Amazon refunds are being treated as credit card payments (edited)

I had this issue the day before yesterday, and have now had it a second time yesterday as well. It's very frustrating, and causing a real mess in my accounts.

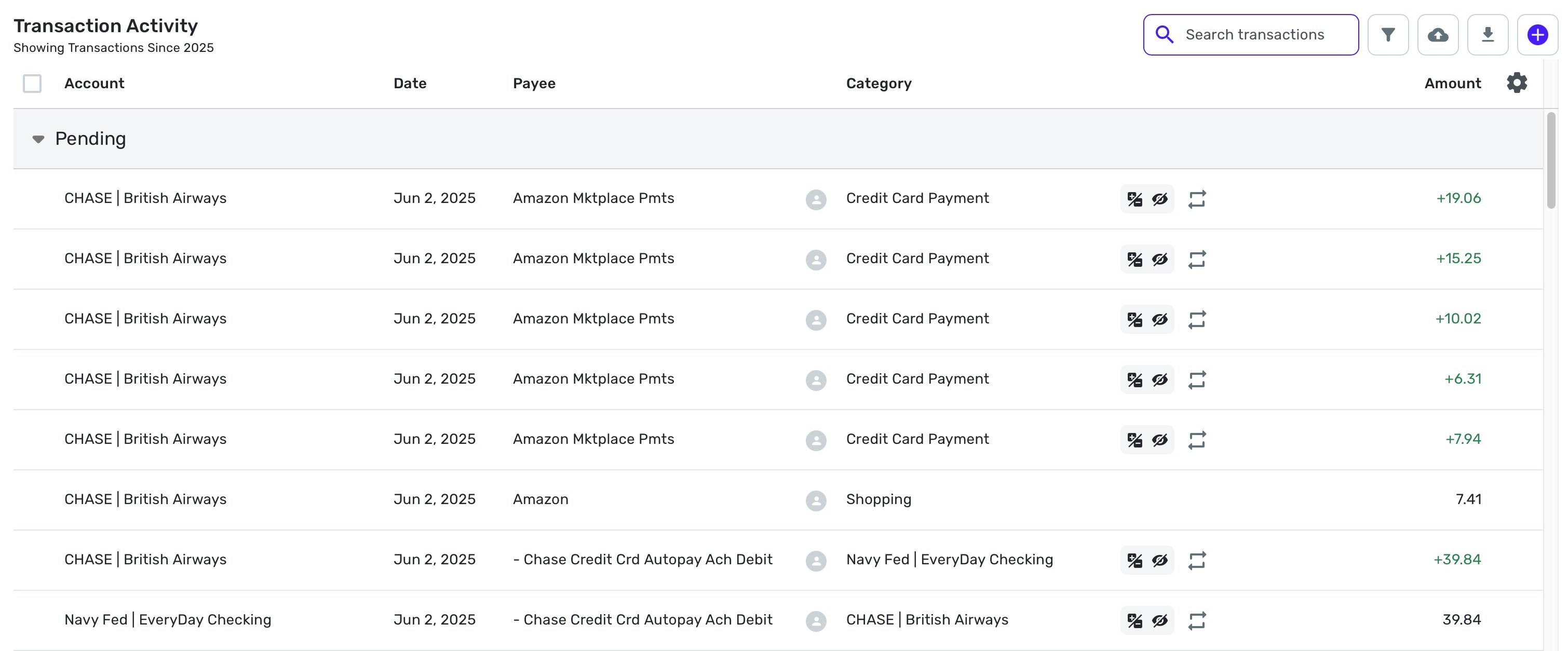

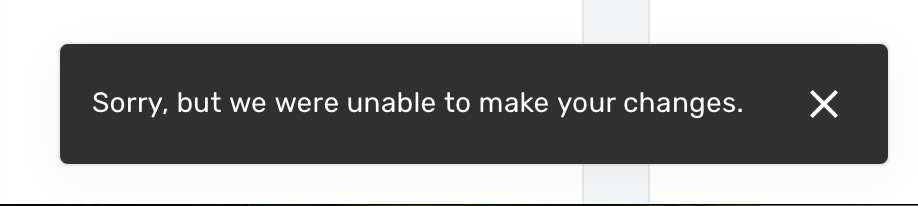

The main issue seems to stem from the system classifying an Amazon refund as a credit card payment. Here's the transactions in question:

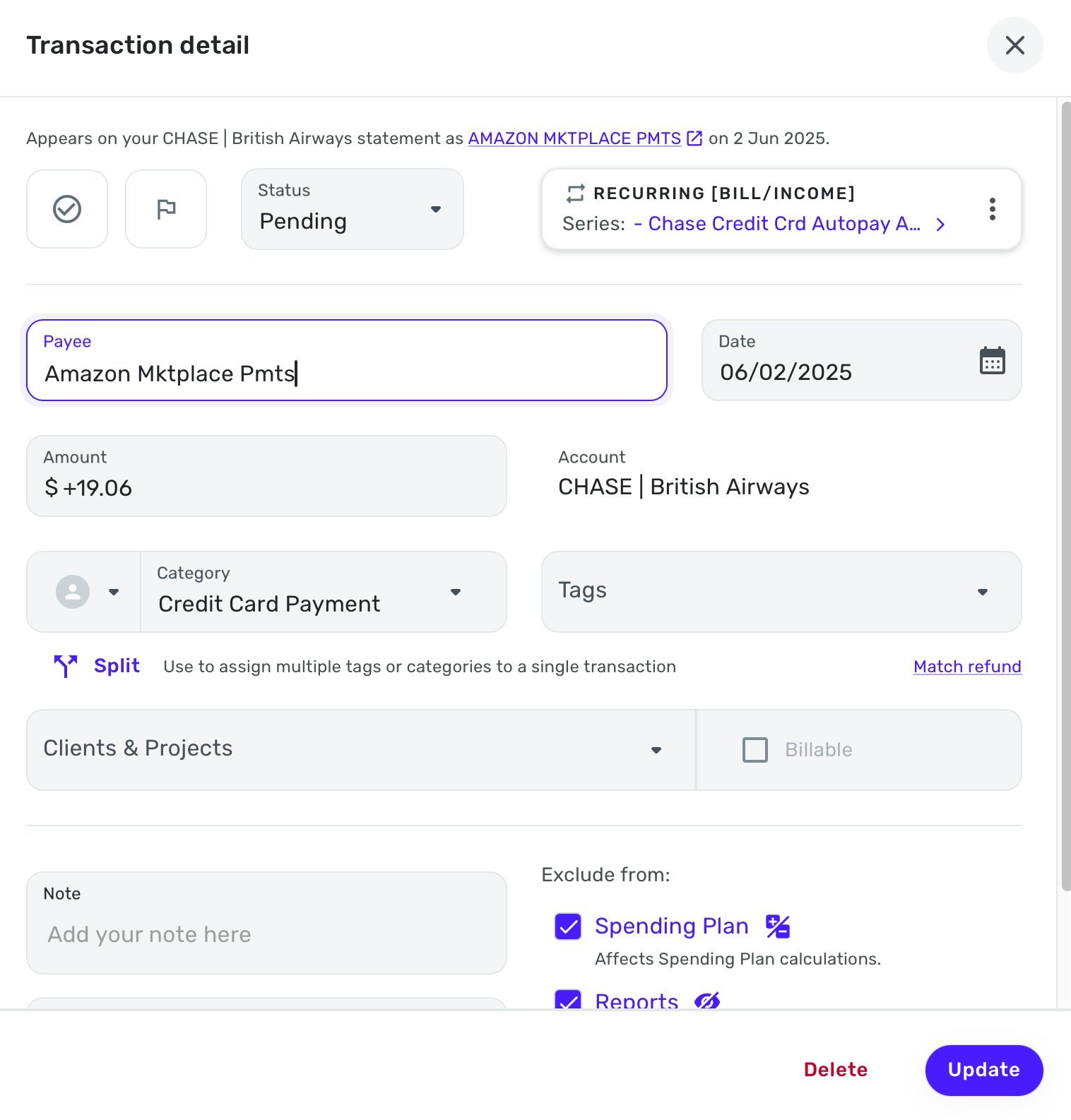

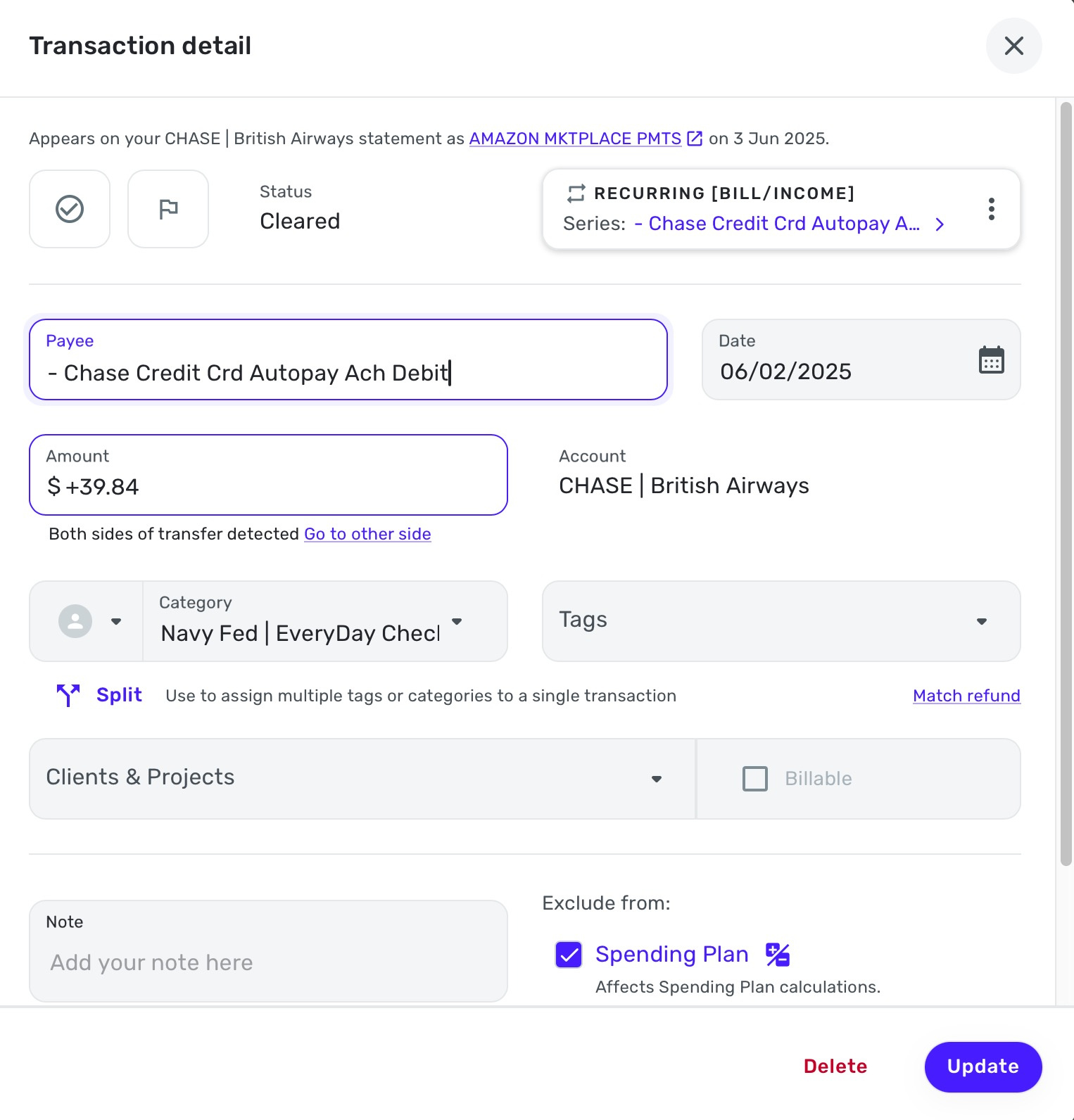

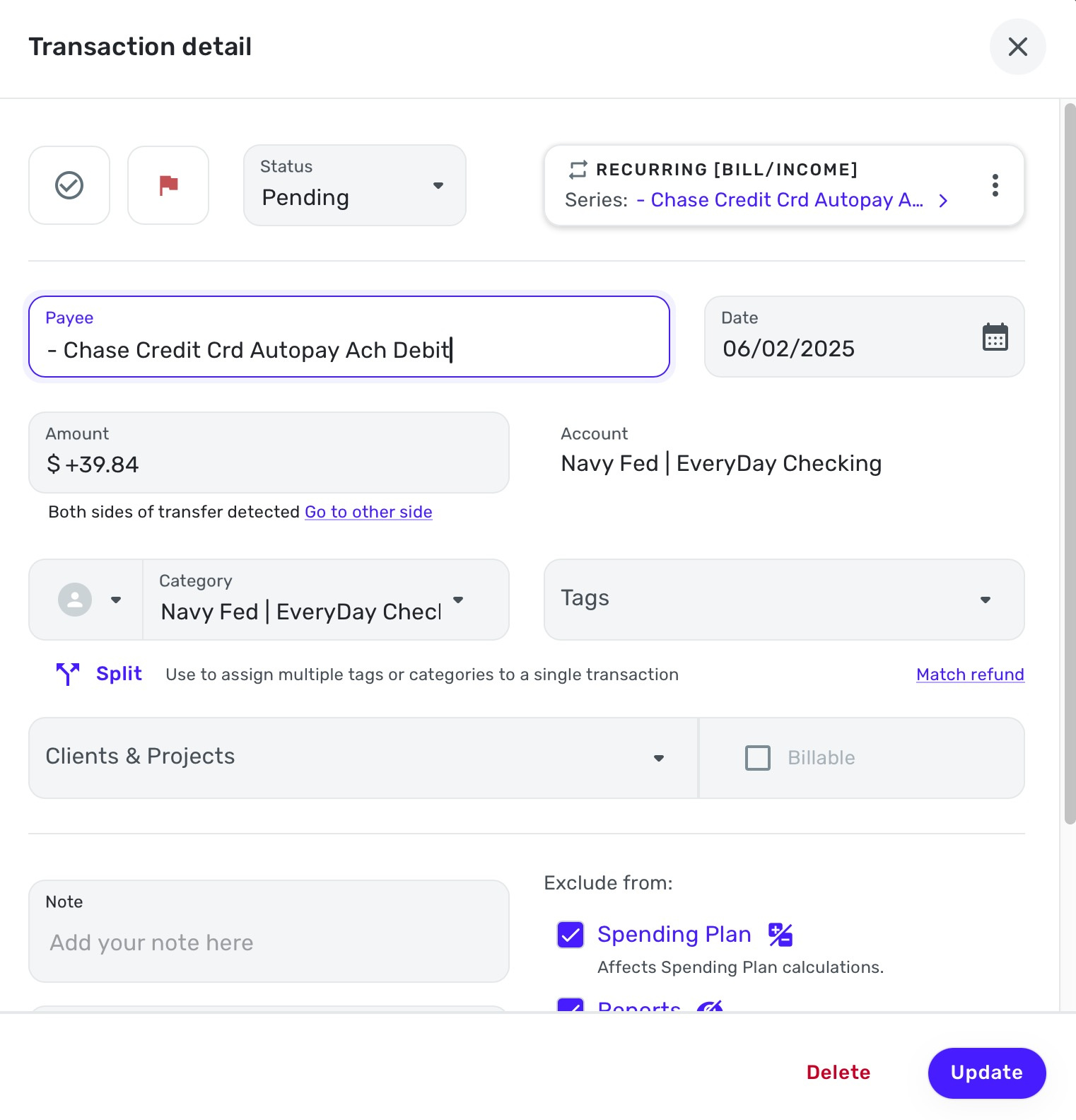

If you go into any one of the refund transactions, this is what you see:

As you can see, it clearly states the transaction comes from Amazon, but the system has categorized it as a CC payment. And more frustratingly, has assigned it to the recurring CC bill payment that I had setup. This is despite the fact that the refund amount is vastly different to the expected payment amount on the recurring CC bill as setup.

I have checked and I have no rules setup that say Amazon refund payments like this should be classed as CC bill payments.

I assume there might be a rule I could create to stop this from happening, but not sure exactly what that should be, since not all the Amazon refunds are going to be the same category?

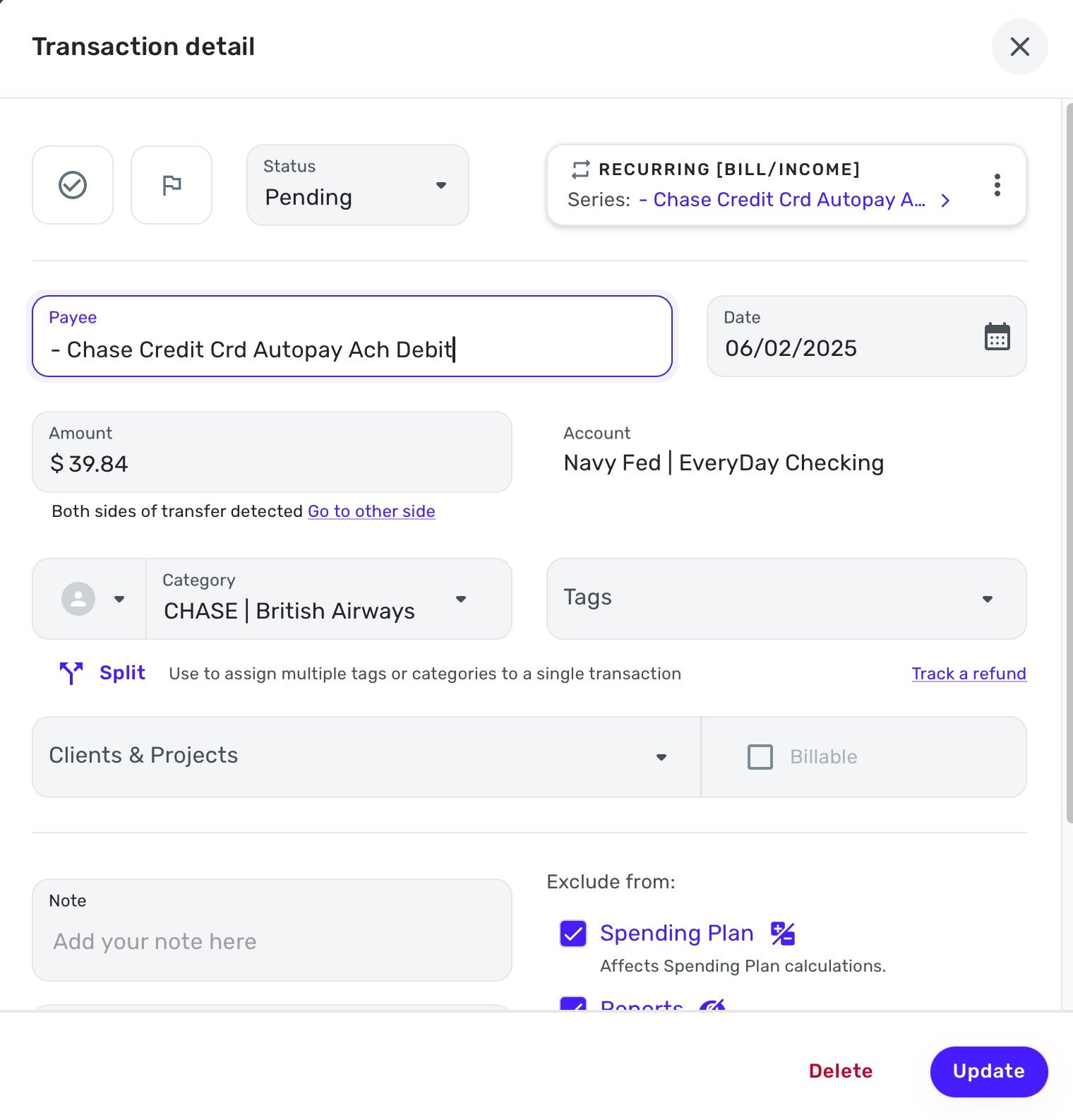

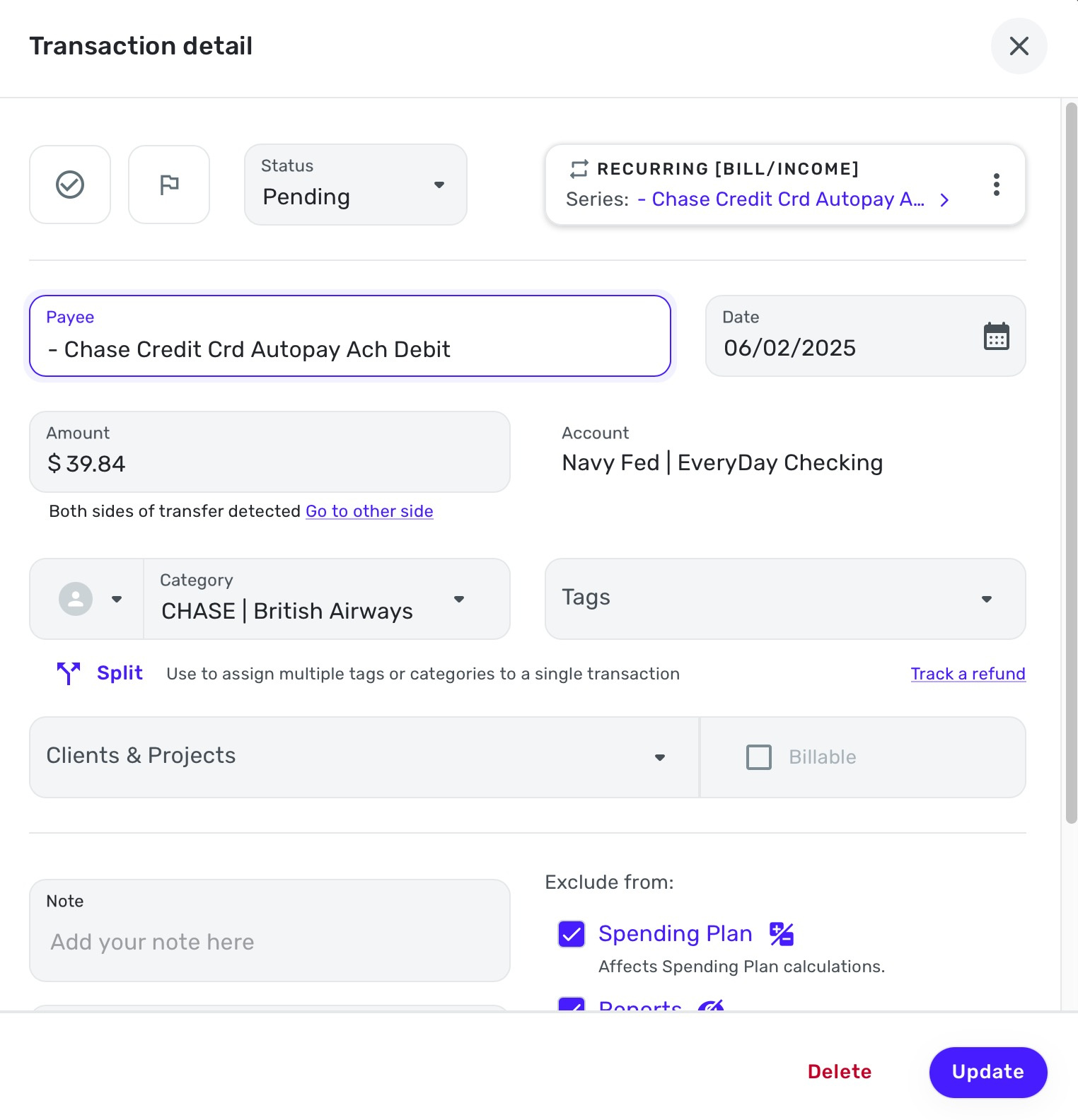

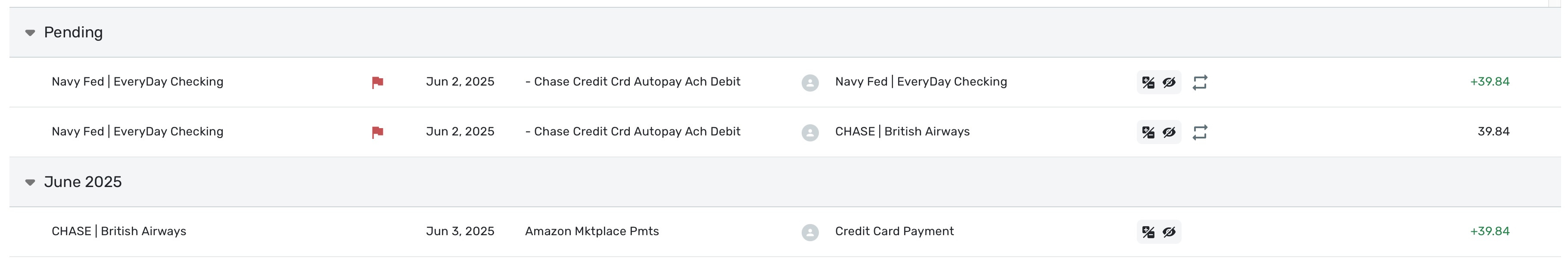

More strange/worrying/frustratingly, is the transaction above purporting to be from my Navy Fed account (for $39.84) which the system has hallucinated. No transaction exists on my Navy Fed account, and nor would I expect it to, as this is a refund coming in from Amazon, not a transfer from my Navy Fed to CC as a bill payment.

This is the exact same thing that happened to me the day before yesterday, with another hallucinated transaction attributed to my Navy Fed account for another Amazon refund, that was also mistaken as a CC bill payment.

I can manually resolve this issue for the transactions that exists(as I had to the day before yesterday), but how do I stop this from happening in the future?

It's particularly frustrating that the Amazon refunds are being classed as my CC bill payments, as this then removes that upcoming recurring payment for this month, and I have to go back and add it in again.

It's also hugely frustrating/confusing that the Navy Fed transactions are being hallucinated in this way, and makes trusting the software very difficult. This should not be an option for the system to invent transactions that do not exists. I literally just want it to pull in and record real transactions from my accounts, nothing more. This hallucination/invention is adding additional confusion and complexity that is making the software less reliable and more difficult to deal with.

Please advise how I might stop this from occurring in the future, and how I can setup my recurring CC Bill so that it is correct, and don't keep getting improperly assigned.

Thanks!

Comments

-

Hello @cloudquick,

Thanks for reaching out! How do these transactions look on the bank's website? Are they showing the same or a different category? In your case, I would see if creating and working with transaction rules would work to resolve the issue you are seeing here. Creating transaction rules will allow you to make sure your transactions always come in the way you want them to.

Transaction rules can be used to have Quicken Simplifi automatically recognize your incoming transactions based on specific or broad keywords, and then rename those transactions appropriately. Transaction rules can be created for both payees and categories as well.

Here is a great support article that explains transaction rules and how to specifically set up category rules for the transactions you mentioned.

I hope this helps!

-Coach Jon

-Coach Jon

0 -

Hi @Coach Jon - the transactions show as returns on the banks website.

Appreciate I can try and setup a rule for these kinds of refunds, but ideally these would just not be assigned as payments to the credit card, as setting up a rule means I have to put any and all Amazon refunds in the same category which is not accurate, and then also assign them to either business or personal, when they could be either. How can I address that?

More at issue is what I call the hullicnated transaction that it has created for my checking account. This is not information it is pulling from the account itself, but has itself created/invented. How to prevent this?

Lastly, how to prevent these small refund payments from taking over the recurring bill payment for my credit card when the amounts are nowhere near similar, and the place they are coming from (namely amazon) is not my credit card?

0 -

Hello @cloudquick,

Thanks for the reply. With rules, you can customize what specifically is being applied for the rule, depending on the payee and category, so if the actual payment transactions have a different payee, you should be able to just create a rule for the refund transactions. This will then prevent these refund transactions from applying to the recurring payment.

As for the issue with the transaction that was categorized as coming from your NavyFed account, if you open the transaction details window for that transaction and click "go to other side", does it show the other side of the transfer and what that side looks like? Was this a one-time thing with this transaction? Let us know!

-Coach Jon

-Coach Jon

0 -

@cloudquick I don't get many refunds from Amazon, and I usually just have Amazon give me a credit on my next order instead of having it refunded to the credit card.

But I wonder when you get a refund, if you couldn't use the Refund Tracker and put in the exact amount. I know the credit card payment varies.

I probably would skip the refund tracker and just enter a transaction with an expected refund date and go ahead and categorize it. There's a better chance that Simplifi will match that.

Anyhow, that may not work for you. I tend to enter things in advance and be much more proactive. I understand the frustration though when the downloads don't match. I hope you find a resolution.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Hello @cloudquick,

Additionally, I would also see if setting your Amount Match Criteria for the Recurring Series would also work to resolve the issue you are seeing here. This feature empowers you to control which transactions are linked to which reminders, ensuring accuracy every time. Here is a great support article explaining how to use Amount Matching:

-Coach Jon

-Coach Jon

0 -

I assume there might be a rule I could create to stop this from happening, but not sure exactly what that should be, since not all the Amazon refunds are going to be the same category?

That's true, and I doubt that you can set up a rule to categorize the refunds correctly if your objective is to match the refund category to the category of the original purchase (which is what I do).

A half-way solution would be to have a rule categorizing all transactions for "Amazon Mktplace Pmts" with a new category called "AMAZON REFUNDS." They would then be easier to locate and recategorize to match the expense category of the purchase — and maybe they wouldn't hook to the recurring payment.

(Of course, this does nothing to help with the "hallucinated transactions" you mentioned.)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)2 -

Hi again @Coach Jon - the issue that I have, as seen in the first screenshot image I shared, is that the payee is all the same (nsamely Amazon), but the category is not, so I don't see how I can setup a rule that deals with this, unless I am missing something?

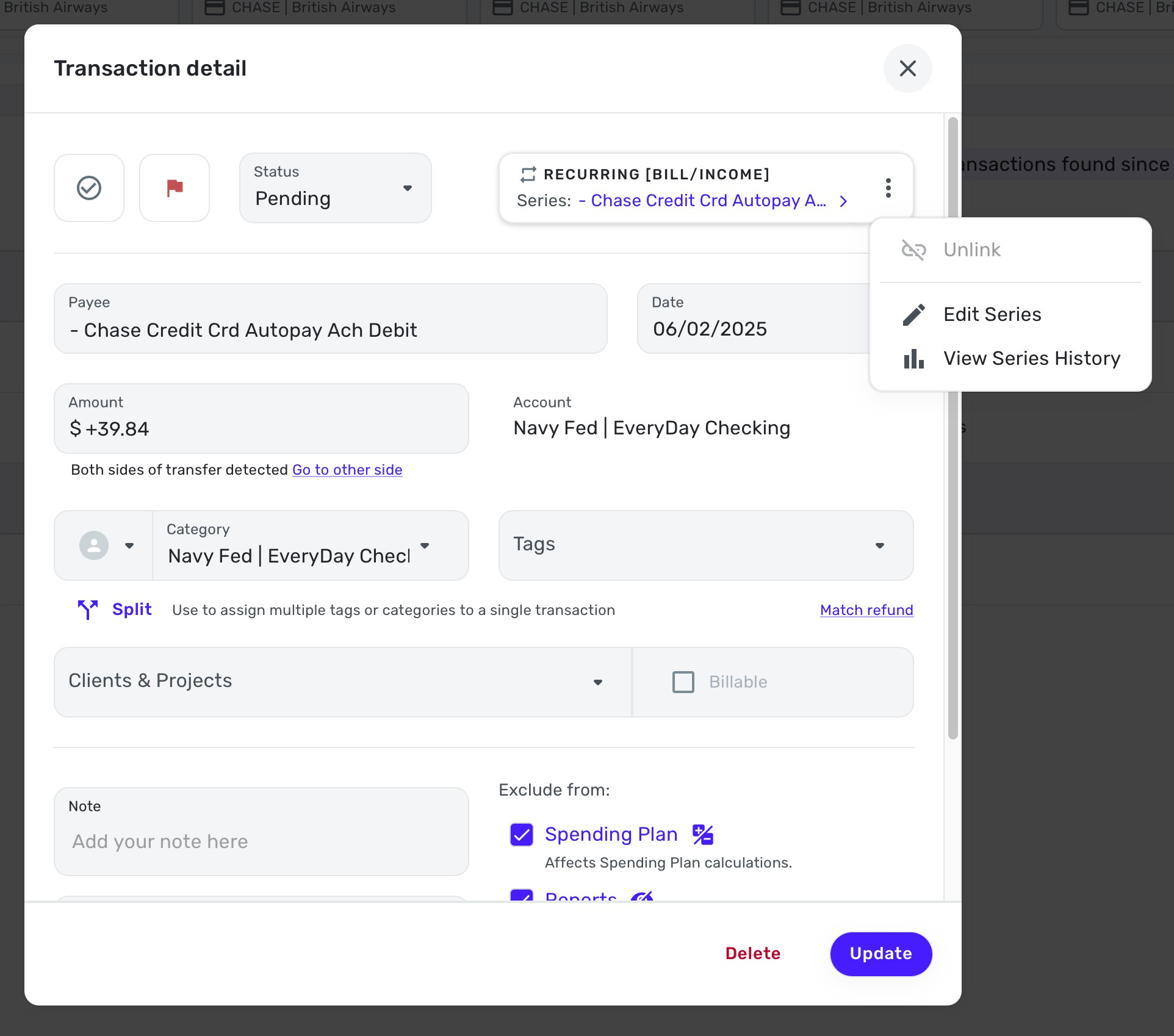

With regard to the Navy Fed issue, here are the two parts of the transaction:

Again the first screenshot here relates to a transaction that the system has invented, not something that appears in my Navy Fed account, and nor would it, as the transaction has nothing to do with the Navy Fed account.

And no, as stated in my original post, this is not the first time it has happened. I had the exact same issue the day before this occurred.

Please let me know if I am not explaining something clearly, as I understood to have already communicated all of this information.

Many thanks!

0 -

Thanks @Coach Jon I was actually familiar with this feature and article from Coash Natalie. I think my personal issue is that the amount that gets paid each month can vary quite significantly, so there is not really a good option that covers that. The issue is more that refunds from 3rd parties are being classified as payments, rather than bill payment transactions from one particular payee (in this case my NavyFed account). Can the system not limit what is classified as an actual bill payment to payments income from one particular payee for example? Ideally I could just set that only payments coming from Navy Fed would be classified as Bill payments for recurring bills.

0 -

the payee is all the same (nsamely Amazon), but the category is not, so I don't see how I can setup a rule that deals with this

Regarding the Amazon refunds issue…

Are you unable to make a rule based on the original statement name ("Amazon Mktplace Pmts") and use it to change the category from Credit Card Payment to something that shows that it is really a refund?

Or is it that such a rule works but would not suit your needs?

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

Are you unable to make a rule based on the original statement name ("Amazon Mktplace Pmts") and use it to change the category from Credit Card Payment to something that shows that it is really a refund?

Yes, this is essentially what I have decided to do, based partly on the suggestion of your previous comment. For my purposes I have made a rule so that these payments would just be "unclassified" and then I can manually sign them when going through the refund process or just in my day-to-day management of transaction. It's not 100% ideal, but it's good enough for now.

Thanks for the follow up and advice!

0 -

Hello @cloudquick,

Thanks for the reply! I do see from your screenshots that the transaction in question was categorized as a transfer to the other account, so that would be why the transaction would have been created. I am unsure why it would be downloaded as a transfer if the transaction was not a transfer on your bank's side, however. Can you verify if you have an existing rule already within Quicken Simplifi that may be causing this miscategorization?

-Coach Jon

-Coach Jon

1 -

Hi @Coach Jon I'm pretty sure none of the (handful of) rules I have set up would be causing this. It's also strange that it just did this for one of the amazon refunds, when there was a total of 6 that all came in at the same time. Only this one triggered the creation of the phantom transaction associated with the Navy Fed account, even though all 6 transactions are essentially similar bar the amounts. Is this a bug?

0 -

Hello @cloudquick,

I do not know if this is a bug at this point, but if this just happened as a single instance, I would suggest editing the transaction to remove the transfer category and set it to the correct category it needs to be. You mentioned that Amount Matching would not work due to variance of the amounts, but have you tried the Limited Range option? For this option, Quicken Simplifi will use a 30% variance of the amount set for the Series (15% above and 15% below) when linking transactions to the Series. This is beneficial for bills that may experience occasional changes in the amounts.

-Coach Jon

-Coach Jon

0 -

Hi @Coach Jon to be clear, this was not a one off occurrence, it happened twice. But I'll take your advice and remove the transaction. This will be deleting the hallucinated transaction allegedly from my NavyFed account, and putting the Amazon refund in the correct category.

Unfortunately the 30% variance is too small. Since there is only ever one transaction between my checking account and my credit card (for monthly bill payment) that would be the criteria I would need to use, but I guess that is not an option.

0 -

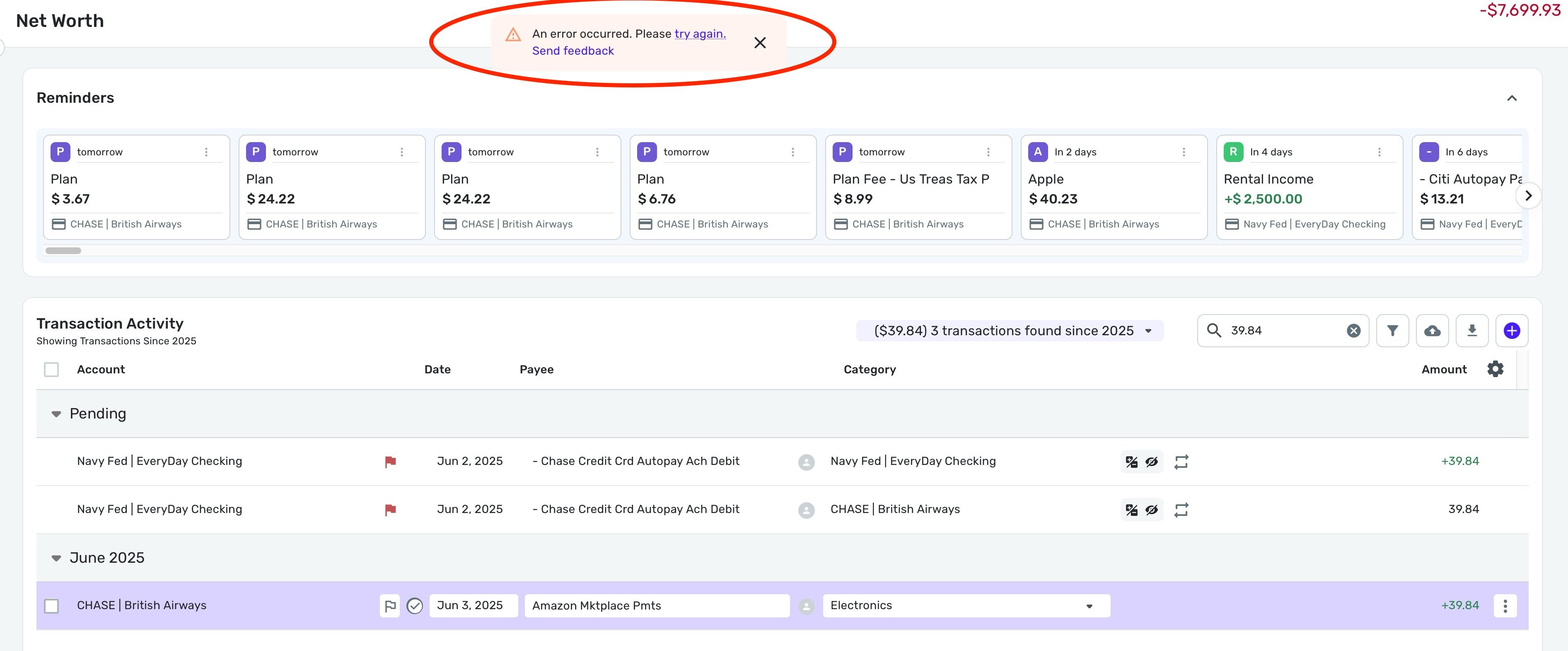

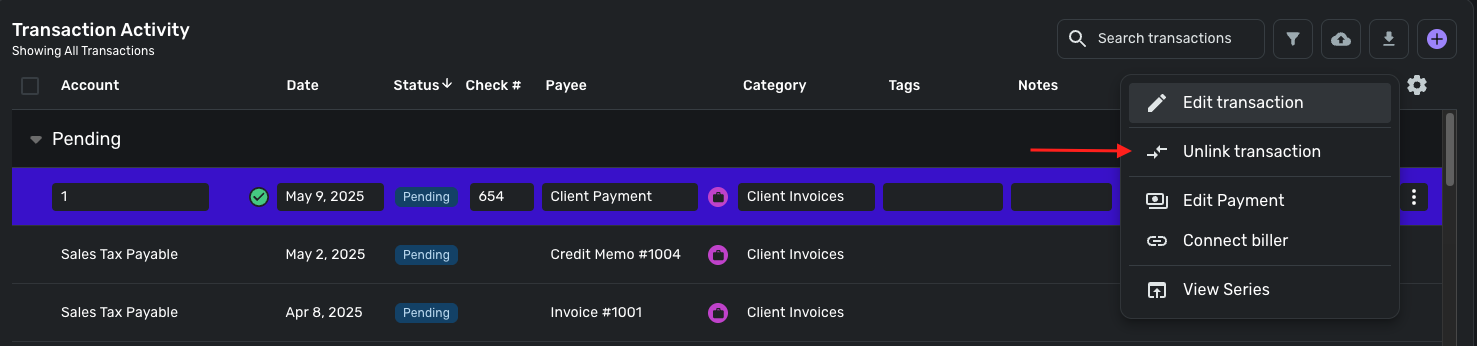

I unlinked the two transactions, and got some sort of error message (which I apologies I did not screen shot), and now I have these three transactions:

0 -

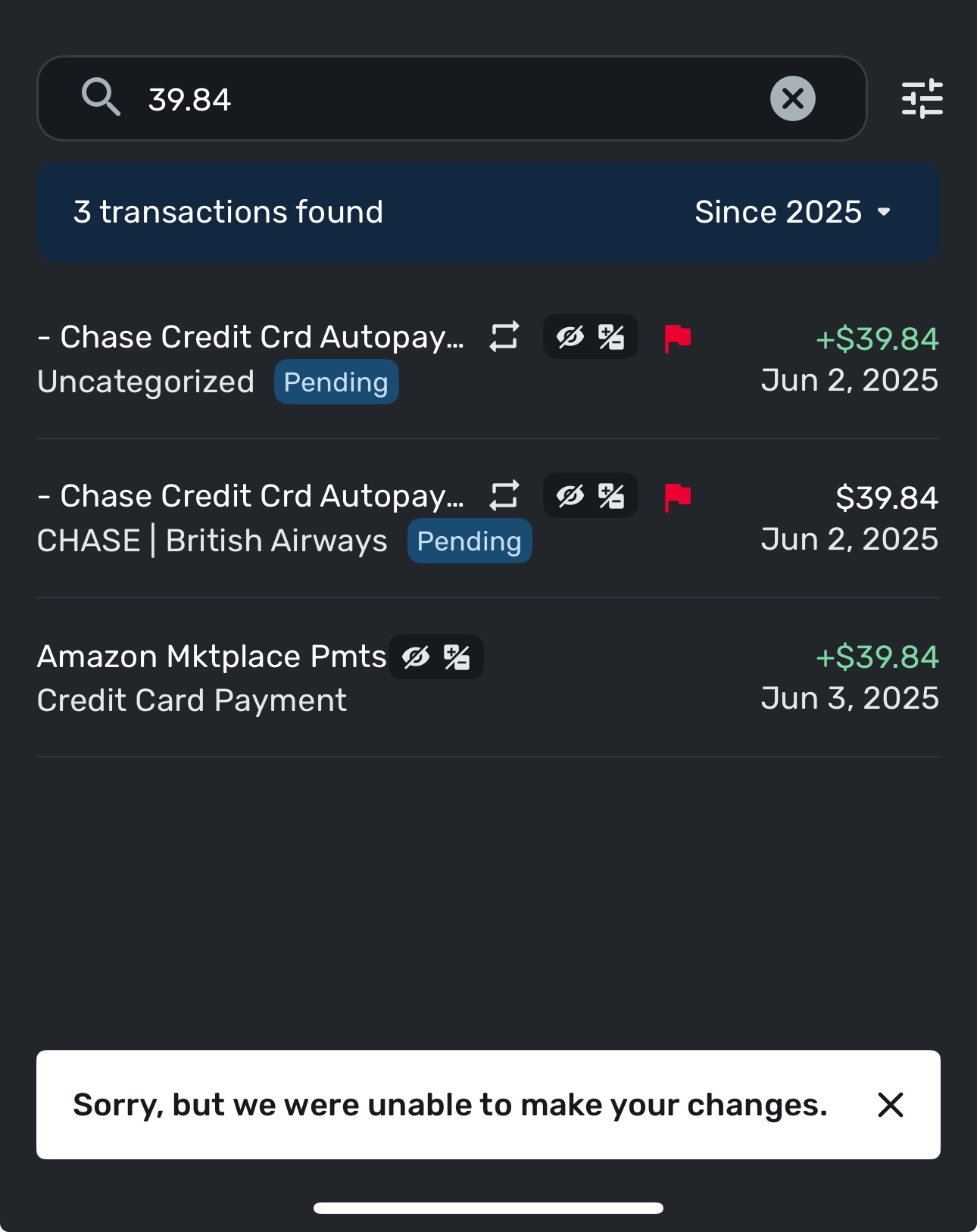

And now when I tried to change the category of the bottom transaction (the one not linked to a recurring payment), I got the following message:

0 -

Hello @cloudquick,

Thanks for the replies. That is certainly strange that it would split into 3 transactions like that. If you go into the transaction details window for each one, do they have the same "Appears on your.." statement information? Are you able to delete these transactions?

-Coach Jon

-Coach Jon

0 -

The first (original) transaction has "appears on" as Amazon:

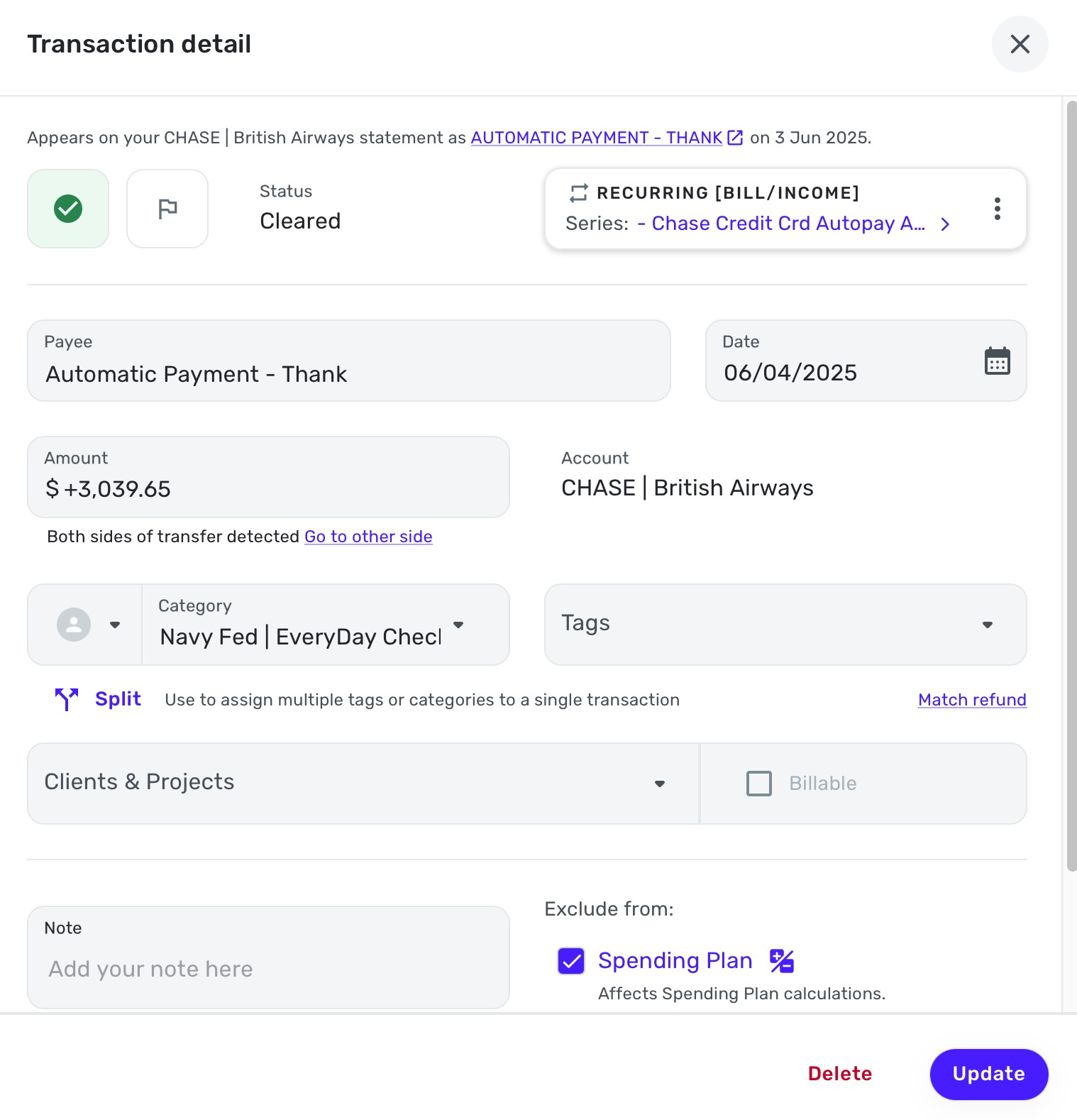

And then the other two are a linked pair, which have attached themselves to a recurring payment, and may have something to do with the issues I've described in this post:

And look like this:

I have not tried deleting either of these two transactions yet, in case they mess with the recurring bill and/or there's a better way to go about this to fix the recurring bill issue I'm having.

0 -

Hello @cloudquick,

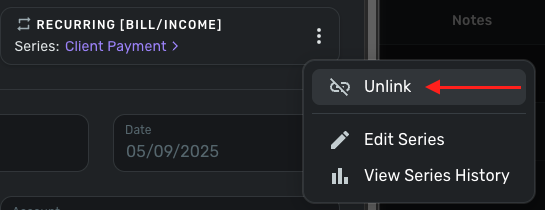

Thanks for the reply. Are the two transactions you mentioned correctly linked to the recurring transaction? If they are not, I would see if you can unlink the transaction from the recurring series using the Unlink option.

For the other transaction, if it has no place in your register or you do not recognize it, I would suggest deleting it. If it does belong in your register, but the category is wrong and you cannot change it, I would still suggest deleting the transaction and recreating it manually.

-Coach Jon

-Coach Jon

0 -

Hi @Coach Jon

I would love to unlink them from the recurring transaction, but I am blocked from doing that:

N.B. This is the same for either side of the transaction.

I now believe this is part of the cause of the issue I'm having with the cashflow screen as well.

0 -

Hello @cloudquick,

Thanks for the screenshot and for following up. That is certainly strange behavior. Are you able to unlink them from the account register itself? If you try from the mobile application or a different web browser, does it allow you to? Let us know!

-Coach Jon

-Coach Jon

1 -

Hey @Coach Jon

I was unable to do this in either safari, chrome, or iOS and got the following messages:

0 -

Hello @cloudquick,

Thank you for confirming. If you go into the transaction details window and then click "Go to other side", can you try unlinking from that side? Let us know how that goes!

-Coach Jon

-Coach Jon

0 -

@Coach Jon yes I have tried this and it is the same outcome.

0 -

Hello @cloudquick,

Thanks for letting us know. Is this the only recurring series that cannot be unlinked for you? If so, it might be best to try to delete and recreate the recurring series in this case.

-Coach Jon

-Coach Jon

0 -

Hi @Coach Jon

yes, I believe this is the only one. Do you suggest deleting that recurring series via the Bills & Income page, and then if necessary deleting these two additional transactions?

0 -

Hello @cloudquick,

Thanks for the reply. Yes, I would suggest deleting via the Bills & Income page, and then deleting the transactions that do not belong in the account register if needed.

-Coach Jon

-Coach Jon

1 -

Thanks @Coach Jon I've done that now.

Hopefully this won't occur again. I'll comment below if it does, but otherwise I'm going to consider this resolved.

2