Best Of

Re: T. Rowe Price Retirement Plans - FDP-102 Error

I agree with @CJM. After a month of nothing being done to correct the problem, the "we know the problem exists, and we're doing what we can" just doesn't hold any weight. I'm sure the moderators / admin on this site want it fixed as much as we do, but I wonder at what point they have lost any credibility in responding by just saying it's still broken. If it can't be fixed in over a month (and this is true with now with TIAA and T Rowe Price for me as well), then more information and transparency is needed. These are not minor institutions/banks, and neither is Quicken, so it makes me wonder if anyone is really working towards solutions. If that level of brain power can't fix it, makes you wonder. It's really ruining an otherwise functional and good financial app.

Re: T. Rowe Price Retirement Plans - FDP-102 Error

Natalie. Being aware of it and fixing it are 2 different things. Especially since you are still charging full cost. When cable or cell services are down , we receive a credit. I recommend every cancel their subscription just based on the terrible customer service.

Re: T. Rowe Price Retirement Plans - FDP-102 Error

Would be helpful to share what actions have been taken to date to troubleshoot and what is the next action and target date. You could also start to proactively communicate. If there is a blocker that is taking you time to develop a solution for the best thing you can do is provide transparency and let everyone know you will provide an update based on the estimated time to resolve.

Re: Correct Setting for an Account that downloads Balance that already includes pending transactions

Thanks again @Coach Jon. I think this whole thing needs rethinking, but in the meantime, I'll continue to use my workarounds to avoid Simplifi's faulty AI and make my data match reality. In other words, if my bank counts one of my pending as cleared, I'll just clear it!

SRC54

SRC54

Re: Add OneFinance/OnePay to Supported Banks (edited)

Unfortunately, manually managing my account transactions is precisely what I wanted to avoid. [removed competitor mention], the other software I am experimenting with, has no problem linking my bank. So despite the fact that I prefer the quicken experience otherwise, right now the lack of bank integration is a deal breaker. I will hold out hope that the integration can be fixed in a timely fashion, but otherwise a budgeting app that can't track income is about as useful as a calculator that can't add.

When you know you are wealthy

According to a poll I saw the other day, one is wealthy once his net worth is $2.3 million dollars.

I am 71, and I am not going to make it.

SRC54

SRC54

Re: Recurring Charge on 30th - Doesn't Appear in February

Thanks, Jon! I've updated the series accordingly. That said, it feels like Simplifi is putting a lot on the customer to work around this when a simple coding update and push could make this turnkey for those paying for this product.

Re: Recurring Charge on 30th - Doesn't Appear in February

Hello @stacyvance,

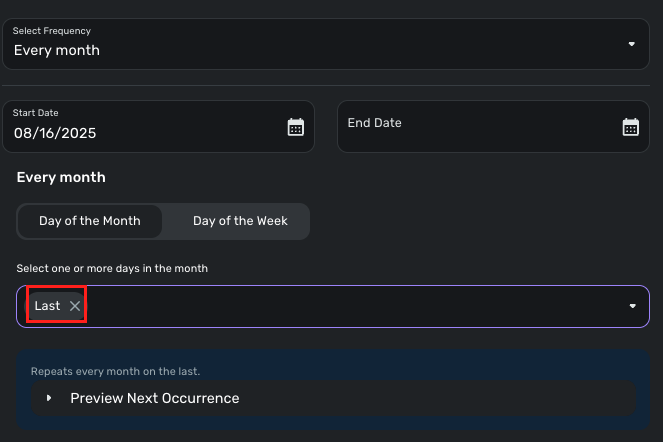

Thanks for reaching out! I can definitely see why this would be frustrating. I would see if using the "Last Day of the Month" option works better for you in this case. This way, it would not skip February.

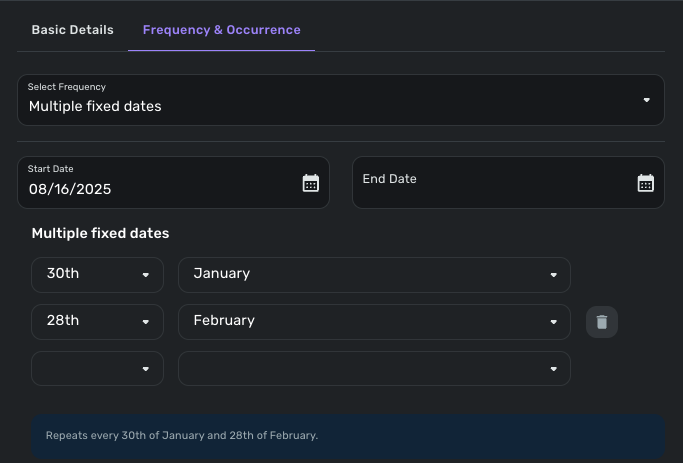

You could also set up the series to use specific dates for each month as well, using the "Multiple Fixed Dates" option.

I hope this helps!

-Coach Jon

Re: Unable to sync - LPL Care Code: QCS-0429-2

Ah, able to resolve. Read through more of the link sent earlier and opted to reset my connection (the three dots to the right on the settings\accounts page). Entered credentials, prompted for the verification code (sent to my phone), entered credentials. Had to enter twice my verification code. Successful.

So, I will keep the link you sent earlier to refresh my memory and try not only entering the credentials but to reset the connection.

Reading is fundamental, your instructions sent via the URL, was helpful

Issue resolved.. Thank You

Re: Certain transactions always come auto flagged as "exclude from spending plan" (edited)

Thanks for the clarification. This change should have been rolled out together with the new spending plan. Having income not in a series or auto matched to a series excluded makes the spending plan less useful without the rest of the changes rolled out. I will keep monitoring the transactions and including non recurring income back in the spending plan as needed.

UrsulaA

UrsulaA