Best Of

Re: A warm welcome to our newest Superuser!

Welcome, @DryHeat - I could tell from your interest in the forums early on that you would likely be the next superuser. I've got a lot going on lately (though things may be calming down finally), so i haven't been able to keep up the last month or two with forum posts. It's a difficulty, I suppose, when you try to run your own "1-man business operation" and handle everything yourself (though, Quicken Simplifi does help make things easier, with respect to account management).

RobWilk

RobWilk

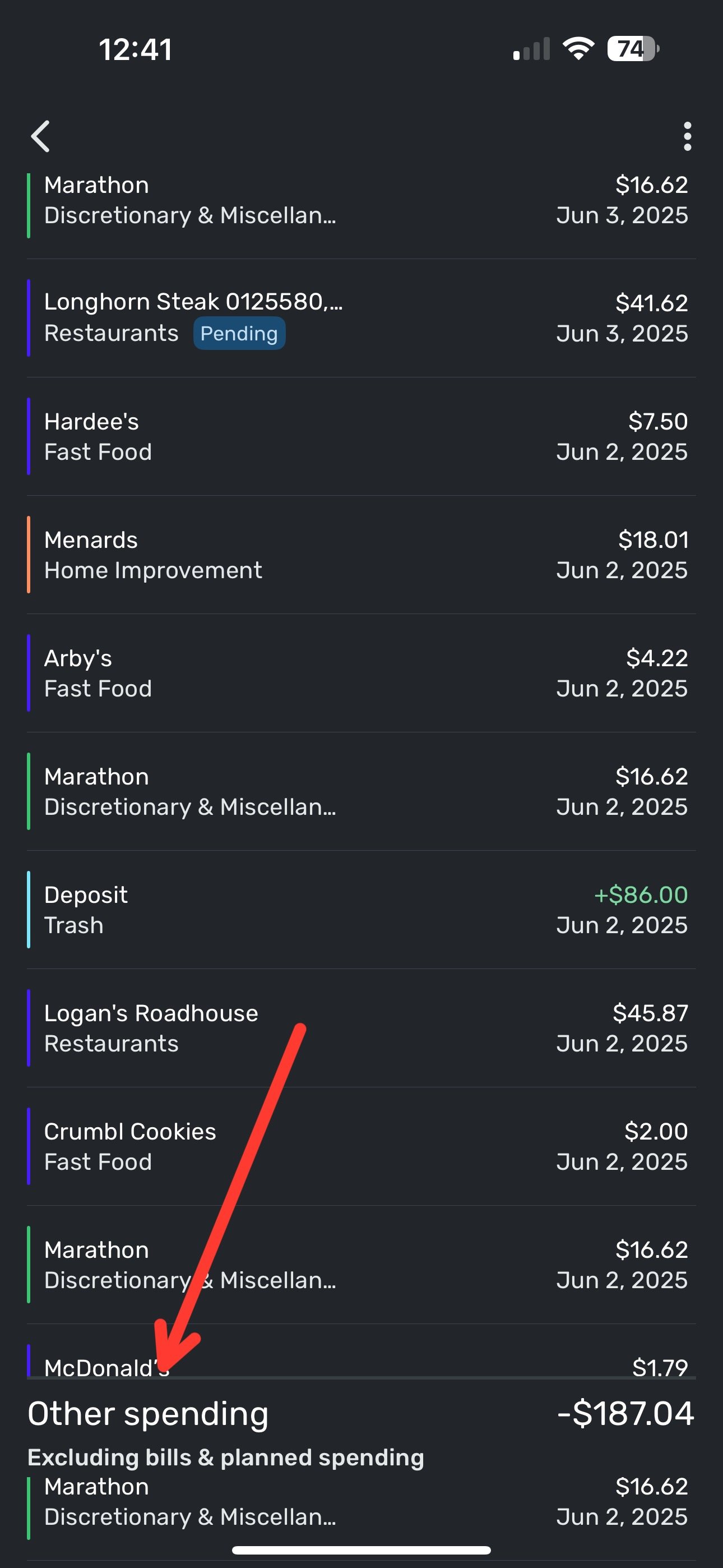

The "Other Spending" amount bar on the mobile app floats above the bottom of the screen (edited)

Just updated iOS Simplifi to current version (5.32.0). When you go to the Spending Plan Overview and select "Other Spending" — the amount section at the bottom is covering the transactions and won't set back to the bottom as it does in other sections like "Planned Spending", the amount is nested at the bottom. Same issue on iPad as well.

housetr

housetr

TIAA Reporting Connection Issues

Just when you think that all has settled down with your bank connections and synching with Simplifi, another link goes away. After working just fine, all of my TIAA accounts have suddenly stopped synching. I receive a message saying that TIAA is reporting connection issues and that Simplifi is investigating the issue. I made the error of making all my accounts manual and retrying to synch with TIAA, so now I have bogus data in those accounts and of course my net worth statement is completely out of whack - which makes working in Simplifi very difficult. What does it mean, really, when Simplifi says that it is "investigating"? I feel like that's just a black hole of punting the issue away. Vanguard, Merrill, TIAA, TRowe, all of these connections have needed major work arounds or have simply never gotten fixed, even though they are being "investigated". I'm trying to be patient with the product support, but it's a shaky platform to work on, and you never know what's going to be working on any given day. Are others experiencing the same error with TIAA?

Re: TIAA Reporting Connection Issues

I'm still getting the FDP-155 error code when trying to connect to TIAA. Not error code 102 or 106.

Re: Unable to add American Express CD account (edited)

Hello @MagosDante,

Thank you for the information. I did get this reported to my product team and will be sure to follow up here when we have a status update!

In the meantime, you can track the account manually by adding manual transactions, which will keep your records up-to-date. Here are the steps to do so: Managing Transactions in Quicken Simplifi | Quicken Simplifi Help Center

-Coach Jon

CTP-13601

Re: Unable to add American Express CD account (edited)

Hello @MagosDante,

Thanks for providing the requested information! We will still need the following:

- Has the bank made any recent changes to its website or sign-in process?

- Are you the owner of the account?

And finally, we will also need logs to be sent to us; The instructions to do that can be found below:

- Log into the Quicken Simplifi Web App.

- Select Profile from the left-hand navigation bar.

- With the Profile menu open, hold down the Option key for Mac or the Alt key for Windows, and then click Send Feedback.

- Leave all boxes checked, add a brief description of the issue, and then click Send.

-Coach Jon

Re: Reviewed flag for pending transactions gets reset to not reviewed after posted

I just noticed in my cleared transactions this morning that the Reviewed flag is persisting after the transaction clears. I haven’t seen any announcements that the issue is resolved, but the behavior has changed … at least for me, this morning. Any one else notice this?

Re: Simplifi Projected cash flow for retirees, best practices

I agree with the above advice, and want to add a couple of other things.

I'm not a tax advisor, but be aware that tax-advantaged plans like a 401(k) have a required minimum distribution beginning at age 73 (I think). So how much you need to withdraw each year may depend not only on your needs but also on the type of plan and your age.

As others said, in the long run the Spending Plan will be the best guide to how much you will need over and above your social security. But it will become a fairly accurate guide only after several months of usage. I usually go back over the months and look at "Other spending" and how much is "left at the end of the month." Assuming you do not exclude your investment draws from the Spending Plan, that will give you a good read on how you are doing.

In the short run you should also keep a close eye on the cash flow projections for your bank accounts. The Spending Plan tells you how expenses stack up against income on a month to month basis, but it doesn't tell you anything about whether you actually have the cash available to pay upcoming bills.

DryHeat

DryHeat

Re: T. Rowe Price Retirement Plans - FDP-102 Error

Hello @TexAgDMZ257,

Thanks for reaching out! I can see that you are receiving an FDP-102 error with T. Rowe Price Retirement Plans from our side. To answer your question regarding the mentioned alert, yes, the issue is still ongoing at this time. I would make sure to follow the alert for updates, as we will be sure to update the alert when we hear anything from our product team on this issue.

In the meantime, you can track the account manually by adding manual transactions, which will keep your records up-to-date. Here are the steps to do so:

If the account is an investment account, the manual tracking steps are a little different:

- Make the account manual so you can add and edit Holdings:

- Add/edit your Holdings to keep accurate records: and

-Coach Jon

Re: How to treat Unreimbursed Partnership Expenses

Hello @azevin,

Thank you for coming to the Community with this question. Since that specific line item isn't in Quicken Simplifi, perhaps you could use Schedule E, Other Expenses, and include UPE in the category name, so that you still have an indicator which line to use at tax time.

Additionally, I recommend that you create an Idea post requesting that the tax line item be added. Ideas that get enough votes may be implemented in the future. For information on creating an Idea post, please review the post below:

I hope this helps!