Best Of

Re: Better Automatic Transaction Merging [Edited]

This enhancement request is critical. The whole point of Simplifi is to simplify financial management. We users understand that sometimes matching a downloaded transaction to a manually entered transaction won't happen (and we hope that will be improved). But for now, please consider adding a LINK TO MANUAL TRANSACTION in the 3-dot popup for the downloaded transaction. Simplifi already provides "Link to existing recurring". But that's not what we need in this case.

Re: Account Register Update: Share your feedback here!

@Quicken Kirby I tried resetting the column selections in gear settings back to default and the date column reappeared. I then added additional columns and date column remained in place this time.

Re: Convert Reminders to a Transaction on the day they occur [edited] (1 Merged Vote)

Hi there. If I am understanding you, I think you have a manual account and you would like the Reminder to be entered as a transaction automatically on the date you have it set for. Is that right?

If I am right, we already have a feature request to do that: [removed link to merged thread]

And here's another feature request for users to be able to convert a reminder into a transaction themselves:

Consider voting for both. Thanks!

SRC54

SRC54

Re: TIAA Connectivity Appears Down - FDP-105 (edited)

One solution that worked for me was not to choose the first TIAA on the list when you add an account. Scroll down and choose another TIAA connection with the same address. This alternative option connects you through a 3rd party aggregator, but appears to work.

Re: For Exclusions in Recurring Transfer Series -- which is Money In and which is Money Out?

@DryHeat, thanks for posting your inquiry to the Community!

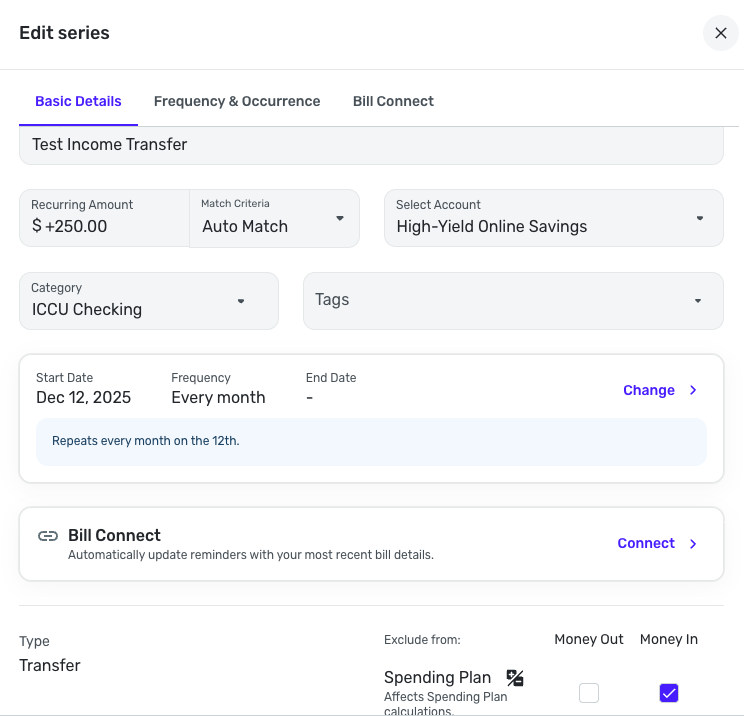

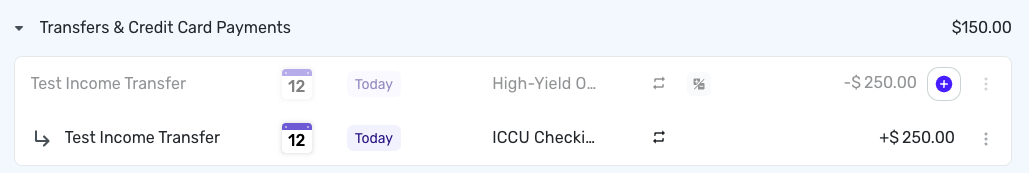

When testing this with both an Income Transfer Series and an Expense Transfer Series, it seems to me that the "Money Out" side is tied to the account that's paying, and the "Money In" side is tied to the account that's receiving. The account that's paying would be the 'Select Account' field in the Recurring Series setup, and the account that's receiving would be the 'Category' field in the Recurring Series setup.

So, for the Income Transfer Series you presented, if you want the money coming into your checking account to be included as income in the Spending Plan, you'd want to exclude the "Money In" side.

I definitely agree that it's confusing when using an Income Transfer Series, and you are welcome to create an Idea post to request a change if you'd like. I also think the way these are presented in the Spending Plan is confusing, since it is showing account names as the category for transfers. It definitely made my testing this morning more complicated. But we do have an Idea post to vote for a change there!

I hope this helps!

Re: For Exclusions in Recurring Transfer Series -- which is Money In and which is Money Out?

The whole money in and money out for transfers hurts my brain!

DannyB

DannyB

Re: Advanced Security Needed in addition to simple password

Hello @Billybchampion,

Thank you for your feedback! We truly value our users' need for security. Quicken Simplifi is designed with robust measures to keep your banking information safe. Additionally, we have a great idea post regarding enhanced security options that you might be interested in voting for:

I hope this helps!

-Coach Jon

Re: Eliminate Confusion on Accounts Listed in Spending Plan Transfers/Credit Card section (edited)

Perhaps an easier fix that wouldn't confuse current users would be to just change the labels so they read "Sent to" and "Received from." That's how I always interpret them in my head, anyway.

I also agree that reversing the order, so the "Received from" account is on top, would make more sense given the way the arrow points … or they could just reverse the arrow graphic, the way I did here.

DryHeat

DryHeat

Re: What is your favorite holiday movie?

Oh, yeah, a couple more "recent" ones (2021) that has become a favorite is "A Boy Called Christmas" based on the 2015 book by the same name.

DannyB

DannyB

Re: Reviewed Flag is being reset

I do the same thing, but I minimize the Pending section first and don't look at them (unless I have a specific reason to) until they clear. Since pending transactions can change (sometimes the amount changes, for example), the OCD in me would worry that my Reviewed transactions could change which is why I wait until their information is more reliable. Sometimes pending transactions just disappear too.

It does get a little bit annoying though that they are counted in spending plan. It could throw things off a little. So sometimes I'll categorize the pending transactions properly if I notice that in spending plan, but I still won't mark them as reviewed until they clear.