Best Of

Re: Cannot add First Command account - FDP-101/FDP-108 (edited)

Hello @drouetd,

Thanks for the reply. These debug sessions can usually take some time to schedule when it comes to cases like this. I would suggest staying on the lookout for now, as they will be sure to contact you to schedule this session based on your availability, given prior.

Thank you for your patience!

-Coach Jon

Re: Persistent 324 error with Fidelity (edited)

Hi Natalie: I did that yesterday. The connection was broken again by today. Will re-attempt it now.

UPDATE 10:46 AM PT: Done. Works for now. I'll post a screenshot if it breaks again.

Re: The Community Meetup - July 2025 Edition

"Who knows? I might even think about waiting to pay off the card until the statement comes out. Nah! "

I'm just the opposite.

I put all credit cards on autopay, which typically takes the money out of my account on the day it is due — usually 3-4 weeks after the statement comes out. That way, I keep the money in my account until the bank is contractually entitled to it, and payments are always made on time and in the right amount.

With Simplifi automatically downloading transactions frequently, I always know how much is owed in total and how much will be paid on the due date. So I don't get confused about how much money I actually have available to me. And there are no surprises.

DryHeat

DryHeat

Re: Allow users to classify an Investment Account as a non-investment account

@Dognose Yes, and I am lucky I still have mine under Savings. People need to upvote this even if you don't yet have a Cash Management account. One day you might. Upvote it!

SRC54

SRC54

Re: Allow users to classify an Investment Account as a non-investment account

@Dognose, that ability is no longer available:

Thanks!

Re: Using Transaction Activity SEARCH

Hello Kristina,

Sorry for the long delay in responding. I have Italicized your comments;

Thank you for coming to the Community with this question. We do have an article with transaction search tips, which provides some of the rules the search uses, but it is focused on searching amounts and dates:

Yes, I went there first and found nothing relevant.

Is the symbol for the security you're trying to search included in the Payee name or another field in the transaction? When I tested, I observed that searching by symbol was effective only if the symbol was included somewhere in the transaction.

Yes, All searches started out in Payee.

I also observed that when putting in 3 characters or more when searching, the results were transactions that included those exact characters in any column. When searching for a value with less than 3 characters, the results included everything that had either or both of the characters in any column. The only exception to that was when searching $7, it listed exclusively transactions where the amount column started with a 7.

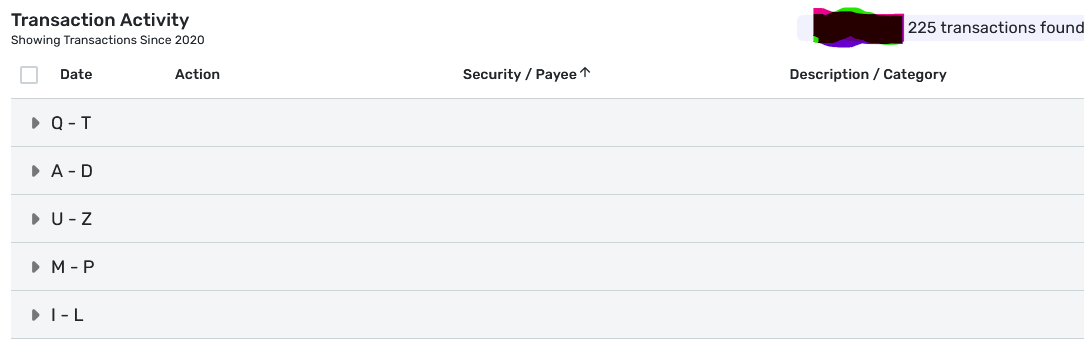

Correct. So, here’s what’s happening; my search for symbol TY produced 225 transactions. I eventually came up with a possible 46 transactions. But… if you look on the left side of the page under the Date header you’ll find a light grey horizontal line with, in my case, Q –T. Under that line is anything with a TY in any column.

The next horizontal separator is A-D. This has another set of hodge-podge listings.

Next came up anything between the letters U – Z.

Next came M – P. Now Payments/Deposits came up with all past entries to TY.

Then I – L with long term gains for TY and Internal Transfers. It picked up one stock with Equity in its name.

What a mess.

Basically, SQ can’t search for AT&T. It will eventually find 2 letter symbols within 5 collapsible headers. It’s hit or miss with 3 letter symbols. Four letter symbols is a slam dunk.

Hope this makes sense. Certainly time consuming putting a response together.

Re: Upgrade Quicken plan

Based on my experience when I was using Quicken Classic, upgrading or even down grading will not affect your data base, it will simply change what features are available with a given version.

DannyB

DannyB

Checking Account at Fidelity Brokerage is forced to be Investment Account

I have my checking account with my Fidelity brokerage. I used to be able to change the account type to: Banking > Checking, but now Simplifi forces it into the Investment category. Please fix this problem. It makes managing cash very complicated to have this intermingled with investment accounts while separated from my other cash checking accounts. Furthermore it causes it to display an erroneous total cash amount.

Re: Best Account Update Frequencies within Simplifi

My daily active accounts I keep set up with the default setting.

My occasionally active accounts I have set up for Daily.

My savings accounts are set up for Weekly or Monthly.

This has reduced the amount of time QS spends refreshing when I sign on in the morning and especially if I happen to sign in during the afternoon or evening for some reason.

DannyB

DannyB