Savings Goal Contributions should reflect on Projected Cash Flow graph (2 Merged Vote)

Comments

-

I have read of possibly making savings goals a transaction but I do not agree with this route since it is not an actual transaction. I would just like to see how it affects projections since you are theoretically holding those funds for a purpose. If you see the projection take your balance low or in the red you can take out of a goal to compensate for this if needed. The option to have 2 lines on the graph is an ideal situation for me personally, one showing actual projections and one showing projections taking contributions to goals into account.0

-

Hi! I think it would be very helpful to have the ability to view the Projected Cash Flow based on the Available Balance (balance after savings goals are taken out) and not just the total bank balance!3

-

One of the most useful features of this program is the projected cash flow graph for forecasting and planning. Unfortunately the projections do not account for money set aside in savings goals. There should be a line or a setting to have the funds set aside accounted for in your projected graph. So one line shows the actual balance projections and another line shows the balance projections minus the money already added to a savings goal in that account. That way you can see what the account actually should have and how much of that money is available to spend without affecting your goals. This would be very helpful.

1 -

i enthusiastically vote for this as well. I still have to keep my Kualto.com subscription as I do not trust the projected cash flow here. Plus Kualto can go out much further than simplifi.3

-

PLEASE do this. New user here and so disappointed I can’t make cash flow more useful to include planned recurring spending (groceries, etc). OR make it easier to create a ‘bill’ that tracks multiple transactions. Thanks.2

-

Plus one too! Good idea @cfoxcvg . Right now, due to this specific thing, I really only view Savings Goals as something that are useful for Savings Accounts…not Checking Accounts. Typically, I’m not concerned about the daily balance of my Savings Account. However, if I set them up for my Checking Account, then I’d run the real risk of making the Projected Balance chart inaccurate…leading to overdrafts. Ideally, this would be a setting or something that could be turned on and off.

I found this idea from this other post which has a really helpful screenshot showing the problem.

https://community.simplifimoney.com/discussion/3262/can-the-projected-cash-flow-be-set-to-not-show-savings-goals-in-the-total

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.2 -

I concur, with this. I am transitioning from Quicken which has the option of keeping the the savings goals out of the projected cash balance. I would like the cash balance to show just the available, or better yet make it selectable.

1 -

The available balance projection should also include planned savings goal contributions.0

-

Agreed. I think this is a great addition and any potential expenses should be included in projected cash flow. It would be helpful to add all of those items into the cash flow preview.1

-

I agree 100%. An additional cash flow line that reflects future cash flow net of savings goals is a must to make the Goals tool truly useful. Otherwise you have to put savings entries in both the goals tool, as well as a real life transaction to a savings account or something to *truly* have it set aside for a goal.0

-

See this discussion post for more information related to this idea (click here) and for some helpful screenshots - for any visual learners.

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.1 -

Please add the option to include Planned Spending in cash flow. Not sure why this isn't in to begin with. I can create "bills" for these items to track cash flow accurately or use a spending plan to track the categories but not both? Seems like a design flaw to me.2

-

I like it 'in theory' but in practice, 'planned spending' is over an entire month, where would it go, considering a paycheck or three (or more) might appear at different parts of that month. Planned spending wouldn't necessarily be on the first of the month, but maybe a virtual subtraction of it at the end of the calendar month might make sense.

—

Rob Wilkens

0 -

Hello @Sixstring67 & @RobWilk,

Thank you for sharing your feedback with the Community!

I believe the Idea post you're looking for is available here. This Idea post is to have Savings Goal Contributions reflected in the Projected Cash Flow, not Planned Spending items.

I hope this helps!

-Coach Natalie-Coach Natalie

0 -

I see this is pretty old, but I am new to Simplifi and looking for the same feature. Ideally it should be a toggle on a per account basis. Also, it would be cool to show a second line in the graph view on the web app to include the forecast with and without savings goal transfers.

0 -

@RobWilk Changing the Savings Goal system to include a proposed date of the month to contribute to the goal doesn't seem unreasonable. For instance, I know that I'm going to contribute to my Savings Goals on the day after my first paycheck of every month (my first paycheck happens to be on the second Wednesday, which Simplifi also doesn't support, but that's another thread).

To me there are other, more problematic things. Presumably the users want the cash flow projection to stop adding in SG contributions after the goal is reached, which is doable but maybe not quite so easy…the target date of the goal doesn't change if you accelerate or decrease - or even "withdraw for another purpose" - contributions to the goal.

Also, there's the issue of when does the cash flow report that SGs will be added back to an account rather than withdrawn from it - when you withdraw from a goal "for it's purpose?" Some of my goals (I have one for Car Insurance, for example) I can definitively say what day of the year I'm going to withdraw from the goal (though frequently I won't know more than a couple of weeks in advance how much I will need to withdraw). But I also have a goal for Furniture which can be withdrawn from at any time. What is Simplifi supposed to do with that projection?

And all that is not even considering the issue that I have yet to see the app display correct information about SGs to begin with (mine are currently at least -$11 incorrect, which is closer than I've ever seen it).

Anthony Bopp

Simplifi User Since July 2022Money talks. But all my paycheck ever says is goodbye0 -

@ajbopp I think my reply in December 2022 was to the wrong thread (I do that at times, and I'm not sure why, I've been trying to be more careful recently). Specifically, I seem to be talking about planned spending there, where the topic is about savings goals and cash flow chart.

I don't need this particular feature, but I'm not against it. When I transfer money to a savings goal, I transfer it to a savings account, and that will be reflected in the cash flow chart. I suppose Scheduling savings goal contributions would be nice separate from scheduling transfers. After that having a parallel "cash flow factoring in savings goals" chart "could" be interesting, but in my case, 100% of my savings account is typically intended to be in a savings goal.

—

Rob Wilkens

0 -

It would be nice to see a line on the cash flow graph for how much is allocated to a savings goal to visually see the "available to spend" and see if you are ever going to dip below your savings goal.

For example, if I have $1000 saved in a goal for an account, I want to be able to predict if I will ever be below that in the account in the next 6 months.

0 -

I would like an option to show the projected cash flow account balances based on the available balance not the total, so it's obvious the savings goal is separated. And show the savings in the future transactions in the cash flow.

Possibly by selecting the available balance in the list accounts would take you to this view instead of going back up to the main account view that way both views are available. Like it's a sub-account.

1 -

Yes! I posted something similar last year. If you use savings goals heavily tied to you main cash flow account, the Projected Cash Flow graph is pretty much useless because you have to mentally subtract off what you have in savings goals in order for the graph to make sense.

I agree, when clicking on the Available Balance, switch the projected cash flow graph to show the balances which exclude the savings goal amounts.

Quicken since 1995. Simplifi since 2023.

2 -

If your savings goals are tied to a separate savings account, it probably won't matter much unless you have regular recurring withdrawals from savings.

—

Rob Wilkens

0 -

True, but for those of us that tie them to our checking account, it does matter.

Yes, I could transfer savings goal cash over to savings for a whopping 0.2% interest, but for short term savings goals like maybe quarterly estimated taxes, it is not worth transferring back and forth. Plus I also like to have a "goal" that is really an overdraft buffer. And I would like to not see either of those in my Projected Cash Flow graph.

Quicken since 1995. Simplifi since 2023.

1 -

Agree, the amount shown in the bank should be deducted of the savings. I actually would like to see a net available amount which is the bank total minus the saving goals minus the credit card. I also have the issue with the quarterly property tax. I do not want to reset a goal every quarter. As an alternative I created a goal which will be slightly more than the quarterly tax and there is no goal date. It should work like a fund for property tax. Unless someone has a better idea how to handle this. Overall I do like Quicken Simplify.

0 -

I like the idea of having two cash flow projection lines, the existing one for Actual Cash Flow and a new one for Available Cash Flow. This is conceptually similar to the Balance and Available Balance in Transactions view.

As for how to calculate the Available Cash Flow, I don't think it needs to be over-complicated. It is, after all, an estimate. The amount at the start of the month would be equal to the "Available Balance" as shown in accounts. From there, the amount would be calculated just like the actual cash flow, but with two additions:

(1) the total of Savings Goals for the month is subtracted on the first day of the month,

(2) any money released from a Savings Goal is added back in when released.

You could get more precise by taking into account the dates and amounts of contributions to Savings Goals during the month, but for me it's not necessary. Available Cash Flow is just a rough guideline to keep me aware of how I should manage spending to meet my targets. It doesn't mirror anything in the real world.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

I've been thinking about this since my last post, and I think there is a simpler way to calculate Projected Available Balance that might be quicker and easier to implement (and would still serve a purpose). The Projected Available Balance graph line could just be a graph of:

- (Projected Cash Flow graph amount - amount of Savings Goal contributions already made)

It's true that this would not show how your cash flow will be affected by future Savings Goal contributions. But the Projected Cash Flow doesn't really show what your actual future balances will be anyway. It ignores any expenses that aren't hard-coded into future Reminders/Series.

Essentially, this would cause the projection to treat future Savings Goal contributions just like future Planned Spending and future Other Spending in the Spending Plan. (Conceptually, that would work well with the redesigned Spending Plan that separates these 3 expense items out from Income and Bills.)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

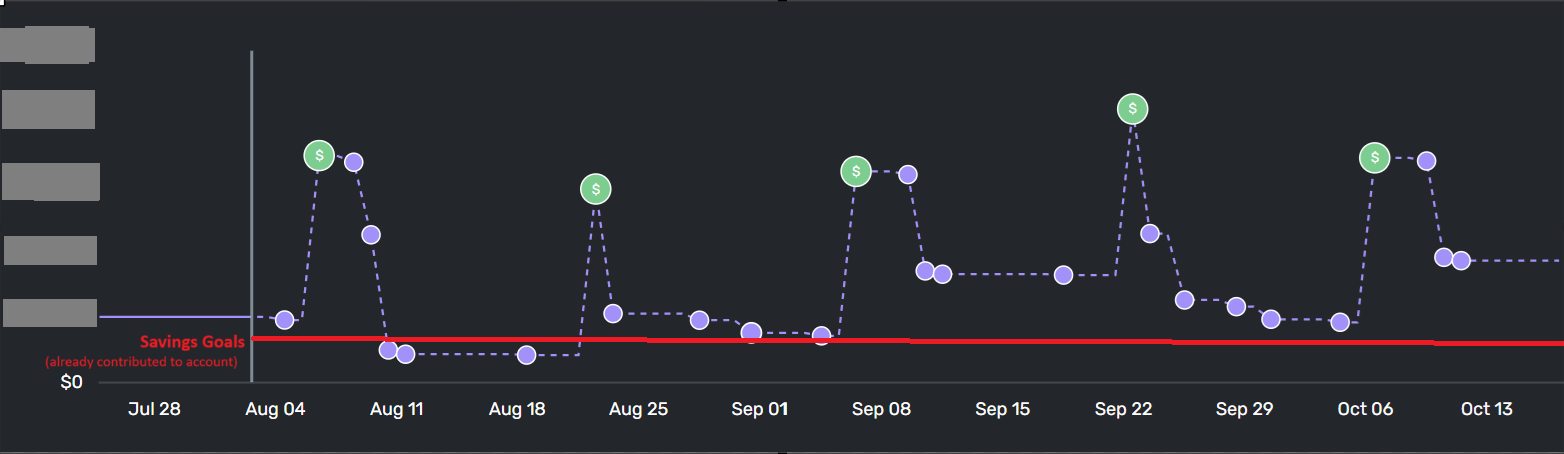

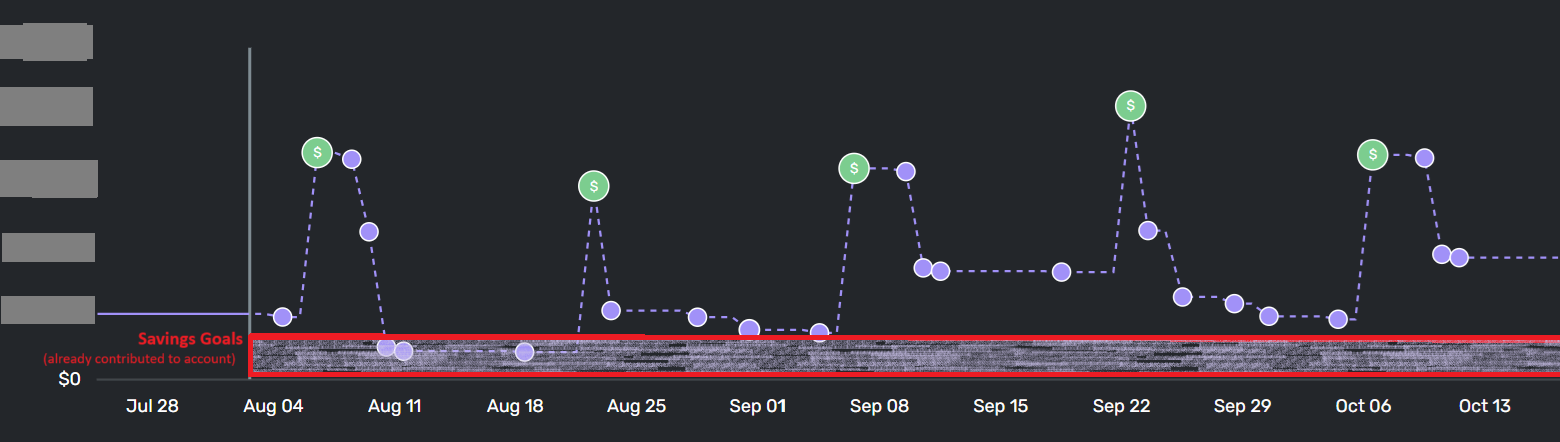

Having Savings Goal contributions (already made) shown on each account's Cash Flow chart would be SUPER HELPFUL! Right now I have to eyeball this. It'd be really simple chart-wise too. And since they already have the total Savings goal contributions number for each account calculated, it seems reasonable to add this to the chart. All you need is a horizontal line showing those Savings goal contributions or make it a shaded area on the chart. Here's rough examples of how it could be easily implemented (obviously make it look better than my horrible free Paint edited snips).

Edit: For context this is a Checking account where my Savings goals for it include the required min account balance and a small amount of $ I keep as "short-term Efund". I transfer my real "savings" to either investment accounts or High Yield/Money market savings accounts so they are earning at least 3+%. So I'm always working on Cash Flow management of this account to keep it right around that Savings goal line without dipping under. So having the Savings contributions line visual on the Projected Cash Flow graph would be really helpful as I'm adjusting future transfer estimates.

1 -

Your proposed Projected Cash Flow graphs with an added Savings Goals baseline (above) serve pretty much the same purpose as the "Projected Available Balance" graph line I proposed last month.

But I think your solution is clearer to look at and does a better job of conveying the idea that it is Savings Goals that make the difference. Overall, I think it's a much better solution.

I would prefer it be implemented just by adding one static horizontal line to the graph, rather than a shaded area. As a bonus, that static line could provide a use for the Savings Goal color from Spending Plan.😉

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

When you set aside money for a savings goal, you can take it out of the spending plan, but the account but the account forecast doesn't recognize it. It still shows your full amount. It would be nice to have a dotted line or something that shows the account balance minus the saved money towards goals so you don't spend it when making decisions about future balances.

0 -

I'm giving this a bump because I was looking at the Projected Cash Flow in my bank account for the new year.

Currently, I have to estimate how much the Savings Goals will grow over the timeline, considering contributions, then mentally take that into account when I look at what the Projected Cash Flow looks like.

It would be easier if there was a second line for Available Projected Cash Flow, below the main line, showing:

- the amount for the Projected Cash Flow, minus

- the amount projected to be in Savings Goals (taking planned contributions into account)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0