Bill Connect for Credit Card: Statement Amount Is Not Counting Some Transactions

This discussion was created from comments split from:

How is Bill Connect supposed to handle the next (not current) credit card payment?.

Comments

-

Well, I spoke to soon… October 7 was the last day of the period for one of my credit cards and things changed.

Bill Reminder correctly shows that the bill is finalized (see below):

But the amount shown for the bill omits the last two transactions in the period. One was a purchase, and one was a refund, and both were dated within the now-closed period and are shown on the statement.

Adding the one and subtracting the other from the amount Bill Reminder shows gives me the exact amount that my statement shows is actually owing. It looks like Bill Reminder pulled the finalized bill amount from the account before those transactions were accounted for.

[EDIT] I waited around for another update cycle. (This card updates once a day in Simplifi.) It updated this morning and still has the same wrong amount for the upcoming bill.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat, thanks for reaching out to the Community with this issue!

I believe that the statement balance is provided via aggregation with the bank, so they are the ones providing the amount at that juncture. The amount of the reminder will update based on how you have Bill Connect set up for the card, and there is a three-day buffer before this takes place.

With that, at what point was the reminder updated to show that the statement period had closed, and when did the transactions in question take place? Is it possible that your bank sent in a statement balance before those transactions cleared? What is the 'Amount' setting in your Bill Connect tab for the card? Also, what is the name of the bank that the account is connected to? Are you able to manually edit the amount of the "closed statement" reminder to correct it?

Please let us know!

-Coach Natalie

0 -

- To provide a framework for the following, note that:

- the billing period for the current statement is 9/9/25-10/8/25

- payment is scheduled for 11/6/25

- Simplifi correctly lists both the closing date and the due date

At what point was the reminder updated to show that the statement period had closed?

I think it was on 10/11/25, the date I reported this, but I can't be sure

When did the transactions in question take place?

missing purchase sale date & post date = 10/04/25

missing refund sale date & post date = 10/04/25

when I checked the statement on 10/11/25 these transactions were reflected there

Is it possible that your bank sent in a statement balance before those transactions cleared?

I'm not sure what you mean by "sent in." If you are asking if Simplifi downloaded the statement balance before the transactions cleared, I don't know- I do know that by 10/11/25, three days after the period closed, these transactions were listed on the statement and included in the statement balance calculation

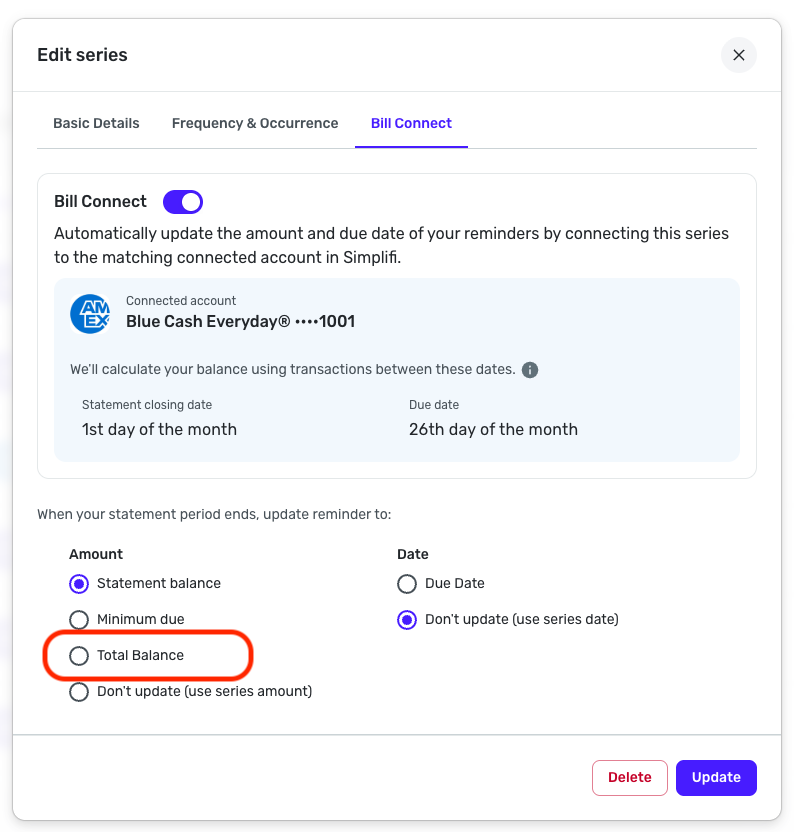

What is the 'Amount' setting in your Bill Connect tab for the card?

Statement balance

Also, what is the name of the bank that the account is connected to?

citi

Are you able to manually edit the amount of the "closed statement" reminder to correct it?

yes

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat, thank you for the reply!

Since you are able to edit the amount of the reminder to correct it, let's go ahead and have you do that for this round so we can keep an eye on things moving forward. It's possible that this was a one-off occurrence that won't pop up again. Please keep an eye out for this issue with other credit cards as well (if you have any others enabled for Bill Connect in Quicken Simplifi) to see if we can establish any kind of pattern or narrow down a potential cause.

Let us know how things progress!

-Coach Natalie

0 -

"It's possible that this was a one-off occurrence that won't pop up again."

My guess is that it will "pop up" whenever similar circumstances occur, but that those circumstances will be infrequent for each individual user.

It looks like what happened here is that transactions occurred within the statement period but remained pending until after the closing date of the of the period. By the time those transactions cleared and were applied to the statement balance, Simplifi had already downloaded the balance.

My guess is that Simplifi uses an API call (something like "/liabilities/get/last_statement_balance") to get the payment amount, but does not recheck later on to see if anything has changed. It would be better if Simplifi rechecked to keep the payment amount correct, but I doubt if that will be implemented.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat, I've never personally had pending transactions show up in a credit card statement. If they haven't cleared by the time the statement comes out, they would not be included in the statement balance. Is this something unique to how Citi bills its customers?

-Coach Natalie

0 -

"I've never personally had pending transactions show up in a credit card statement."

Perhaps I didn't explain the sequence of events clearly. I did not mean that pending transactions showed up on the credit card statement. I meant that it is possible the transactions in question were pending when Simplifi pulled the account balance. Here's how events I observed actually occurred:

- 10/04 - The "sale" and "posted" dates shown for the last two transactions in the period

- 10/08 - The end date for the billing period

- 10/11 - The "three day buffer" period you mention above expires

- 10/11 - I first notice the updated "next payment" amount in Simplifi — it shows a payment amount that does not include the last two transactions

- 10/11 - I first examine the online PDF of the statement — it shows a payment due amount that does include the last two transactions

My best guess is that Simplifi somehow pulled the account balance before Citi had finalized the billing amount. (Possibly the when the last two transactions were still pending.) Although if Simplifi actually waits for the three days you mention before pulling the balance it is hard to explain how that would happen.

Note that I suggest this only because I can't think of any other way Simplifi could set a next payment reminder amount that is off by exactly the amount of the last two transactions. Perhaps someone else can.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat, thank you for the detailed timeline!

Yes, I'm also unsure how Quicken Simplifi would pull the statement balance before Citi finalized the amount, especially with the timeline you provided above. It seems that the three-day buffer was honored exactly. Please go ahead and keep an eye on things and let us know if this pops up again.

Another thing you might try is using "Total Balance" in the Bill Connect setup. I'm not sure if this would prevent the issue you've outlined here, but I think it is definitely worth a try to see if you get better results!

-Coach Natalie

0 -

"It seems that the three-day buffer was honored exactly."

I wonder about that, for a couple of reasons.

- As I said, I "first noticed" the updated next payment amount on 10/11. But I don't really know how long before that Simplifi updated the amount.

- I do know that I received an email from Citi at 6:11 am on 10/10 stating the correct statement balance. So Citi had it right less than 24 hours after the statement period closed. Well within the three-day buffer.

(I am providing the above detail in case you want to pass it along to whoever handles the way Simplifi pulls balances from accounts.)

"Another thing you might try is using "Total Balance" in the Bill Connect setup."

Maybe, but I'm not sure how that works. The docs say it would "Update the reminder amount to the total balance when the statement period closes." Is that a one-time thing or does it keep updating the total balance as time goes on?

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

-

Maybe someone who has used it and knows how it works can tell us.

I've had to redo Bill Connect on my credit cards a few times already and I'd like to avoid that if possible.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0