Best Of

Re: Transactions in liability accounts not included in reports (edited)

You know, I thought @DryHeat was probably right that this had something to do with transfers, so, like him, I created a Test Liability account and charged myself $25 mortgage interest fee, and it doesn't show up in any reports. And this after I go in and choose all accounts including the test account.

I even checked the Settings:Accounts to make sure that it hadn't somehow got set to ignore in Reports. This is weird.

Guess what? It does show up in the Planned Spending of the Spending Plan under Fees. (I just called it a fee as I already had an expense category for that.)

P.S. I woke up and played with this some more. I even made a Mortgage Interest category. It all shows up in Spending Plan whether it is recurring or not. But it won't show up in Tax Report or Spending Reports.

I even tried excluding the account and unexcluding the account and doing the same with the transactions, and that made no difference either. I couldn't figure out any workaround other than to reclassify the liability account to a credit account. Then it all worked! (It even works as a bank account or an asset account (just has a negative balance). So there's the workaround, make your liability account for the time-being a negative asset.

I am wracking my brain trying to figure out why Liability Account transactions would be excluded from Reports. So it must be a bug.

SRC54

SRC54

How can I monitor spending by category AND tag?

My wife and I collaborate in a single Simplifi account and we tag transactions that belong to each of us. There are categories we both spend on but one of us would like to watch our own spending more closely.

Examples:

- We both spend on hobbies, but I spend more and want to reign myself in.

- We both buy clothes for ourselves and our daughter, but she spends more and wants to reign herself in.

I'd like to budget or monitor how much I spend on hobbies MINUS her spending. She wants to track her clothing spend MINUS my spending.

I can see two ways to do it, but I don't care for either of them:

- Reports. Easy to do, but requires too much activation energy (too much clicking, filtering, drilling down) to be useful as a daily tool and no notifications (I think?) to help us stay on track.

- Custom tags. Make tags named me hobbies and her clothing. This would make it possible to track with the spending plan or watchlists, but it pollutes the tag list—especially if we want to set up more category tracking later—and the data (categories and tags) are already there. I just can't use them.

Am I missing any other options? I'll set up option #2 if there's no better way to do it.

Thanks!

Re: Persistent 324 error with Fidelity (edited)

@Bill Barol, thank you for providing the requested info!

I have gotten this issue escalated and will post back here with updates. It would be wonderful to get a couple of additional users added to the ticket to show the impact, so please comment with the requested info if you're willing to participate.

Happy 4th of July, everyone! Safe holidays!

CTP-13694

Re: Account to Account Transfers (A2A): Share your feedback here!

@dcleck, thanks for posting to the Community!

I have merged your post with the dedicated area for A2A feedback. With that, it looks like DC residents need to select Maryland for the state:

I hope this helps!

Re: Transactions in liability accounts not included in reports (edited)

@stevel0821 I have a couple of questions to try to get a better handle on this:

—What sort of transactions are you testing? (transfers? income category? expense category?)

—What sort of reports are you running that don't show those transactions?

I ask because the accounts where transactions are not showing up are loan accounts, and transactions in those types of accounts are usually transfers. (i.e., you are either borrowing money or paying it back, neither of which should show up in and income or expense report.)

You've probably already thought of that, but I just wanted to check.

DryHeat

DryHeat

Re: Savings Goal Doesn't Update

Hello @brucelee1968,

Thanks for following up! I can see that the ticket you submitted with our support team is being reviewed. I would suggest waiting to hear back, as they should reach back out to you once they have more information or a status update.

-Coach Jon

Re: Apple Wallet integration in a Household

Hello @csolutions,

Thank you for verifying and letting us know! I did see the idea post you created at the advice of Coach Natalie. I will post here as well in case any users come across this thread and want to vote for and follow it.

-Coach Jon

Re: Apple Wallet integration in a Household

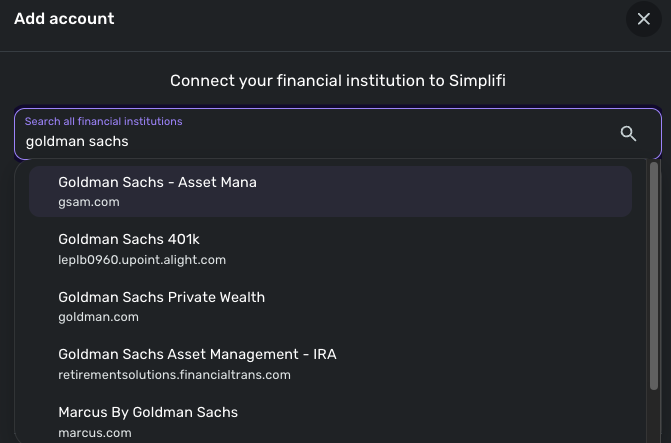

I looked into this, since the accounts are made via Apple it seems like there is no way to get a login for goldman sachs, they are simply the backer. So this method won't work unless goldman sachs started considering apple users real members of the bank and issued them login credentials. Thank you for looking into this also!

Re: Apple Wallet integration in a Household

Hello @csolutions,

At this time, the accounts do need to be available from the Apple Wallet app on the same iPhone. We do have Goldman Sachs available to connect to within Quicken Simplifi as well, so you could try connecting that individual account if it allows you.

I am sorry that I do not have a better solution to offer for the separate Apple Wallets.

-Coach Jon

Re: Apple Wallet integration in a Household

@csolutions, thanks for confirming!

Since the integration with Apple Wallet is managed via the Apple Wallet app on that phone, I don't think there is a way to allow other/outside accounts to be connected. You are, however, welcome to create an Idea post requesting this ability so other users can vote on it and our product team can review it. We can also keep it updated if this type of integration becomes available in the future.

This comment here has a link to how Apple Wallet integration works as of iOS 17.4, which may be helpful:

I hope this helps!