Best Of

Re: Persistent 324 error with Fidelity (edited)

Everything was working fine over the last few weeks since I started using Simplifi. Now I’m getting ….

This financial institution needs your attentionWe have lost connectivity to 2 of your accounts. To restore connectivity, you must reconnect with your FI.(Care code: 324)

I tried reconnecting and no luck.

Any guidance ???

Re: Persistent 324 error with Fidelity (edited)

Care: 324. I'm also having this issue, across two different user accounts. Brokerage, Rollover IRA, and Roth IRA all broken. The HSA accounts don't appear to be an issue. I've disconnected through Fidelity and have attempted to re-auth through Quicken with no luck.

Re: Persistent 324 error with Fidelity (edited)

Same problem. Losing connection to Fidelity brockerage account for about a month now. It used to work fine.

Re: Persistent 324 error with Fidelity (edited)

Experiencing same exact issue. Brokerage accounts lose connection. Been happening for 2 weeks

Re: Persistent 324 error with Fidelity (edited)

Hello everyone!

The persistent 324 errors with Fidelity has been escalated. We would, however, like to add a few additional users to the ticket to show the impact. To do so, please follow the steps outlined in my comment here:

If the issue persists after doing so, please provide the information outlined in my comment here:

With the exception of submitting logs, the information will need to be provided here in the Community. If you'd like to keep the info private, you can send it via DM. Otherwise, users are welcome to contact Chat Support regarding this issue to report it in a private setting:

Thanks in advance to anyone willing to participate!

Re: Persistent 324 error with Fidelity (edited)

I hate to be a "me too" poster, but…. me too.

Mike T

Mike T

Re: Don't change target amounts in Planned Spending when releasing funds (edited)

Your point about updated transactions that come in after the end of the month is a good one.**

I like your idea that they automatically get added to the amount spent, with the amount released adjusted accordingly. That would be the path of least effort, which as a lazy person I am always looking for.😉

PS: If you like the idea, don't forget to upvote it at the top of the page.

**I've only had that happen a couple of times. I believe I was able to fix it by resetting the target amount for the month's expense and then re-releasing the funds. But I don't remember for sure.

DryHeat

DryHeat

Re: Don't change target amounts in Planned Spending when releasing funds (edited)

The discussion you linked is related, but significantly different. It is primarily about implementing a "daily progress bar" in the current month so that users can see how their spending so far compares to how far along we are in the month. Like this image from that discussion:

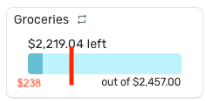

My suggestion is about changing the way Simplifi displays the spending, the planned target, and released funds in both the current and prior months so that the user can see how actual spending compares to planned spending, even when the funds have been released. Like this:

This way the user could release funds in a past or current month so that the "Planned spending" and "left at end of month" figures would match actual expenditures, but they would not lose the information about how much they had planned to spend.

DryHeat

DryHeat

Re: Account to Account Transfers (A2A): Share your feedback here!

@dcleck - The last time I did this (in March of this year) the deposits were taken back out within 24 hours after I responded by inputting the deposit amounts into the sending bank's verification system.

DryHeat

DryHeat

Re: Change the order of the "Planning" section in new navigation menu (edited)

Thanks for the update on this. I haven't given ANY thought to this since I first posted it back in November '24. I just now took a look at the Web App menu and discovered that the order has been changed to match the Mobile App. I have no clue when that change was made nor when the headings were removed but having consistency between web and mobile and putting Spending Plan at the top the list no matter the order of Savings Goals and Bills & Payments, in my mind meets the "spirit" of this input/feature request.

DannyB

DannyB