Mileage and rent for schedule C

I used the mileage feature and made Miles logged list. However it doesn't reflect schedule C document on quicken. How can I make my Miles logg reflect to tax calculation?

Also, how can I add portion of my rent into schedule C?

Thanks in advance.

Best Answer

-

@TK_25, thanks for posting your inquiry to the Community!

It doesn't look like the Mileage Tracker is integrated into taxes in Quicken Business & Personal. Instead, I think you'd just be able to keep track of the miles for each business, or for personal use, so you can carry that info over to your Schedule C at tax time to get your deduction.

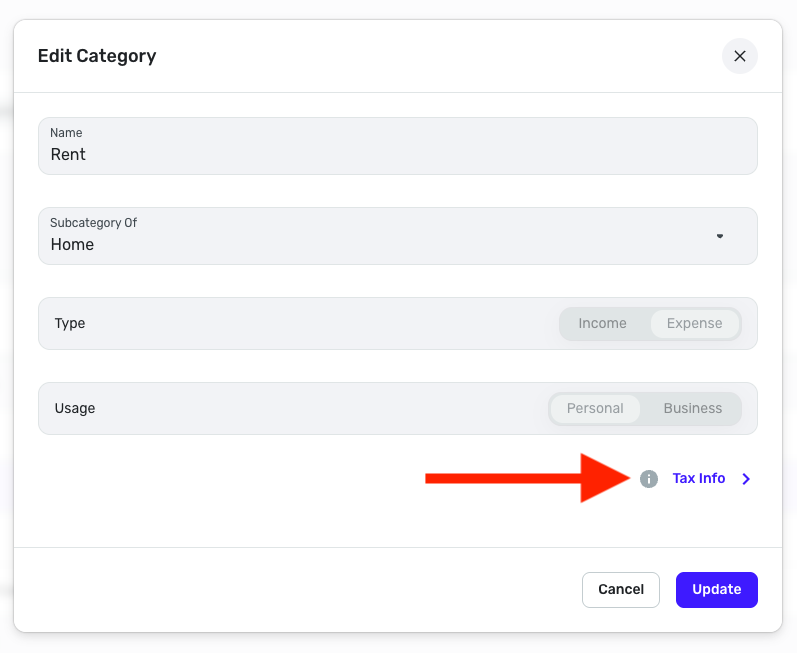

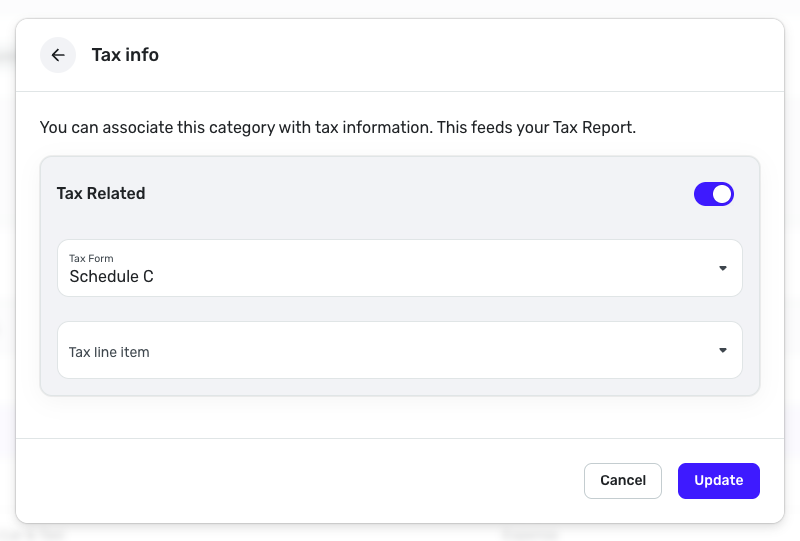

As for applying a tax form to your rent payment, you would do so by assigning a Tax Line Item to the Category used for the transaction in Quicken Business & Personal.

Our support article here goes over setting up Categories with Tax Line Items:

And our support article here has the steps for recategorizing a transaction:

Let us know if this information is helpful!

-Coach Natalie

0

Answers

-

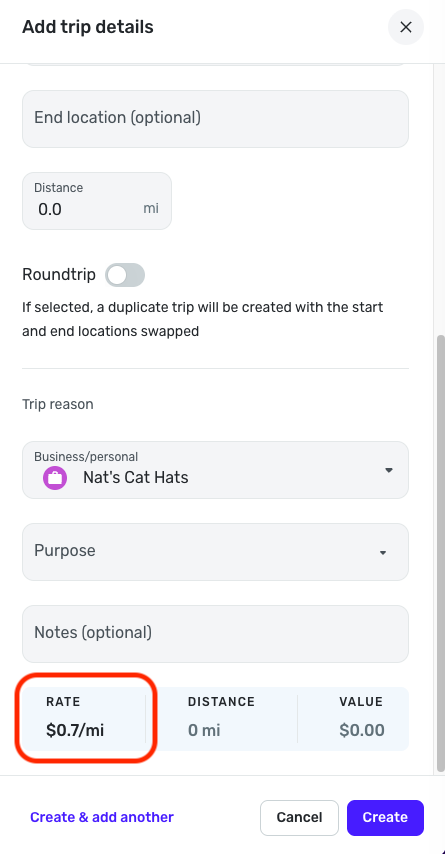

I see. Do you know what rate the gas mileage feature is using?

Also, I need to include only part of my rent on Schedule C, not the entire amount. Is there a way to do that in Quicken?

And finally, can I edit Schedule C so that I can add both gas costs and rent?0 -

@TK_25, thanks for the reply!

The mileage rate is set at the current IRS rate, which is 70 cents per mile. You can see this info at the bottom of the screen when logging miles:

As for only including part of your rent, as well as adding gas costs to Schedule C, again, this would be accomplished by Tax Line Items in Categories. For the rent payment, you can split the transaction and only assign the part you want to count towards taxes to a Tax Line Item Category.

And you can set your Gas Category up with a Tax Line Item as well. The steps in the article I shared above for Managing Business Categories will walk you through how to do this. And if you are editing an existing Category instead of creating a new one, the steps to do so can be found here:

I hope this helps!

-Coach Natalie

0