Investment Transactions not reflected in Balances or Performance

This discussion was created from comments split from:

Hidden Investments [Transactions] showing up in the Spending Plan Income section.

Comments

-

@Coach Natalie so I've close, deleted, the Schwab accounts. I created a single manual account and added a transaction to create an opening balance. The transaction shows up but the amount of the balance is not reflected in the Transactions tab.

Any ideas on what is going on?

0 -

@Max1223, yes, Investment Transactions don't impact account balances or anything along those lines. To maintain the manual investment account balance, you'll want to add/update Holdings in the Portfolio. Here are a couple of articles that go over how all of this works:

Let me know if you have any additional questions!

-Coach Natalie

0 -

@Coach Natalie Hi, there seems to be a problem.

Here in a test account, I've added $100 as a Payment/Deposit but the balance shows as zero. I added the Transaction via the Plus button to the right. I've done this in the past, about 2 months ago with a different manual investment account. Balance and Portfolio are reported and match transactions.

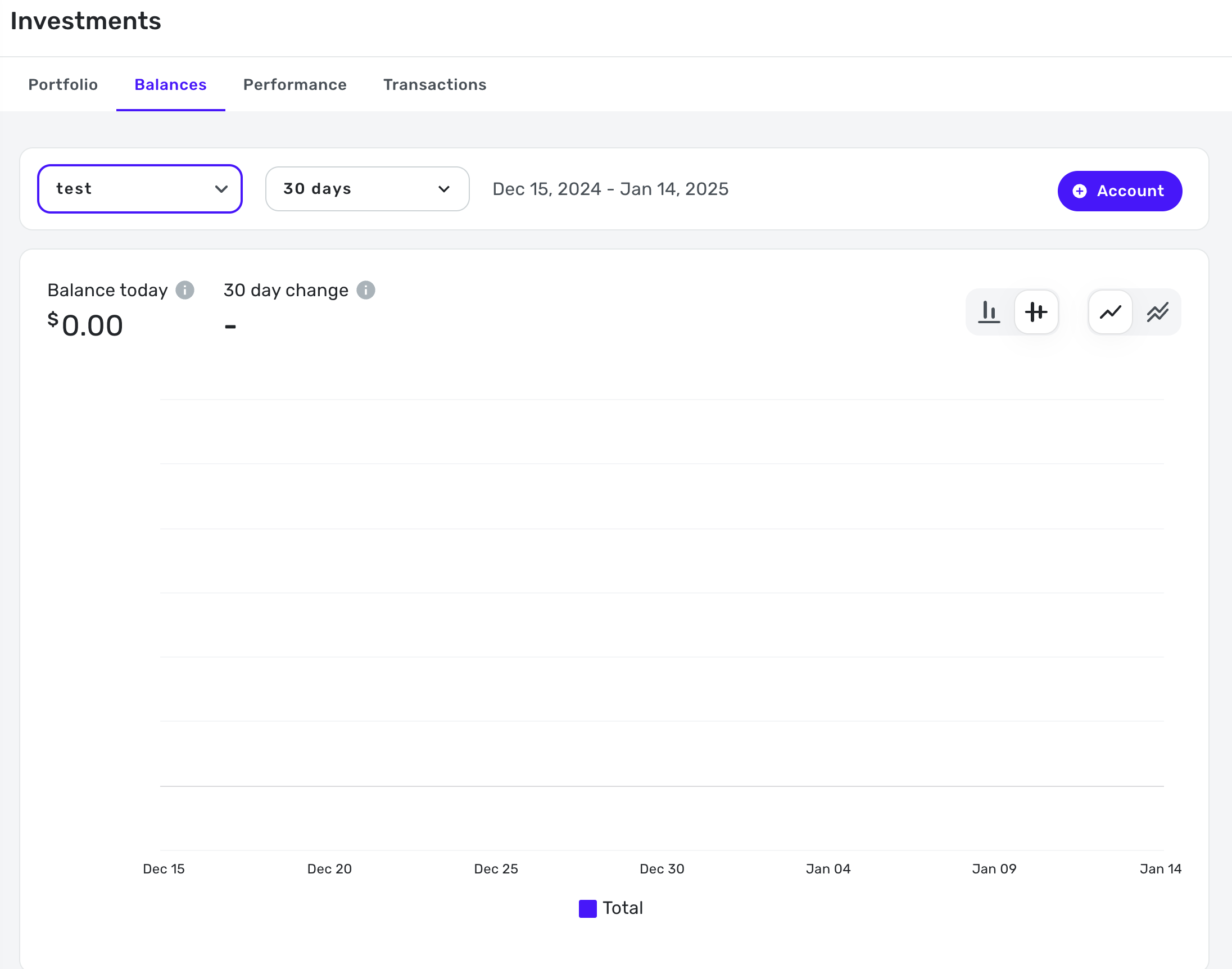

Here is a view of the Balances

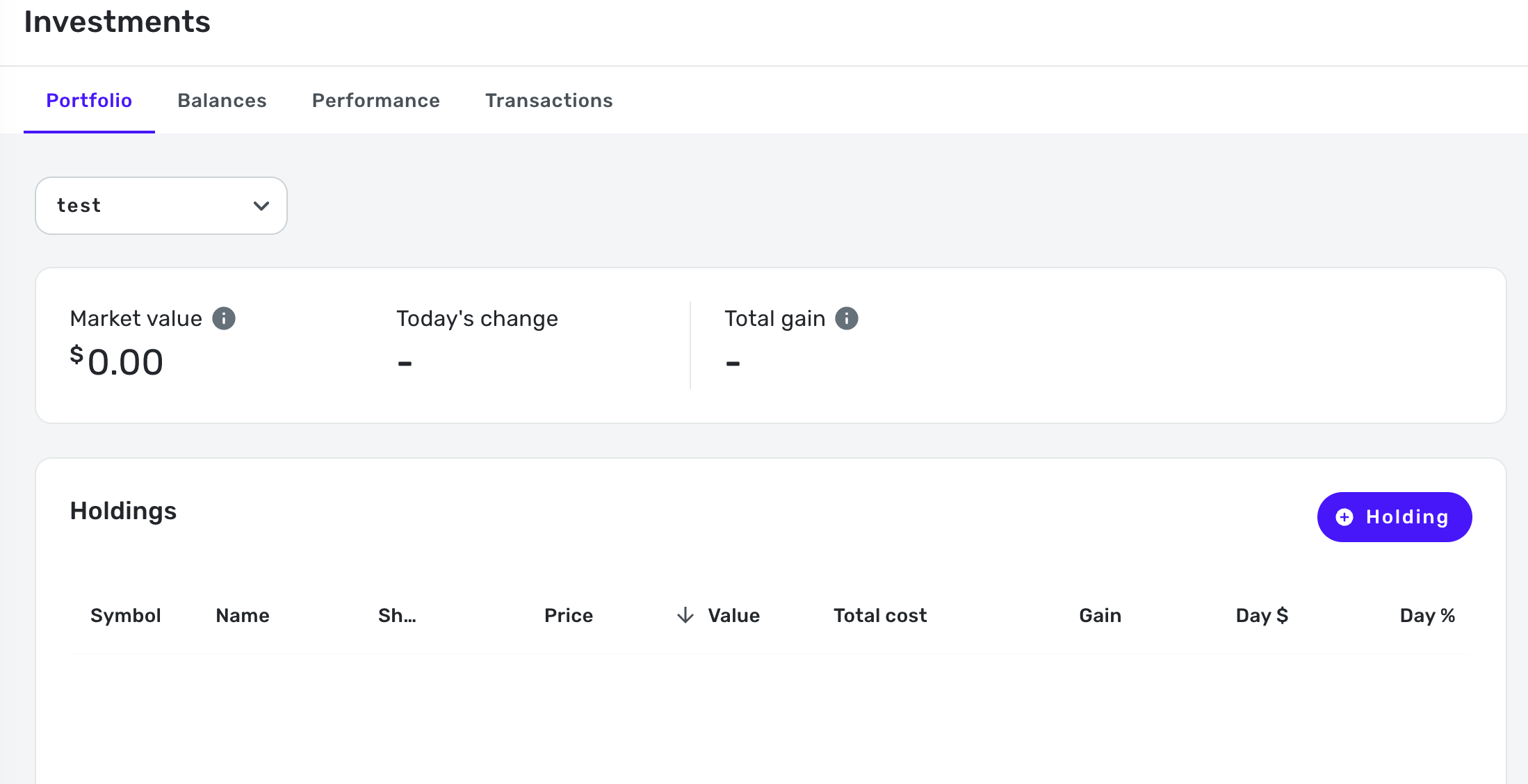

and a view of the Portfolio

So I've created other manual Investment accounts in the past, they have worked as expected, but today, creating a new manual account, it's not working in the same way.

Suggestions? thanks

0 -

@Max1223, hmm, it's my understanding that Investments > Balances derives its data from the account balance history (which is the balance in the Accounts List), and that for manual investment accounts, this balance is maintained by the Holdings in the Portfolio. However, I see that the Investment Transactions support article says:

- Investment Transactions will impact the Balance Over Time feature, as well as the Performance Over Time feature.

Is the balance for the account in the Accounts List $0? Can you try adding a Cash Holding in the Portfolio to see if that's reflected in the Balances tab? If it is, we may need to research from our end what the expected behavior is at this time, and whether the support article needs updated.

Let us know!

-Coach Natalie

0 -

yes Balance in the Accounts list is zero too

what's odd is literally a month or so ago, created another manual Investment account and its seems to work.

I added a cash holding, that DOES get reflected in the Balance and Portfolio sections BUT it does NOT show as a transaction. I added two Cash transactions, the balances add up but again, I don't see any transactions.

I guess not seeing transactions is not critical as I'm just maintaining a monthly balance to keep my Net Worth in the ballpark.

but in the past with the other Investment manual accounts, I added Transactions, and that would be reflected in the balance and Portfolio.

0 -

an update, by clicking the button to the right, I am able to see the Balance of the Test account. Though the 2 cash additions (one for $25 and one for $50) are not showing up as Transactions.

I only see the manual transaction I added, that oddly, does NOT add to or show up as part of the balance. In my mind, the balance should be $175. 3 transactions: 2 cash entries and 1 manual transaction

0 -

@Max1223, do you still have one of the other manual investment accounts in Quicken Simplifi? If so, can you try adding a Payment/Deposit Investment Transaction to the account to see if it still impacts the Investments > Balances and Investments > Performances features, please?

If it works in that account but not your new one, let's next have you try deleting and recreating the new account to see if perhaps there was a glitch or something in the setup when it was first created.

Thank you!

-Coach Natalie

0 -

@Coach Natalie upon further investigation, it seems that the other manual investment accounts are no longer affecting the balances. no matter what transaction i enter, the balance stays the same.

What is the proper way to open a manual with a starting balance, then add/subtract an amount. I did read the link you provided to start the test account with the same results of transactions not changing the Balance.

So here is something very odd. the image below on the 25th DOES accurately reflect a transaction I added to adjust the balance. You can see the dates of the graph and transaction register match.

BUT on the 28th, the balance went back to the original opening amount. Notice there are NO other transactions in the register.

I would ask at this point that someone at QS try to recreate the steps, create an account, add a Payment/Deposit with Balance Adjusment as both Security and Description to see if the error can be replicated. If you can't replicate, please send me the steps to start a balance, then manually increase or decrease the account balance. Note that my recent Test account was created via the method on the link as a cash transaction. While the Balance are showing accurately, there are no Transactions shown, maybe this is by design?

Also. there seems to be no way to REDUCE the balance. I cannot add a negative number using the method shown in the link and again adding a manual transaction does not change the balance.

0 -

a new find, I have changed my balance by manually changing the cash total in the Portfolio section of the account. This in turns changes the Balance bar graph. No Transactions via this action are registered, maybe by design, so this method will work for me moving forward. Though it would seem that by changing the balance, a transaction would register.

Regardless, I do feel there this isn't an intuitive user experience, to add transactions, then not have them impact the balance.

1 -

@Max1223 I'm glad you have found a solution that will work for now. I have followed this discussion but had nothing meaningful to add. I haven't had the problems you've had with Fidelity. My wife's Roth IRA is Schwab and it seems to work as expected. I have it set to ignore in Reports/Spending Plan along with my IRA at Fidelity.

With my Fidelity Brokerage account, I have to tweak it some but not much, mostly updating the cost basis about once a month or if I transfer some cash as Fidelity keeps the cash in a Money Fund whose price stays at $1 so the cost basis is always what the cash total is. Quicken Classic handles this differently but with Simplifi I have to update the cost basis.

Good luck.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

@SRC54 I do some transfers to/from investments to regular accounts, but I see those in checking/savings so I'm ok with that. Yes, for the errant transaction registers, especially having them show up in the Spending Plan was the last straw, so I deleted all the Investments and just now have a way to change the total balance as needed. This is less work than changing lots of individual transactions, then only to see them duplicated!!

1 -

@Max1223, I'm seeing the same thing on my end. I just wanted to confirm the behavior from your end to see if it was only impacting the new account.

With that, I did get the issue of Investment Transactions not impacting Balances and Performance reported as a bug so we can find out what's going on, or if there was a change in design, etc. I will report back with updates! In the meantime, I'm glad to hear that Cash Holdings will work for you.

Thanks!

SIMPL-25202

-Coach Natalie

1 -

@Max1223, I already heard back from our product team and they stated that Investment Transactions are not currently hooked up to anything, so they won't impact Balances or Performance. I'm not sure why this changed, or when, but I did get the help article updated. It now states: "Investment Transactions will not impact the Balance Over Time feature or the Performance Over Time feature."

Sorry for not having better news! Luckily, Cash Holdings will do the trick for you.

-Coach Natalie

0 -

@Coach Natalie Thanks for looking into this. Glad that this discovery helped you refine your help article.

1