Categorizing distributions from retirement investment accounts

I am retired and track all my income, expenses and investment in quicken. I get a monthly distribution from my investment accounts.that are transferred into my checking account. What is the best way to categorize both transactions … distribution as a transfer and deposit as other income?

Comments

-

Hello @Sandra W.,

To clarify, when you say both transactions, are you referring to both sides of the transfer (the withdrawal from the investment account and the deposit in the checking account)? If that is what you're referring to, then both would reflect the transfer in the Category column. The reason for this is because a transfer is neither income nor expense; it's just money moving between your accounts. If needed, you can create and add tags to provide additional information. For more information on creating/using tags in Quicken Simplifi, click here.

When you refer to a monthly distribution, are you referring to money you are moving from your investment account to your checking account, or are you referring to a payment the company or fund is sending to investors? If it's the former, then documenting it as a transfer makes sense.

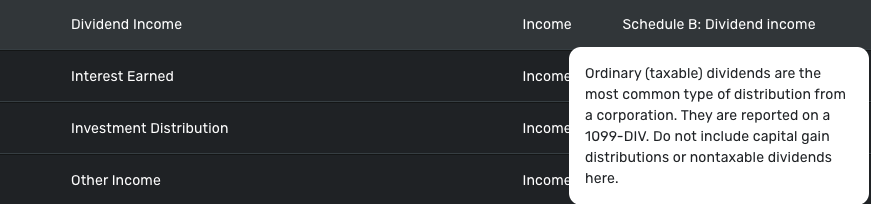

If it's the latter, then the distribution going into the investment account would be a separate transaction from the transfer moving that money from the investment account to the checking account. You would want the Action column to reflect the appropriate Income (Div Int, Dist), and you would want to select/create a category that shows it as income (and, if applicable, reflects the correct Tax information). If you're not certain which tax line applies, you can hover over it to see more information.

I hope this helps!

-Coach Kristina

0 -

To me it would depend on the type of transaction.

I will sooner or later start making DISTRIBUTION from my IRA (should be the same for 401K, 403a, etc.), but am putting it off as long as I can. This will be from an account on which taxes were deferred, so I will mark the distribution as Income since I'll have to pay taxes on it. From your post @Sandra W., it sounds like this is your case as well.

However when I transfer money from my Brokerage accounts to a checking or savings account, it is just a transfer because I already pay taxes on the dividends and interest I receive there. This money is therefore post tax and just a simple transfer. 😀

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

I don't track my retirement accounts in QS - way too much work for no real benefit in my case. (I believe most folks do so they can see their net worth tracked in QS - again, this is not necessary for me and not worth the work to keep all the minutia of our retirement accounts up to date in QS.)

I have my monthly retirement account distribution set up as a recurring income event and track it under the Income section of Income after bills & savings in the Spending Plan. Since my retirement accounts are not connected or tracked in QS there is no issue or need to mess with how to set up the transfer stuff.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0