Best Of

Re: Ability to see a Total for all Planned Spending Items (Original & Current) [edited]

It would be very helpful to be able to see how much of my planned spending I have left for the month, in preparation of releasing the funds.

Re: Security Federal Savings Bank - IN - FDP-390 (edited)

Thank you for your reply,

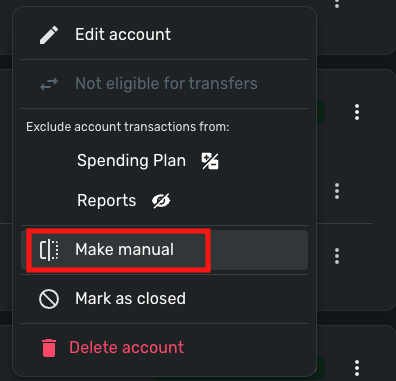

Based on the first screenshot you provided, you have not made the affected accounts manual. Instead of clicking the 3 dots next to the financial institution, please click the 3 dots next to each affected account. When you click the 3 dots next to an account, you will see an option to make it manual.

I hope this helps!

Apple Wallet integration in a Household

My wife and I use the same Simplifi, her having her own log in credentials and we both have our own Apple Cards and Apple Cash (not through Apple Family Sharing but two actually separate credit cards). When trying to connect both, Simplifi reports an error and we cannot add both of our Apple Wallets. The App asks me if "I got a new iPhone" which, I am guessing, is prompted by the fact that we are trying to add another Apple Wallet from another iPhone.

Can Simplifi Resolve this issue? Is this a problem for anyone else? Or is there such a problem with other banks? I would think if there are two different log-in credentials used on the same Simplifi dataset each should be able to add their own stuff. Otherwise what's the point? Families use this app and I would bet I am not the only one with similar issues.

Thanks!

Re: We're looking for feedback on the Spending Plan!

ok, I don't particularly like it.

I'd rather have something different.

Now that you have the new Income & Expenses report, you would be great to have a version of that report that includes the budget. On a monthly basis.

How much do I budget per month on each category/sub-category?

Show that compared to actuals.

That would be all I needed.

Re: Understanding – Pending in Transaction Activity

@Dick_Davis I'm glad @DryHeat gave you that extra information. And just to show you more complications, there are some banks that download pending transactions twice and it often makes a duplicate! This happens with my local bank when we make Debit Card transactions. On the first day, it downloads the pending transaction with that day's date. On day 2, it downloads the pending transaction again with today's date. Then on Day 3, it clears it.

Since I tend to edit the transaction and split it, if necessary, on day 1, I end up having to delete the second downloaded pending. This doesn't hurt, because it's only the final transaction that matters. Pending transactions just help you keep up with your available balance. This can be important if you keep a small balance in an account as you don't want to overdraw.

My current policy is that I only enter manual transactions for accounts that don't download the pending transactions (Capital One, Fidelity Cash Management) but I wait for the downloads from banks that do download pending (Chase, American Express).

Once you get the hang of it, it isn't too complicated. Just be aware of your banks' peculiarities.

SRC54

SRC54

Re: Understanding – Pending in Transaction Activity

Thank you for the information and the reference.