Best Of

Re: Using splits (multiple categories) in Recurring Transactions (4 Merged Votes)

We have recurring transactions that each month I have to split to several accounts. It would be a great benefit/time saver if Simplifi could do this for me each month.

Re: Using splits (multiple categories) in Recurring Transactions (4 Merged Votes)

I've been using Simplifi for about two years. We have a retirement annuity (with tax and health insurance deductions), Social Security benefits (with Medicare deductions) and a mortgage (with PITI splits). Except for the mortgage, the income deposits have the same amounts for the splits for an entire year. And although the mortgage splits change from month to month, it would still be easier to edit the splits rather than to create them. It's long overdue that Quicken/Simplifi should have the functionality to make these recurring splits.

Re: Using splits (multiple categories) in Recurring Transactions (4 Merged Votes)

I agree with this. Also. When the transaction. Is flagged or marked reviewed,the splits are marked the same no matter which type of account.

Re: Ability to See and Edit Savings Goal Contributions and Withdraws [edited] (1 Merged Vote)

This suggestion from 2021 seems an awful lot like the suggestion below (also from 2021). They are not exactly the same, but they cover much of the same ground and address many of the same needs.

Could their votes be put together to show how popular this idea really is?

DryHeat

DryHeat

Re: Allow Savings Goals to have full functionality of other accounts

Same, I've stopped using Savings Goals as it just wasnt working for me. As I recall, one of the bigger things for me was not seeing any kind of register of transactions going in and out of the Goal. Felt it lacked information and history and not tied enough to real accounts and transactions.

I like the analogy of opening a Savings account at a bank, putting money and using it when I hit the goal. The deposits and withdrawals and Spend is all there in a register.

Ideally QS would have a similar system that tapped into an existing account, eliminating the need for me to open a real account at a bank. Then show all the transactions linked to the real and Savings Goal account.

Re: Allow Savings Goals to have full functionality of other accounts

I'm a long time Quicken Desktop user who made the mistake of moving to Quicken Simplify. I made the move at the time because I wanted access from everywhere, modern interface, not having to worry about backups, etc. I used Simplify for a year and the lack of transparency in Savings Goals (being able to see the register) is what pushed me to move back to Quicken Desktop. I'm thrilled now that I'm back on Quicken Desktop, but changing platforms was a big undertaking and huge time sink. I've had times on Simplifi where a savings goal would get out of wack and when you can't view the register, it makes it impossible to resolve.

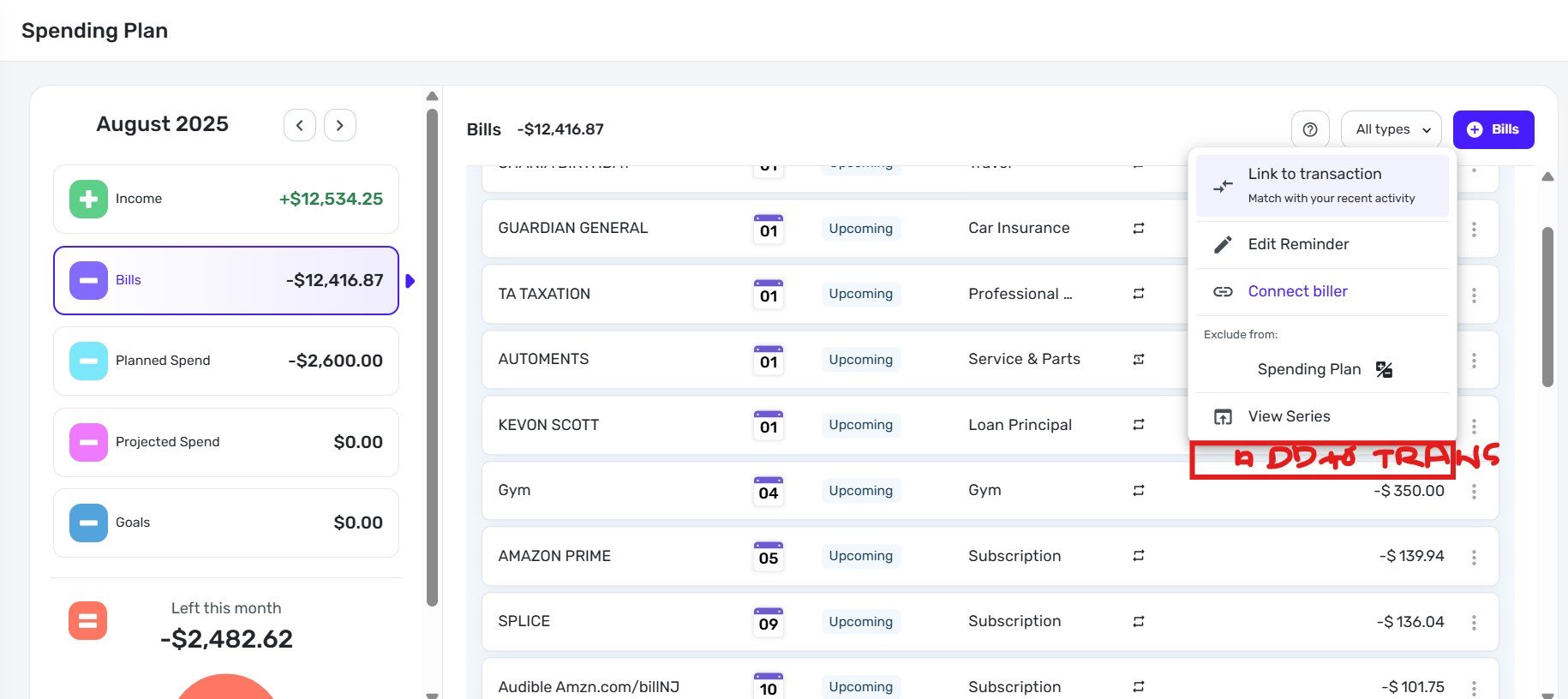

Re: Spending Plan Redesign: Share your feedback here!

I would still like the option to easily add the reminder as a transaction. When I click on the reminder, options show, and in the options i can click "ADD as A Transaction" and it is added as a transaction. And maybe each reminder colour may change or in the upcoming text will change to paid and green.

Re: Spending Plan Redesign: Share your feedback here!

The navigation panel (on the web) seems to be much wider than it needs to be. There is a large gap between the name of the section (like Planned Spend) and the dollar amount.

That horizontal space could be better used in the transaction/reminder listing panel.

DryHeat

DryHeat

Re: Spending Plan Redesign: Share your feedback here!

One single data point, FWIW…

I just spent my weekly 45 minutes helping an 85-year-old relative use Simplifi. (This relative has had a lot of difficulty staying on top of her finances. I introduced her to Simplifi 3 months ago as a last ditch effort.)

She has had difficulty grasping the point of the Spending Plan up to now, but the new layout seemed to make it much easier for her to follow. (Although today's new topic, Savings Goals, is still a bit mysterious.)

As we went over the Spending Plan, suddenly she said, "Oh, I see. You start with this, and then you take out this this and this, and you end up with this."

And I said a silent "Hallelujah!"

DryHeat

DryHeat

Savings Goals and the Spending Plan

I'd like to see some additional functionality for spending money from Savings Goals. Right now they only work one-way, where money can be subtracted from the Spending Plan to go towards Savings Goals.

What I would like to see is where we can spend money from the Savings Goals, link it to a transaction, and have the money be subtracted from the Savings Goal without affecting the available spending in the Spending Plan. After all, the point of putting money to the side is to spend it one day. And there should be functionality that allows us to do so without having to either add income or hide transactions from the spending plan, like we currently do.