Why is investment income excluded from reports? (edited)

I'm new here, thinking of converting to Simplifi from Quicken Classic. Can anyone explain why Investment income like Dividends is excluded from reports? I like to keep up with my taxable income through the year, and I can't see how to get a report in Simplifi to do that. Am I missing something….or is there a rational explanation for this exclusion? Thanks.

Best Answer

-

Well, it seems that a lot of users wanted these transactions such as buys, sells, dividends to be excluded, so Simplifi excludes everything except payment/deposits. And you cannot include them UNLESS you change the TYPE to payment/deposit.

So if you want dividends that are taxable to be in reports, you have to change those to payment/deposits and categorize them. To do that, you have to create your own Investment categories. Once you do that, they will show up in reports if you've made sure to toggle off the Exclude in Reports.

If you want these transactions in the Spending Report, and I do, then you toggle off the Exclude in Spending Plan. Also, you have to make sure you automatically include new income in the Spending Plan.

Remember that anything you put in your Investment accounts will not alter the balance of those accounts. Those balances are downloaded once per day. But you can make things show up in reports and spending plan per above.

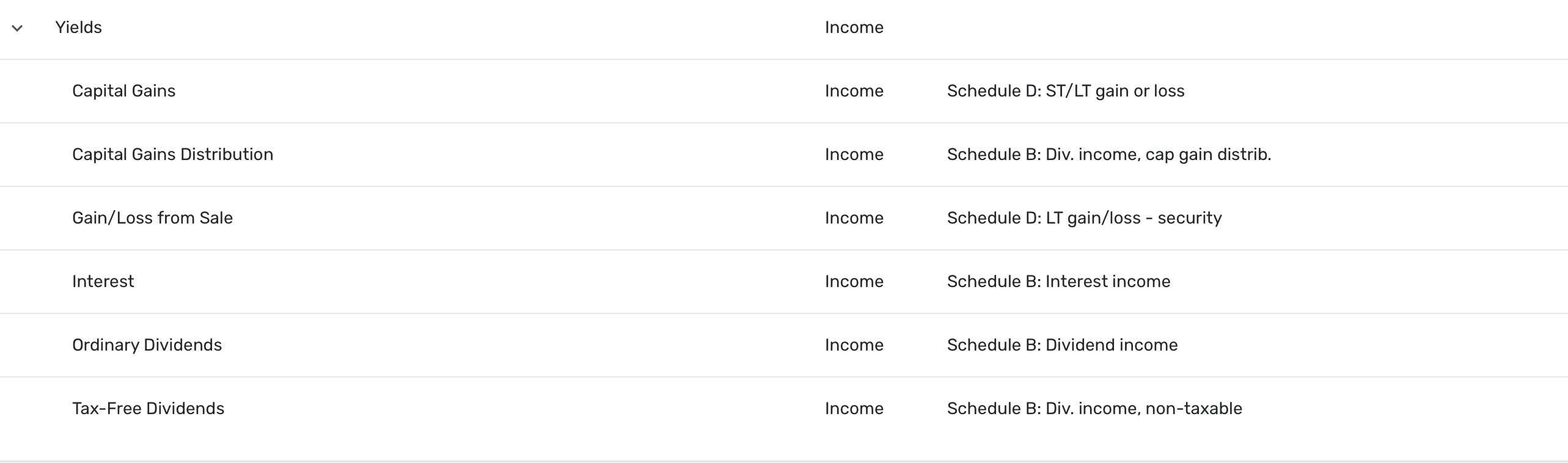

Here is my Income category and subcategories I use for these things to help get you started:

Once I got used to this, I also do the same in Classic in my brokerage accounts and use my own categories instead of the canned ones. I prefer it. I don't have but a few each month. Obviously, it's a bit of a problem if you have a lot of these. For a while, Simplifi seemed to remember that I wanted these to be payment/deposits, but lately not. I have to edit them as they come in.

There are several conversations on here about Investment accounts and several feature requests too. Here's one of them.

With just 35 votes in almost 2 years, it is not likely to get implemented, which is why I use the workaround and have turned my attention to getting checking features in the brokerage/cash management accounts. We needs splits, check numbers and reminders. There aren't good workarounds for those.

Hope this helps.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1

Answers

-

Wow. What a mindset….to deny EVERYBODY an option rather than to allow ANYBODY to choose whether to exclude something.

Thank you so much for your detailed and considerate response to my query. I love everything else about Simplifi, but this situation will preclude my converting to it, as I am a retiree and have many retirement and brokerage accounts, whose dividends are the bulk of my income, which I must monitor closely.

Again, thank you.

1