the page.

Simple basic example shown below showing a line to indicate the day of the month compared to the amount of money spent during that month:

Re: Allow users to classify an Investment Account as a non-investment account

@SRC54 and @WJB - Thank you for responding to my related post, although I think my post goes a bit further regarding this issue (brokerage accounts that also function as cash accounts) and suggests that Simplifi already has all the data needed to enable brokerage accounts’ cash transactions to be identified as such and treated as any other cash transactions is treated regardless of the account it resides in. I’ve upvoted your request. However, I think a more helpful feature would be to govern treatment of transactions at the transaction level rather than the account level.

See post here:

I should add that I know I can check a few boxes to include/exclude some cash transactions in brokerage accounts from reporting, but this does not solve the full set of problems with the current lack of functionality (as explained in my post).

I should also add that I am a LONG time Quicken Classic user, and I am trying to set my kids up with Quicken Simplifi. I REALLY want it to work for them. But it doesn’t, largely b/c of problems like this.

Re: Allow users to classify an Investment Account as a non-investment account

@SRC54 and @WJB - How about a feature upgrade along these lines… maybe we collaborate a little in the comments on its design…

If agreed, appreciate upvote

Re: Multi-currency support

"once you select the currency you want to use, it will support only that currency (USD or CAD, but not both)."

I have both USD and CAD accounts. Simplifi works with both in the same dataset and downloads from both US and CDN banks at the same time without difficulty. The ability to download from both USD and CAD accounts was a big factor in my move to Simplifi.

The only problem is that the account balances can be deceiving, as Simplifi is not aware of the currency and makes no adjustments for exchange rates. That makes linked transfers a problem, but otherwise all works well. I generate separate reports on my USD and CAD accounts so I get meaningful results.

DryHeat

DryHeat