How to unapply a recurring payment from the wrong transaction to correct cash flow? (edited)

This is related to the part of the issue I have been detailing here:

I'm now unable to fix historic inaccuracies with my main monthly recurring bill (CC payment from checking account to CC account), because the system applied the wrong payment.

Whilst I was able to remove the incorrect payment, I now have an issue because the correct payment has gone through today, but because the recurring payment got messed up, the payment today has been applied to the recurring payment for July 3rd, and the system thinks that the next recurring payment is now scheduled for August 3rd.

More frustratingly, the cash-flow projection is now wrong, and does not include the payment that occurred today. And does not project a payment for July either.

I cannot see a way to go back and make the cashflow reflect accurately the payments that have been made today, or to include the one scheduled for next month.

Comments

-

You will probably have to delete and recreate the series to fix the "next recurring date" problem. I have found that to be the quickest way, although there has been a problem with deleted series coming back to haunt people.

But about the cause of the problem…

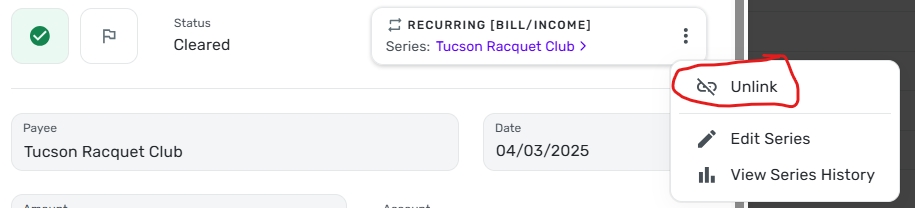

Did you remove the incorrect payment by unlinking it from the recurring series using this option:

Or did you just delete the transaction?

The whole "recurring series" system has been a source of issues for me, but I've had some success with using the "Unlink" option when a transaction is liked to the wrong recurring series.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

@DryHeat I think this is what I have done previously. But have you found a way to restore historic payments so that they reflect accurately in the cashflow page?

For example, the main payment that occurred today (that got messed up) is now lost from my cashflow, so it doesn't look like it occurred at all.

0 -

I'm not sure what you mean by "restore historic payments" or "lost from my cashflow."

So I'm not exactly sure what your situation is. But several other folks have had linking problems and, if you clarify your problem, they may be able to help you.

FWIW, when you unlink a transaction from a recurring series payment it should leave both the transaction and the recurring payment in place (unlinked) — in other words, make it like the erroneous linking had never happened. But there have been problems with that. See here for example:

When I have deleted and recreated a series in order to adjust the date of the first transaction, that first transaction shows up in cashflow. (But sometimes I have to do it a couple of times to get the right initial date.)

When I have deleted an actual transaction that I want to have in my records, I usually just create a new transaction and marked it as cleared. That also shows up in the cashflow.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

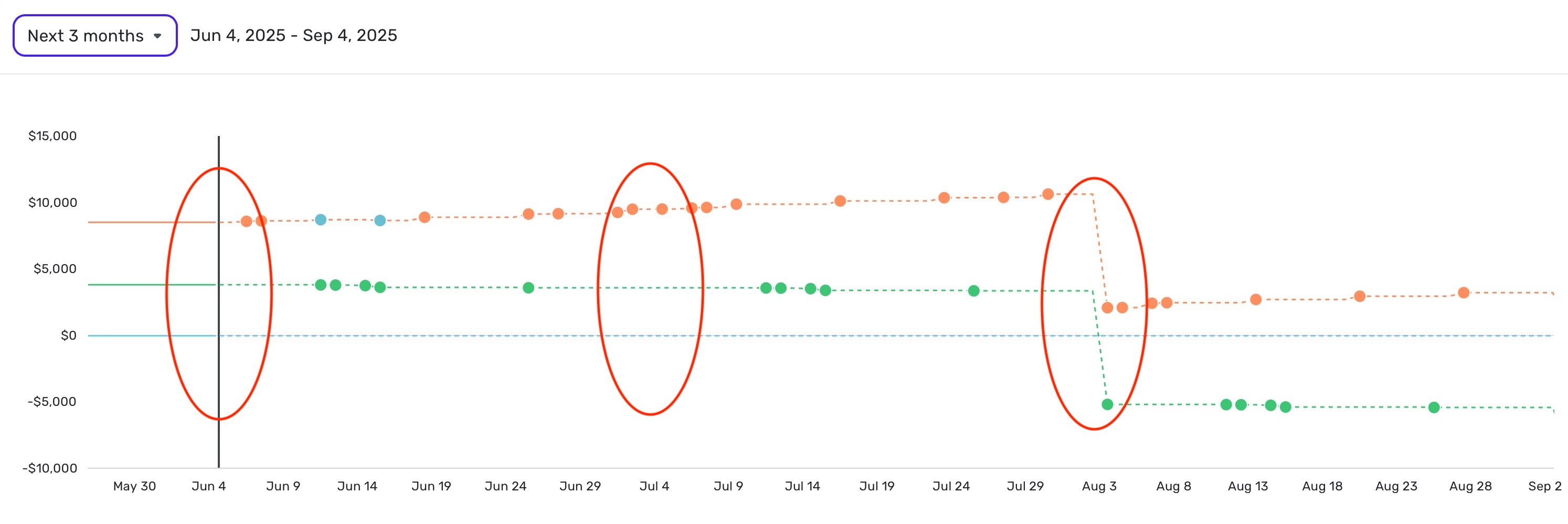

Perhaps this illustrates the issue I am having:

The big dip you see around August 3rd is the next projected CC payment.

There should be a similar (actual, not projected) payment taking place in the first red oval around June 4th, since the payment has posted today, and the transaction is in the QS system

There should also be a similar projected payment around July 4th (second red oval) since I have a monthly recurring bill setup for this payment.

Because the system assigned the wrong transactions to the recurring payment, the first two payments (one actual, and one projected) are now not showing.

There does not seem to be a way for me to make the system add them.

Perhaps you are right, and I need to try do it, and re-do it before it takes, but so far I have had no luck.

Any suggestions you have would be very welcome.

Thanks

0 -

@cloudquick I won't be able to look at this until later this evening, but in the meantime…

Could you post an image of the actual payment "Transaction detail" view and the July 4th projected payment reminder in both "Edit reminder" and "Edit series" views? (redact any personal information)

That will show critical information such as the date, amount, and account that is supposed to be affected.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat I think I have gotten the screenshots you requested, but please let me know if you need more.

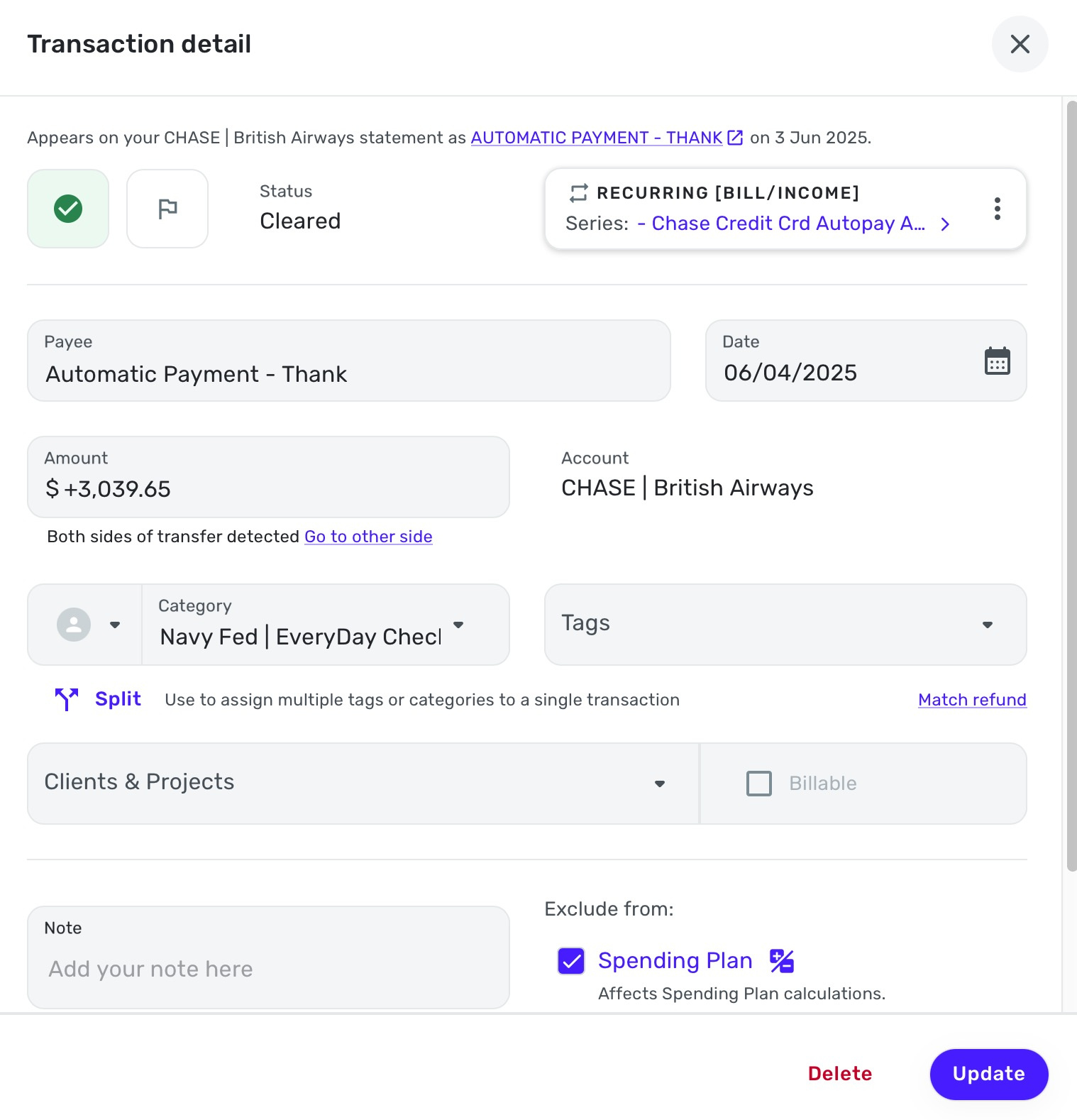

Here is the Transaction detail:

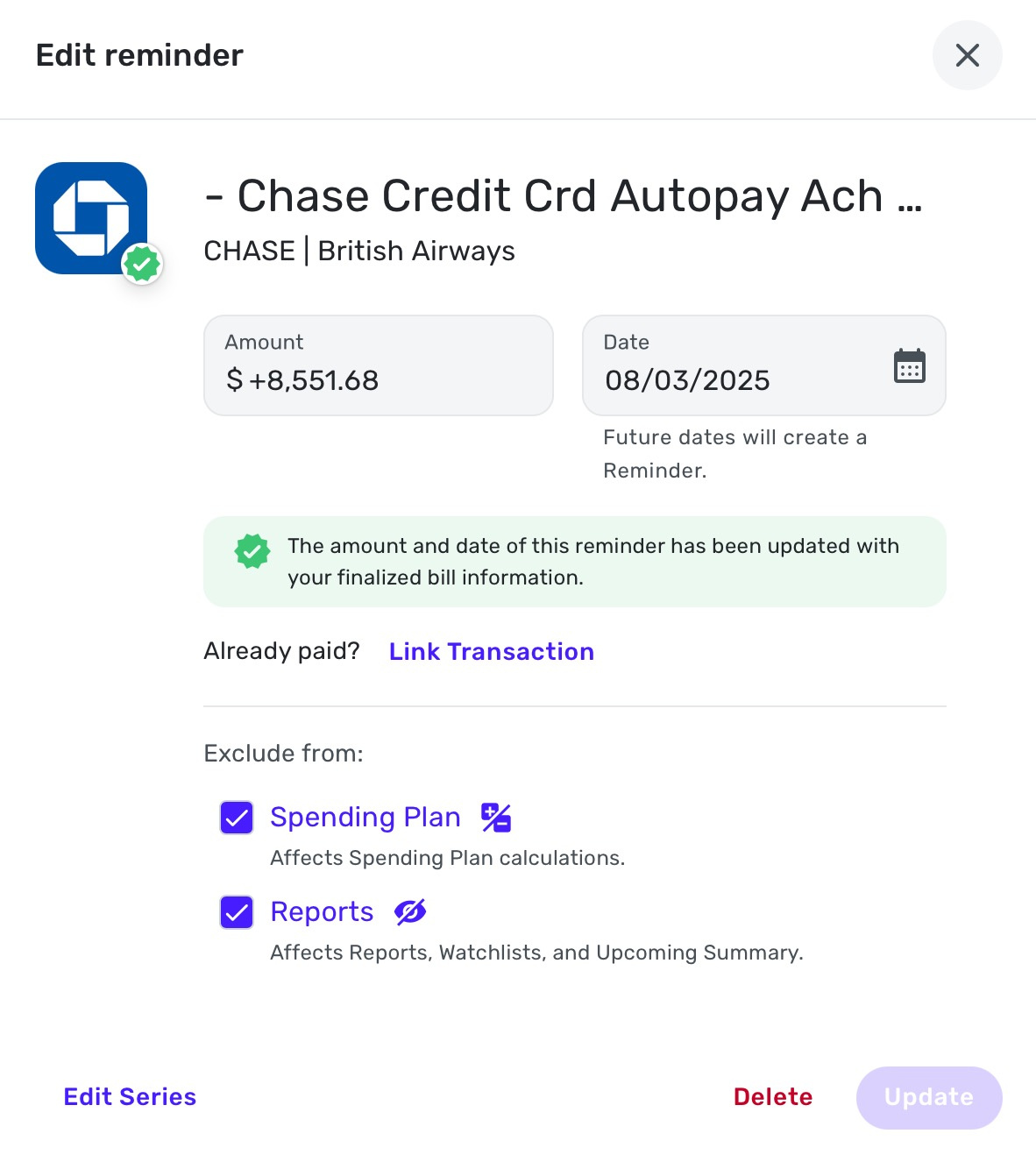

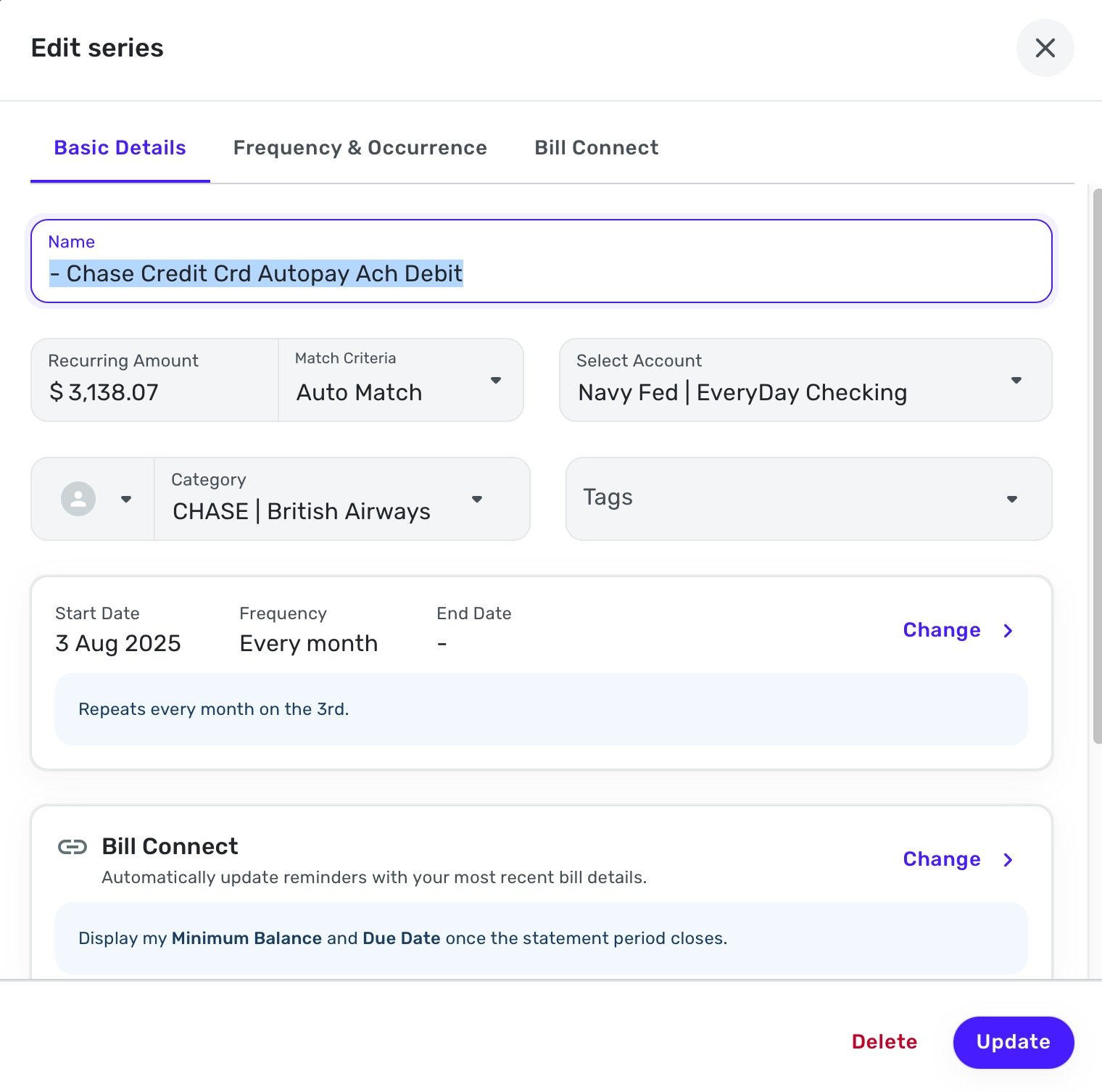

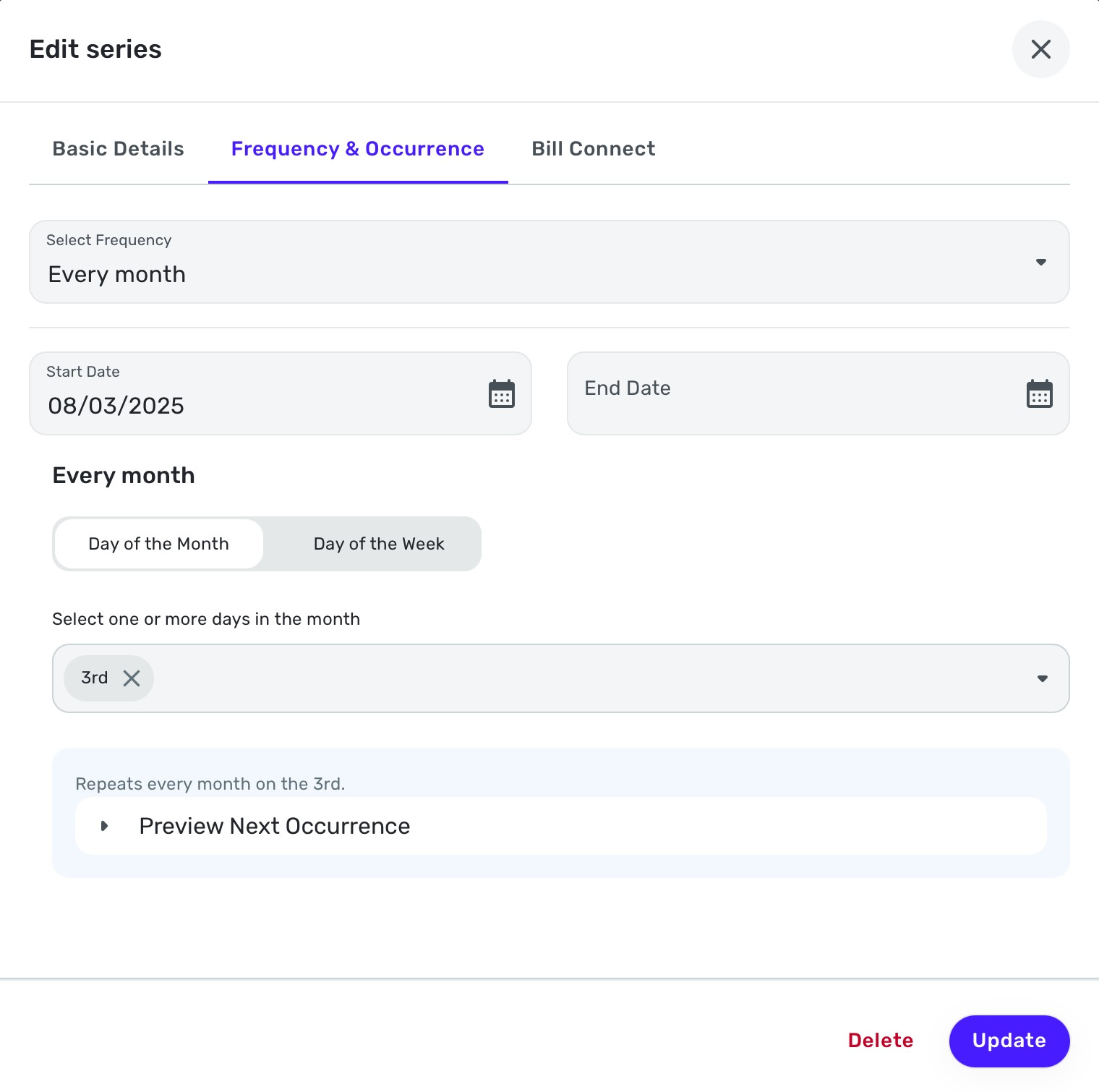

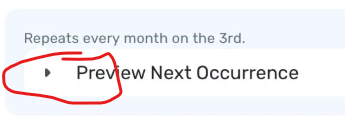

However, since the July projected payment has been disappeared/wrongly assigned by the system (I don't really know), I can only share with you the next recurring bill, which is now set for August:

Please let me know if I can share anything else?

Thanks again!

0 -

It's hard to figure out what is going on, but here are some observations:

(1) Your June 3 credit card payment doesn't show up as a dot on the cashflow graph because the graph was accessed on June 4. Past transactions don't show up — they just start with a straight line.

(2) Your July 3 recurring payment doesn't show up because the recurring series has a start date of Aug 3, 2025:

(3) The automatic "bill connect" system seems to have put your current credit card balance into the Aug 3 payment instead of the July 3 payment — I can't be sure of that from the graph. Perhaps because there is no earlier scheduled payment.

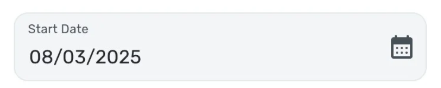

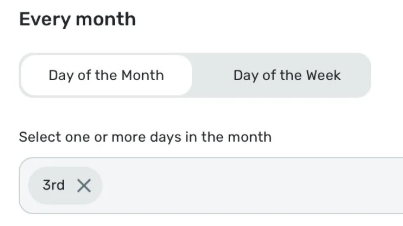

If I were you, I would try changing the start date of the series to 7/3/25 and see if that puts an upcoming 7/3 payment on your reminder bar and your cashflow graph. Remember that the start date is not enough. You have to set these values:

Also check to see that the scheduled payment after that is on 8/3 by clicking here:

I have no idea if it will be able to adjust the amounts so that the 7/3 payment equals your statement balance and the 8/3 equals the later charges, but it might. If not, you can edit them manually and see if they work better later.

An alternative is to delete the entire series and create a new one, making sure to give it a starting date after today but before the July 3 payment.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

Just gonna respond here as best as I can:

(1) whilst I can understand that to be true, the fact is that baseline should therefore be lower since the payment was made, but it is the same as it was before the payment (approx. $3,000) was made. So even if we can no longer see the transaction, it should nevertheless have lowered the cashflow by $3K and it hasn't.

(2) but I don't know why this has happened, since the recurring bill was setup before even June 3rd/4th. What's happened to the recurring payment for July 4th? It's just jumped straight to August.

(3) I will investigate this and see where I get to. Thank you. I am also dealing with a connected issue with @Coach Jon which I think you have also commented on, and I think is related. I will link that below:

0 -

(From all you've posted, I'm assuming the CC account in question is CHASE | British Airways, that the orange line in the graph above is the line for that account, and that the green line is the Navy Fed | Everyday Checking account from which you are making payments on the CC. Let me know if that's not true.)

(1) Regarding the balance shown on the cash flow graph: Simplifi doesn't calculate the CC balance based on what is in the Transaction Activity list. It just displays whatever balance it downloads from your CC bank website. So it's confusing to me that Simplifi is displaying a balance on the cash flow graph that is approx $3k off from what it "should be." To understand better what is going on, let me ask:

- You mention that you "can no longer see"" the $3k payment on your CC Transaction Activity list in Simplifi.

- Does that $3k payment show up on your CC bank website?

- Does the balance shown at the top of your CC account in Simplifi seem to match the cashflow graph?

- Is the balance on your CC bank website significantly different from the balance shown in Simplifi?

(2) Regarding the missing July 3 payment: I don't know why the series is set to start Aug 3 either. I'm just suggesting that that is probably why there is no scheduled recurring payment for July 3 … and further suggesting how you might fix that.

(3) Regarding the large payment scheduled for Aug 3: If resetting the start date of the current series doesn't' fix it (after the next bank update cycle), then deleting and recreating the series with a first transaction date of July 3 will probably get rid of the $8,551 payment currently scheduled for August.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

Thanks @DryHeat appreciate the time and attention!

With regard to the cashflow question (1) I see what you are saying and believe that to be accurate. I think it has taken into account the $3K payment, and is pulling the right overall amount from the account. So I was mistaken and had read the graph incorrectly / gotten a bit confused because I didn't see the change and assumed it hadn't happened. Apologies for that.

I'm waiting to hear back from the other issue I'm having regarding the recurring payment, but will try your suggestions once that is resolved.

Thanks again!

0 -

@cloudquick "I see what you are saying and believe that to be accurate."

I'm not sure exactly what you mean by this, but I think you mean that (1) the June 3rd $3k payment does not show up in the Simplify Transaction Activity list but does show up on your CC website, and (2) the balances on the CC website, the Transaction Activity list, and the cashflow graph are all in agreement.

If that is the case, you can always manually add the June 3rd payment to the Transaction Activity list. But be aware that if you add it as a transfer from the Navy Fed account Simplifi will attempt to match a transaction in that account or create a matching transaction.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

@DryHeat sorry if I'm not being clear.

I was trying to say that you are right, and the cashflow graph does reflect the $3k payment, at least in terms of the balance. I.E. the payment itself may not be visible, but the balance has been reduced by $3k and the balance is therefore accurate and includes the payment made on June 3rd.

0 -

Ok. If I understand correctly, your concern was that the June 3 payment was not visible in the cashflow graph you looked at on June 4. That doesn't really indicate a problem — I wouldn't expect to see it there as the transaction was in the past. When you said earlier that you could "no longer see the transaction," I thought you meant that the June 3 payment was not visible in the Transaction Activity list. Which would have indicated a problem.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1