Tracking Sales Tax on Personal Transactions - Is it worth it?

I'm curious how many people track sales tax on personal transactions. I have diligently tracked it for years, but have recently been thinking that I don't get much use out of it other than perhaps the honor of spending extra time doing data entry.

If you do track it, what do you actually use that info for? Are you just curios? Do you report it to someone? Do you claim it in at tax time?

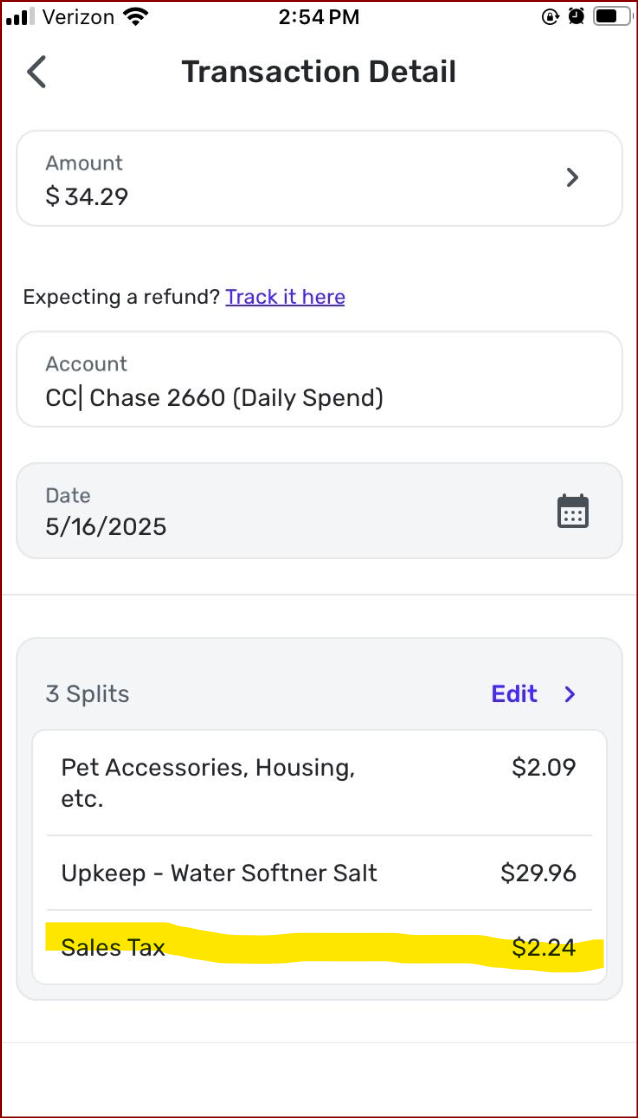

If you don't track it, what do you do when splitting transactions and you have $2.24 left over like in the screenshot above?

Simplifi doesn't have the "Split Remaining Amount Proportionately Between Each Split Line" feature that Quicken Classic had. This was a really nice feature and is the ONLY thing I miss from Quicken Classic.

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.

Comments

-

Hello @Flopbot,

Personally, I don't track sales tax due to the amounts I pay not being large enough to have any impact on my taxes.

I did briefly track sales tax due to my Dad's observation that he was often being charged 10.1% (Seattle sales tax rate) when shopping online instead of his local rate of 9.1%. What I discovered was that online businesses were really slow to start collecting sales tax for the state I live in, but I'd get hit with Seattle sales tax rates when shipping items to my Dad.

I don't often need to document split transactions, but when I do, I find it makes more sense to label the leftover amount as sales tax, rather than risk confusing myself later with an unlabeled mystery amount.

I hope this helps!

-Coach Kristina

0 -

I don't track sales tax. The only benefit (besides "the honor of spending extra time doing data entry") would be as a deduction if one itemized on federal and state returns but even then, only if one made one or more significant purchases in a given year.

I don't do many splits but if I do, I figure sales tax as simply part of the total cost of the item.

If the taxable split out items are in different categories, I'll do a quick calculation to figure out how much sales tax goes to each split and add it to the price of each split out taxable item.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer1 -

Interesting @Coach Kristina and @DannyB . Thanks for the feedback!

Unless someone else jumps in with this good situations to consider, I might just start ignoring Sales Tax on receipts unless I'm splitting the transaction, then I'll continue to track it as more of a place to put the leftover amount.

I see that the link above was a reply to the original so it didn't make much sense. Here's the link to the actual Idea Post for adding a "Split by Percentage" (I meant proportionally). It hasn't gotten much love. Oh well.

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.0 -

Well, I fear that I do track it. I admit it can a pain but most of my transactions have to be split anyhow as I buy groceries, home supplies, sundry items at the same retailers (Amazon, Walmart, Publix) so keeping up with sales tax isn't that much more trouble.

Also, now that I will no longer pay State Income Tax (Retirement income is non-taxable in Sweet Home Alabama), I can deduct the Sales Tax on the federal return. This is still unlikely to matter given the high standard deduction on federal returns. Even our tithe and medical expenses don't go high enough to make a difference.

It is interesting to know how much we pay. We have a special new vehicle sales tax and most sales taxes here are 10%. Food tax will only be 8% come September. But that doesn't count prepared food. I have sales tax categorized as Concomitant:Surtax. I only put payroll taxes in Tribute. I have Property tax as Home:Real Estate Tax and Vehicle Tax is Automobile:Vehicle Tax.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

@SRC54 "I have sales tax categorized as Concomitant:Surtax."

Interesting… Why do you call it that?

Are these goods already taxed in some way in Alabama such that the sales tax is a "surtax" on top of that?

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat Just one of my idiosyncracies. I try to keep my categories to one word as much as possible. 😀

We have state sales tax of 4% (2% for groceries); sales tax of 6% for city and county combined for 10%. But in county alone, it is 9% although it is 9.5% in some stores for some reason!!!!

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Since the federal income tax system was so massively changed during Trump's first administration, I stopped worrying about tracking sales tax; it's just pointless busywork. The standard deduction is now so high my wife and I (both retired) can't possibly do better itemizing. If we itemized, it might be different, but we'd need a whole lot more income and "SALT" (state and local taxes) to make itemizing such taxes financially beneficial. If one has significant six-figure income, and I'm not sure how high that would have to be, tracking sales tax might make sense. For me, it's a waste of time. I just consider it part of the cost of whatever I buy. The most time-efficient system for most of us is probably to toss any receipts with sales tax into a "shoebox" for the year and when it's tax time, if you find that sales tax is an irrelevant figure, then just toss/shred the receipts. If for some reason the sales tax mattered and you could itemize, then taking the time to add up all the sales tax would earn a handsome hourly wage, since it would save you taxes.

Just my 2 cents.

0 -

@DannyB Yep, it was 10%, now 9% and in September will be 8%. Our Legislature is slowly lowering it but SO afraid they won't have enough money to waste on . . .

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

@KB2014 Yes, they wanted to move toward simpler taxes; in some ways it's been good, but the drawback is that many people now cannot deduct charitable deductions. Most do them anyhow, but some people need that incentive.

Earlier Congresses had already taken away the medical deductions; you have to have a lot. It is pretty much impossible to take employee deductions now unless you are your own business. Most people come out ahead with the big standard deduction. But there are always winners and losers…

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

Wow... I've never paid sales tax on groceries. Right now we pay 8.5% sales tax on non food purchases: 7.25% State and 1.25% local (city and county) for a total of 8.5%. Local taxes.vary by county and city and can go up to 10%. The new national sales tax will drive this up substantially.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0 -

This has been fascinating. Thank you everyone for sharing. My main takeaway, I didn't realize sales taxes were so complex!

That sent me down a fun rabbit hole of looking for quotes about taxes. Here were a couple good ones…

Jean-Baptist Colbert: “The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.”

Thomas Paine: “What at first was plunder assumed the softer name of revenue.”

Winston Churchill: “We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.”

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.3 -

Taxation, in my memory, was always cast in a negative light, you may recall the old saying that there are two things you can't avoid, or two things that are inevitable, death and taxes.

But, taxes are the means by which we provide for the common good. Of course, as with everything else we humans lay our hands on, without certain strong societal safeguards, what is meant for the common good can become quite the opposite and then it's time for… well, this can quickly go beyond the scope of this forum and your original question.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer1 -

Danny B - "The new national sales tax will drive this up substantially."

I'm curious what country you're in? The only countries I was aware had national sales taxes called them VAT - value added tax. But I've been to less than a dozen countries outside the U.S., so I don't have a very big sample!

0 -

I don't track sales tax. Hard to find the value of seeing tax separately as it's number I don't control, outside of just spending less at large.

1 -

@DannyB "Tariffs are basically sales tax on imported goods."

Tariffs are indeed an import tax, but they is not the kind of tax that can be deducted on personal income tax returns. So they are not part of the sales tax that I might have wanted to track for income tax purposes.

Anyway, tracking sales taxes for income tax purposes became pointless for me when the standard deduction was raised significantly a few years back. It's now at $30k for a married couple, and may go up to $32k.

Some folks who have other major deductions may still want to do it, but using the alternative calculator provided by the IRS is probably sufficient even for them — unless they made some really big purchases.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

Not making any claims that they are... just being snarky with no intent of any tax advice or speculation.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer2