Automatic Car Value Tracking

Comments

-

@trewbux I agree it's reasonable to do it either way.

It kind of depends on the use you have for the "net worth" figure. The net worth that I am interested in tracking consists of the assets that I can use to fund my life now and could potentially use to fund my life (or my child's life) in the future. I view demand and investment accounts as candidates for those uses (both now and in the future), and real estate holdings as candidates for use in the farther future.

But I don't really view my cars as assets that might fund my future life. Instead, they will sit out there and demand care and feeding for several years until they depreciate so much as to be negligible. (Come to think of it, that pretty well describes me.☹️)

My view is partly driven by the way I deal with cars — I buy them and drive them until they are pretty well used up. Then I use whatever residual value there is to fund part of the next car and the cycle starts over. In other words, I don't see myself selling the car and using the money for other purposes.

My view is also driven by the financial planning software I use. It is very detailed and takes many things into account, but it does not consider automobiles to be assets for planning purposes. (I don't suppose I should identify the software here, but it functions on the premise of "consumption smoothing" and has helped me tremendously.)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat Well, it's still a work in progress but what I do is make a transaction for my car on the date that I bought it and I update it with the current Carfax trade-in value every month or so.

Here's the current transaction for my present car:

I got a good trade-in on my 2014 CRV so they were transfers. So far my expenses are the sales tax and dealer fees (yuck) and depreciation. So my simple expense so far is about $6700 in 4 years.

I also add the 2021 HRV tag to insurance, maintenance, gasoline, etc. so I can do a report, which shows a total cost so far of $13717.94. The Dealer payee includes the depreciation, which is why it is so high.

For my past cars that are now valued at 0.00, I don't have the total expenses as I started this with my latest car. The same is true of my wife's 2019 CRV

The simple cost was was $10890.00 but of course with insurance, licenses, repairs and maintenance and gasoline, it is much more.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Thanks for the detailed explanation. I used to do something similar in my previous bookkeeping software, taking all the figures off the purchase docs and parsing them out into assets, liabilities, and expenses. And tracking depreciation.

But I quit doing it (with the exception of loan tracking) because I didn't see the benefit from the effort.

That's why, in my earlier post, I asked WHY you did it (rather than HOW you did it).

@trewbux says it's to avoid a skewed picture of net worth. I get that, but I don't feel I really need it.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat LOL. Yeah, one reason I gave you the details is I figured you could point out some holes in what I am doing. Basically I do it to keep my net worth somewhat accurate as well as because I'm retired so what else do I have to do? Accounting/Bookkeeping is kind of fun to me.

And I thought it would be neat to know just how much cars actually cost us. A lot, but what can we do? You notice I get the cheapest thing I can find.

But my wife is getting a new CRV next month and I already priced them. Sticker shock! It will be at least $34K!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I saved my car in Simplifi for information as I bought it outright. I enter a balance adjustment to update the value using KBB as the source. I update the value twice a year or so. Having said that, my 10 year old car is not a major contributor to my net worth.

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

1 -

I upvoted this request a while ago.

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

0 -

Not who you directed it to but I'm a business owner that has to provide financial disclosures for bank LOCs (yes, personally guaranteed) and the Net worth report meets this need for me assuming I have everything in it (yes including assets and liabilities - all of them). What they ask is extremely complete and missing something like a vehicle asset can put you on the bad boy list 😕

2 -

agree that this should be a feature for business users with the business and personal version. If the feature results in a higher subscription fee, the personal only users should have an option to opt out.

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

1 -

2 years and still working?

0 -

You can’t just shove up the car value onto the screen like a caveman presenting his recent kill to his cave family! Two years is a mere blip for a major feature like this. Have some patience, sir.

There’s a lot to consider. The right font, and the color of the value of your car as it’s presented to you. Should they update the value daily or weekly? Should the value of Teslas be updated more frequently by default so as to capture their dramatic fall from grace?These things take time, focus groups, trial and error. For all we know they are on their 30th iteration of the feature, almost releasing it to the unwashed masses, only to pull it back at the last minute. Because it has to be PERFECT. It WILL be perfect.

(or possibly KBB is trying to over charge and the economics of the feature don’t pan out)1 -

any updates in the KBB integration?

1 -

any update?

0 -

The original suggestion/request for KBB integration with simplifi was from 2020, and yet there has been no progress in going on 5 years?

0 -

I would like to recommend Simplifi to use the find the value of the vehicle by the VIN. This would be a similar experience to Zillow to find the value of an vehicle, an auto. By using this feature, the user would always know the current (last refreshed) value of the vehicle that is in the Simplifi asset record. There are several of these that can be Googled like Edmonds, NADA, Kelly Blue Book, etc. This is a feature that is with one of the competitors, Monarch Money.

Dick Davis

Wanting to Migrate from Quicken Classic Premier to Simplifi

0 -

Simplifi already plans to add Kelly Blue Book values. But there is no timeline yet.

[removed link to merged thread]

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Intuit Credit Karma and its predecessor Inuit Mint updates the vehicle values automatically from a J.D. Power database. This should be instituted in Simplifi as well instead of having to research and enter data manually. You already have the programming available in the company and free products should not have more features/capabilities than a premium one.

0 -

@Hammertime7 Understand that this is not an Intuit product. There is a cost involved with constant updates, and the cost would have to be passed along in the form of increased subscription costs. How badly do you want this feature?

—

Rob W.

1 -

Personally, I have no use at all for automatically updated vehicle values.

But @botjnilt pointed out a reasonable use case a couple of months ago for businesses that have to provide a detailed Net Worth report to their banks. I can see their point. Possibly this is something would be more appropriate as a feature in QBP, rather than in QS.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@Hammertime7 I'm not saying they couldn't add this, and it might be worth the extra fees

re: Your ID: this was playing just now

[removed - off topic]

—

Rob W.

0 -

Like @RobWilk I don't really have any use for this feature, and I am not sure I will use it when it arrives as I have my own way of doing things and I can keep both my cars in the same account.

If I do use it, I shall probably do what I do with Zillow, which is to let it update and then delete the transaction so that it keeps up with historical data while I keep my 2009 split transaction for what I paid for the house along with its appreciation (based on Zillow's inflated numbers).

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

At this point, I don't even have a functional car (it constantly overheats, and i can no longer open the front passenger door after i side-swiped someone on i-95). Fortunately, I have a brother in law in the family who builds race cars (like a Shelby Cobra) for fun, and a good local body shop — my only option may be to let them fix it, since i probably don't have the credit to finance a new car

—

Rob W.

0 -

Sad that Quicken doesn't connect to some provider like Kelly's Blue Book for vehicle prices, like they do with Zillow for house prices.

0 -

We have added Kelley Blue Book integration in Early Access. Check out the following announcement for more details!

-Coach Natalie

0 -

@Coach Natalie Is this being slowly rolled out? Or was it possibly pulled back?

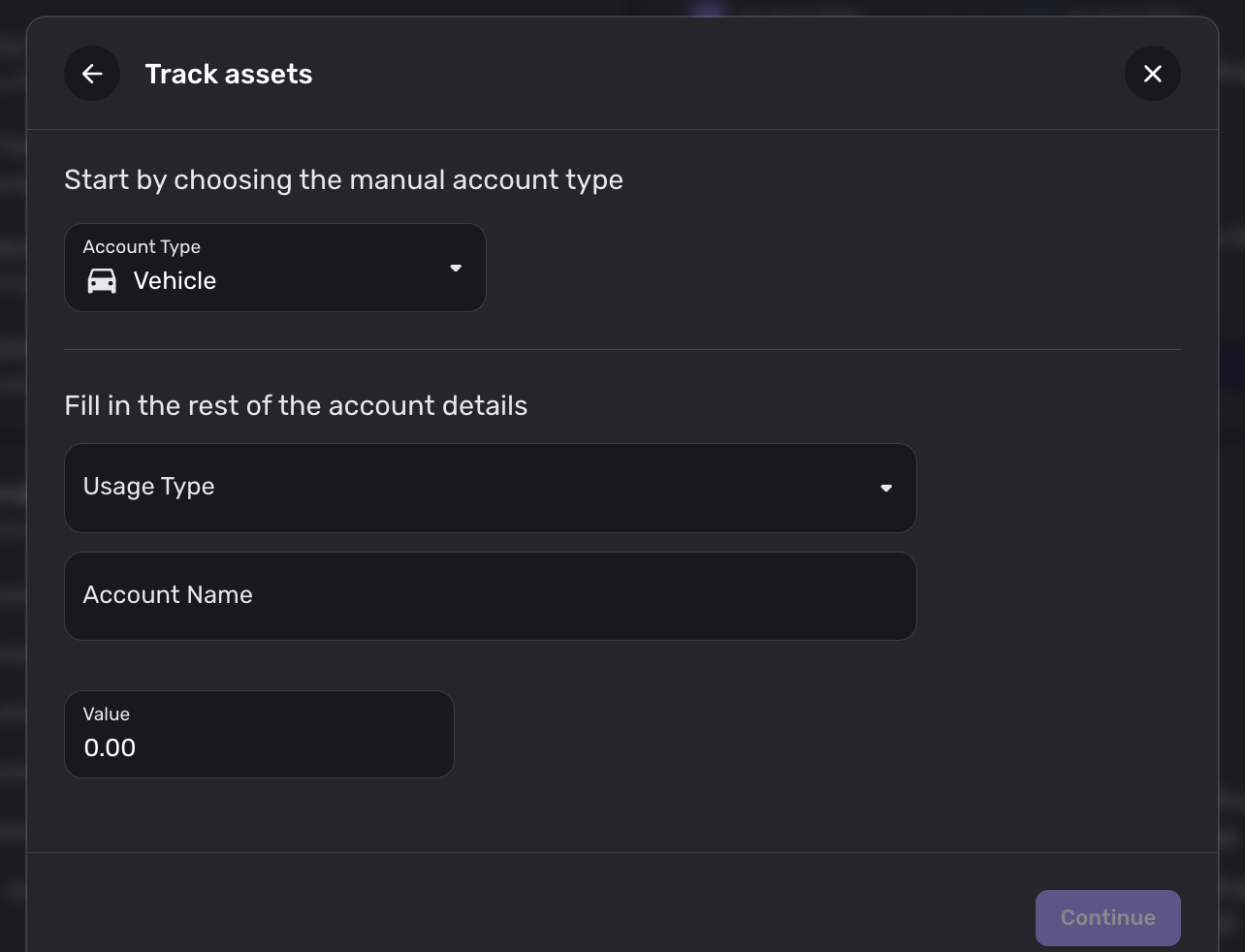

I just tried adding a vehicle asset, and don't appear to see the options I should see if this feature were there:

Unless I'm missing something (doing something wrong) which is always possible.

—

Rob W.

0 -

Edit : Usage type here is 'business' or 'personal' I believe - so is it possible this feature isn't rolled out to QBP early access yet?

—

Rob W.

0 -

@RobWilk, as mentioned in the announcement, the feature is only live to 20% of Early Access at this time.

Once you have the feature, you will want to post any questions or feedback in the dedicated feedback thread:

We're very excited to see KBB integration rolled out to more users over the coming days!

-Coach Natalie

0 -

@Coach Natalie Sorry :-) - I was running through e-mail real quick this morning, and was surprised something new was here, so I quickly wanted to check it out, should have read all the details - my bad.

Have a happy holidays (Whichever ones you do/don't celebrate)…

Rob

—

Rob W.

2 -

Please add Kelly Blue Book prices for vehicles based off of the VIN.

0 -

I believe this is already here. When I setup kbb on Simplifi (it's a new feature), I seem to remember going to GEICO to copy the VIN off their website.

I could have a faulty memory here, though

—

Rob W.

0