Mr. Cooper mortgage account - set to manual and now payments show as income (edited)

I'm aware there's a known issue with Mr. Cooper. However, before I knew about it, I set the account to manual. Now it's showing every payment as income rather than a mortgage payment. Yes, the manual account is set as a mortgage. But my net worth is now ridiculously wrong. How can I edit the manual account so that it accurately reflects the account status?

Comments

-

Hello @Nancy Roberts,

Thanks for reaching out! I think we will need a little clarification to determine what specifically is occurring here. To confirm, your mortgage account is manual. And once you set the account to manual, did the existing transactions in the account change to income transactions when they were previously expenses? Or did transactions appear in the account once you set the account to manual? Let us know!

-Coach Jon

0 -

Hi Coach Jon,

The existing transactions changed to income transactions. I really have no idea what to do to fix this.

Thanks,

Nancy

0 -

Hello @Nancy Roberts,

Thanks for the reply! I would usually have you try connecting the account, but I am aware of the known issue with Mr. Cooper currently, so you may not be able to do that at the moment. Can you provide the following information to better assist us regarding this issue?

- The name of the account the transactions reside in, as it appears in Quicken Simplifi.

- The Date, Payee, and Amount of 3 example transactions where the issue is occurring.

- A screenshot of the Transaction Detail window for each of the provided examples that shows the "Appears on your statement as…" info (this is easiest to obtain from the Web App).

- A screenshot of the same example transactions from the bank's website showing that they're charges and not credits.

-Coach Jon

0 -

Hi Jon,

Is this a private channel? If not, how can I send you this information privately?

Thanks,

Nancy

0 -

Hello @Nancy Roberts,

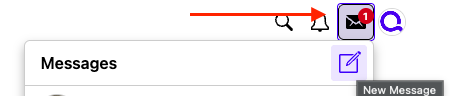

You may feel free to DM me this information via the message icon in the top right of your screen!

I hope this helps!

-Coach Jon

0 -

Hello @Nancy Roberts,

Thanks for the information and DM! Can you please verify about how many transactions there are that have changed to income transactions? If they are just monthly payments, it may be faster in this case to edit the transactions and change the positive amounts into negative amounts.

Additionally, if your financial institution allows downloading the transactions from the bank's website as a CSV file, you can also import the transactions into Quicken Simplifi via a CSV file.

Let us know!

-Coach Jon

0 -

Hi Jon,

There are 37. But it's a mortgage. Shouldn't it also reflect how much I still owe? Without that, my net worth won't be accurate.

-Nancy

0 -

Hello @Nancy Roberts,

Thanks for the reply. Since the account is not connected, the account balance is maintained by manually adding transactions. If the opening balance is correct in the account, and you edit the transactions that were changed to income back to payments, this should resolve the issue you are seeing. Does this make sense?

-Coach Jon

0 -

Well, no. It won't work because there is no "opening balance" on this manual account. It's just a bunch of payments. Which are now duplicated because there's a payment coming out of my checking account and another one in the mortgage account. When is Quicken going to fix this bug??

0 -

Hello @Nancy Roberts,

I apologize for my confusion in this matter. I am not sure what the payment coming out of your checking account means in this situation, in regard to your mortgage account. Can you please help clarify what you mean here? Additionally, are you stating that the transactions within the mortgage account are all duplicated now? Let us know!

-Coach Jon

0 -

No, I mean there's a mortgage payment in my checking account (of course), and now because the mortgage account is all messed up, all the transactions in that account are also marked as payments. Plus, as I said, there is no "opening balance" to be seen in the mortgage account - just a bunch of transactions. [removed - profanity]

0 -

Hello @Nancy Roberts,

Thank you for the clarification. In this case, the best steps going forward for this manual mortgage account would be to delete all of the transactions in the mortgage account and then add an opening balance transaction with today's date to track it currently, until you can get the account connected again in the future once the known issue clears up with Mr. Cooper.

-Coach Jon

0 -

Got it. Thanks for your help. Looking forward to a proper fix.

1