Bill Connect for Credit Cards: Share your feedback here!

Comments

-

@stullos what you describe certainly would be frustration. This has not been my experience though I'm not quite understanding you are describing. Are you talking about the Bill Connect (Biller) feature or the Account connection to your financial institutions.

Another question, is this happening with the mobile app, the web app or both?

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0 -

this happened to me when they rolled out the credit card bill connected feature and decided to turn it on for existing transactions.

you can hand edit each series to put it back, I am doing it as I notice it

—

Rob W.

1 -

Hello @stullos,

Thank you for letting us know you're encountering this issue. I merged your post with the official feedback thread for the new Bill Connect for Credit Cards feature.

The issue you're encountering may be related to the known issue with the Bill Connect toggle turning itself on. There is a fix expected for that particular issue in 5.31.1 Mobile Release.

Please let us know if you continue to see the issue after that time!

-Coach Kristina

1 -

Thanks for giving me a +1 on that feature enhancement. I've added that to our list of improvements for this feature.

1 -

I feel your pain, stullos. I regrettably converted from classic Quicken to Simplifi, and it's required far more of my effort than it should have. And every time I think I have it working the way I need, something like this happens. It's very frustrating. (I hope we can convey our frustration without getting our comments censored!) It's as if the software is being "improved" by people who don't have enough contact with real users and assume everyone uses Simplifi the way the people in the meeting do and we'll all be thrilled by their changes. Too often, I'm the opposite. 😡

0 -

Not to quote myself but I think most of the complaints here (except for adding support for more credit cards, which I know is not totally under quickens' control) would be solved by the simple change below

1 -

@flintster_99 I almost, but not quite, agree with your suggestion (quoted below):

.1. Add an option under 'amount' below - 'Statement balance, when it exceeds the Reminder amount'

.2. When this option selected, update the logic from 'reminder amount = statement amount' to 'if statement amount > reminder amount then reminder amount=statement amount'

This doesn't work well for me when the statement balance is less than the Reminder amount. For example, assume the CC statement has issued showing a balance of $900 to be paid on June 8 — and assume that the Reminder amount was set at $1200. I see no reason to keep amount of the upcoming payment at $1200, when I know for certain that I am only going to pay $900.

If you slightly change your suggestion to apply only to future payments for which a statement has not yet issued then it seems like a good idea. In other words, instead of having the payment amount equal to "charges so far," have it equal to "charges so far when they exceed the Reminder amount, else the Reminder amount." That would fix the problem of future payments showing $15 (or worse, zero) when you know you are going to charge at least $1000.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

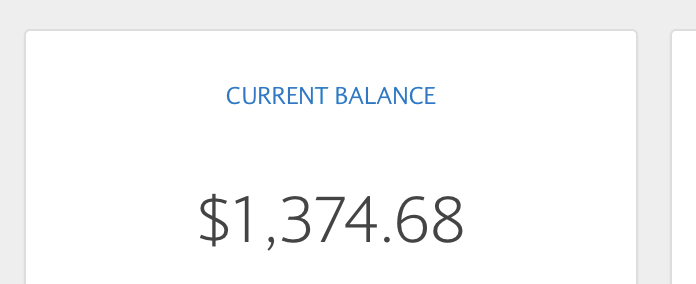

For the first time in years I'm carrying a balance on a credit card and if I was paying it off monthly I would have no problem with the balance showing in the projected cash flow BUT since I am not paying it off immediately I need that projected cash flow to show what I put in as my planned payment. Is there any other workaround besides disconnecting bill connect?

0 -

I haven't used it, but there is an option for "Don't update (use series amount)" on the Bill Connect tab of the "Edit series" pop-up window. I think its purpose is to allow you to set the payment amount in the series and have that show up as the payment amount for next and future payments.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

I'm struggling with this. I have 2 credit cards. One of them Amazon Chase) is showing a reminder for last month's balance every month forever. The other (Wells Fargo Visa) will not let me enter a transfer for the category.

I would also like to have the credit card payment amount held as planned spending. If I can't do this, then what's the point of this app?

0 -

@Birdie2300, thanks for the feedback!

Could you please provide screenshots showing the issues you're reporting so we can get a clearer picture? For the ability to set up Planned Spending expenses for Transfers and Credit Card Payments, please vote for our existing Idea post here:

We look forward to your reply!

-Coach Natalie

0 -

"Amazon Chase [credit card] is showing a reminder for last month's balance every month forever. "

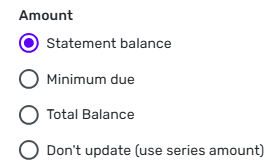

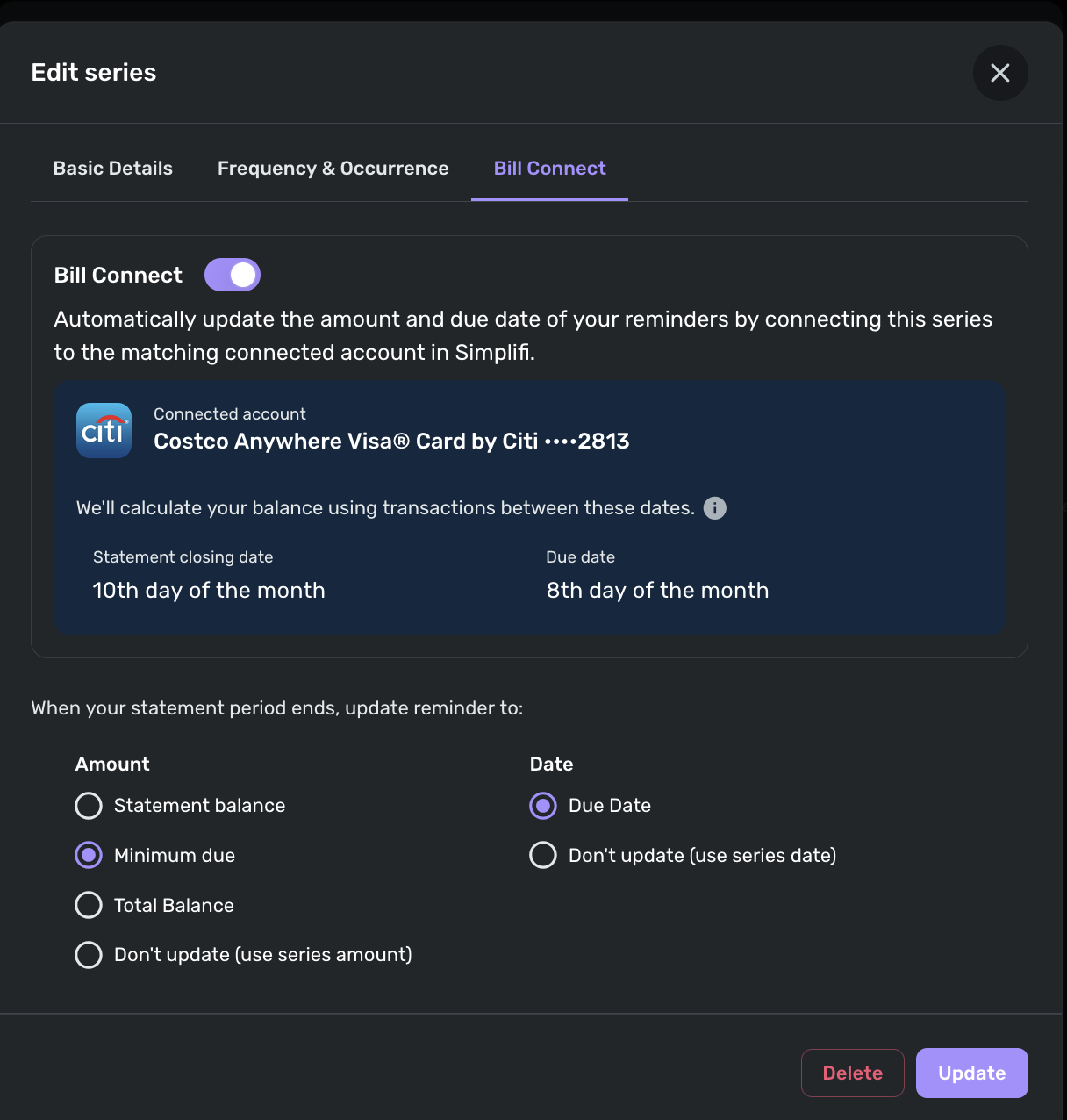

I also have an Amazon Chase credit card, but I am seeing something different. I have it set up to use Bill Connect, with these settings:

Right now, the reminders are showing my statement balance as due on July 8, my new charges since that statement as due on August 8, and zero for each month after that.

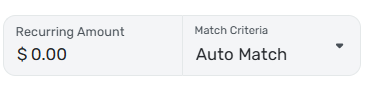

It's possible that the zero balance for future transactions is based on the Recurring Amount I set in the series — which I set to zero because I let Bill Connect control the amounts for near-term payments. That setting looks like this:

How do you have your Recurring Amount set?

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

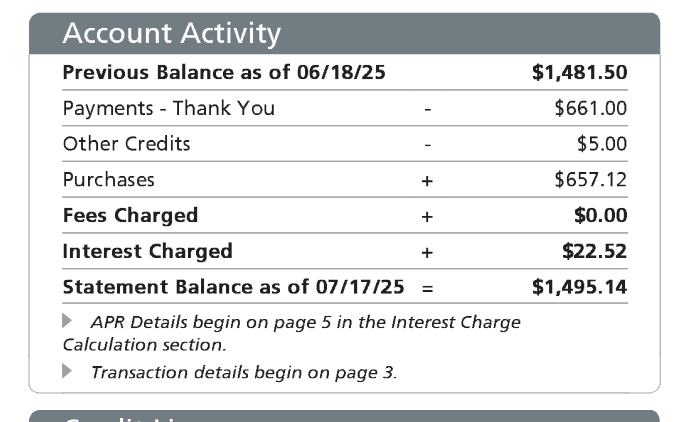

New user here……using an existing transaction for the payment of my Wells Fargo credit card to set up a recurring reminder. I'm past the statement closing date (June 23rd) and I'm linked to WF account but the reminder still shows the transaction amount as the last payment I made on June 18th. Is there a delay from the time I set up the recurring reminder to when it will show the correct statement balance? Thanks in advance.

0 -

I believe you have to wait for the next statement date before it knows the next statement amounts, and even then there may be a delay before it updates.

—

Rob W.

0 -

When I set my credit cards to use Bill Connect, nothing happened until a few days after the next upcoming statement was issued.

In the meantime, I set the Recurring Amount in the Series to $0.00 (so that future reminders that had not been set by Bill Connect would show $0.00) and set the Amount of the upcoming Reminder to the amount of the last statement (so it would correctly predict the payment needed). After that one cycle, everything worked automatically as advertised.

See this article for more:

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

Thank you!!

0 -

I think it would be useful if I could see somewhere the date that a bill/series amount was last updated, and also have a button to manually refresh it.

I understand that Simplifi pulls in the information when the statement closes, which makes sense. But sometimes the amount changes after the fact (some people make partial payments, I don't but I do sometimes get refunds for returns that get subtracted from the statement amount even after the statement closed). From my occasional manual reviews, it seems that Simplifi sometimes pulls in those updated numbers but not always and I don't know how often it checks for updated statement amounts. I am curious to know that as well.

These pieces of information would help me see if I do need to manually review my projected payments or if they might just need a couple of days to get updated.

0 -

Still on the fence here. I've connected a couple of my credit cards to see how this works. I've tried using $0.00 for the payment amount in the recurring series reminders and I've tried an average amount typically paid. Either way I'm having some confusing results in both my transaction registers and the Spending Plan under the Transfers & Credit Card Payments section.

I'm going to try one more set up for the amount paid - I added up my recurring expenses that are paid via my connected CCs and am using that as my monthly payment for all future incidents. This at least brings my account to zero month-by-month instead of either and ever-increasing balance month-to-month (this happens with zero as the monthly payment amount) or a growing positive balance over time (the result with the monthly average for the monthly payment amount).

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0 -

I'm seeing some confusing results on one of my credit cards too.

My upcoming reminder disappeared for some reason so I had to manually recreate it. It seems hooked to the series, but did not update when the statement came out.

And now my next payment has ceased updating (meaning the amount shown stopped increasing even though I continue to have new transactions).

I'm just going to wait through another cycle and see what happens.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

My Chase card reminder disappeared. I still have the AmEx reminder, but it isn't connected. I thought it was, but maybe I didn't connect it. Chase was connected.

I may recreate the Chase later, but since I pay my credit cards off as I use them, I am not sure it is worthwhile for me.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Some of the new comments in this thread have renewed my interest in this feature. I've ignored it because it doesn't work for the 2 cards I use.

Apple Card and BofA Visa

EDIT***** Now that I posted in here about it now working it appears to be working for these 2 cards. Fingers crossed it stays that way.

0 -

I, also, having just reset my data set (my brain was hacked, not entirely my fault), last night set up this feature on every supported account. I still don’t have unity by hard rock Mastercard (comenity/ bread financial) support, but all other cards seemed to offer it. For the unity card, today was the statement date it turned out, and $30 was minimum payment, so I set up a manual recurring reminder.

—

Rob W.

0 -

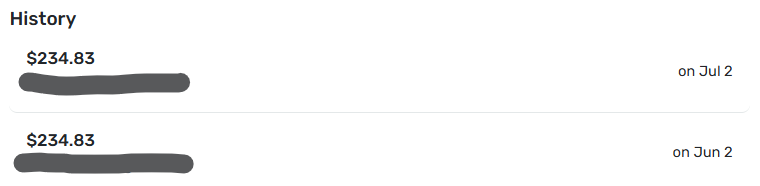

When I look at a normal recurring bill that is not connected to Bill Connect I see this:

But when I look at any credit card that is connected to Bill Connect I see this:

This is true even though the credit card has been connected to Bill Connect for months.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

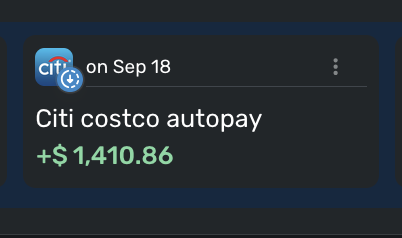

CITI Costco Card is set to 'minimum due' but appears to be showing something like statement balance or maybe total balance (?).

—

Rob W.

0 -

@RobWilk, thanks for reaching out!

I have merged your post with the official feedback thread for Bill Connect for Credit Cards. For the issue at hand, has your statement officially closed, or is the reminder still reflecting the account balance as it updates throughout the month?

Our support article here has more info on how this feature is designed to work:

-Coach Natalie

0 -

July 11 statement period closed 10 days ago. I waited for 5 days, but eventually I had to manually adjust the payment reminder for that statement as it was incorrect.

The next reminder (for the next statement period, which closes in 20 days) is showing $195. But it has shown $195 for quite a while (at least a week), even though my account balance has continued to increase during that time. Apparently it has ceased to update.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

I just enabled the feature, the amount is larger than current balance and is likely the statement balance. Will monitor.

—

Rob W.

1 -

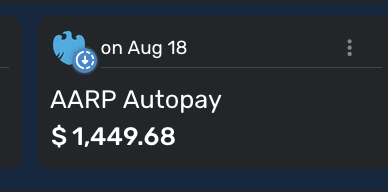

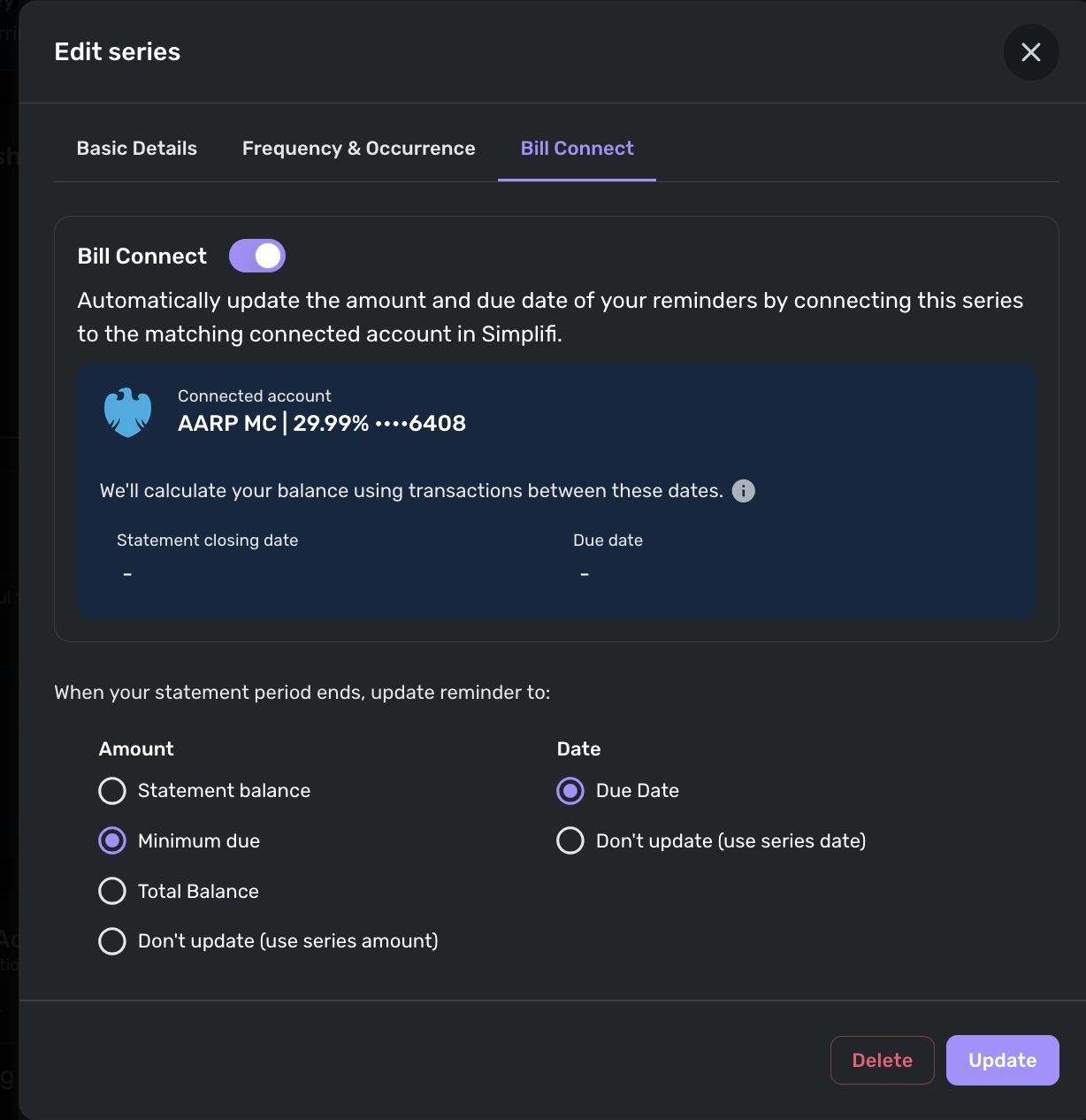

Once again, the same kind of issue seems to exist for BarclayCard AARP card.. Does this take one billing cycle to correct? It seems to be showing me (most likely) statement balances

—

Rob W.

0 -

Well, it seems to be neither statement balance nor current balance

I don't typically carry balances, but an emergency happened.

I'm carrying about 3 months of income in debt right now. It's not that bad, but i cannot pay it off all at once.

—

Rob W.

0 -

I tried to reconnect Chase, and it has disappeared from the list of billers. It was there before but it's gone. I tried Chase Credit Card, Chase Bank, etc. I even tried Amazon Prime but it was just going to tell me when I owed the membership.

Did Chase get dropped or did it drop us?

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0