Best Of

NEW 2/27/26: Bank of America - Missing Pending Transactions

We are currently seeing an issue with Bank of America where pending transactions are no longer downloading in Quicken Simplifi after migrating to their new OAuth API. This is a known issue that we are working to resolve as quickly as possible. A fix is currently expected early next week.

If you would like to be automatically notified of any updates regarding this issue, please "bookmark" this Alert by clicking the bookmark ribbon in the upper right corner.

Thank you!

ISS-12262536

Re: Pending transactions are not downloading after Bank of America migration (edited)

Hello everyone!

We are aware of the known issue involving pending transactions with Bank of America, and we do have an alert you can follow in the meantime. A fix is expected this coming Monday, so be sure to be on the lookout around that time.

Thank you for your patience!

Re: Net Worth Report: Add more granularity to the y-axis to better reflect small changes (edited)

Much better - having a dynamic y-axis in both the new Net Worth module & the old Net Worth Report is great. Thanks, @Coach Natalie!

Re: Net Worth Report: Add more granularity to the y-axis to better reflect small changes (edited)

Hello everyone,

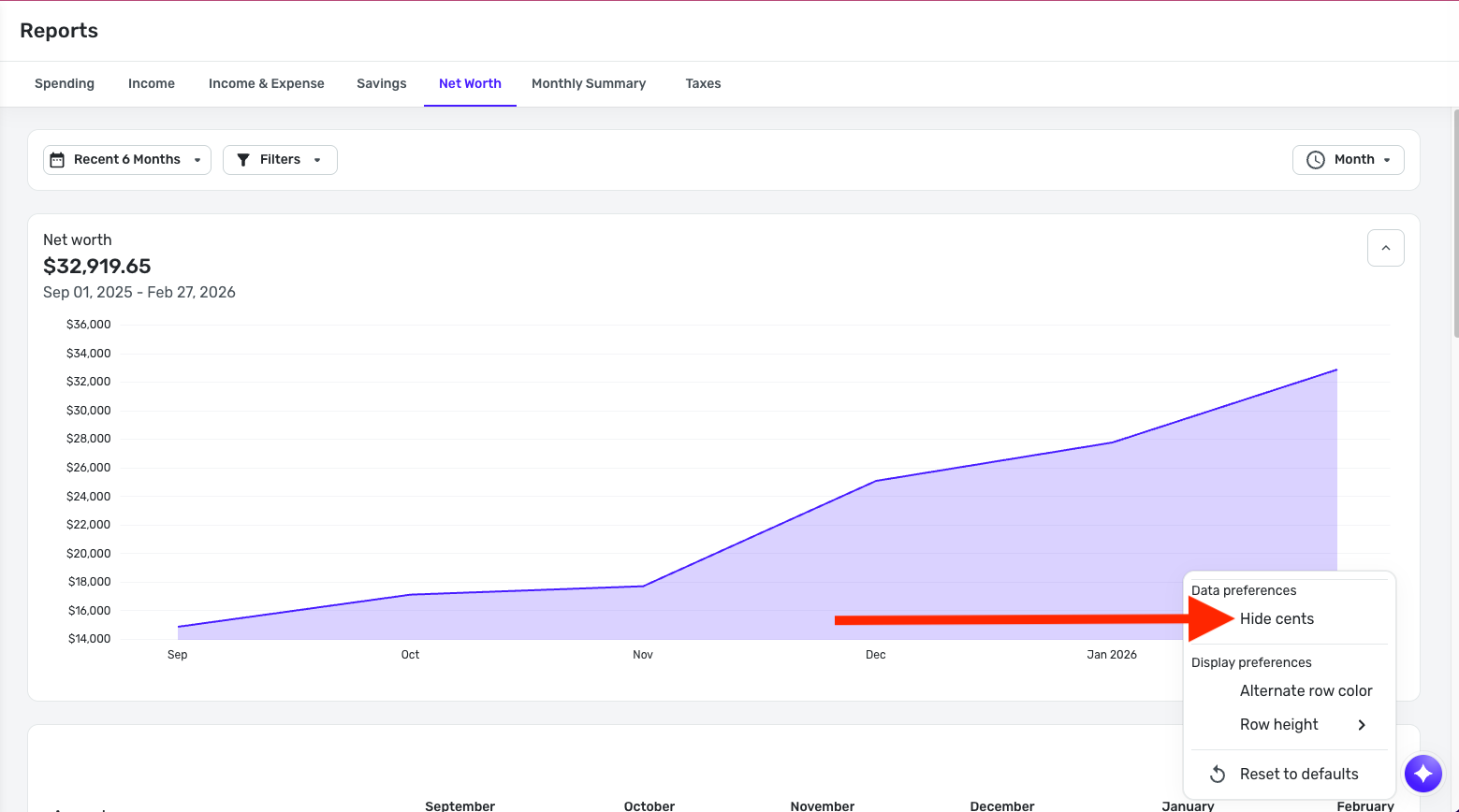

With the Enhanced Reports currently in Early Access, we have added more granularity to the Net Worth Report graph when viewing the various interval options. Does this enhancement meet the needs of those who have posted here and requested this?

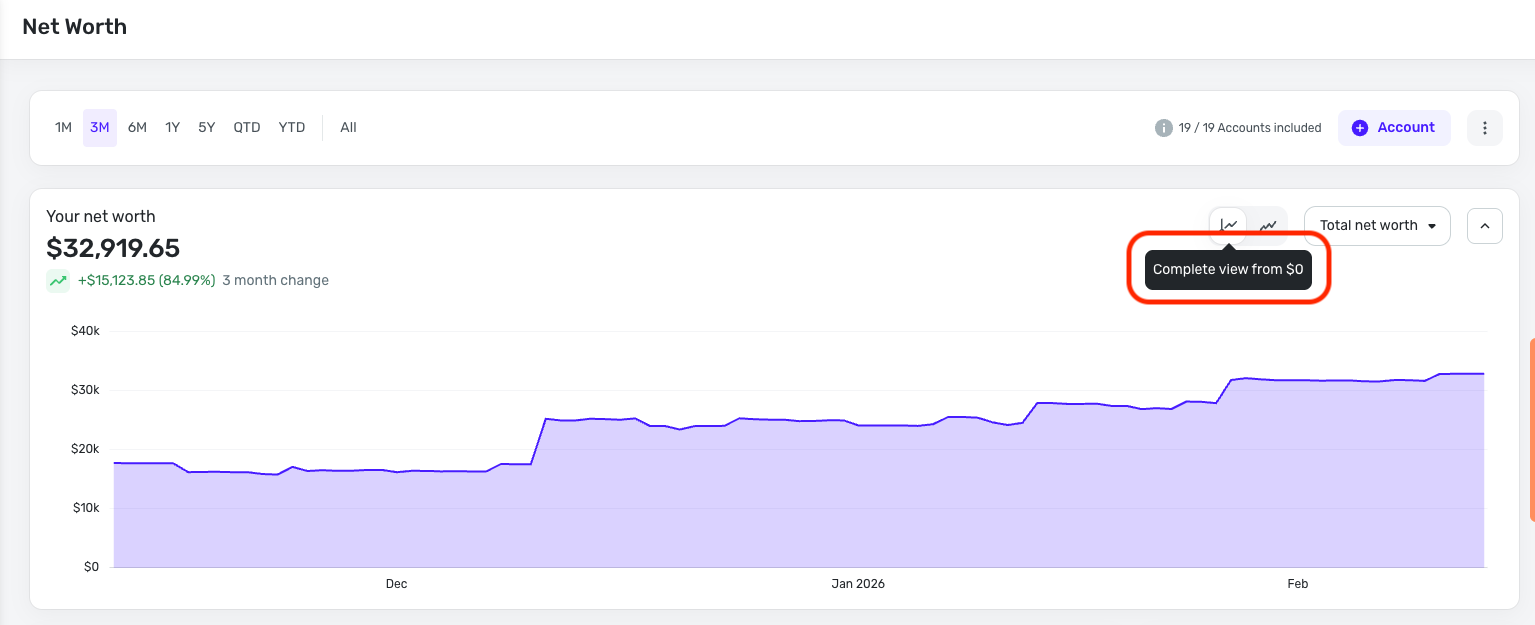

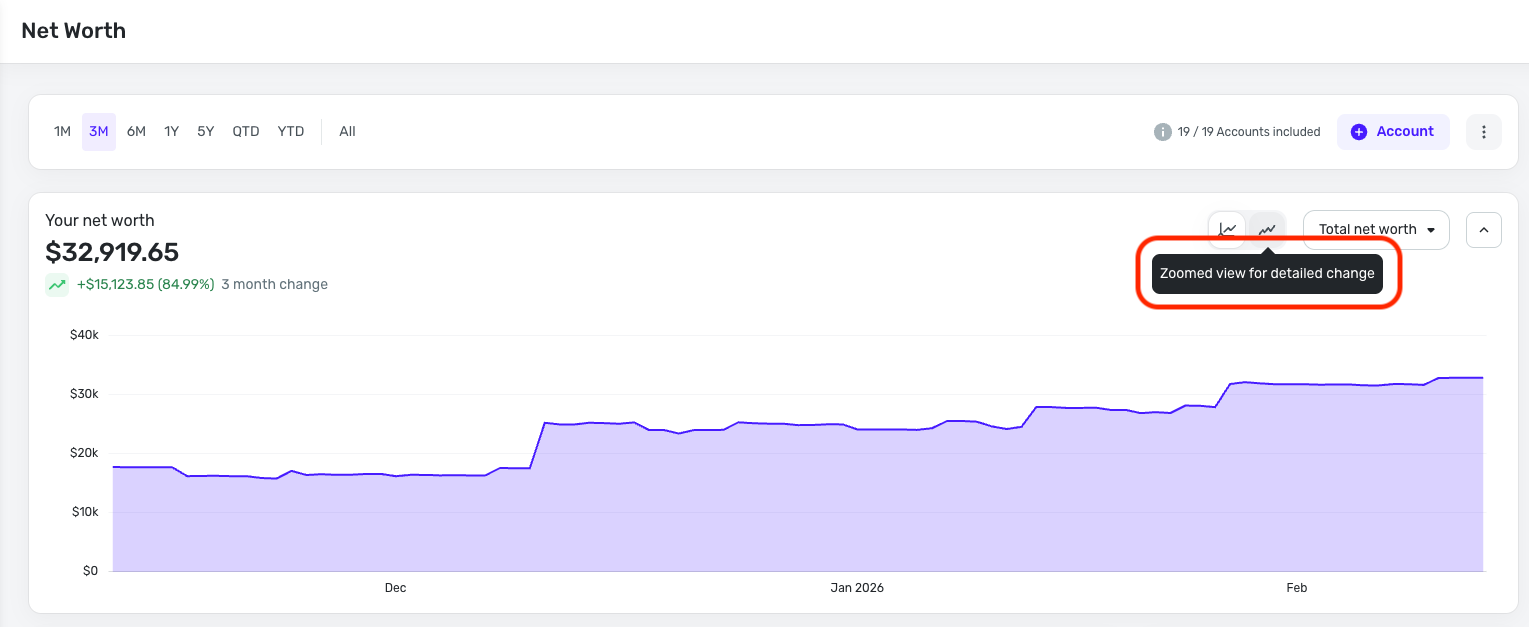

Also, with the new Net Worth feature in Early Access, you can view the graph there by "Complete view from $0" or by "Zoomed view for detailed change". Does this help at all here?

Please let us know!

Re: Get rid of "Everything Else" and show all Categories on the Spending Report graph (edited)

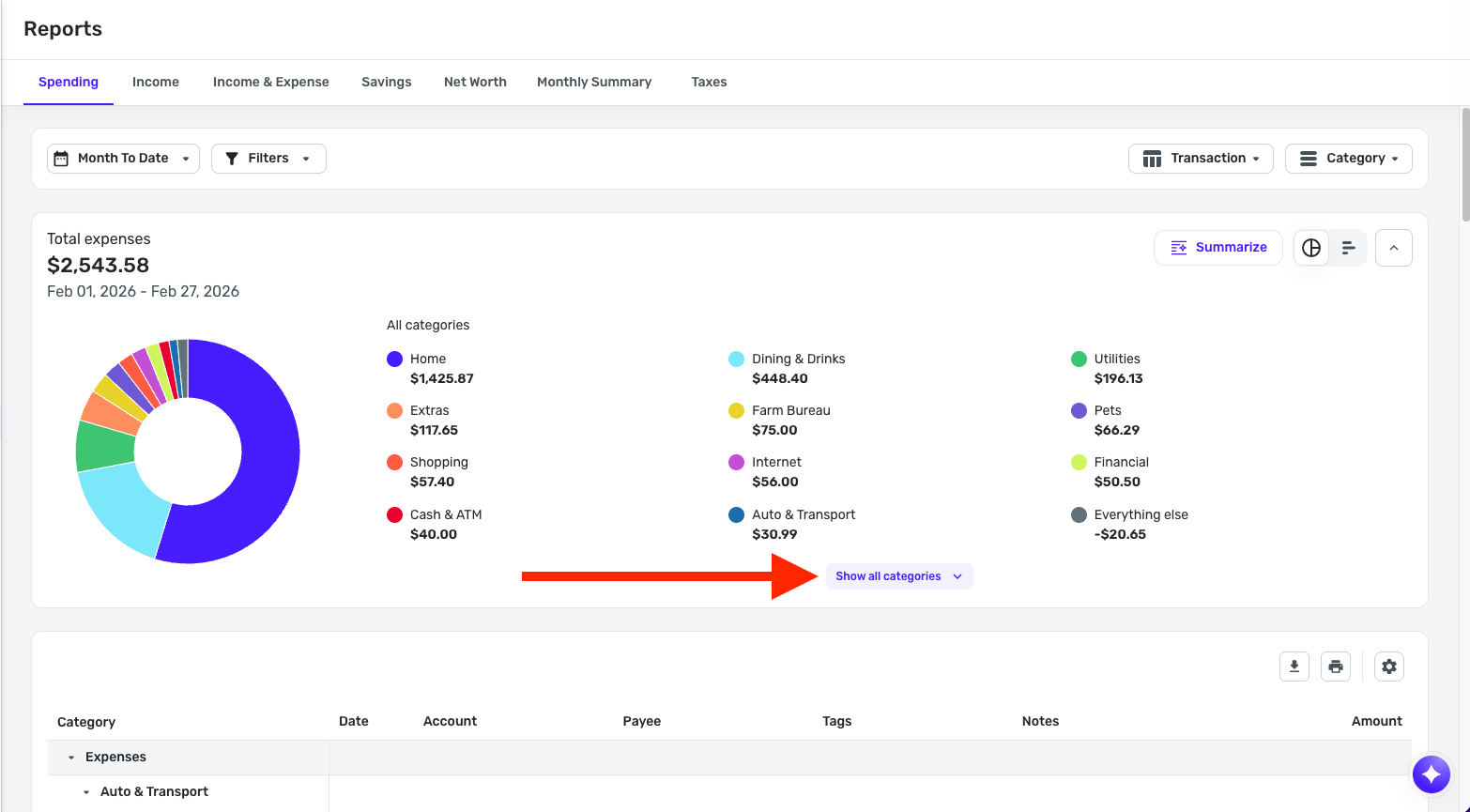

With the Enhanced Reports currently in Early Access, we have added a "Show all categories" option. This will get rid of "Everything else"!

Re: Recent Spending includes Income categories

@SRC54, thanks for confirming!

It may have been fixed in the Web App via a separate ticket, as there have been no updates on your escalation ticket. With that, I updated your ticket to note that the issue is now only happening on the Mobile App. I will continue to keep you informed of progress here in this thread!

Re: Net Worth Report: Add more granularity to the y-axis to better reflect small changes (edited)

Absolutely! Thanks so much

Re: Expand the "Hide Cents" option across all Reports

With the Enhanced Reports currently in Early Access, we have added a "Hide cents" option to all reports in Quicken Simplifi.

Re: Enhanced Reports: Share your feedback here!

I want to highlight a few current issues, how to address them, and some upcoming changes.

“No Data” appearing in reports - Some users are seeing a “No Data” screen in the Spending, Income, and Savings reports, even when data exists. Clicking Reset will resolve this. During this transition, some reports expect specific configuration elements. If those elements are missing, the report can’t render and displays “No Data” instead.

Report type and row/column settings are reverting to the default configuration for beta users - As we update configurations to automatically add the missing elements (and reduce the issue above), some beta reports will reset. We’re able to preserve filter settings and date ranges, but report type and row/column selections will return to their defaults.

Unfortunately, this will happen again when we turn on the new reports for all customers, which is currently planned for the second week of March. We apologize for the inconvenience.

Upcoming change to account grouping logic - For Profit & Loss (Income & Expense), Spending, and Income reports grouped by Accounts, we currently determine whether transactions appear under Business or Personal based on the account’s designation.

In a couple of weeks, we’ll switch to using the transaction’s usage instead. This means that if a personal account contains both business and personal transactions, all transactions will appear in the report according to their individual usage.

Pie Chart Improvements - Currently, the pie chart may display categories twice. This happens when a category is both a Business and a Personal category. The fix we're making is to include whether a category is Business or Personal in the pie chart legend so you can distinguish between the 2.

Net Worth Balance Improvements - Currently, we always use the Bank balance when calculating Net Worth. A number of customers asked us to change this behavior and to use Balance with Pending if they are using that balance.

We're sorry for the inconvenience this may be causing, but we hope you'll like the report improvements. We're trying to minimize the changes, but unfortunately, some can't be avoided.