M1 Finance Not showing Money Market account when Syncing

When I try to sync my M1 account, I can't seem to see the money market account that I have there. it does show the investment account correctly though. I've tried deleting and re-adding, but still don't see an option to sync data from the money market cash account. Any ideas?

Comments

-

Hello @gms,

I'm sorry to hear you're running into this problem. To clarify, is this a separate account that isn't showing as an option to add, or is it part of the investment account that you have connected? If it's part of the investment account, since you mentioned the money market account is a cash account, is it reflecting in the cash balance?

I look forward to your reply!

-Coach Kristina

0 -

I am having a similar issue. I had M1 Finance linked to Simplifi for over a year, with a few investment accounts and a HYSA account. Recently (at least since Jan 1st), the HYSA has shown as disconnected with no input from myself. I have tried several times to reset the connection, but the HYSA does not show up as an option to link. The other accounts show up fine and link up but not that one.

0 -

@mrbook, thanks for posting on this topic!

I definitely understand how frustrating this situation could be. To begin troubleshooting, please establish a completely fresh connection with the bank by following these steps:

- Make all of your accounts with M1 Finance manual by following the steps here.

- Once you see the account(s) listed in the Manual Accounts section under Settings > Accounts, go back through the Add Account flow to reconnect to the bank.

- Carefully link the account(s) found to your existing Quicken Simplifi account(s) by following the steps here.

Please post back here to let us know how it goes!

-Coach Natalie

0 -

I followed your steps. I marked each account with M1 as manual. Added an account, but once I logged in with my credentials it only showed 3 of 4 accounts. It did not display the HYSA account as an option to connect.

0 -

@mrbook, thanks for giving the steps a try and posting back!

To identify potential culprits, please provide the answers to the following questions:

- Has there been any activity in the account in the last 90 days?

- Is the account considered an external account (i.e. are you redirected to a different website when selecting the account on the bank's website)? If so, what URL are you redirected to?

- Is the account a subtype of a different account?

- Has the bank made any recent changes to its website or sign-in process?

- Are you the owner of the account?

-Coach Natalie

0 -

I am having the same issue with my non-investment accounts. The sync worked fine until about a week or so ago. My M1 high-yield savings and credit card no longer sync, but my investment accounts sync fine. I have converted the accounts to manual, and Simplifi no longer sees them when attempting to re-add them. Can we escalate this to a technical team to be researched?

0 -

@seymoursolo, thanks for letting us know!

Can you please provide the information requested in my last comment? Thanks so much!

-Coach Natalie

0 -

@Coach Natalie Back again.

1. There is a few transactions that occur in that account every month.

2. It is not an external account, it is native to M1.

3. It is it's own standalone account in M1, just like the investment ones that show up.

4. I haven't noticed any changes in the log in process for M1.

5. I am the account owner.1 -

@Coach Natalie, thank you for responding. My answers are the same as those of @mrbook in the previous comment. I have multiple investment accounts that still work. My High-Yield Savings and Cash accounts and credit card stopped syncing around January 6th. Those are the last transactions I received.

I had a lengthy chat yesterday with Coach Maria, during which I sent a lot of information and diagnostics. She said the issue is being escalated for resolution.

1 -

@Coach Natalie I'm also having the same problem. My answer are the same as @mrbook as well. All the investment accounts work, but the HYSA does not show up

0 -

@Coach Natalie Same issue as others since about a week ago or so. M1 Investment account gets syncd but the HYSA does not refresh. Tried deleting and reconnecting the institute but it only shows the investment account as an option to choose from. Please resolve the issue soon.

0 -

Hey everyone, thanks for letting us know, and we apologize for the connectivity issues with M1 Finance!

It looks like this issue was already escalated internally, so we got an Alert up that you all can follow for updates:

With that, however, it would be great to get some of you added to the ticket to show our engineering team that the issue is impacting multiple users. To do so, we need the following data:

- Has there been any activity in the account in the last 90 days?

- Has the bank made any recent changes to its website or sign-in process?

- Are you the owner of the account?

- The name of the account, as it appears on the bank's website.

- If the issue is occurring on an existing Quicken Simplifi account, the name of the account as it appears in Quicken Simplifi.

- A screenshot of the Accounts Summary page from the bank's website (the page that lists all accounts and balances - feel free to redact any private info) that has a wide enough scope to show the page URL (this must be taken from a web browser and not a mobile browser). This needs to show the missing account.

- A screenshot of the Add Account screen in Quicken Simplifi showing that the account in question is missing at account discovery.

We will also need logs:

- Log into the Quicken Simplifi Web App.

- Select Profile from the left-hand navigation bar.

- With the Profile menu open, hold down the Option key for Mac or the Alt key for Windows, and then click Send Feedback.

- Leave all boxes checked, add a brief description of the issue, and then click Send.

Thanks in advance to anyone willing to provide the info to be added to the ticket! Otherwise, we appreciate everyone's patience as the issue is worked on.

-Coach Natalie

0 -

Do you still need these details about the M1 Finance login flow? I've written a scraper to query M1's APIs (it's just GraphQL) so I can provide details to Quicken's engineers for troubleshooting.

0 -

@bmeares, thanks for offering to help!

If you'd like to provide the information I requested above, I'd be happy to get you added to the ticket:

I'm not sure what a "scraper to query M1's APIs" is, but we would just need the above-requested info, including logs. Thanks!

-Coach Natalie

0 -

@Coach Natalie I submitted logs (reference ID 473161846984855808) and gathered screenshots. Please let me know if you need further information and/or if an engineer would like to connect with me. Here is my account information for your requests:

- Yes, there has been activity in the last 90 days. The issue began January 1, 2025.

- Not to my knowledge, at least on the user-facing login flow. Note that I use 2-factor authentication.

- My investment accounts are still syncing as expected. The M1 savings account, cash account, and credit card are not syncing.

- M1 Finance is planning on phasing out savings accounts and credit cards, which could explain if some APIs were deprecated.

- Yes, I am the owner of the accounts.

- The display names of the affected accounts are "M1 High Yield Savings" ([removed - privacy]), "Emergency Fund" ([removed - privacy]) and the "Owner's Reward Card" ([removed - privacy]).

- My Quicken ID is my email address ([removed - privacy]).

- Below are screenshots of the account pages from M1 Finance.

[removed screenshots - privacy]

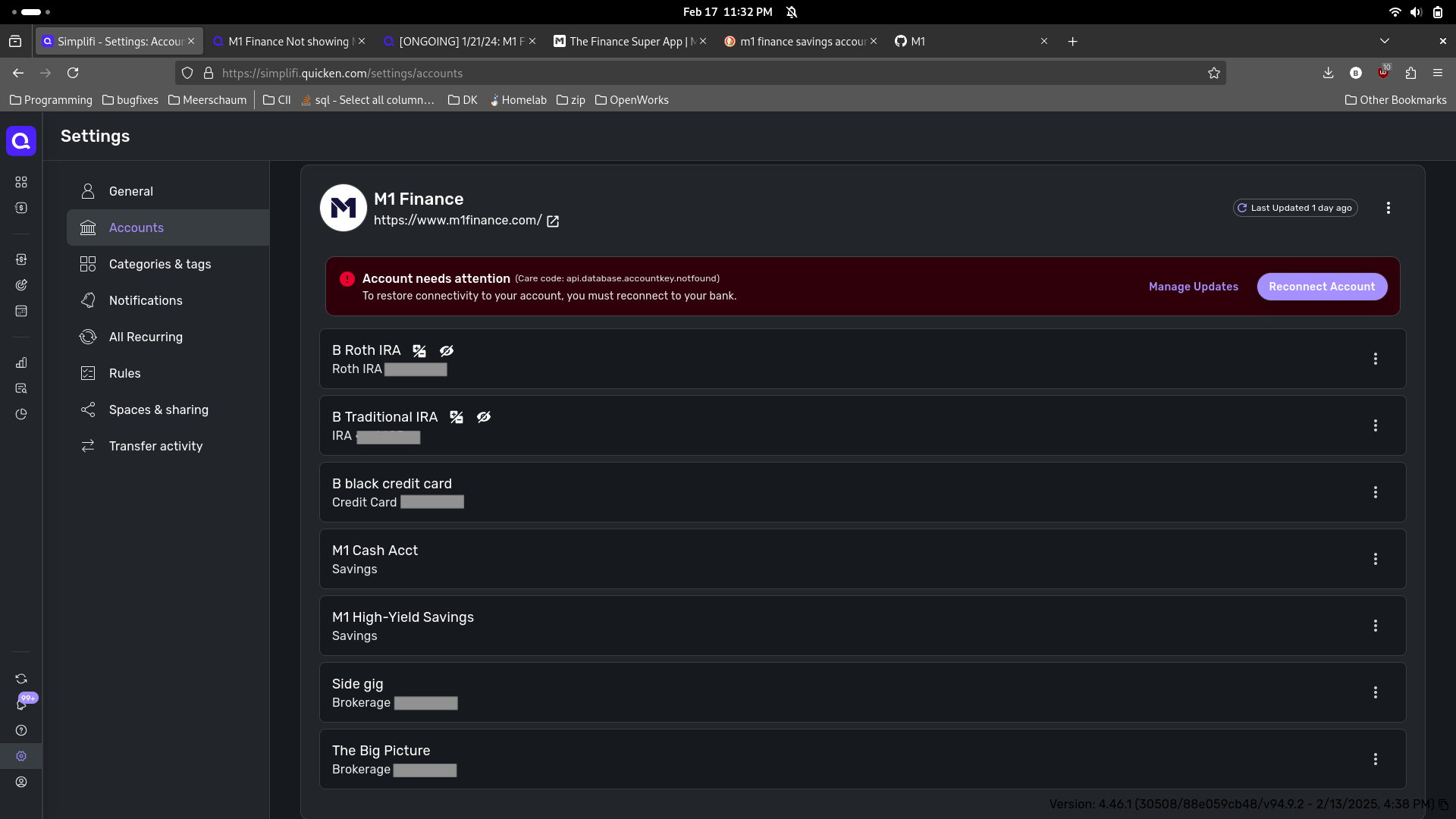

7. Below are screenshots of the M1 accounts on Quicken:

[edited image - privacy]

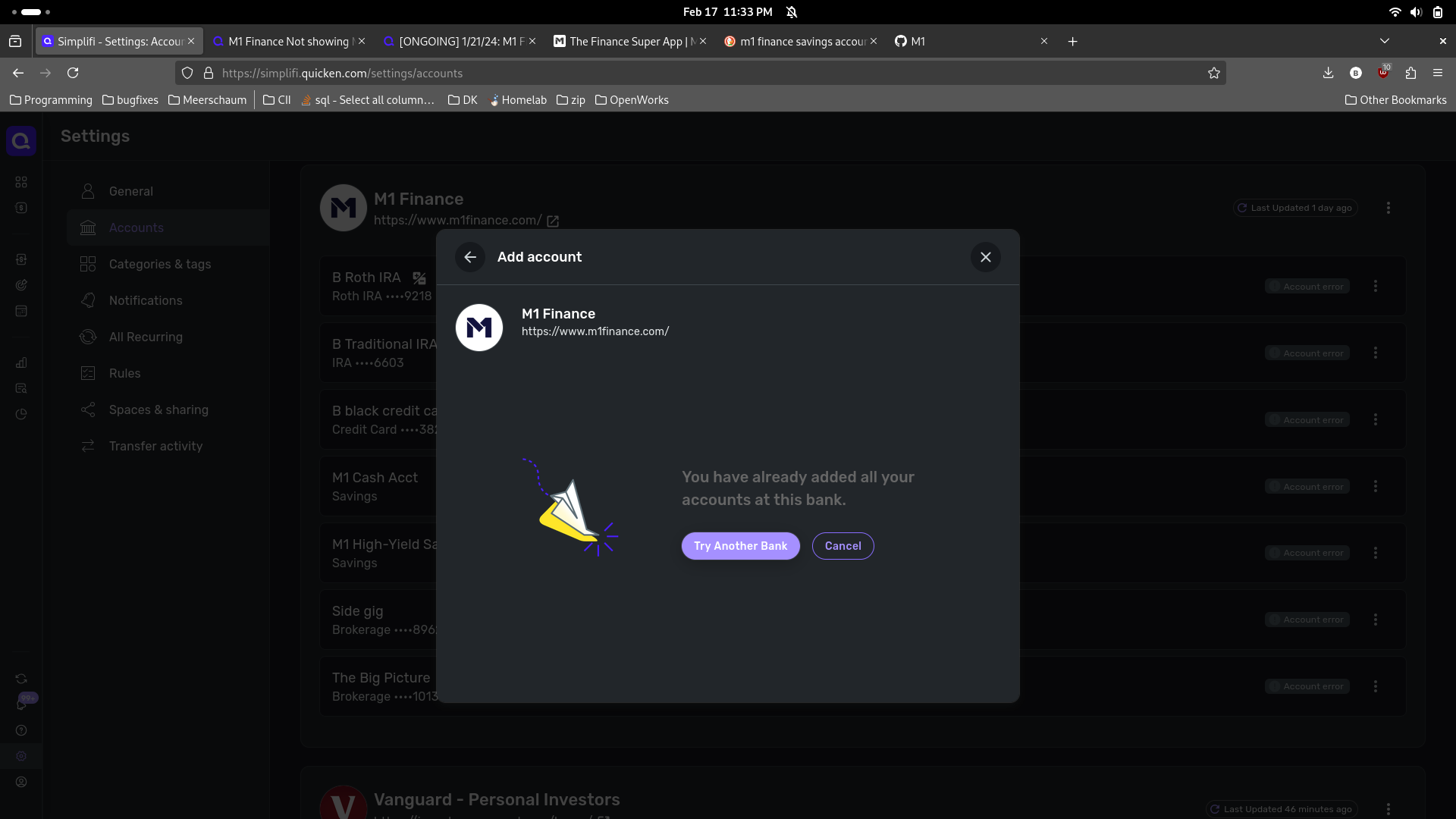

and failure to reconnect them (do I need to delete and reconnect all my M1 accounts? Worried about breaking the investing data):

0 -

@bmeares, thank you!

I went ahead and removed some of the information you provided for privacy. Also, for number 6, we don't need the individual account breakdowns from the bank's website. We need the Account Summary page, which is the landing page after signing into the bank's website. This page usually lists all accounts and balances, and we need to see the URL at the top. You can redact any private info such as balances and account numbers.

For number 5, this would be the bank account names in Quicken Simplifi (if they already exist), not your Quicken ID. I see in your screenshot from Quicken Simplifi that at least the HYS account already exists — is that the same account? Have you been able to add the credit card and emergency funds accounts to Quicken Simplifi? If so, what are they named?

For number 7, let's have you establish a completely fresh connection with M1 so we can see the Account Discovery screen:

- Make all of the accounts with this bank manual by following the steps here.

- Once you see the account(s) listed in the Manual Accounts section under Settings > Accounts, go back through the Add Account flow to reconnect to the bank.

- Carefully link the account(s) found to your existing Quicken Simplifi account(s) by following the steps here.

- Take a screenshot of this window so we can see the accounts that have been discovered, and also see that the other three accounts are missing/not being discovered.

I look forward to hearing back from you!

-Coach Natalie

0 -

Heyo,

I'm also having this issue with M1 not syncing my savings account in to quicken. Can I be helpful in anyway to get this resolved? curious what info I can help provide?

Thanks!

0 -

@jslem, thanks for posting on this topic!

It looks like the Alert for M1 Finance was marked as resolved, as our service provider confirmed that only Investment Accounts are supported.

This was also added to our list of Other Known Online Banking issues here:

With that, what type of account(s) with M1 Finance are you unable to connect? Please let us know so we can best assist!

-Coach Natalie

-1 -

hey @Coach Natalie

yeah two accounts of mine aren’t syncing:

- high yield savings account

- high yield cash account

so your service provider is saying that only investment accounts work. But the savings and cash accounts worked before January 2025. I’m curious what changed and how this can be remedied. Again happy to help in any way

1 -

@jslem, thanks for confirming the account types!

I'm not sure what changed, but the issue was recently escalated, and that's the result we received back from our service provider. Since the other account types aren't currently supported for connectivity, you can track them manually in Quicken Simplifi. Let us know if you need any help with doing so!

-Coach Natalie

0 -

I did some digging around (I'm a software engineer) and the data for these accounts that aren't syncing is still available. I have successfully written a small program that taps in to M1s GraphQL API and grabs the balances and transactions for savings and cash accounts. So there is no reason why these accounts couldn't continue syncing with simplifi.

Why things broke back in January? I'm assuming here, but I think something changed with M1s GraphQL APIs (the specifics I wont' get in to) that moved the savings accounts' data elsewhere from where other accounts' (investment accounts) data is accessed. This is what caused the stop in syncing. And your service provider that is doing the syncing now only sees the investment accounts in that original list and really just needs to adjust and look in a slightly different place for these savings and cash accounts.

Let me know how I can be helpful (code etc).

Also, I'm using this small program to generate the CSVs needed to manual import the transactions into simplifi. If there is enough interest I could make something generic enough for others to use. If anyone else would be interested in that I could do a little work and publish it on GitHub. Let me know.

3 -

My high yield cash account also stopped syncing in January. It worked fine before then. Also, SoFi Relay is currently able to pull this data from my M1 accounts without a hitch (as well as the balance on my margin account, as an added bonus, which never synced on Simplifi). This plus @jslem’s comment suggests to my (admittedly non-software programming) eyes that the issue needs to be resolved on Simplifi/its provider’s side rather than M1. So if the data can be synced, my question is if Simplifi will pursue fixing this. The resolution to the escalated Alert on M1 Finance is pretty unsatisfying in that it says investment accounts which, at least for me, never stopped syncing can be synced as normal, and then just kind of shrugs with respect to the cash/savings account issue that started this. My Simplifi subscription is due to renew next week, so if there’s no interest in resolving this moving forward, you know, no worries, but resubscribing won’t make sense for me as someone who banks with M1. So it’d be awesome to have clarity on Simplifi’s plan moving forward.

0 -

This is really disappointing update—a decent amount of my main expenses, savings, and transfers flow through M1 and I've used this integration for some time. I'm hoping by sharing my disappointment that someone can re-evaluate. Being able to sync these accounts is very useful to me; I'm not sure that continuing to use this service makes much sense without it as I don't want to dedicate the time to manually managing all of the transactions. Please reconsider.

1 -

Without m1 sync working simplify is useless to me please fix. It was working fine in January. Why increase the price for less features??

2 -

Same here. This is incredibly disappointing and just paid for the year… not sure I can continue using this if my income is out of whack each month and have to manually add it and track it that way… (my income goes into M1). I say that they should take the help of the dev on this thread because he seems motivated and also wants this fixed.

1 -

adding here that it’s also super frustrating. I don’t see why only investment accounts can be supported. I have two high yield savings accounts that no longer connect. Incredibly frustrating. Also to know how widespread this issue is, simply look at everyone with an M1 account and that will tell you how many people are having issues because I think everyone gets a high yield or cash account for the investment account anyway.

1 -

Dropping back in ― here's my best attempt at reverse-engineering M1's GraphQL API. Like others in this thread, I'm disappointed that the engineers at Quicken have dropped support for M1's savings and cash accounts and credit cards. My income flows through M1, so my Quicken data have been useless. I will be closing my account, and I expect a refund for the my payment of the annual subscription for 2025.

2 -

I'm also dropping back in. Here is a little website I whipped up to make this easier for people. It isn't perfect, and requires a little bit of technical know how to use. The website walks you through what to do. But hopefully saves someone some time:

0 -

I have disabled the renewal of my Quicken Simplifi account because of this issue. Without this, the service is not worth my money. My account expires on May 6th. If this issue can be fixed, then I may consider coming back, but this is very poor customer service and support.

1 -

Posting for the first time after creating a community account just because of this! I can’t believe after months of claiming it was being investigated and worked on, coach just comes back and says the engineers [removed - accuracy] and claim only brokerage accounts are supported… that logic doesn’t hold up across any other brokerage connection that offers cash accounts, which is most. As others have mentioned, having this account sync error causes complete disruption to my entire finance tracking ability, rendering the simiplifi product practically useless.

I feel compelled to write a message directed at your engineering management team:

Please for the love of god, stop distracting your engineers with new product offerings when they need to focus on fixing the core product you advertised to recruit your user base! I keep seeing “new features” being advertised, like investment tracking, money transfer from within the app, document storage in cloud, etc. but who in their right mind is going to trust or pay extra for any of these add-on features, when your core function of finance tracking can’t even accurately import or track finances anymore!! M1 Finance broken, Coinbase broken, LPL Financial broken, WeBull never even attempted link, Stessa never even attempted link…. Please take a moment to realize that users will not benefit from new features, if they can’t rely on your base product function! Please refocus more engineering time on these connection/API issues! Your user base is so frustrated and the issues are apparently so simple to fix, that users are posting scripts to manually work around your broken app for proper data import! The solutions are literally posted in this thread right above my comment, and your engineers aren’t implementing it in the app!! This seems like it must be management at fault causing the engineers to ignore this, so I beg the people in charge to wake up before we all leave!

2