Current Info re Account Authentication Protocols

Is Simplifi using OAUTH for all account connections, or does it depend on the financial institution. Old threads suggest the financial institution needs to support read only OAUTH for secure connections, but in the past, some financial institutions didn't support that (eg, Vanguard), so I think then Simplifi would instead turn over your log in creds to some third party like Plaid. What's the current state of these security affairs?

Comments

-

@turtle, thanks for posting your inquiry to the Community!

Not all banks use an OAuth API connection, though most of the major banks have moved to this type of connection, or will likely do so soon. Some of the banks that are currently on an OAuth API connection are:

- American Express

- Capital One

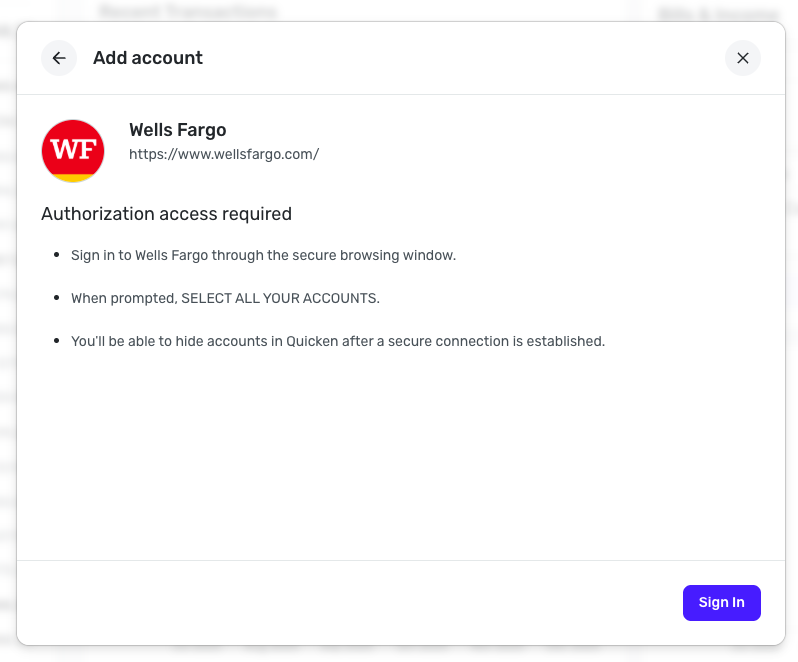

- Wells Fargo

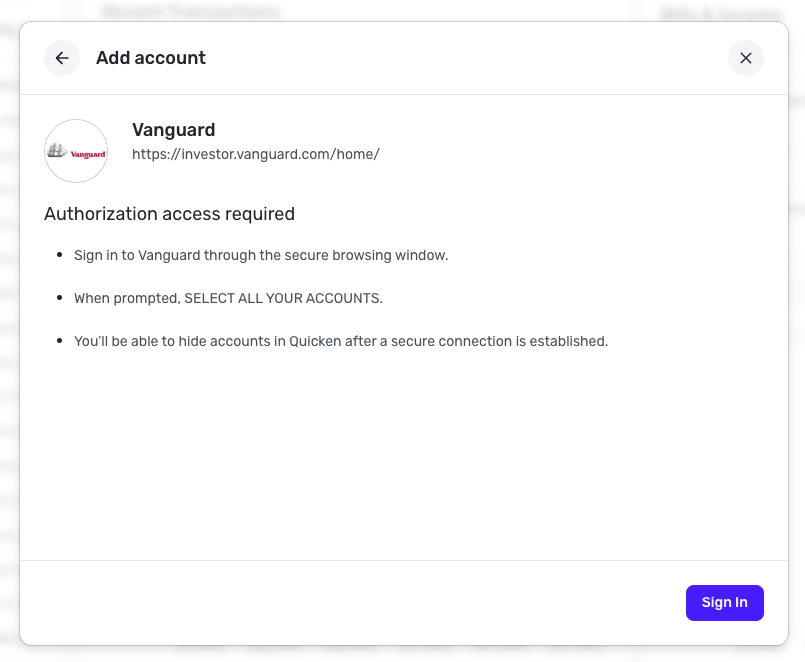

- Vanguard

- Fidelity

- Citibank

- Chase Bank

- Navy Federal Credit Union

- USAA

- PNC Bank

- TD Bank

- U.S. Bank

- Robinhood

- Charles Schwab

The best way to determine if your bank is on an OAuth API connection is to try connecting in Quicken Simplifi. If you see a window that says "Authorization access required", then the bank is on OAuth.

Otherwise, we would use the traditional screenscraping method for any other banks, including banks that are supported on Plaid and Finicity.

I hope this helps to answer your question!

-Coach Natalie

0 -

Thank you. I connected to, eg, Citibank a long time ago, perhaps before they used OAUTH. Can I disconnect it and reconnect it without losing transaction data, including my own edits to downloads, maybe use the "reset connection" option in the menu next to the account in settings?

0 -

@turtle, thanks for the reply!

If you were connected to Citi or any other OAuth bank before the bank migrated to OAuth, you would have been prompted to migrate your accounts. You will not be able to stay on the old connection type once the OAuth rollout is complete. In the case of Citi, the rollout was complete quite some time ago.

With that, if you'd still like to establish a fresh connection for Citi in Quicken Simplifi, you may do so by following these steps:

- Make all of the accounts with the bank manual by following the steps here.

- Once you see the account(s) listed in the Manual Accounts section under Settings > Accounts, go back through the Add Account flow to reconnect to the bank.

- Carefully link the account(s) found to your existing Quicken Simplifi account(s) by following the steps here.

May I ask if you're experiencing a connection issue or something along those lines that is prompting these inquiries? Let us know so we can help, if so!

-Coach Natalie

0 -

I'm just trying to be a more educated consumer when it comes to security and beef up everything possible while foregoing services if they're not following modern protocols/frameworks.

Vanguard seems to disconnect. I think because I require an SMS code to get in??? I just tried to connect to see what the issue is and I get a Simplifi dialog window where I enter my Vanguard username and password. Can I assume this window doesn't mean that Simplifi is collecting my login information, but rather it is going straight to Vanguard to obtain a token for Simplifi's use?

0 -

Also, Quicken Classic Premier on Mac shows exactly what type of connection each account is using in the account settings. It would be helpful if Simplifi would show something for each account at the UI level indicating whether it has migrated to OAUTH. This is taking me a lot of time to sort everything out.

0 -

@turtle, that is correct that if the bank uses their own OAuth API connection, the token is granted by them directly, and Quicken Simplifi has no need to store your credentials. The page where you enter your credentials will not be in Quicken Simplifi; it will be a bank-hosted page.

As for requesting the ability to see connection types in Quicken Simplifi, although I don't know how needed it would be since Quicken Simplifi doesn't offer most of the connection types offered in Quicken Classic (we only support Quicken Connect and EWC+), you can create an Idea post so other users can vote on it and our product team can review it. Our FAQ with more details on how to do so can be found here:

I hope this helps!

-Coach Natalie

0 -

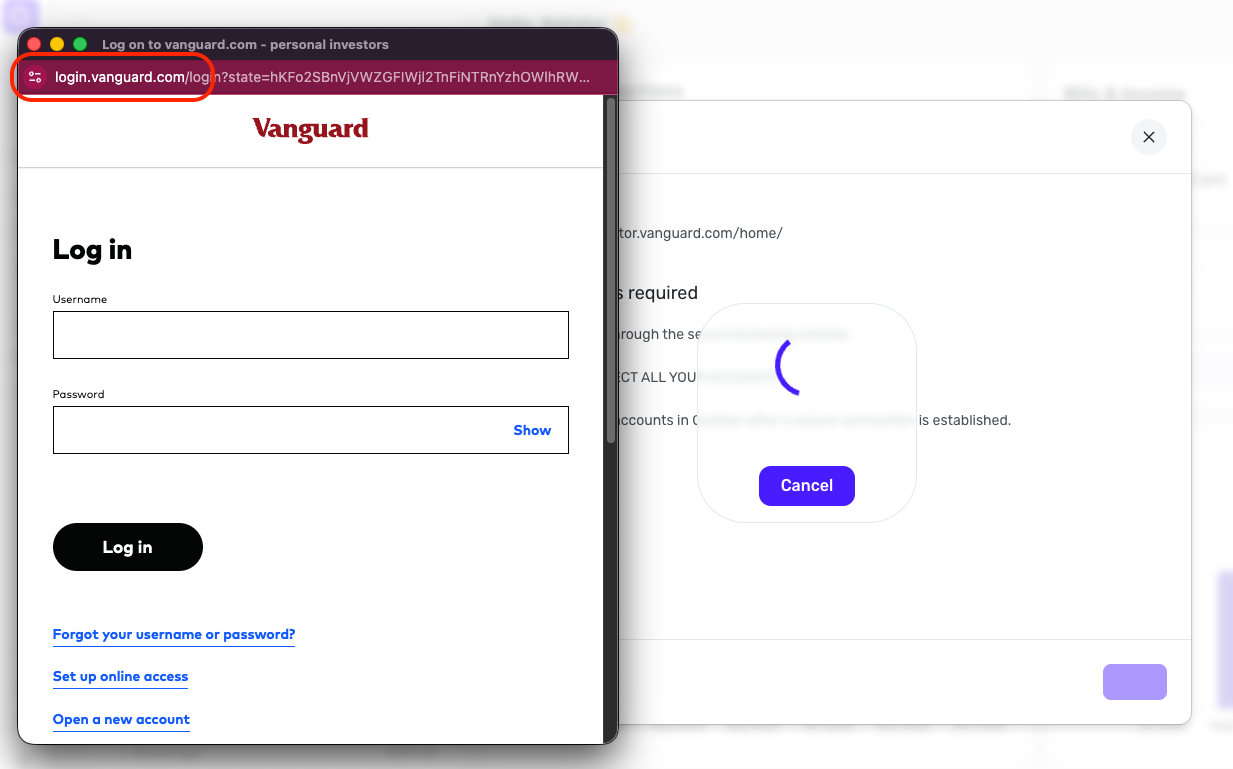

Thanks, just to make sure we're on the same page, I've connected to a bank through some other app (don't recall which one but maybe even Quicken Classic Premier) that for OAUTH actually opened my browser and took me to the bank website itself to log in. This isn't what's happening when trying to connect Vanguard (it uses OAUTH) in Simplifi. I get a dialog page within the Simplifi app, with Simplifi's color and design etc., to log in. Is this actually direct log in to the banks' website to establish OAUTH? If so, it's not at all ideal to have the log in dialog window conform to Quicken's UI, rather than going to the bank website to log in there, and once doing that, seeing a message that the connection is approved, go back to Simplifi to continue.

0 -

@turtle, thanks for the reply!

To clarify, the window that opens from Quicken Simplifi to enter your credentials for Vanguard is not a Quicken Simplifi site. You can see that the URL at the top belongs to Vanguard —

Once you enter your credentials and authorize your accounts with Vanguard directly, you will be redirected back to Quicken Simplifi, where you can finalize adding the accounts in the program.

I hope this helps to clarify!

-Coach Natalie

0 -

Oh okay. When I signed in using the Simplifi browser app, I get that window, but the top bar isn't in Vanguard's color, and the black footer was below my MacBook Air screen, so I missed that it shows the Vanguard login web address.

However, twice now when I tried to connect the account, after entering the login info, I didn't get a Vanguard screen to select accounts. Instead, it went back to the Simplifi browser app and I got this empty session message. I probably need to try doing this right through the Simplifi website, but I think it should be working in the app too.

0 -

@turtle, it looks like you're using an expired bank option of "zzz-Vanguard - Personal Investors". You should instead be using the main Vanguard bank option listed as "Vanguard".

The flow should be the same on the Quicken Simplifi Web App, the Mobile App, as well as the browser extension app, which is what it looks like you're using. You will select the bank in Quicken Simplifi, sign into the new page that opens to the bank's website, authorize your accounts, and then be directed back to Quicken Simplifi where your list of discovered accounts will be presented so you can add them.

Let us know if the Vanguard bank option works for you!

-Coach Natalie

0