Investment Detail - Payment/Deposit Process

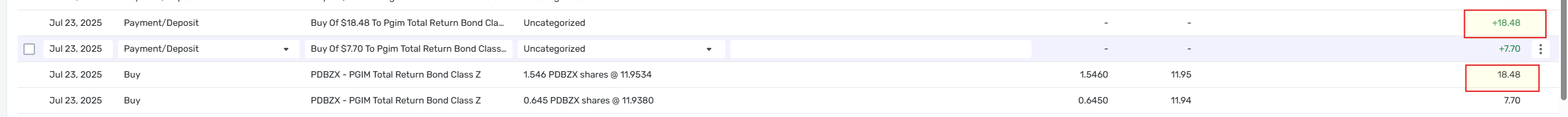

I have a direct feed to my 401k and I've been noticing that the transactions come in as Payment/Deposit.

I initially thought that because of the information on the Payee field "Sell Of $0.12 To Pgim Total Return Bond Class Z." that this was the same as the Buy transaction.

So I converted the transaction to a Buy transaction along with the detail in my brokerage account as show in the last two lines in the screenshot.

I then conducted another download and the Payment/Deposit transaction showed up again. I think this occurred because the amount were different signs. It appears that the Payment/Deposit is the actual contribution (from my paycheck) and I should be manually entering the Buy/Sell transaction separately.

If that is the case, what should I put as category for the Payment/Deposit transaction? Is it just income?

Best Answer

-

I think they just duplicated because you updated them to buys. You can probably delete the duplicate Payments since they aren't really payments, right? They should stop re-downloading after a day or two. At least, this is what happens with my Fidelity investments.

Were these buys you initiated or dividend reinvestments? If the latter, you can just change them to Reinvestment, which is what I do. OTOH, if you prefer, you can change the payment/deposits income dividend and have both sides of the transaction.

Remember that Simplifi always ignores investment transactions unless they are payments or deposits, and unless they are paid from one of your other accounts and you want them in the Spending Plan or Reports, there is no need for them.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1

Answers

-

What do you mean by this?

"Remember that Simplifi always ignores investment transactions unless they are payments or deposits, and unless they are paid from one of your other accounts and you want them in the Spending Plan or Reports, there is no need for them."

I wanted to keep track of the shares in my 401k so I can conduct analysis. Is there another to do this without inputting the shares that were transacted based on the paycheck contribution?

0 -

If your account is connected, your 401K transactions will download; it's just that it won't be used by QS to compute your positions or account value. That information is downloaded separately and shown in Portfolio, Balances and Performance.

This information is independent of the transactions that are there for record purposes. They won't be included in Reports or Spending Plan unless you decide to include them but you can only decide to do that if you make them Payment/Deposits, eg., contributions.

Depending on your FI, you may also have to update cost basis (some do this for you), so you can how well you are doing. (Of course, your cost basis for tax purposes when you start taking distributions will be 0.00).

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0