Best Of

Re: Bank Accounts Disconnected, Reconnections Advice Please

Since you already have the accounts in Simplifi with transactions presumably, and they are now disconnected, you may need to tell Simplifi to link them when you reconnect them. Instead of accepting them as new accounts, you use the drop down menu to link each one to the manual account you already have.

Since they are disconnected, when you reconnect, just make sure each one your bank provides is linked to the right account. If not, link them yourself using the advice from the support article below.

Here's a support article showing you how:

SRC54

SRC54

Re: Missing Utah Educational Savings Plan (aka my529)

Same boat - considering switching to another money manager due to this and other problems. Don't understand how my529 showed up on previous free sites (mint and empower), and now they don't work on a site I'm paying for the service.

Re: Add OneFinance/OnePay to Supported Banks (edited)

@metamaterialsuit, thank you!

This has been turned back into a request. Please note that we cannot guarantee we'll be able to add support for a requested bank, but we will be sure to update this request if/when any news becomes available.

In the meantime, you can track the account(s) manually in Quicken Simplifi:

How to add a manual account:

How to add manual transactions:

I hope this helps!

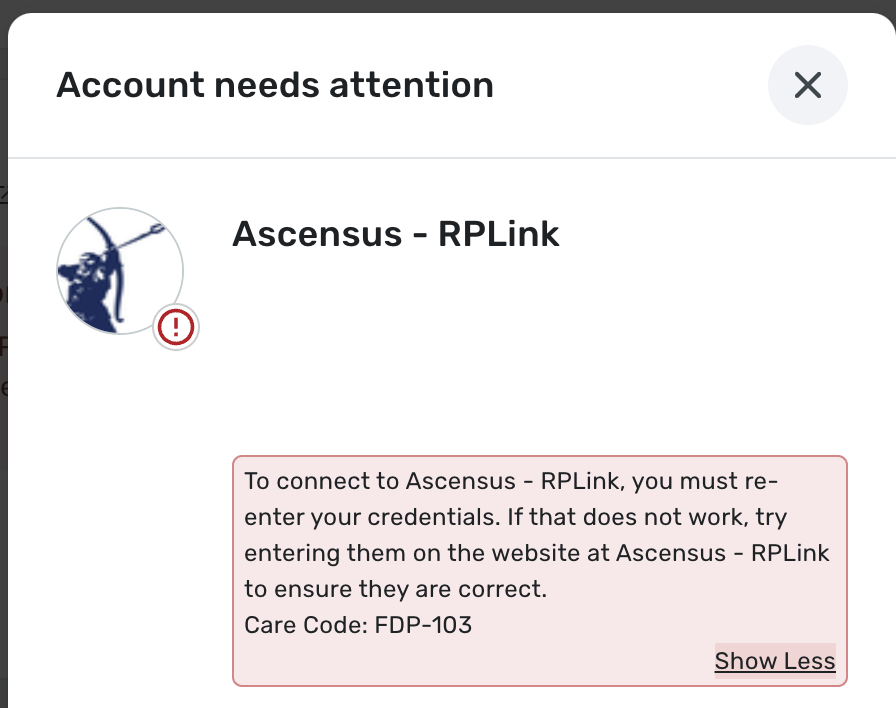

Re: FDP-103 error on Ascensus

I am getting the same error - my ascensus account no longer will update. The credentials are verified and will log me into their website.

To connect to Ascensus - RPLink, you must re-enter your credentials. If that does not work, try entering them on the website at Ascensus - RPLink to ensure they are correct.

Care Code: FDP-103

Re: FDP-103 error on Ascensus

Hi! I am also having the same challenges- when I log into ascensus to their page I have to use: myaccount.ascensus.com

I tried all the steps above in troubleshooting also, and with no success! Ascensus did not supply or document needing an app password either.

It does not allow me to remove phone number for security (mfa) but I did check that I selected trust my computer/and browser - for future logins (thinking that was stopping me) but I have not had that issue in the past with quicken products….. and nothing has changed on ascensus side for 2 years….

Re: The "Other Spending" amount bar on the mobile app floats above the bottom of the screen (edited)

Hello @housetr,

Thanks for the information! I did get this reported to our product team and will be sure to follow up here with any status updates.

-Coach Jon

SIMPL-27851

Re: Consumer Loan Paid by Credit Card Monthly

I'm assuming that you have a liability account for the loan (otherwise there would not be two transactions). I do not know if that loan account is connected online or not — perhaps you could tell me.

Paying on a consumer loan works exactly like making a payment on a credit card. The only complication is that you are making the payment from a credit card account, not a bank account. But it works the same.

You need to create a transaction in your credit card account (or modify a downloaded transaction) so that it shows a transfer FROM the credit card of $122.07 TO the loan account (which you select as the category). If you do it correctly, a newly created transaction will show up in the loan account as a positive $+122.07 (green, with a plus sign).

But to get this right you will need to split the transaction (assuming interest is charged) to show the interest as an expense. For example, if the interest this month is $2.00, then you would have a transfer split of $120.07 to the loan account and an interest expense split of $2.00.

If the loan account is connected it may already have a transaction that could match the credit card transaction — but it will only match if you have correctly adjusted for interest.

DryHeat

DryHeat

Re: Consumer Loan Paid by Credit Card Monthly

I tried this last night and Simplifi worked as you outlined. I want to be sure that I was entering it correctly. Thank you for the confirmation.

Re: What Type of Account is an Annuity Account

Just to expand a bit on what @SRC54 said… it depends a lot on what kind of annuity you have.

The insurance company annuities I have seen aren't actually accounts. Rather, they are contracts where you give the insurance company your money and they agree to pay you a fixed or variable amount for a fixed number of years (or life). If that is the case, then there is no account that you are drawing on. The insurance company is just paying you a monthly stipend.

I don't give tax advice, but you should look into taxation of annuities. Usually only a portion of a purchased annuity — the gain — is taxable. Try googling "is a purchased annuity taxable income in the usa?" for relevant articles.

DryHeat

DryHeat