Best Of

Re: Recurring Charge on 30th - Doesn't Appear in February

Thanks, Jon! I've updated the series accordingly. That said, it feels like Simplifi is putting a lot on the customer to work around this when a simple coding update and push could make this turnkey for those paying for this product.

Re: Recurring Charge on 30th - Doesn't Appear in February

Hello @stacyvance,

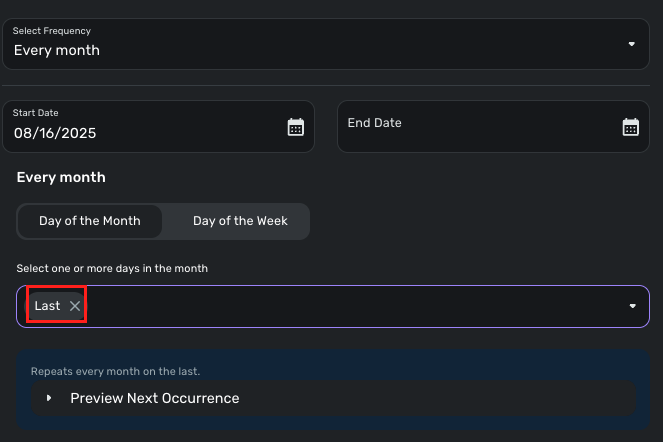

Thanks for reaching out! I can definitely see why this would be frustrating. I would see if using the "Last Day of the Month" option works better for you in this case. This way, it would not skip February.

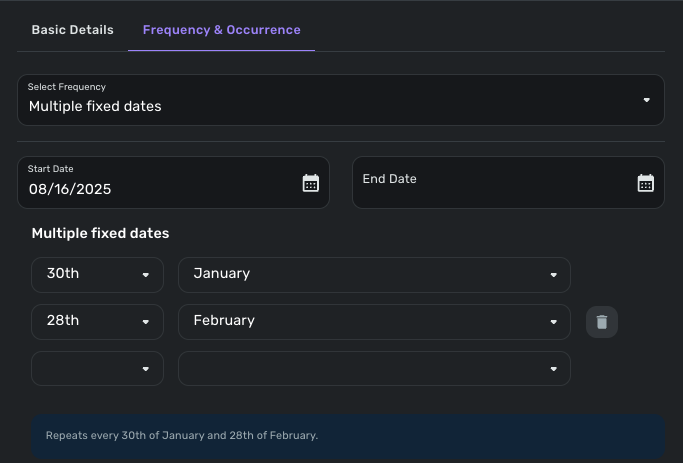

You could also set up the series to use specific dates for each month as well, using the "Multiple Fixed Dates" option.

I hope this helps!

-Coach Jon

Re: Unable to sync - LPL Care Code: QCS-0429-2

Ah, able to resolve. Read through more of the link sent earlier and opted to reset my connection (the three dots to the right on the settings\accounts page). Entered credentials, prompted for the verification code (sent to my phone), entered credentials. Had to enter twice my verification code. Successful.

So, I will keep the link you sent earlier to refresh my memory and try not only entering the credentials but to reset the connection.

Reading is fundamental, your instructions sent via the URL, was helpful

Issue resolved.. Thank You

Re: Certain transactions always come auto flagged as "exclude from spending plan" (edited)

Thanks for the clarification. This change should have been rolled out together with the new spending plan. Having income not in a series or auto matched to a series excluded makes the spending plan less useful without the rest of the changes rolled out. I will keep monitoring the transactions and including non recurring income back in the spending plan as needed.

UrsulaA

UrsulaA

[ONGOING] 07/09/25: Fidelity Inv & Retirement - Persistent 324 Reconnect Error

We are currently seeing an issue with Fidelity Inv & Retirement, where users are receiving a 324 error and being asked to reconnect their Fidelity accounts daily in Quicken Simplifi. This is a known issue that we are working to resolve as quickly as possible. We currently have no ETA to provide on when a resolution can be expected, but will post updates as soon as we do.

In the meantime, users should be able to connect to the Finicity instance while this issue is being worked on by making your existing accounts under Fidelity Inv & Retirement manual, and then re-linking the accounts under the "Fidelity Investments" instance in Quicken Simplifi.

The instructions to do this are:

- Make all of the accounts with the bank manual by following the steps here.

- Once you see the account(s) listed in the Manual Accounts section under Settings > Accounts, go back through the Add Account flow to reconnect to the bank under the "Fidelity Investments" instance.

- Carefully link the account(s) found to your existing Quicken Simplifi account(s) by following the steps here.

If you would like to be automatically notified of any updates regarding this issue, please "bookmark" this Alert by clicking the bookmark ribbon in the upper right corner.

CTP-13694

Re: Watchlist "This Month - Spent so far" amount should include only actual spending [EDITED]

Your description of the calculation method matches what I outlined in my previous post. We are on the same page on that.

What remains is that I think the method is very misleading. The discussion you linked covers part of the problem and the one below covers another:

At least I know I'm not alone on this one.😉

DryHeat

DryHeat

Re: Watchlist "This Month - Spent so far" amount should include only actual spending [EDITED]

This projected spending concept is not an easy problem to solve because it will vary greatly depending on the type of spending. It seems that it is only considering a linear approach to spending spread evenly throughout the month. This would work decently for those categories that are very regular like gas and groceries. For expenses that occur infrequently or are irregular amounts, the projection will be fairly meaningless. However, even today my grocery watchlist is likely low because of the distribution of trips to the store this month. It will likely be in line with my monthly average however, is showing lower by $200-300

I think displaying the monthly average is useful information and perhaps showing the difference between spent so far and the monthly average would be a more valuable piece of information than a linear projection.

I agree that the nomenclature of Spent so far is typically understood as transactions that have occur to date. I think removing the reminders amounts from the spent so far and addjng a "With Reminders" number would be useful to clarify the difference.

Re: Persistent Filters & Views in Reports: Share your feedback here!

I agree with @SRC54, it really would make sense if there was a way to at least toggle the ability to only include full months in the recent 3, 6, 12 months filters.

If this gets added (plus a way to show a live average income/expense over the time period/category selected) it would be a nice win!

Transaction Download - Transaction Detail Not Descriptive Enough

Is there any way to ensure that the transaction description is near-identical to what transaction descriptions would be on the bank statement?

I've noticed that ever since I've imported my transactions from Mint and started using Quicken Simplifi going forward, the transactions aren't as descriptive as they used to be, heck, the transactions now seem to be very generic descriptions of its counterparts when pulling it up against the bank statement. Mint transaction downloads had a lot of details, almost near-identical to what shows up on the bank statement, but now, the transaction details aren't very helpful at all.

Not sure if it's the way I've linked my accounts or if there's a setting somewhere but without this visibility, it sort of defeats the purpose of the tool in my opinion.

Re: Transaction Download - Transaction Detail Not Descriptive Enough

I fully agree with this. I disagree with the assertion that Simplifi is "simplifying" the payee info. What is the goal of simplification? To me the goal is to save time and make it less confusing. When I have a dozen Venmo transactions to different businesses or individuals, they ALL show up with a payee of "Venmo" - no futher detail. I have to click into each transaction, look at the detail header at the top, and make a note of who this is for.

How is this designed to simplify anything? If the full detail were there, I just look at my transaction screen and I'm done. However with the way this is designed I have to click each transaction, then make a note for each transaction, then show the Notes column on my transaction screen. This is but one example. I am on my second day of using this service and finding this to be a problem all over the place with how payees are simplified.

This needs to change, or perhaps Simplifi isn't for me.