The year is officially halfway over!

I, for one, cannot believe how fast this year is zooming by. Halfway there, folks! Can you believe 2025 is already 6 months in the books?! 🤯

Did your financial goals for the first half of the year go according to plan? Let us know in the comments:

- One thing you splurged on in the first half of the year that was totally worth it!

- One financial goal you're focusing on saving for in the second half of 2025! (Bonus points if you include how your savings goals are helping you!)

Let's inspire each other to finish the second half of the year strong!

-Coach Jon

-Coach Jon

Comments

-

I admire your forward-thinking … but the year won't be halfway over until the end of June. 📆

I've still got a month to try to make things work out. 🤑

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)7 -

LOL @DryHeat. I thought the same thing, but I still round up my age even at 70 (71) though I keep trying to break the habit. It was cool when I WAS young. Now not so much.

We don't splurge much but I suppose our replacing the wife's car with a Honda CRV Hybrid was a splurge. I know gas prices have dropped and probably won't recoup the extra $3 or $4K. I made the mistake when she asked if she should get the hybrid or regular by answering, "whichever one you prefer". 😆

But her old CRV got 29 mpg and this one is at 43. Even on highway trips, it seems to be maintaining that. And what a difference 6 years makes, this thing does everything for you. (I warned her to be careful trusting it too much, adaptive cruise control, lane intrusion, blind spot warnings, etc., etc.) It makes my 4 y.o. HRV feel like a go-cart.

I am feverishly saving to recoup the money. But I am keeping the rinky-dink HRV for a few more years!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)3 -

Splurge - Japanese Classes

Saving goal - Funds for Black Friday Shopping

3 -

splurge- AirPods 4 and fancy birthday dinners

savings Goal second half of the year - vacation funds for next year

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

4 -

My splurge this year was the same that it is every year: taking a vacation to visit Dad. Travel expenses, eating out frequently, and buying stuff for Dad does get rather expensive, but getting to spend time with him is worth it.

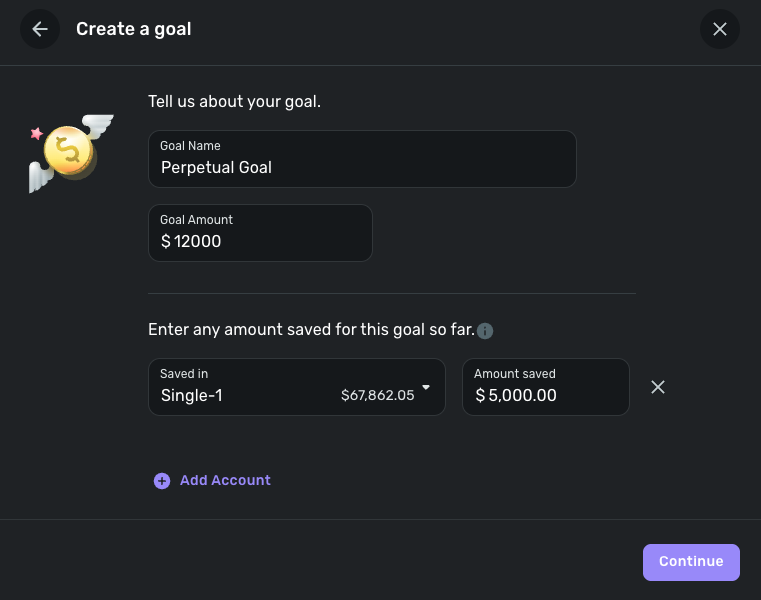

I don't really have a lot of savings goals. I have a perpetual goal where I set aside a specific amount of each paycheck for vacation, unexpected expenses, and emergencies. I also have a 5 year goal, where I'm setting aside a little extra each month so that when my furnace reaches the end of it's expected service life, I'll have enough on hand to replace it, when needed.

-Coach Kristina

3 -

Only 193 shopping days until Christmas.

https://days.to/christmas/2025/12/25

3 -

Splurge: 30-day trip to visit Australia, New Zealand and Tahiti.

Savings Goal: 2026 travel adventures.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer2 -

"I have a perpetual goal where I set aside…"

I need to do this, but am unsure how. All my current goals have Target Amounts and Target Dates.

My sister needs a goal where she can contribute a certain amount per month, then draw funds out periodically for a certain purpose — with no end date to the cycle.

Questions: How do you set up a "perpetual goal"? Do you set the Target Amount and Target Date? When you withdraw, do you use "Withdraw for something else"? Anything else I need to know?

Any guidance would be appreciated.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

Since I physically transfer the funds to a different bank account, I use recurring transfers instead of savings goals for that perpetual goal.

I suppose if I was to use a savings goal for it, I would set it up with the target amount that I expect to save over the course of the year. At the end of the year, I'd create a new goal (with the target amount being what I anticipate to save over the year + the leftover savings from the previous year), show the leftover savings from the previous year as already saved, then delete the old goal once the new one is created.

-Coach Kristina

0 -

Thanks for the suggestion. But the Savings Goal you describe is substantially different from my use case.

My sister needs to save up money for 3 months, then pay her quarterly HOA dues, then do it all over again — in perpetuity. And I want to set it up so that I don't have to create a new savings goal for her every 3 months — although I may end up having to do that.

Wanting to split the expense of a "quarterly recurring bill" over the included months seems like something that would be fairly common. So I was hoping someone had already figured out the least complicated way to do it.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat There is no current mechanism in Savings Goals to do what you describe as a perpetual goal. However, this is one of a number of SG feature requests/improvements that have been posted to this forum.

Continuous Savings Goal — Simplifi (surprisingly only 26 up-votes for this but it seems like a very useful SG option.)

I recreate my ongoing goals annually along the lines of @Coach Kristina's suggestion.

An option is to use the rollover feature in Planned Spending for these quarterly, semi-annual and annual expenses. But the accounting/tracking for the set aside funds seem problematic to me since unlike Savings Goals, the rolled over funds are not visible as designated funds in your actual bank accounts where they are supposedly/hopefully held.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer1 -

Thanks @DannyB — I've added my vote to the suggestion you linked.

My sister's bill is quarterly, so I think I'll set her up with a quarterly goal and just keep withdrawing funds and changing the date each quarter. I'll see how that goes.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)2 -

@DannyB I went to add my vote to the Continuous Savings suggestion, and had apparently upvoted it previously, but have no memory of this.

I do as @Coach Kristina and have a recurring transfer at the end of the month from my checking. If my checking is over a certain amount, I transfer it to Savings. I just started this a month ago, so I will report back on how that works out for me.

I've struggled with how to make Savings Goals work for me. I usually consider what is left over at the end of the month to be my savings, but cannot really transfer that amount because it is spread out in many accounts with things like interest, dividends, etc.

Thanks for pointing us back to this suggestion, but needs a lot more votes.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Back when I first started with QS I was paying quarterly estimated taxes. I set up a Savings Goal for these payments. I made it an annual goal and renewed it annually after the January payment.

I set the goal amount for the total of my estimated taxes and contributions were set aside monthly and estimated taxes paid quarterly.

What I prefer is if QS design and engineering team could figure out a way to incorporate non-monthly fixed and flexible expenses into the Spending Plan.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer1 -

This year sure is flying by! It's crazy that we are almost halfway through. 🤯

Splurge - A trip to Loreto, Mexico in April

Savings goal - A new car, though I don't think this will happen this year

-Coach Natalie

2 -

Splurge: An unplanned short vacation with the car, where sadly the car "died, but got me home"

Savings Goals: Temporarily suspended, but I was using them to make sure i had the minimum balances required to avoid bank fees (so i don't spend into where i'm charged).

—

Rob W.

2 -

BTW: Something strange i noticed, maybe a bug but i can't prove it… The spending plan says i'm more than $19,000 over budget for the month, but somhow my net worth is only around -$3000. I know i didn't have $16,000 to start, so whatever.

—

Rob W.

-1 -

One nice think about the Spending Plan is that it lists every transaction that goes into its calculations.

If you are unexpectedly $19,000 underwater for the month, you can probably find the reason for that somewhere in the listed transactions. Maybe some things are being included or excluded that shouldn't be.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0