Manual adding for Savings Goals

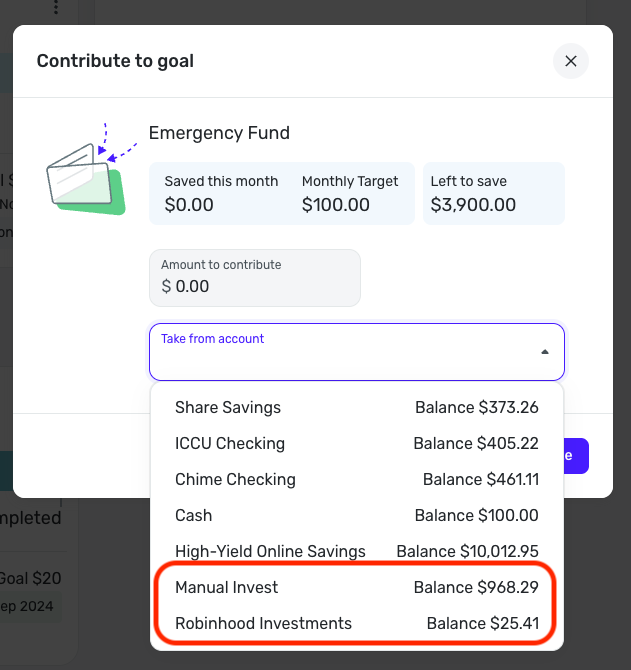

You previously supported the ability to add funds from investment and other accounts to savings goals. Currently, when contributing to a goal, you must enter the contribution amount and select the “Take from account” option to specify where the funds will come from.

I understand the importance of linking savings goals to actual accounts to accurately track real funds. However, it has been frustrating to see my past contributions from investment accounts still reflected in my goals, even though the ability to add them has been removed. As it stands now, contributions are only supported from Checking, Savings, or Other Banking account types—not from Credit, Loan, or Investment accounts.

Many users, including myself, have investment accounts intentionally set up for savings purposes. Others may even have physical cash savings, such as a piggy bank at home. Savings goals require linking to an account because they separate goal contributions from your available balance, making it clear what funds are earmarked for goals versus what’s available to spend. This system works well, but without a way to account for alternative savings sources, it leaves a gap.

I believe adding a manual entry option for cash savings or other savings types would be very helpful. It would allow users to track all of their savings in one place, without restricting others who prefer to link only actual accounts. This would make the feature more inclusive and practical for a broader range of users. Without this flexibility, the goals section risks feeling incomplete or even unusable for those with savings kept outside of the supported account types.

Comments

-

@Sarahmaeb11, thanks for posting to the Community!

I have moved this out of Feature Requests for now so we can do some troubleshooting. I'm not aware of contributing to Savings Goals from Investment Accounts being removed from Quicken Simplifi, and I currently see that I'm able to contribute from both my manual and connected Investment Accounts.

As for contributing from Debt Accounts, this ability has never been available. You can vote for our existing request here and then follow it for updates:

With that, please provide more details about what you're seeing in Quicken Simplifi so we can get a clearer picture of what's going on.

-Coach Natalie

1 -

To move from investments to a saving goal would cause a sale to cash of a placment in a checking or savings account or trade to cash with a placment in a checking or savings account. With this option, a split woudl also be required to send a portion of funds to a checking and savings account. This is the same logic as performing splits now. But with the current V 4.74.0, when splits are done as positive to increase the funds in a check or savings account, these are currently handled in such away that will not allow the flags to be added in the accounts and the system reports that only the main transaction can be flaged. When the flag is added here, it does not show up on any spit transaction in the account.

Dick Davis

Wanting to Migrate from Quicken Classic Premier to Simplifi

0 -

Hello @Dick_Davis,

I tested in my Quicken Simplifi to see how it behaves when funds from an investment are contributed to a savings goal. From what I can see, it doesn't trigger any sale or split transaction. Instead, it documents it on the sidebar:

To clarify, are you seeing this behavior in your Quicken Simplifi? If you are, is this happening when there isn't sufficient cash balance in the investment account to cover the savings goal contribution?

I look forward to your response!

-Coach Kristina

0 -

@Coach Kristina, I was not having an issue, but was rather just making a statement of possibility. I am sorry if this was confusing.

Dick Davis

Wanting to Migrate from Quicken Classic Premier to Simplifi

0