Chase Cards not syncing [transactions] pre-2025 with Simplifi

All of my credit cards and other accounts are updating correctly in Simplifi with one exception - all of my Chase (Visa) credit cards aren't pulling in information from before 2025.

I've reset the Chase connection, confirmed it is showing all transactions (or should be), and looked on Chase to see if Chase is limiting the years shared with Simpifi (but couldn't see such a setting), but no impact.

Since it is not showing anything from 2024 or prior, I'm assuming there is some very simple setting I am missing. Any suggestions would be appreciated, thank you -

Comments

-

I assume you are a new user using a new file with Simplifi. Often banks won't download more than 90 days of transactions when you link your accounts. Most new users just start at that point.

You might be able to download from the Chase site to a .csv file and import into Simplifi. I just went to the Chase.com site, and they let you download statements, but didn't see any obvious way to import transactions. If you don't have too many transactions, you could manually enter those from the statements.

If you were using another app before Simplifi, such as Quicken Classic, you could import from that using a .csv file. Here's a support document to help you in case you need it.

My recommendation is, if you can, try to get all the 2025 transactions in, so that you will have a full year of data come Dec. 31. Good luck!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Thank you.

So the odd part is that I've been a Simplifi subscriber since last year (2024), and I could swear in the past (it's been a while since I looked back at transactions) that I was able to see those 2024 transactions (at the time, or thereafter).

I like the method you recommend, though sadly need to get that full year as soon as possible (thus was hoping for a July 1 2024 - June 30 2025 look). The 90 days makes sense, but it is so perfectly cropped to start pulling in data as of Jan 1 2025 that it seems something is blocking it pre-2025. That is for all Chase credit accounts…the checking account for some reason it will pull in data from 2024 still (and earlier years), though I would have expected that to be aligned with the credit cards and only pull in the same range of data (from 2025). Curious indeed…thank you again for the advice !

0 -

Hello @tryingtosimplifi,

Thank you for reaching out with this question. In addition to the information @SRC54 provided, if these Chase accounts have been connected long enough that there should be information from 2024, there is one setting you can check.

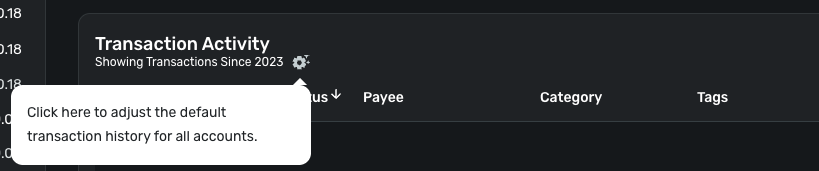

In the account register, right below the words "Transaction Activity", there is a line that says "Showing Transactions Since (year)". If you hover your mouse cursor over that line, a gear icon will appear.

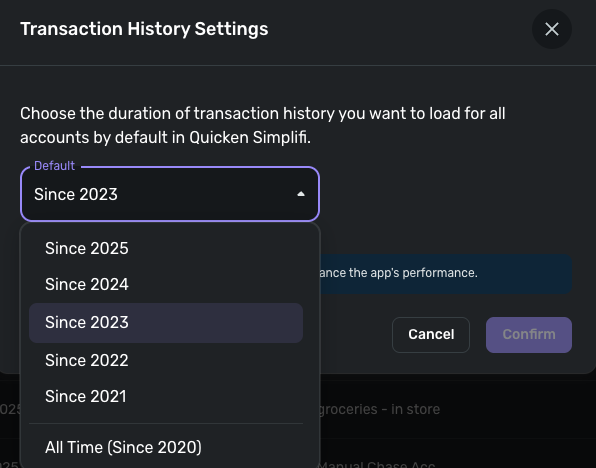

Clicking on that gear icon will bring up a Transaction History Settings menu.

Chose how much history you want visible in your register, then click Confirm. If you have transactions from that timeframe, adjusting this setting should make them visible.

I hope this helps!

-Coach Kristina

1 -

Hi @tryingtosimplifi. Thanks.

Since you did have 2024 data before, then I am pretty sure that @Coach Kristina's suggestion is probably the answer. Sorry I didn't think of it this morning.

Let us know how it goes.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Hi - thank you all for the replies, much appreciate!

I probably should have explained in a bit more detail with my initial question…unfortunately yes, I have toggled that setting to 'Showing all transactions' (I have also selected different years just to see if that would "reset" anything in doing so). But that is exactly what I was thinking - somewhere there is a setting that is cropping off at 2025…and that one is just the one you would think is the culprit. I'm wondering if there is an issue with that feature in my account, something at Chase, or other…hmmm!

Since all other cards are showing multiple years and it is just applicable to the Chase *credit cards* (not even to the checking account), it makes me think that maybe Chase is cutting off the ability to import somehow (instead of something on the Simplifi side…as I don't know what else it could possibly be).

I have also reset the Chase account - not sure I should take a step further and delete and re-add (which makes me nervous after all the work I have done in creating categories, selecting categories for specific transactions, etc.)

0 -

Thank you for your reply,

Resetting the accounts shouldn't cause any data loss, but if you delete and re-add the accounts, then you will lose all transaction information currently in those account registers, and will get back only what Chase makes available for download once you re-add them.

When did you first add these accounts in your Quicken Simplifi? Were there originally transactions from 2024 in those account registers?

Thank you!

-Coach Kristina

0 -

I first added Chase accounts I am guessing in 2024 (possibly earlier) when I first started using Quicken.

Thanks re: delete/re-add…I've done so much work I am avoiding the delete/re-add at all costs :D

Thank you!

0 -

Hello @tryingtosimplifi,

Thanks for the reply. Per @SRC54's previous suggestion, have you tried to navigate to the Chase website, download a .csv file, and import it into Quicken Simplifi?

This may be the best course of action in this case for transactions older than 90 days. Let us know!

-Coach Jon

-Coach Jon

0 -

I have not tried doing that yet in the hope that this week I might be able to get an answer from Chase (I guess they would be the ones that might be able to let me know versus Simplifi?) regarding what information they make accessible…and if this can somehow be changed on the Chase end before I take other steps.

If that doesn't work and I need to try to import, 2 questions:

- if I import and then Chase "fixes" itself, is there a way to simply "undo" the import of all of the 2024 transactions (over about 6 credit cards, all from Chase)? I'm guessing I could put all the transactions into a single "Chase 2024" account, and then if something is fixed with the "normal" accounts, I could just go back and delete that entire "Chase 2024" account? Does that sound right?

- in the example of how to import, it shows adding Tags, but then the process says you assign categories AFTER import. In that case, will Simplifi try to automatically categorize all the imported transactions? And will all the rules I have already created be applied to the imported transactions?

Thanks again @SRC54 @Coach Kristina @Coach Jon

0 -

Hello @tryingtosimplifi,

Thanks for the reply! By importing the transactions from 2024, the bank would no longer need to fix/download those transactions into Quicken Simplifi, as it would be the same data that the bank would send normally. Categories are not imported. You will need to categorize your transactions once imported. Only tags entered into the 'Tags' column will import into Quicken Simplifi. As for your inquiry about transaction rules, yes, when you import transactions into Quicken Simplifi using a CSV file, any applicable transaction rules that you have set up will be applied.

I hope this information helps!

-Coach Jon

-Coach Jon

0 -

Even more odd…my wife's Chase transactions (on other credit cards) are downloaded for 2024, only mine aren't.

Furthering my confusion, when I try to download 2024 into a CSV file from Chase, it won't let me download 2024 (!) - it says "We couldn't find any activity that matched the date range you chose…" 🙄

However:- I am able to download ONE of the statements from 2024, all the other months give the message "You downloaded your account activity. If you don't see a window asking you to open or save it, check your downloads folder.", however, it never downloads any data

- When I manually input a date range, no matter how large or small, it gives the same message as above.

So it seems there is something going on at Chase, specifically in my credit card accounts, that is preventing this….the mystery continues.

Thanks again everyone. Probably no more tips needed here since it sounds like a Chase issue I have to work out with them (unless anyone has experienced this before in trying to download transaction data).

0