Best Of

Re: Summer is almost over! Share your stories!

No fun stuff this summer. Surviving the humidity is a full-time job when playing tennis 3x per week in it. My wife went to New Orleans this month (in August!!) and to Pigeon Forge, TN in June, so she did the traveling. She wants us to go somewhere in October, and we might, but she already spent the money.

Sorry I am so boring, but I need an excuse to travel, usually a tennis tournament. If we go, it may be to the Gulf, but only IF it is cooler and there is no hurricane brewing.

I did get a new refrigerator installed; that was ordeal enough.

SRC54

SRC54

Re: Summer is almost over! Share your stories!

@Coach Jon, This summer my spouse and I traveled Europe to see Iceland, Belgium, Germany, Czech Republick, Monaco, and Portgual. This was to celebrated a wedding anniversary, my forth coming birthday in October, and my retirement. We were gone for three weeks. Also, we were traveling with friends and seeing friends in these countries. The temperatures in Europe were nice as compared to here in the States. In Czech Republic we were to the hot water springs and Pilsen for beer - which got a sample of the Czech beer.

Re: Ability to Exclude part of a split transaction [edited] (3 Merged Votes)

It would be helpful if, when you split a transaction, you could adjust whether each category split shows up in spending plan. For instance, I don't like to see work expenses in my spending plan (since I know they will be reimbursed). But my reimbursement comes with my paycheck. I want to see my paycheck in my spending plan, but I don't want to see the portion that is a business reimbursement.

Re: Ability to Exclude part of a split transaction [edited] (3 Merged Votes)

People pay for expenses on behalf of themselves and others (getting reimbursed for a portion of the total cost). Similarly, people receive funds where some of the money represents a reimbursement and some is true income (e.g., Venmo cashouts). Users cannot currently hide (from the Spending Plan or Reports) individual splits in a split transaction. It is currently all-or-nothing (either all splits are hidden or no splits are hidden). Please add the ability to hide individual splits in a split transaction.

Re: Move the "delete" button to the left when deleting transactions, and make it a trash can icon

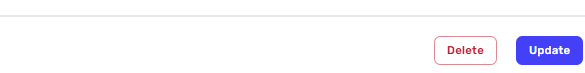

I am assuming @Dick_Davis is referring to the location of the "Delete" button when editing a transaction. Currently, the Delete & Update buttons are side by side. I believe the suggestion is to move the Delete button to the left-hand side.

For example, this is how the buttons look when editing multiple transactions.

I do think it would be helpful to have the button locations in the same location throughout the system and labeled the same way. With the Delete & Cancel buttons in the same place on different menus, it would be easy for a user to click Delete instead of Cancel either by habit or just by accidental clicks or incorrect clicks due to lag, etc. I do like the Delete separated from the other buttons for these reasons. However, I prefer the words spelled out if screen size allows the space rather than the trash can icon.

Re: Issue connecting two logins with Vanguard (edited)

Checking back in after multiple months, problem still persists. Unfortunate to see no update in over a month since "appreciating" our patience. Perhaps this kind of dual-accounts household is not the target market for this product. Discussion threads on a couple social networking sites report continued frustration here.

This will be an easy non-renewal decision.

Re: how do I get a projected budget to generate?

Hi @SweeTea

I'm not sure what exactly you are trying to get at, but the Spending Plan gives you a monthly projection of your available income after deducting your fixed expenses (Bills), your flexible expenses (Planned Spend) and any contributions to Savings Goals (Goals). Also, any expenses that fall outside you budgeted fixed and flexible expenses (Other Sped) will be deducted from the available, so you have a running tally of what is left as the month unfolds.

DannyB

DannyB

Re: how do I get a projected budget to generate?

Hello @SweeTea,

Thanks for reaching out! Quicken Simplifi offers a different approach to budgeting. Quicken Simplifi creates a Spending Plan automatically based on the Recurring Income, Bills, and Subscriptions you've set up, leaving the money that's left over as available to budget or save for other items, or to spend as desired.

Here is a support article explaining how the spending plan works in Quicken Simplifi:

-Coach Jon

Re: Applying rules to past transactions is not working (edited)

Hello @housetr,

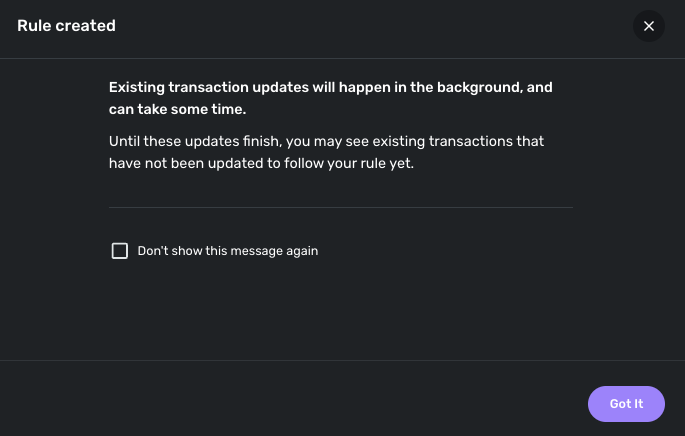

Thanks for reporting this issue. I was unable to reproduce this issue from our side, unfortunately. I do know that sometimes the rule change can take some time for existing transactions, however.

How recently did you create the rule? Have you checked to see if signing out and back in or trying from another web browser works? Let us know!

-Coach Jon

Web Release 4.71.0

Hello everyone!

Here are the issues and features we were able to tackle with the 4.71.0 Web Release, released August 13th:

- FIXED: The text color for tax rates and investment returns is too dark in the Retirement Planner while in Dark Mode.

- FIXED: The background color of investment ticker chips on the Investment Holdings Dashboard card is incorrect.

- FIXED: Various errors and crashes.

- FIXED: QBP: Misaligned “Got It” button in the 'Rearrange Account Groups' alert on MacOS.

- UPDATED: The Investment News Feed logo for items with no picture to a placeholder image instead of the Quicken logo.

- UPDATED: Minor enhancements have been made to the recent redesign of the Spending Plan.

- UPDATED: Other minor visual/UI enhancements across the app.

- UPDATED: QBP: Allow users to delete transactions in the Client Invoices account.

- ADDED: The 'per day' amount to the Spending Plan Dashboard card.

To be automatically notified of new product updates, please be sure to follow the Updates from the Product Team category by clicking "Follow" at the very top of the page.

Thank you!