Best Of

Re: Support multiple currencies

I just said for INR, you can expand to multiple countries based on popularity.

Re: Support multiple currencies

is there a way to do this in a manual account since support isn't responsive to this request?

Re: Support multiple currencies

I keep track of multiple currency already, only need ability to automatically maintain balance in a single currency at mid market rate updated daily. Custom account types by currency also would be beneficial.

Re: Notifications Reappearing

Hello @KCinKC,

Thanks for reaching out and for your feedback! Are you seeing the same issue reported in this thread with notifications showing up on another platform after deleting them on one platform?

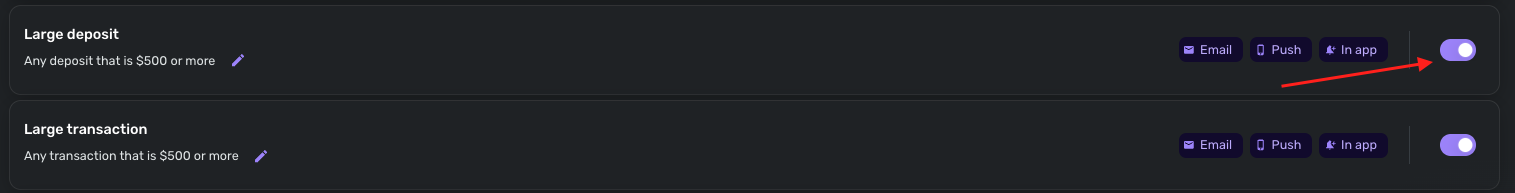

For your feedback, there is an option to turn off "Income received" and "Large deposit" notifications in the Notifications settings. You can just toggle these options within the settings menu for Notifications, as shown below.

We also have a couple of idea posts you may be interested in here:

If these do not match what you're specifically looking for regarding notifications, I would suggest creating your own idea post so that other users can vote for and add their feedback as well!

I hope this helps!

-Coach Jon

Re: Recommend increasing the columns for the Payee and Category fields (edited)

@Dick_Davis, thanks for posting your recommendations to the Community!

Since we have a register redesign right around the corner, one that includes customizable columns, I would suggest waiting for that release to occur. We don't have an ETA as of yet; our product team is still working out some kinks. But you can follow our Updates From the Product Team category to be notified of this redesign when it occurs!

I hope this helps!

Re: Issue with Barclay's MFA

@Coach Kristina - So today I reconnected the account after being unable yesterday and it worked as usual pulling in the few transactions. Barclay's does use SecurePass MFA and it messes with the connection. Perhaps letting a day or so go by let's it reset itself. Who knows.

Re: The Cash Flow Graph Should be Removed Until it Includes Planned Spend (edited)

I use the cash flow graph on a regular basis and wouldn't want it removed. Recurring items that come out of my bank account are set up as bills so that the cash flow accounts for them. All categories that I set up in Planned Spending are paid via my credit card, so they affect my cash flow a few weeks later when the credit card bill is due. These are displayed on my cash flow (I used to update them manually, now they are done automatically and I like to double check just in case). This way my cash flow is more or less accurate for the upcoming month or so. I don't usually look at it further than that because I can't accurately predict exactly what the CC bills will be so far ahead. I wouldn't want planned spending to show in my cash flow because it would not be a realistic prediction for my account. My "planned spending" categories vary from month to month so I use it more as a "try not to spend more than X in this category" idea, but almost never max out all the categories every month, so budget-wise it doesn't matter to me.

Re: Changed manual asset to investment and now balance shows zero

Update 2: I was able to find a fix (posting for others who find themselves in this situation). I closed the account, which then enabled me to download the transactions from the Investments tab. Then I created a new manual "Other Asset" account, changed the data in the .csv to match Simplifi's upload format (both for transactions and balance history) and then uploaded it to the fresh new account. Now it all appears as it was before I changed the account type.

Re: Taxes Report Export/Print Display Suggestions (edited)

@Coach Natalie, I understand and do appreciate your action.

Re: Credit Cards and the Spending Plan (edited)

I am going to try out the New feature you posted.