Allow users to classify an Investment Account as a non-investment account

This is really needed for Cash Management accounts from Fidelity and other Investment Firms that act like checking accounts. Generally they come with debit cards, bill pay and checking features. The cash in the accounts is generally tied to interest from Sweep Bank accounts or to a single cash fund such as a Government Money Market fund. So there isn't much need to keep up with myriad stocks and bonds.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)

Comments

-

Coach Natalie's response worked for me:

https://community.simplifimoney.com/discussion/6759/add-fidelity-cash-management-account-cma-as-checking

0 -

-

@Dognose Hope you will upvote this because right now you and I have this classified as we like, but new users don't have the option. In addition, if we ever have to reconnect our Cash Management account, our only option will be a brokerage account, or we'll have to make it a manual account (which is what I currently have to do with Quicken Classic Mac).

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)2 -

That's unfortunate.

2 -

@Dognose Yes, and I am lucky I still have mine under Savings. People need to upvote this even if you don't yet have a Cash Management account. One day you might. Upvote it!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

I’d prefer that they just fix the features in investment accounts so this wasn’t such a big issue (eg, permit split transactions and document uploads, and exporting of transactions, etc), but this would also permit the old workaround for most of those issues. Just seems like a huge flaw for a paid service to not permit users to categorize their own accounts however they want.

0 -

@WJB You make a good point. It's now been at least two years since we gained the ability to have transactions in Investment accounts, and these accounts are still missing features. Recurring transactions is another one.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

@SRC54 agreed - it’s actually strange that this hasn’t been fixed when so many marginal added features have been rolled out in the interim. I’d appreciate a better explanation on what’s going on here.

At a minimum I would have thought the new tax feature would have driven categories in investment transactions and splits, given the different tax treatments applicable to various dividend and sale transactions. And the “solution” of locking investment accounts into the investment category to stop the workaround of switching them back and forth to permit exporting / categorization / splits seemed almost aggressive without an explanation / time frame for adding these features. Enough to make me wonder if they see some sort of user lock-in advantage from denying us these features but I can’t see it.

Hopefully we can get a little more information here from Simplifi?

0 -

@WJB The wheels turn slowly it seems in Simplifi development. Some things happen quickly while others are on turtle time. Who knows whether it's marketing or the development team that drives this? Most likely a combination of both based on how complicated the programming is.

Initially, Simplifi didn't show investment transactions at all; you could only see the total investment balance and your holdings. It was all static. Even now with transactions, they are mostly ignored unless they are payment/deposits. And many users want those to be ignored too. The development did respond to those of us who wanted them to be available in the Spending Plan and Reports.

We've been told that Simplifi is now working on a solution for investment accounts that have checking account features, but we don't have a timeline nor do we know exactly what that means.

I have my Fidelity Cash Management set up as a Savings Account since I don't use it much yet. I somehow got it set there before the recent change that wouldn't let you move it out of Investments. In Quicken Mac, I had to make it a manual account to do this. So right now, we either live with the limitations of an Investment Account or we do a workaround.

I've used almost every financial app out there, and they all have their stubborn vagaries. I think it probably comes down to the original vision of the development team. And no doubt, how difficult the programming will be.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

@SRC54 and @WJB - Thank you for responding to my related post, although I think my post goes a bit further regarding this issue (brokerage accounts that also function as cash accounts) and suggests that Simplifi already has all the data needed to enable brokerage accounts’ cash transactions to be identified as such and treated as any other cash transactions is treated regardless of the account it resides in. I’ve upvoted your request. However, I think a more helpful feature would be to govern treatment of transactions at the transaction level rather than the account level.

See post here:

I should add that I know I can check a few boxes to include/exclude some cash transactions in brokerage accounts from reporting, but this does not solve the full set of problems with the current lack of functionality (as explained in my post).I should also add that I am a LONG time Quicken Classic user, and I am trying to set my kids up with Quicken Simplifi. I REALLY want it to work for them. But it doesn’t, largely b/c of problems like this.

1 -

More and more people use Fidelity's cash management accounts or regular brokerage accounts as checking accounts. The main reason I won't be renewing my subscription is that SimpliFi doesn't currently allow these accounts to be treated as checking accounts, which is a feature I am looking for. I hope to see this issue addressed by then, otherwise I'll be forced to cancel.

3 -

Same situation as this comment. I've officially moved over to [removed - competitor mention] because of this change

1 -

@root62 and @macramore Simplifi coaches have said they are working on supporting these cash management accounts. FWIW Quicken Classic doesn't support them either at least on the MAC version. I have my CM account in Classic set up as a manual account. In Simplifi, I have it set up right now as a Savings Account.

I've had to change my Fidelity setup twice and so far it hasn't messed me up. You could try making your CM account manual and then reconnecting it to see if it will let you link it to the manual account and it stays put as a cash account. If it doesn't you won't be able to record buys/sells and you'll have to post any dividends using your own categories and not the built-in investment ones.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

it unfortunately doesn't give me the option to move it out of investment category at all

0 -

You can make it a manual account and then place it wherever you want e.g., checking. At least then you can have splits and cash options.

And you can then try to reconnect the account to see if you can link it and maybe it will stay put. No guarantees.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I would love it if I could manually change the account type, regardless of the account location. For example, I keep my savings at fidelity, for the high yield, but it groups all accounts at fidelity under investments. Yes, I have investments there as well, but I would love to be able to change my savings account to “savings” so that it doesn’t total up in my investments

1 -

It's shocking that Simplifi doesn't support use of investment/money market accounts as checking accounts (apparently, it used to, but that feature was "fixed"). This is very commonly done (most brokerages offer something like it), but Intuit/Blackstone seems unaware of it. As if a different team from the financially experienced one that developed and supported Quicken over the decades has developed and support Simplifi. Not a good sign. That they are so inexperienced that they thought that the ability to classify an investment account as a checking account was a bug, when it is just a common financial practice.

1 -

This worked for me (at least for now).

- Make Fidelity CMA Manual Account

- Delete Fidelity CMA Manual Account

- Create New Banking / Checking Account (I think I actually chose the subtype as CMA)

- Go back to Fidelity Connection > Add New Accounts > Select CMA Accounts (I checked all accounts) > Link to existing Manual Banking / Checking Account

Now I have a Banking account linked to my Fidelity CMA. Not sure if it will get reclassified automatically at some point or not.

I just recently opened my Fidelity CMA so I wasn't worried about historical data. If that's an issue I assume you can export your account history prior to deleting and then import that to the new account.

3 -

@franks Sorry you had to delete the old account, but I am glad you were able to set it up as you like. Thanks for sharing.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I should be able to change my account types myself. Just because Fidelity is an investment company does not mean all my accounts with them are investment accounts. My paycheck is not tracking correctly because it keeps being classified as an investment. Why can't I just manually say, this is a checking account?

2 -

i have the same problem. I am looking at the alternative apps to move over to.

0 -

@RiversideKid Please read and vote for this idea. Also, take note of @franks post above as to how to set your brokerage account as a checking or savings account. Thanks, and good luck!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Vanguard Cash Plus accounts have two components, a money market investment account held by Vanguard that makes sense to be treated as a brokerage account, and a spending account portion held by PNC Bank that allows frequent ACH transactions effectively making it a checking account. It would be nice to see that balance in with my banking and to be able to track and manage the transactions on the PNC Bank portion of the account. I use this as my primary checking account, and not having the option to show the account like a checking account is a major inconvenience.

https://investor.vanguard.com/accounts-plans/vanguard-cash-plus-account

0 -

@SRC54 Thank you for thinking of me. I up-voted this many moons ago. I'll follow @franks advice and see if it resolves the issue.

Lots 1-2-3 (1984-1988)

MYM (Managing Your Money by Andrew Tobias) for DOS (1988-1994)

Quicken for Windows user since (1994-2024) (Still wanting to IMPORT!)

Simplifi by Quicken since (2023-Today)1 -

Thanks @RiversideKid, and good luck.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

This is a show stopper for me. I use Fidelity as my "one stop shop". Having CMA as mandatory brokerage will not work for me.

1 -

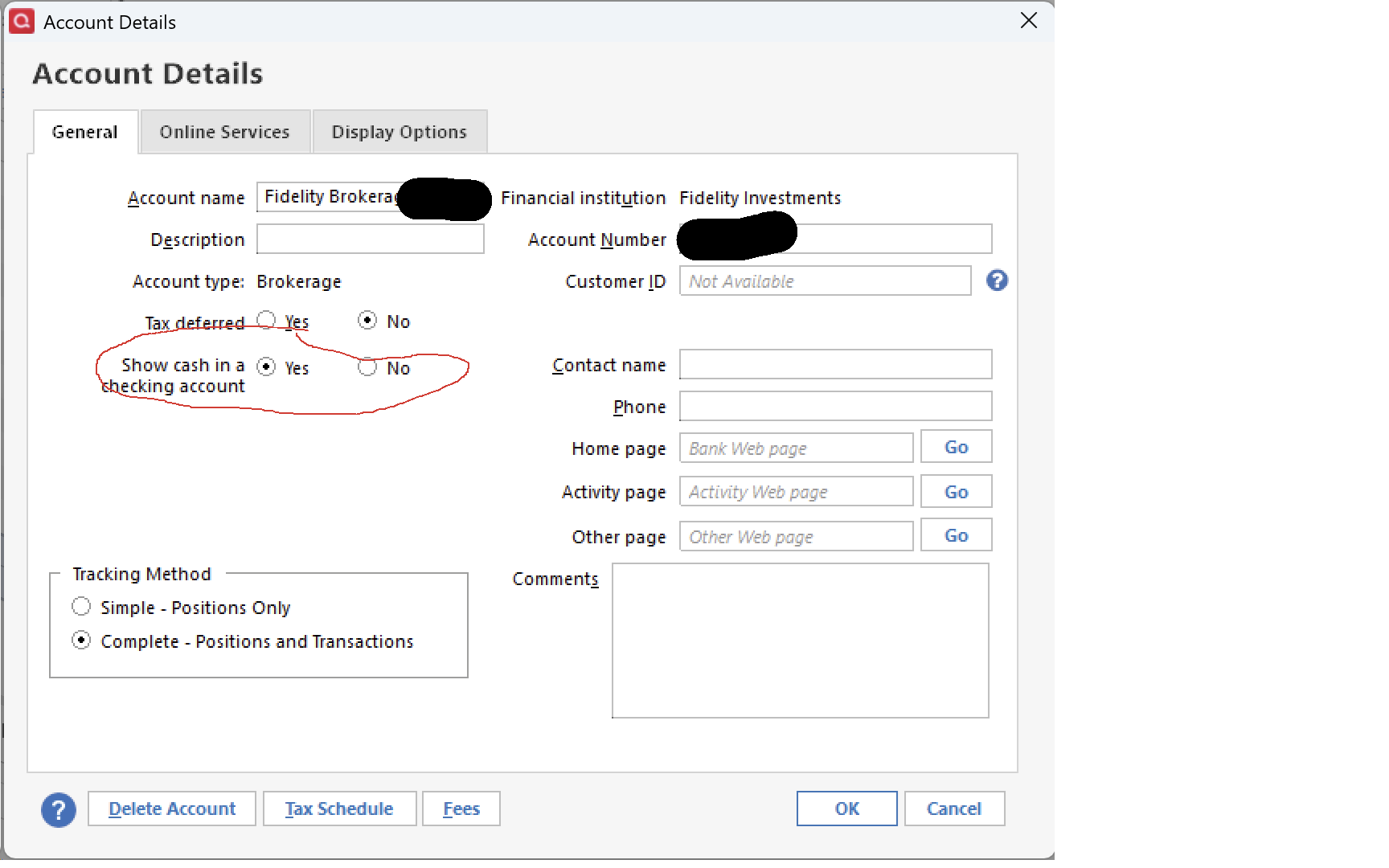

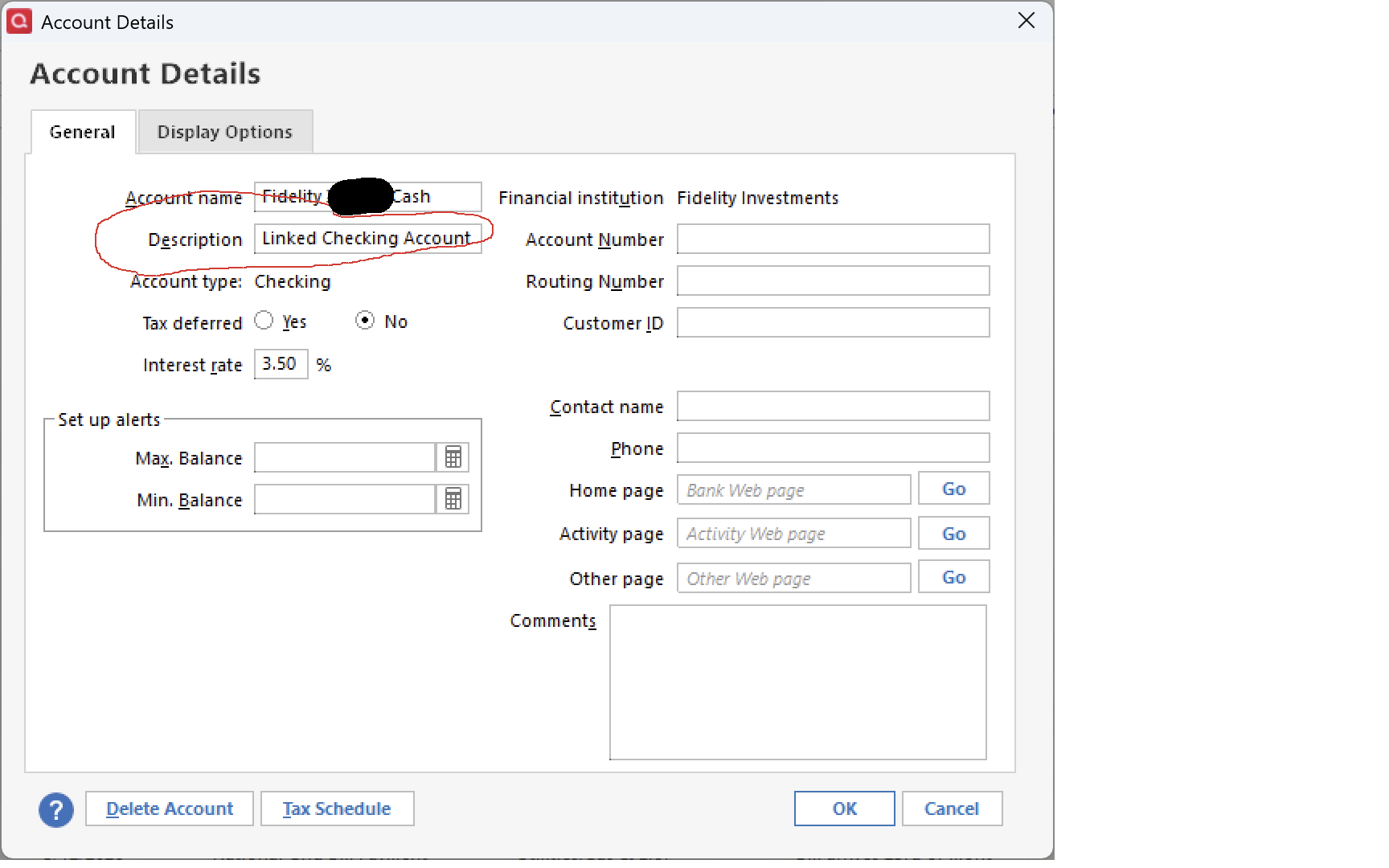

Quicken Classic for Windows has this. Its a checkbox on the account details box. It adds a 'parallel' banking account in addition to the investment account. All the transactions in the core cash MMKt account go there and keeps track of everything just like a bank account would. The cash transactions are removed from the investment account. All the other investment funds stay in the original place.

I now use the cash portion of account as my main banking account. It allows me to maintain in a higher 'safe' balance and earn interest vs the traditional checking bank accounts which I now use less and less.

Without a similar workaround, this would be a showstopper for me moving to Simplifi.

0 -

Some of us also have long term investments in our Fidelity Cash Management Accounts but still use them like a regular checking account. The benefit is that uninvested cash gets automatically swept into a money market investment at the end of each day.

I think if the Simplify development team added the capability of making any investment transactions that were cash in or cash out act like they do in a checking account it might fix the problem. By that I mean the Recurring Transaction, Create Rule or Exclude From capability could be applied to these transactions like if they were in a Checking account. With this change I think the transactions would appear in the Spending functionality which is essential if budgeting is to be utilized with a CMA.

1