Major bug with closed brokerage and loan accounts

Hi everyone.

Major issue, I believe.

Yesterday, the last payment of a car loan was processed and the account showed zero balance in Simplifi. I went ahead and closed the account.

This morning, while checking my Spending Plan for the month, I noticed a strange transaction. Upon further review, it was the car payment transaction showing under the LOAN account as income.

And I am like... wait... Simplifi does not download loan account transactions. What is going on?

I kept looking and decided to check December’s Spending Plan, and the net number had changed. Further research found that for December there was now an “income” from a loan payment. And for November as well, October, all of 2025, and all of 2024.

That loan account that I closed yesterday was now messing up all my numbers.

So I decided to check something else. I checked the transactions of an old brokerage account I closed in 2024. That brokerage account is set so no transactions affect reports or the Spending Plan. And voila... the transactions are popping up everywhere, messing up the numbers.

My conclusion is that the action of closing accounts makes Simplifi lose control of these transactions. Rules and logic stop working, and we cannot trust reports or Spending Plans anymore.

I will need to go into every monthly Spending Plan and fix things line by line... or wait for Quicken to issue a fix.

Guys, please look into this. I cannot use a budgeting app whose numbers I cannot trust.

Quicken team: check my June 25 Spending Plan. Other Spend, June 2nd. You will find the transaction. I left this one untouched for you to see.

Comments

-

It may be safe to simply delete rather than close the loan account if you need a quick fix. Closing accounts usually means you want to keep the transaction history, where if you delete the account, the transaction history is deleted. Just be careful that this is/isn't what you want, as it cannot be undone.

—

Rob Wilkens - RobWilkens.com0 -

When you have a transfer, like from checking to a loan account (representing a payment), that same transaction exists in both accounts. (Positive in one, negative in the other.)

I can understand that deleting a loan account would foul up the transfer transactions in the checking account because there would be no account for them to transfer to. (I think what actually happens in that case is that they become generic "Transfer" transactions that don't actually have a matching side anywhere.)

But you closed the loan account. That should leave the previous transfer transactions untouched — they still transfer to the closed account. If it didn't work that way, I would think something is seriously wrong.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

I have no reason to delete an account. I have two other car loans. These do not show.

The only only that shows is the one I just closed.It is clearly a bug and one I'm positive Quicken will rectify.

Thanks for the reply.

0 -

Hello @nrp06,

Thank you for letting us know you're encountering this issue. To help troubleshoot, please provide more information. Was this a connected loan account (as opposed to one tracked manually)? When the account was closed and you saw that there were suddenly transactions showing up as income, do you recall what category was assigned to those transactions? If possible, please also include screenshots of what you saw (please redact any personal information).

Thank you!

-Coach Kristina

0 -

Thank you for letting us know you're encountering this issue. To help troubleshoot, please provide more information.

Was this a connected loan account (as opposed to one tracked manually)?

⇒ Connected. And loan transactions, as you know, NEVER appear anywhere in Simplifi. I actually thought you guys didn't even download these transactions. I do have 2 other loans connected to Simplifi (still on going) and I can't see any transactions related to those 2 accounts.

When the account was closed and you saw that there were suddenly transactions showing up as income, do you recall what category was assigned to those transactions?

⇒ In the Spending Plan as see them in Other Spend group as uncategorized transactions, with a positive sign and impacting the total number.

If possible, please also include screenshots of what you saw (please redact any personal information).

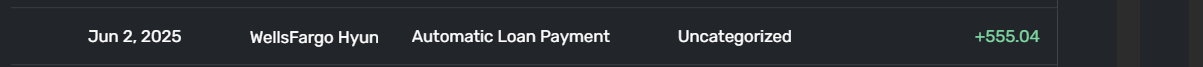

This is the June transaction. These transactions appeared in every single month. This is the only one I left untouched.

Below you can see the transaction for December. I edited this one, changed the category and turned on both exclusions. I edited them all, except June.

The issue is that these transactions are not supposed to be there.

0 -

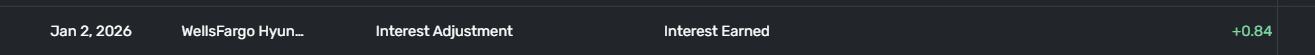

And I just noticed a new line. This line is visible in the Transaction log.

I'm going to edit it and turn on exclusions.

0 -

@nrp06, thanks for the additional information!

I agree that if the loan account was connected, there should be no transactions. It sounds like marking the account as closed caused all of the "behind the scenes" transactions that took place over time to show up. Does that seem accurate? And I'm guessing you see them in the loan account itself when viewing the register as well, correct?

Does excluding the account from the Spending Plan remove the transactions there? It looks like closed accounts can still be excluded/included via Settings > Accounts.

Also, are you able to delete the transactions from the register of the closed loan account?

I am trying to think of some solutions that would give you an instant fix versus manually correcting the Spending Plan month by month or waiting for an escalation to come back.

Let us know!

-Coach Natalie

1 -

It sounds like marking account as closed caused all of the "behind the scenes" transactions that took place over time to show up. Does that seem accurate?

⇒ That is EXACTLY what it seems. With the account open, Simplifi has some filters and controls that hide or ignore those transactions. That is what I believe happens. The moment you close a loan account, these filters become ineffective and these transactions pop up everywhere.

Does excluding the account from the Spending Plan remove the transactions there? It looks like closed accounts can still be excluded/included via Settings > Accounts.

⇒ I will test this and let you know.

Also, are you able to delete the transactions from the register of the closed loan account?

⇒ No, I can't delete the transactions, but I can edit them and turn on the flags for the transactions to be excluded on both Spending Plans and Reports. That fixes the numbers.

I am trying to think of some solutions that would give you an instant fix versus manually correcting the Spending Plan month by month or waiting for an escalation to come back.

⇒ I appreciate the concern but there is no need. I already fixed ALL transactions, one by one, turning the Exclusion Flags. So the transactions are there, but they are not polluting the numbers and balances anymore. I'm good. Honestly, I'm more concerned with the userbase that has no idea this is happening and are looking at number that might be fundamentally wrong. I would say that the focus should be on fixing the problem for everyone, and not just for me. Let me know how I can help.

Let us know!

⇒ Coincidentally, I have a second loan closing in just 2 weeks. The very last payment is about to be processed. We can use that to test the system and confirm that closing a loan account causes all these troubles. If that would be relevant to your development team, just let me know.

0 -

@nrp06, I'm glad to hear that you are good to go at this point!

Just curious — what prevents you from deleting the transactions? Do you not see them in the register of the loan account itself? If you do, is the delete option just not available, or do you receive an error, etc.? Or do you only see the transactions in the Spending Plan with no delete option available there?

I do think this would be worth documenting and filing a bug for if the opportunity is presented again. I don't personally have a connected loan account to mark as closed, so I can't attempt to reproduce the issue myself. Since you have potential future examples, try to get some before and after screenshots so we can clearly show our product team what's occurring.

Much appreciated!

-Coach Natalie

1 -

I have to assume your development team has plenty of testing data in order to replicate this scenario, no?

I will take several screenshots before and after closing the account next week but I certainly hope your development team can find the issue before that.

Best,0 -

@nrp06, I can't speak for the product team, as this may or may not be something they're already aware of, but I can confirm this issue has not been escalated from this thread. To do so, we'd need to gather specific data while the issue is actively occurring.

I hope this helps to clarify!

-Coach Natalie

0