Transfer to a retirement account to a FSA/HSA, allow to mark as pre-tax for reports?

Is there a way to mark a transfer that takes place to a retirement account as part of a split transaction related to salary income as a pre-tax transaction so that Simplifi is able to account for the correct taxable income for the year?

TiggerTrainer

Quicken Simplifi user since January 2025

Quicken Classic (Premier) user since 2004 - 2025 (21 years)

Best Answer

-

No, there's no clear way to do that.

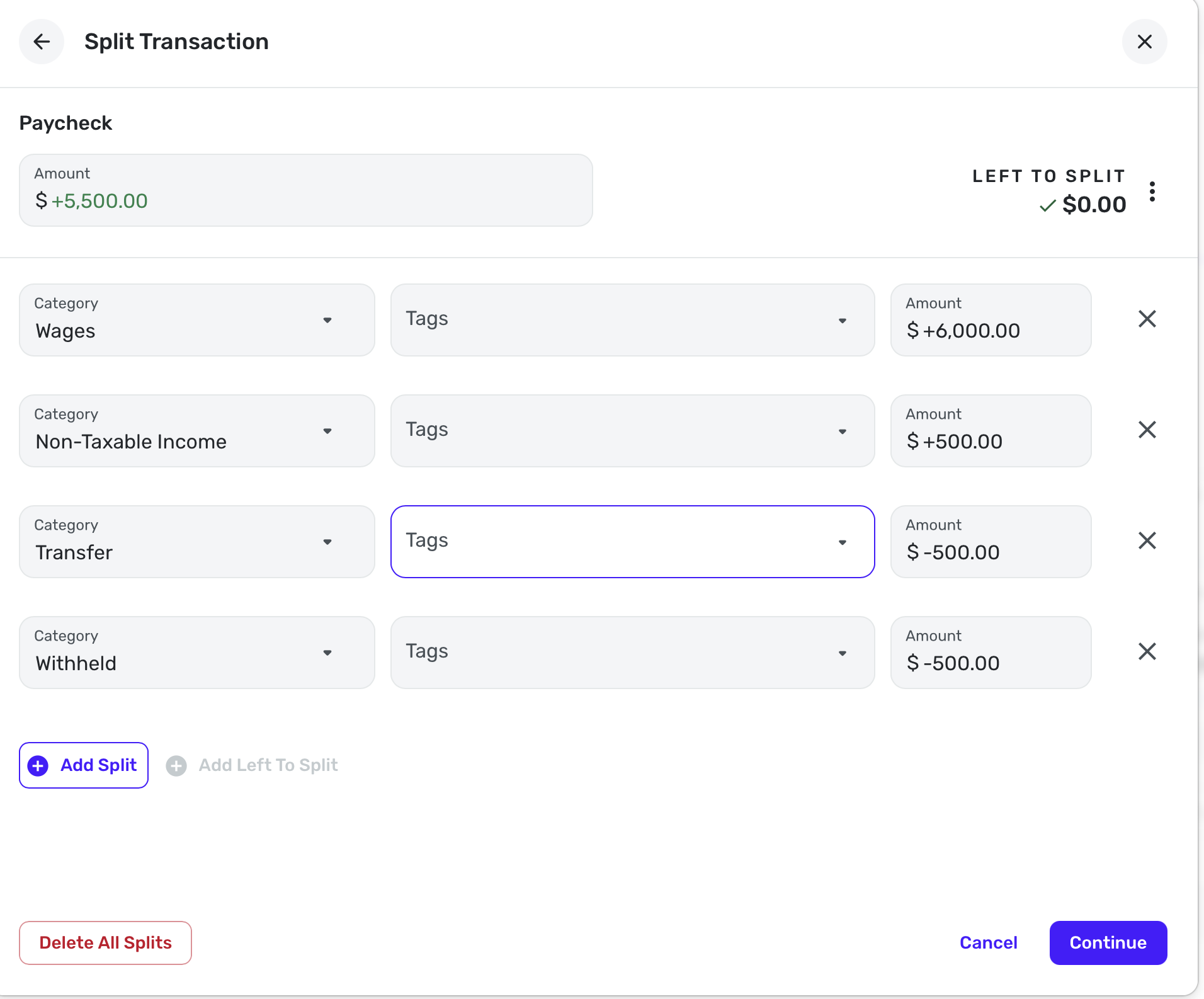

If you are sure that this contribution won't be taxable for state and federal, you could create a category for non-taxable income that isn't connected to the taxes report. It would work something like this.

$5500 Paycheck

+$6000 Taxable Salary (connected to W-2)

+$500 Non-Taxable Income

-$500 Transfer (to FSA/HSA)

-$500 Federal Income Tax (For simplicity, I am leaving out State and FICA taxes)Of course, if that $500 contribution could go into the FSA/HSA account if you are keeping up with that.

When my wife was working, her contribution to the State Retirement was taxable by the state but not by the feds. Also she had a cafeteria plan so her W-2 was complicated, so I didn't bother to to have a non-taxable income category. I did do the transfer to her State Retirement account.

When she did retire, and they annuitized her account, I deleted the Retirement account (we replaced that asset with guaranteed income for her and me for life) and now she gets a monthly distribution that is now taxed by the feds but not by the state. 😀 I am smiling because I just did my income taxes and for the first time in my life, we don't pay a cent in state income tax!

Anyhow, this is how I would handle it. Hope this is helpful.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0