What is the correct accounting & category for sweep in after stock sale and dividends

Hi Simplifi Community!

I love this product and have been getting deep into it lately.

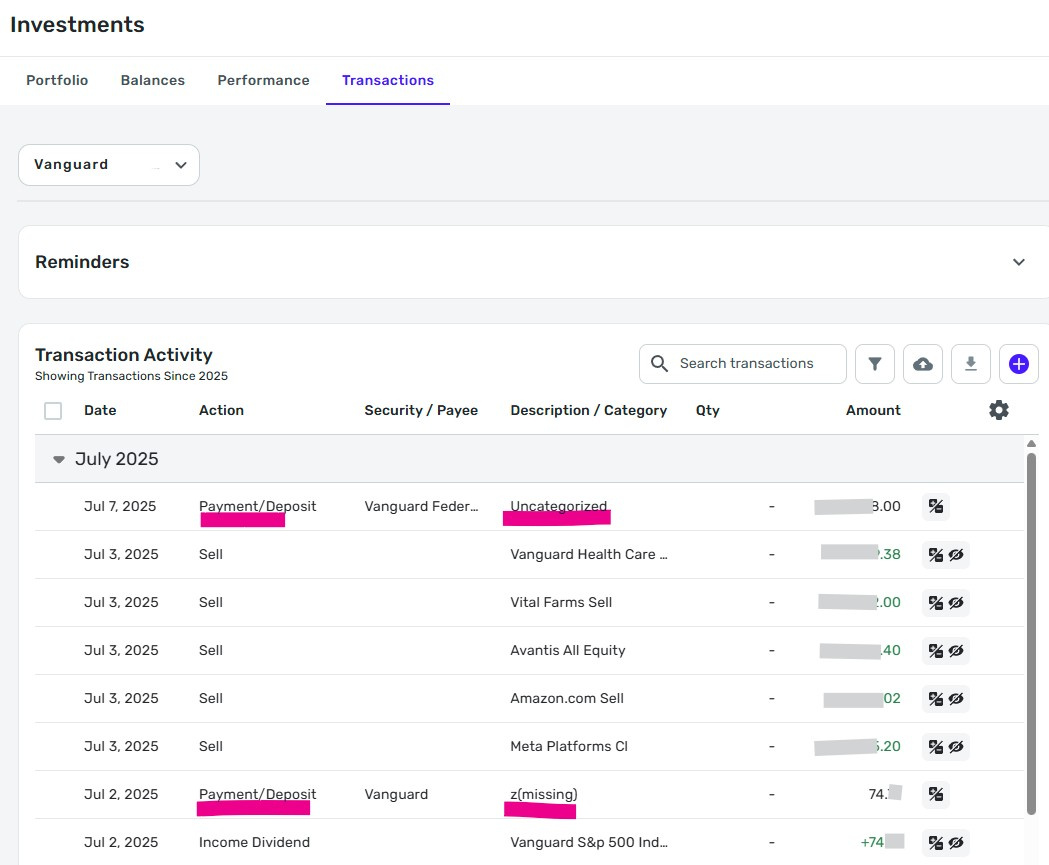

I'd appreciate your advice for the Screenshot attached.

I've recently received dividends and also later sold some stock on my IRA.

Two actions seem correct - "Income Dividend" for dividends and "sell" for sold stock. Both of these are hidden from reports and spending plan which makes sense.

However I also have Payment/Deposit actions for the vanguard federal money market sweep ins which show as an expense and is uncategorized and shows up in my reports.

- What is the correct action for federal money market sweep in after sale or div?

- What category should I use to describe it?

- Should it also be hidden from reports?

- How can I automate/ set a rule for this?

Many thanks for your advice!

PS - I edited the category for June 2nd deposit but really z(missing) & uncategorized are the same so ignore those discrepancy in the image.

Comments

-

[removed] Is this something you know how to answer? Appreciate any guidance 🤓

0 -

I'm not sure I fully understand your question, so my comments should be taken with a grain of salt. I can only tell you how these transactions show up in my register.

I have some fund holding where dividend income stays in the cash account. So there is only one transaction:

- Action is "Income Dividend," Security/Payee is the name of the fund, and Description/Category is some form of friendly name for the fund.

I have other fund holdings where dividend income is immediately applied to purchase more of the same fund. In that case there are two transactions:

- The first one is exactly as described above.

- For the second one, Action is "Buy," Security/Payee is the name of the fund, and Description/Category is a text description of the number of shares purchased and the share price.

The second transaction represents the purchase of shares with the dividend, which shares then become part of the Portfolio. I don't know if that is what is happening in your case.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)2 -

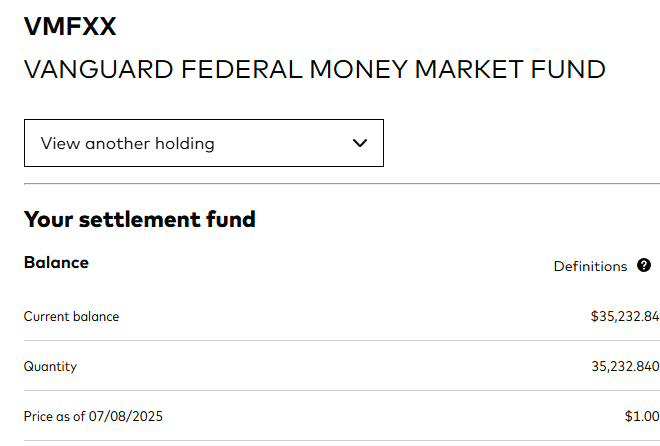

@Thomas R - That could be. I'm not really sure how your money market fund is represented in your brokerage account.

If it is something that has shares that you buy, then it could be a "Buy." If it's just an account that holds your available funds, then maybe "Deposit" is correct.

You could look on your brokerage website to see where that $74 actually went (in the real world) and then be guided accordingly. Sorry I don't have anything more specific to help.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

It's not entirely clear to me - the fund is recorded as $1 per unit (see screenshot) suggesting a buy action but the account type is cash.

For now converting them to "buy" seems to have sorted it as now those transactions don't show up in my normal spending reports.

I also noted that the other transactions in my screenshot were missing the security/payee field so I added those.1