Allow Savings Goals to have full functionality of other accounts

I would like to have all the features of a virtual account with them - register/ledger view, detailed transaction entry, scheduling of transactions, etc., carry negative balances, include transfers to/from them in yearly budget.

Example:

Comments

-

When editing a recurring series, say quarterly taxes. It would be nice if the account to pay from dropdown included the existing savings goals. I have a fully funded savings goal to pay this recurring payment, but the money can only be drawn from the parent account, not the savings goal set aside in the same account.

1 -

I’m voting for this one because I’d love to see some sort of record of past ‘deposits into/ withdrawals from’ built into Simplifi’s Savings Goals so we don’t have to rely on memory. Whether or not it looks exactly like the above screenshot isn’t as important to me. Just make it SIMPLE.

The thing I would not want to see happen is for Simplifi to simply duplicate the way Quicken Desktop does Savings Goals - which is awful. With Quicken, that record of past Savings Goal transactions exists in your actual - real world - transaction register which just cluttered things up and caused issues with account reconciliation.

Simplifi has a really great UI so far with Savings Goals, just continue to make it better!Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.4 -

I want to keep this feature request active. Either through enhanced SGs or through a newly designed interface, keeping tabs on those longer term expenses is something that will make Simplifi even better IMHO.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer3 -

This feature would be a game changer. Without this - savings goals feel meaningless and impossible to keep track of.

This would help me track how much I am actually saving each month in my spending plan, instead of only listing a goal. I contribute during the month, but sometimes have to withdraw from my goal in order to pay other things. Help!

7 -

If this were implemented, I would also like the historical data used to provide more information than "On Track" and "Behind X Months."

For instance, if a register was kept tracking all of the history of SG transactions, the system could say something like "Off track - amount saved is less than the amount should have saved by now by $X." Or "Off track - amount saved is less than amount spent by $X."

That sort of thing.

Anthony Bopp

Simplifi User Since July 2022Money talks. But all my paycheck ever says is goodbye1 -

Yes, please expand the capabilities of Savings Goals to make them more useful. Need to be able to see the transactions in and out. Right now, somewhere in the middle of the month, I'll wonder whether or not I remembered to contribute a savings goal at the start of the month. And after withdrawing for something, I later can't remember when exactly I took money out of the goal and for what purpose.

There is a lot missing right now with Savings Goals. They are very confusing to try to use. Savings Goals in Quicken had it right.

Quicken since 1995. Simplifi since 2023.

1 -

while goals state "contributed", one of my goals says "Not Contribute" but I know I did. It seems it has something to do with my withdrawing some funds from the prior month? Unclear at the this point, so being able to see a record of transactions would be great. @Coach Natalie are you aware of any bugs around what I'm stating, having made a contribution, but it still shows as "Not…".

0 -

@Max1223, thanks for posting!

If you'd like to do some troubleshooting on the issue you're seeing, I'd suggest creating a separate post in the applicable area of the Community to outline and report the issue, since this is a Feature Request.

As for seeing a record of Savings Goals Contributions and Withdrawals, I'd suggest adding your vote and feedback here instead:

I hope this gets you pointed in the right direction!

-Coach Natalie

-Coach Natalie

1 -

I wholeheartedly support this request. I am having to use a separate spreadsheet to track my goals that have credits and debits to them over time. I really would like to be able to monitor and manage my goals all within Simplifi, if possible.

1 -

Voted (and posting) to try and keep this thread/request alive. I have to assume the transactional data is stored in the underlying database. If not fully displaying them as "accounts" as requested by the OP, just being able to see a simple list of savings goal contributions/withdrawals (date and amount) would be hugely helpful.

1 -

Yes, please keep this one alive….Need to be able to see when contributions were made to the goal and when money was taken out (along with maybe the reason for taking it out). Just seeing a total amount floating around there without context is not very helpful.

Quicken since 1995. Simplifi since 2023.

1 -

This is my "annual" contribution to this feature request. Adding functionality along the lines of this idea would greatly enhance the value and usability of the Savings Goal feature.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer2 -

My fiancé recently told me about how her Ally Bank savings account lets her break out her savings account into different savings buckets (ex: $1,000 car savings, $1,500 general savings, $3,000 home savings, from a $5,500 total balance).

The only way to do this currently in Simplifi is to physically have different bank savings accounts, which really is not a good way to do it. My thoughts on this is that the savings goal feature could use a total refresh to be something more like this. In my opinion, the current savings goal feature is way too basic and is not all that helpful, especially since you cannot see the transaction history like you would with a typical account. There needs to be some kind of separate "savings transactions" that shows the breakout.

Currently, if you have multiple savings goals from one bank account, the account tab in Simplifi just pools all your savings goals together, which is not very helpful when trying to see an overall view of your financials. You cane to go to the actual savings goal window and change the view to "by percent" which is just not nearly as intuitive or helpful.

This really needs to be bumped up, I feel this is a huge hole in the current app if it's trying to be a full financial app.

0 -

It's been a year, so here I am, "boosting" this feature request. Come on team, you can do it!

I suppose I should find ALL the SG feature requests and give most of them an annual boost since the 41 up-vote count for this one request is a bit "deceptive." If one were to take the time to count up all the up-votes for all the SG feature requests currently floating around in this forum, I'm certain the count would be substantial.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer1 -

I'm a long time Quicken Desktop user who made the mistake of moving to Quicken Simplify. I made the move at the time because I wanted access from everywhere, modern interface, not having to worry about backups, etc. I used Simplify for a year and the lack of transparency in Savings Goals (being able to see the register) is what pushed me to move back to Quicken Desktop. I'm thrilled now that I'm back on Quicken Desktop, but changing platforms was a big undertaking and huge time sink. I've had times on Simplifi where a savings goal would get out of wack and when you can't view the register, it makes it impossible to resolve.

2 -

"I've had times on Simplifi where a savings goal would get out of wack and when you can't view the register, it makes it impossible to resolve."

Same here.

And the "fix" of deleting the Savings Goal and recreating it isn't really a good solution.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

Same, I've stopped using Savings Goals as it just wasnt working for me. As I recall, one of the bigger things for me was not seeing any kind of register of transactions going in and out of the Goal. Felt it lacked information and history and not tied enough to real accounts and transactions.

I like the analogy of opening a Savings account at a bank, putting money and using it when I hit the goal. The deposits and withdrawals and Spend is all there in a register.

Ideally QS would have a similar system that tapped into an existing account, eliminating the need for me to open a real account at a bank. Then show all the transactions linked to the real and Savings Goal account.

1 -

"Ideally QS would have a similar system that tapped into an existing account, eliminating the need for me to open a real account at a bank. Then show all the transactions linked to the real and Savings Goal account."

This is exactly what I would like from Simplifi, and would be a huge improvement. My solution for the past year has been opening new bank accounts or investment brokerage accounts. With my financials and needs continuing to diversify, that would mean WAY too many accounts unnecessarily. That is not a good solution in my opinion. This really should be built into a financial tool like Simplifi, especially one as big as them.

0 -

This suggestion has 43 votes and is very similar to the suggestion below, which has 60 votes.

This one is more comprehensive, but both are suggesting that there be some way of seeing a list or register of Savings Goals contributions and withdrawals.

Could they be merges so that the broad support for this idea will be more apparent?

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

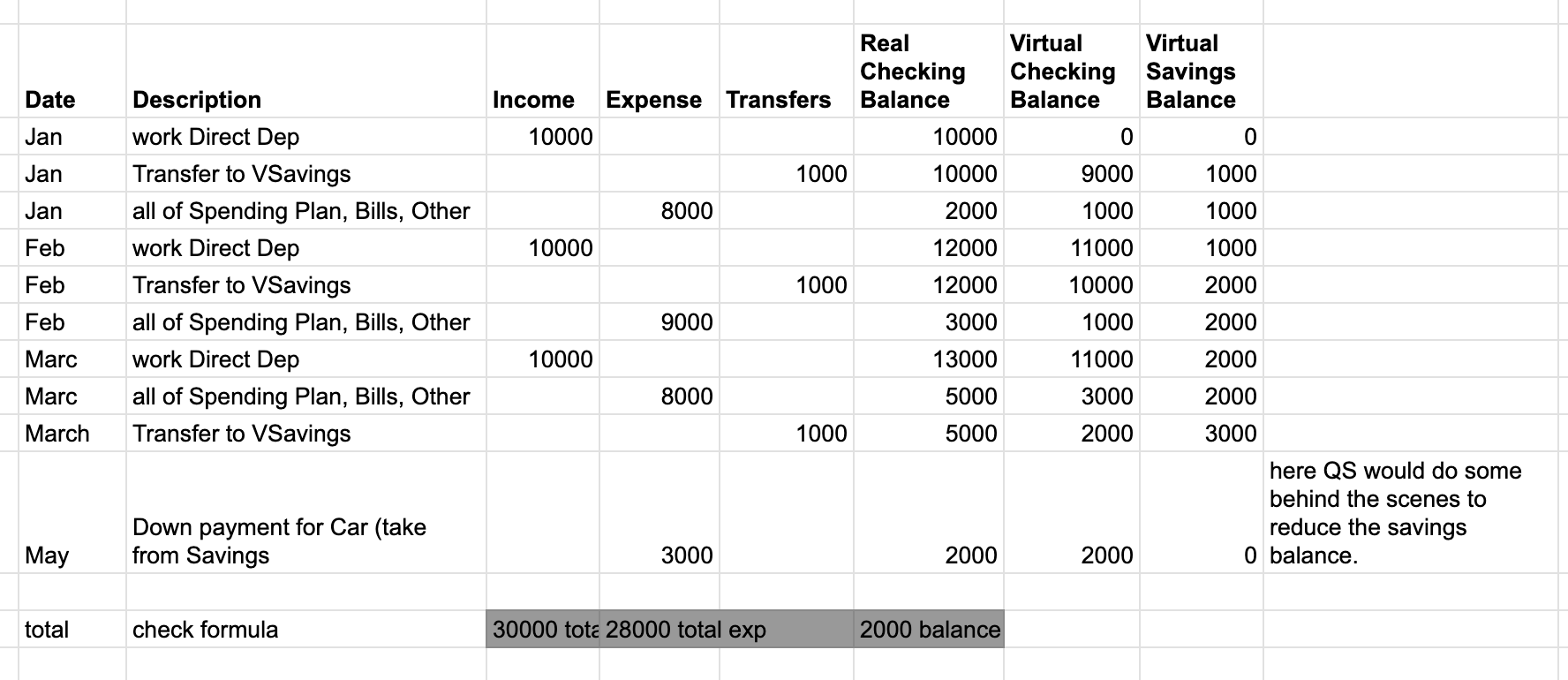

So here is an attempt of what I feel like registers and more functionality would look like for Savings Goals. Feel free to critique or comment…I've done this to start dialog or to get some wheels turning.

I'm following a concept of a Real Checking and Real Savings, where I get Income, distribute it across accounts, then spend it. In the case of QS, only one account is Real and when you create Savings Goals, it creates two Virtuals (see below), where the Virtuals always add up to the Real.

the Expenses below are just one line item to make the sheet simple. The chart is a register of a single Real Checking where a Saving Goal is taking from it.

In May, where I use the savings, maybe this is the one spot that I have to specifically select a "take from savings" checkbox to instruct QS how the money is flowing.

Problems as I see the sheet, if I have many SG's, then I would like to see the balance of all them that are being taken from the Real Checking.

If you use two or more Real accounts to contribute to a single Virtual Savings, its get complicated to restore the Real Balances. I would personally prefer seeing the details and limiting one Real to one or more Virtual savings to keep things simple, where transfers always come from a single Real account. I could always transfer real money between real accounts to cover saving plans or you could set up additional SG's to other Real accounts you can draw from.

For me, seeing the extra expense in May shows the real picture of where money is going. Yes its a big 3k expense and disrupted a monthly budget or creates a negative blip in a report, but that's what I planned for and for me, seeing the blip is good as I can go back and review. So no need to hide from plans or list. @Coach Natalie for viz.

0 -

I would like to see a register for each individual goal that appears when you click on the goal (much like what happens when you click on a planned expense in Spending Plan | Planned Spend).

The following columns would be enough for me to figure out what is going on with the Spending Goal, given that the tile for the Goal already shows Available, Spent, Left to save, Goal amount, and Target month.

Date

Contribution

Contribution Account

Withdraw-For Goal

Withdraw-For Other Purpose

Withdrawal Account

1/1/25

1000

Checking

2/1/25

400

Checking

3/15/25

1000

Savings

4/2/25

300

Checking

With a listing of just that basic information, I could see when I contributed or withdrew (and what kind of withdrawal), as well as which account was involved.

This would not require QS to change the way these phantom transactions are entered by the user. The information in the table above is the same information required when we contribute or withdraw from a goal currently. It would require QS to store the individual transaction information, which I suspect it is not doing now.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)4 -

—

— Same here.

— And the "fix" of deleting the Savings Goal and recreating it isn't really a good solution.

Agreed. I had the pleasure of getting to delete and recreate my Savings Goals again today because the numbers were wrong. The "By Goal" and the "By Account" did not agree and neither were what I know they were suppose to be because I keep a close eye on them since I have had issues before.

Not good to find out that you have less money in your overall account than you thought. They should get it fixed or remove it as a "feature" completely. I guess I am going to have to start keeping a note of my own tracking the contributions to and from my goals so I can check things easier and recreate with the right amounts.

Oh, and I'm paying a subscription for this headache! Thanks.

—— also wishing I had never switched from Classic!!!Quicken since 1995. Simplifi since 2023.

0 -

Hear, Hear! … or is it Here, here! …. nah, it's Hear, hear! as in we're talking QS, are you listening? We are giving good, solid, useful feedback. Please tell us you are doing a major upgrade of the Savings Goal feature.

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0 -

And now this morning, the Savings Goal amount is double what it is supposed to be!

When I check the Savings Goal By Account, I see the new goals I recreated yesterday, along with "Unknown Goal" several times representing the ones that I deleted yesterday. When I look at Savings Goal By Goal, I don't see the "Unknown" ones, so no way to delete them. This leaves the Savings Goal total in the account bar basically double what it should be, which of course leaves my "Available Balance" for my account as a nice gig negative number.

So not sure how to recover from this one since I don't see a way to delete the ghost goals. If anyone knows, please let me know. Otherwise, I guess I will just have to delete that bank account, delete the goals that I can, and add the account back in. What a pain!

UPDATE: OK, I see there is another thread already reporting this same bug by several people since a month ago or so. So, no solution, I guess. BAH!

Quicken since 1995. Simplifi since 2023.

1 -

For what it's worth, I have thanked myself daily for switching back to Quicken Classic (desktop). Was it a royal pain the a$$? Absolutely. Should I have had to? Absolutely not. After spending a year on Simplify, I'm convinced it would only really work for the most casual of finance trackers. Between the broken savings goal system, and ridiculously inadequate report section (can you still not save a customized report???), I think a high school kid with their first job is about the only market Simplify would work for. At about the same cost as Simplify, Quicken Classic Deluxe does absolutely everything I need/want.

1 -

@Max1223 I played around with trying to export csv files from Simplify and importing them to Quicken desktop, but in the end I found it easier to just let the missing transaction download from my banks and cc company. I was only on Simplifi for about a year (probably a little less), so this was an option for me. Of course I then had to manually fix categories for transactions I cared to track (such as for taxes). I also had a lot of tax receipts in the form of attachments in Simplify. They don't let you bulk download attachments because that would of course make it too easy to switch to a competitor, so I had to manually download attachments one at a time from simplify and re-attach them in Quicken desktop. Definitely took a while, but again, well worth it.

2 -

"Glad" to hear that I'm not the only one reporting that the "by account" and "by goal" totals don't match. They requested I delete my goals and start over. I don't even recall now if that temporarily fixed the issue or not - I think it did and then it was out of balance again within a couple of weeks. Either way, I'm back to being "out of balance" by $200. I use a lot of the goal tags and find it easier to let it be than try to delete and try again so I don't interfere with my tags. I use the tags to semi-reconcile the goals, so I'd have to redo all the tags, which was a pain the first time when I was just getting started, so not going there right now. Hoping eventually that they will improve the savings goal functionality and transaction visibility, so I'd be able to find the error and correct it with much less effort on my part. I might have my hopes set too high, but for now, that's the better option for me.

0 -

I think it's also worth noting that savings goals have an additional massive shortcoming: There is no reasonable way to update contribution amounts without ruining all of your previous month's spending plans and reports. For example, lets say I got a raise and want to allocate an additional $200 to my emergency savings each month. I update my contribution to reflect this in my goal. However, Simplifi backdates this change to ALL previous months (which makes no sense, obviously people's contributions to various goals are going to change over time). Now all my previous month's spending plans show -$200 because that contribution change got backdated, which then proceeds to ruin prior reports too. Contribution updates should not be backdated (at least without the user specifically selecting a date to backdated to, it should default to updating for the start of the current month).

1