Break down the Personal Taxes Report by Form > Line Item (edited)

IMO, the tax report really isn't very useful as it only arranges data by Form > Payee. The payee generally doesn't matter, at least not when actually filling out the tax forms.

What is relevant for filling out taxes is the Form > Line item. Since we already have assigned tax form lines to the Simplifi categories, that information is available.

What is needed is the option to list the tax report by Form > Line Item > Category. That would make the report actually useful.

Comments

-

Hello @Norm6257,

Thank you for coming to the Community to provide your feedback! Since you are requesting a change to the way the current tax report works, I changed your post to an Idea. Ideas that get enough votes may be implemented in the future!

Thank you!

-Coach Kristina

1 -

My request is similar, but a little more specific. All we need are Payee Totals. We don't need all the transactions.

On my charitable tax reports for example, they ask for the total for each one, e.g., First Baptist Church, Salvation Army, etc.

For Interest Reports, we need each payer, e.g., Chase Bank, Capital One, etc.

We can use the carats to hide the transactions, but we cannot save the report that way, and when you send the report to a PDF, all the transactions come back.

Does this make sense? Should this be a separate feature request?

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I would add to this, for W-2 Salary, we also need it to aggregate and summarize the data for both income and expenses together. For example, the W-2 Income amount is going to be Salary Income - Pre-Tax Deductions. If these categories are assigned to the same Salary Income W-2 line item to signify pre-tax deductions there should be an easy way for the tax form to show the net amount so that you can compare to W-2's received to ensure accuracy.

I would summarize by line item based on the categories assigned.

TiggerTrainer

Quicken Simplifi user since January 2025

Quicken Classic (Premier) user since 2004 - 2025 (21 years)

1 -

@TiggerTrainer If the Tax Report saved our setup and exported it as we have arranged it, then a lot of this would be easier. For taxes, like SS and Medicare, State and Federal Income, the Quicken Classic report does allow me to summarize payees, so our W-2s could be checked fairly easy as I could see the payee totals.

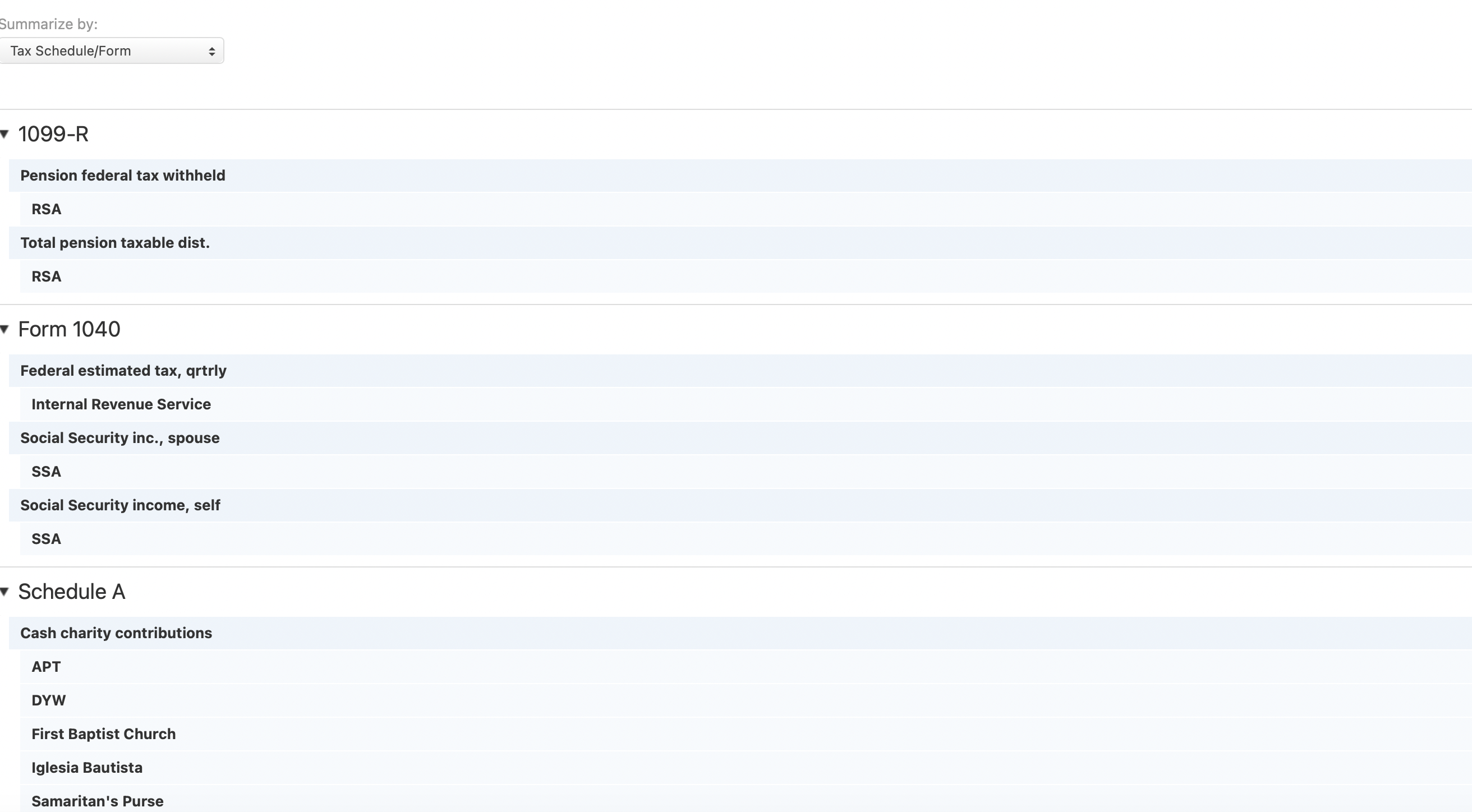

In Quicken classic, you can display by form and show a summary of all categories. Here is how mine looks so far for this year cutting off the amounts (Note we get 1099s now instead of W-2s and they only take out Federal Income Tax):

The great thing about this is it gives me just about everything I need for my tax return and it saves and prints in as I have it. When we worked and paid FICA and State income tax, those were shown with categorized total separated by our employer.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1