Add split paycheck tax deductions to the Bills & Income section of Spending Plan (edited)

I'd like to itemize my paychecks, but I want my tax deductions in the "Income after bills & savings" section, not the "Planned spending" or "Other spending" sections. I know that there are articles for how to itemize paychecks, but I feel like those are partial solutions. Simplify should allow the entire breakdown of an itemized paycheck to stay in the "Income after bills & savings" section so that only the net income makes it to the next two sections.

How to currently track paycheck deductions:

[added link to article on how this currently works]

Comments

-

@MtnCreed, thanks for posting your suggestion to the Community!

I went ahead and turned this into an Idea post requesting that split paycheck tax deductions be counted toward the Bills & Income section of the Spending Plan instead of the current section of Other Spending so other users can vote on it and our product team can review it.

I hope this helps!

-Coach Natalie

-Coach Natalie

1 -

Thanks for changing the post type and adding the article link, @Coach Natalie!

1 -

@MtnCreed I upvoted this. I handle it by putting Health Insurance and Withholdings into Planned Spending. At least that way, my Spending Plan accounts for withholdings. Otherwise, it just counts the gross income. Since we usually get paid the last day of the month and the 4th Wednesdays, it is needed.

Your idea doesn't really help me then as I would still have to have planned spending to account for withholdings OR add a split transaction post dated to the last day of the month. Kind of a kludge.

The main problem is that Simplifi doesn't know how to handle splits that have both income and spending, eg. paychecks. It has now gotten worse for me since I got on Medicare at aged 70 and now that cost comes out of my Social Security check. So now we have that and my wife's pension check. Starting in June, she'll have Social Security and Medicare too so we will have three of these!

In addition, when we get paid, the Recent Spending Card on Dashboard counts the paycheck total as negative spending, which makes that card worthless to see how much you spent last 4 days. It comes out with a + number. I have requested a fix to this as well.

Another problem that needs fixing is that recurring transactions cannot have splits as in Quicken.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Having this feature will encourage me to use Simplifi to track my gross income. Now, I only track my net income as doing paycheck deductions is cumbersome.

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

2 -

Quicken Classic has a means to set up paychecks so that all deductions can be split out in a memorized recurring format. It's found under the Planning tab > Tax Center > Taxable Income card.

This feature could be especially helpful in QS for those who want to track gross income and not just net income. It would make entering paychecks more efficient and add value for tax planning purposes I would think.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer2 -

I agree with this and upvoted. The gist of it is pretty straightforward, you shouldn't really manage your finances based only on net payroll. In a perfect world QS would have a connection to ADP / Paycor / Other popular payroll managers.

0 -

I think that having the split reminder feature would likely help address this.

Using splits (multiple categories) in Recurring Transactions (4 Merged Votes) - Page 7 — Simplifi

This would be a great feature for me. I want to track my entire spending and income, that includes gross and deductions. Right now with only net being reflected this is more difficult for tax planning.

TiggerTrainer

Quicken Simplifi user since January 2025

Quicken Classic (Premier) user since 2004 - 2025 (21 years)

0 -

@TiggerTrainer I think this is going to happen.

In the meantime, I figured out a workaround. Set up a recurring income amount for the Gross Pay and a Subscription recurring amount for the withholdings.

When your paycheck comes in, split it as you like, and then link the transaction to the Subscription withholdings, NOT the income. Now you can dismiss that month's income recurring as you won't need it.

In the Income section of the Spending Plan, it will now show your gross pay because income always shows up (unless you've told it not to, but you can change that setting) and in the Subscription section, it will show all your withholdings one after another.

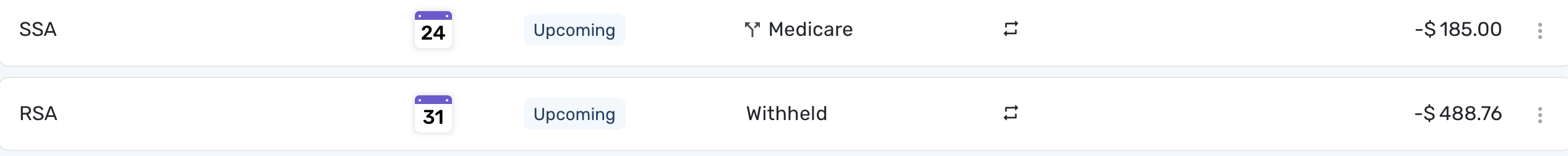

Here's what December looks like right now for Social Security and Retirement Pension (before receiving the pay). Actually, I've already entered this month's SSA as a future transaction so that is why you see the split symbol, which isn't there until you tie the split transaction to it.

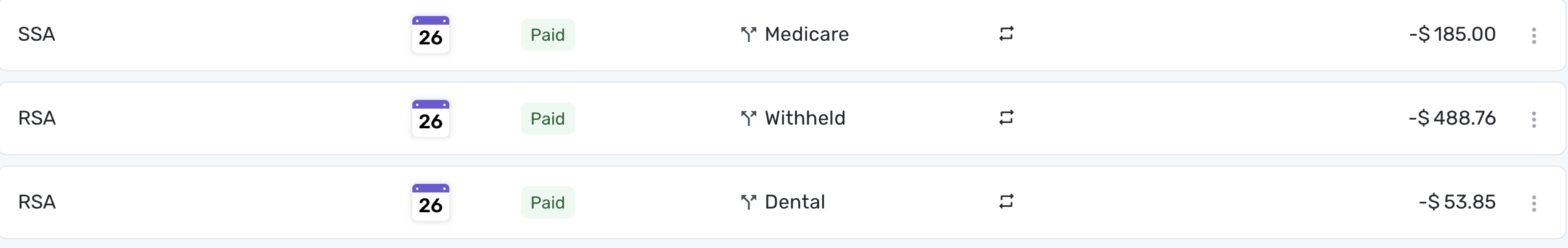

Here's how it looks after you receive the pay (last month):

Here's last month income's section:

Of course, all this will be simpler when we get Recurring with Splits.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

While I don't know a timeframe, I can confirm that I recently tested recurring splits with the Simplifi development team. I had several thoughts that I shared with them. Looking forward to this feature.

TiggerTrainer

Quicken Simplifi user since January 2025

Quicken Classic (Premier) user since 2004 - 2025 (21 years)

3