Bank Account expenses handled incorrectly?

Hey Simplifi Group!

I'm new to the platform (coming from GnuCash) and I've run into an issue with Spend Planning (and the Spend report). It could be that I'm using the tool incorrectly, but can't figure out what it is.

The scenario is something like this:

- I've got two accounts: one checking and one credit card.

- Both accounts have expense transactions in them.

- I've gone through an experiment with trying to setup a Spending Plan.

- When I view the Spending Plan (or the Spend report), expense transactions from the checking account cause my total spend to go down (when I'd expect it to increase the total spend).

Note that both types of accounts show expenses slightly differently. Checking account expense transactions impact your balance negatively (make the total amount available decrease). Credit Card account expense transactions make the balance go up. That all make sense and I think might explain the behavior I'm seeing.

Take the following scenario as a simple example:

- Lets take two accounts, one checking and one credit card.

- Lets say I have 4 expense transactions, each $100 dollars. One on the checking and three on the credit card.

When I view the transactions together in a Spending Plan (or the Spend report), the credit cards will show up as -$300 (so $300 spend). This is as I expect. If we then include the expense transaction from the Checking Account, I'd expect the total to show -$400 (so $400 spend). However, both views actually show $200 (so $200 spend). It's like the expense transaction from the Checking Account is handled the same way as the ones from the Credit Card Account — which is a problem because their impact to value are opposite.

Here is a screenshot showing this in my test report:

I've circled the total spend showing $55 for this category. However, if you look at the transactions listed — it shows ~$265 in total spend. The checking account has a different sign than the credit card (Amex) transactions. The $55 spend is the difference between the sum of the credit card transactions and the single checking account transaction.

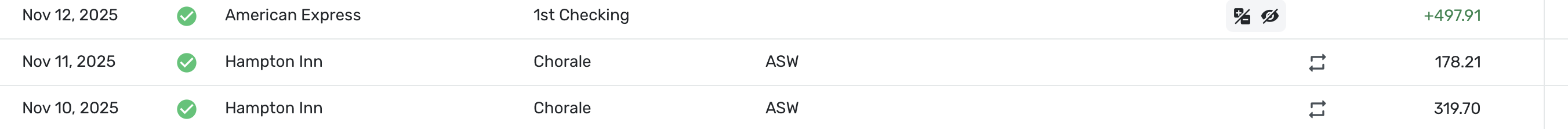

I've also included two example transactions from that report:

Does anyone know if I'm doing anything obviously wrong or miss understanding how the system is intended to work? This would make using the Spend features much harder with my current understanding.

In case anyone needs to know, I'm using exclusively the web interface on a desktop (FireFox) for accessing the Simplifi app.

I really appreciate any help! Please let me know if I can provide any more information or answer any follow up questions.

Best Answers

-

OK, I don't see how the numbers are adding up but the Amex Charge for Groceries should have a negative sign, not a positive one.

Ae you sure that Groceries is an Expense Category? If it is an expense category, the sign should be negative or absent. + would mean adding money.

Credit card charges should also be the same as checking in that they make the spending go up. The only difference is that the checking balance would go down whereas the credit balance would go up because it is a liability account instead of an asset account.

I don't think this is the only problem but it is a starting point.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

I am sure you will get it figured out. It appears you are using the Business and Personal version that I don't use, but the accounting principles are the same. Just go back to your Amex account and make sure that the transactions are spending. Here's what the last three of mine look (from my wife's recent trip):

The one is green is a payment and the two in black with no sign (meaning it's negative) are black. Chorale is the expense category.

BTW, welcome to Simplifi! As you have problems or questions, just post them. Several of our users here have the Business Version. Good luck!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1

Answers

-

Interesting! Thank you for the information.

I'm going to go look at the account documentation again and see that I haven't fubared the transactions somehow. I assume I have and that's why I'm so confused.

Thank you for your insight!0 -

Thanks for all your help Steve!

I found the mistake. I manually upload my transactions and had miss-interpreted the instructions when building the import csv files. This resulted in the transactions to have inverted signs.

Now I just have to roll through all the history I uploaded / categorized and correct the records. (; . ;)

Anyway, I suspect this will fix my issue. I'll confirm once I finish rolling through these updates and compare the results.0 -

Great! Thanks.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0