Temporary Double Counting of Investment Transfer Between Accounts

Hello,

I need help correcting the balances of my investment accounts.

I recently transferred assets from Brokerage Account A to Brokerage Account B (a regular ACATS). Both accounts are connected to Simplifi through automatic syncing, and I did not enter anything manually.

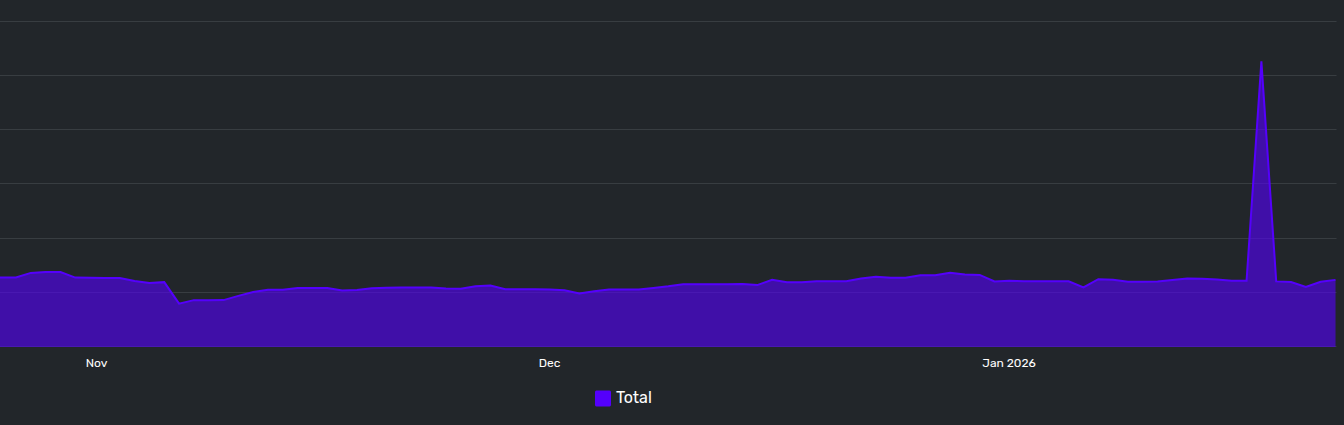

However, Brokerage Account B shows the incoming funds before Brokerage Account A reflects the outgoing transfer. As a result, for about two days my total investment balance is almost double what it should be.

After roughly three days, the balances normalize on their own. But when reviewing my data and balance history, there is a large artificial spike during those two days that I would like to remove or correct.

I have reviewed the transaction dates, and they appear to be accurate in both accounts.

How can I fix this so the net balance across the two accounts is reflected correctly and the temporary spike is eliminated?

Thank you,

Comments

-

Yeah, this happens to me too, and it is an irritant.

And there is nothing (I know of so far) that we can do. Simplifi ignores transactions in Investment accounts and only shows the balance that is downloaded from the brokerage. It usually is just off for one day. I assume these two brokerage accounts are different companies. Mine are two accounts within the same company so they clear next day. Of course, when I transfer to a banking account, I have the imbalance problem.

And you cannot even enter a balance adjustment as you can for other accounts because they too are ignored in Investment accounts. (The only control you can have with investment transactions is to make them payment/deposits if you need them included in Reports and/or Spending Plan.)

And since they are connected accounts, you cannot add or adjust the holdings either.

If it bothers you a lot, you can put in a temporary transaction in another account, say Cash for the amount that is being double counted. This will fix your Net Worth (all accounts total), but won't do anything else. Then when it adjusts, you can delete that transaction.

We really need for Simplifi to subtract/add pending transactions in Investment accounts. I hate that Simplifi isn't consistent across accounts. We should be able to do "Balance with Pending". You'll also notice that Investment transactions cannot even be designated as pending.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Oh yes. I can change the transaction dates but that does not affect the account balances. It is really weird.

0 -

Some great comments here. Thank you.

Indeed Simplifi does not manage investments with the same proficiency it does manage budgets and regular spending accounts. I think this is an area of opportunity for the company.

I will try that idea of yours…. maybe a manual investment account with some "fake" transactions can help here. I will try and report back.

0 -

Quick follow up.

A manual brokerage account does not help. Same issues. Manual transactions do not affect balances.

1 -

Thank you. I made a feature to request for pending transactions to be counted in Investment accounts in order to alleviate this situation you described.

There are two other requests that need to get more votes too:

All of these are needed and would be especially helpful for those who have Cash Management accounts. Please consider voting for them.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

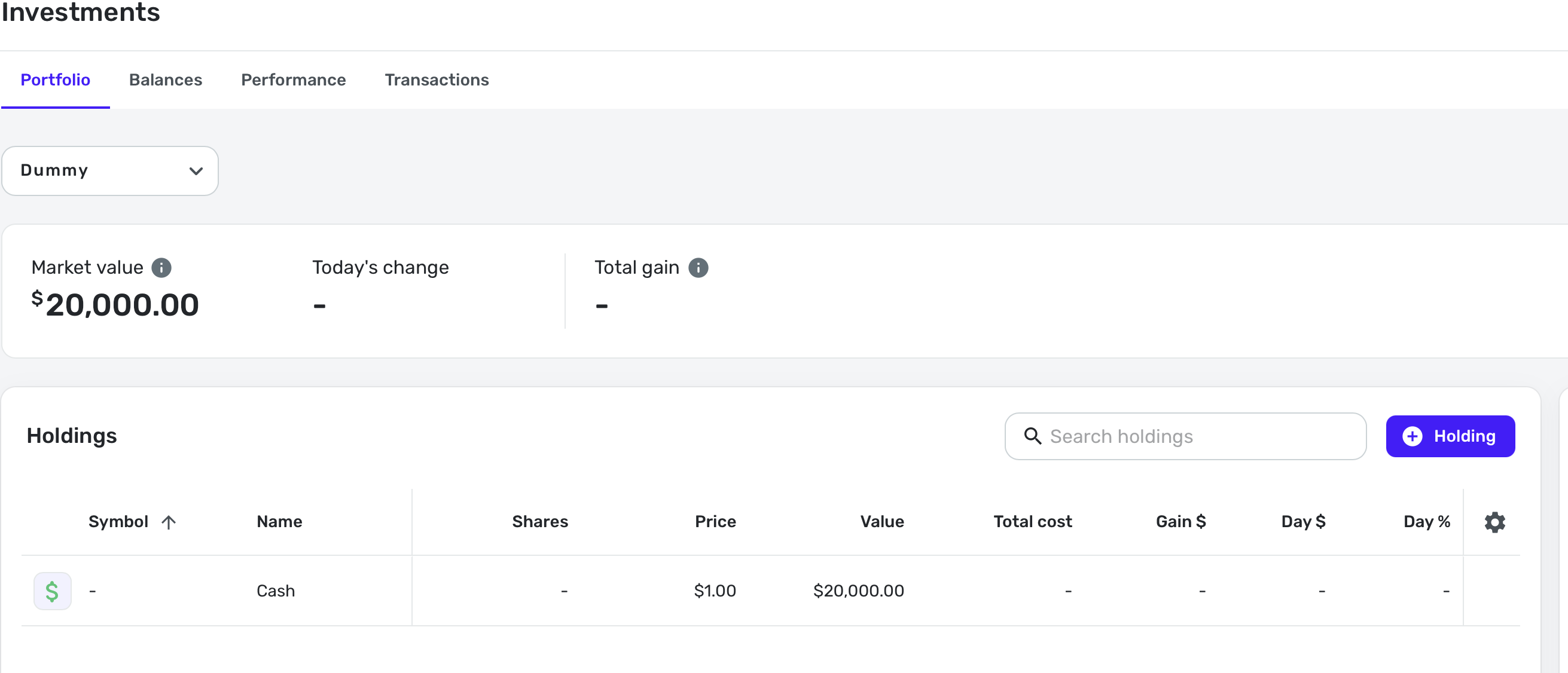

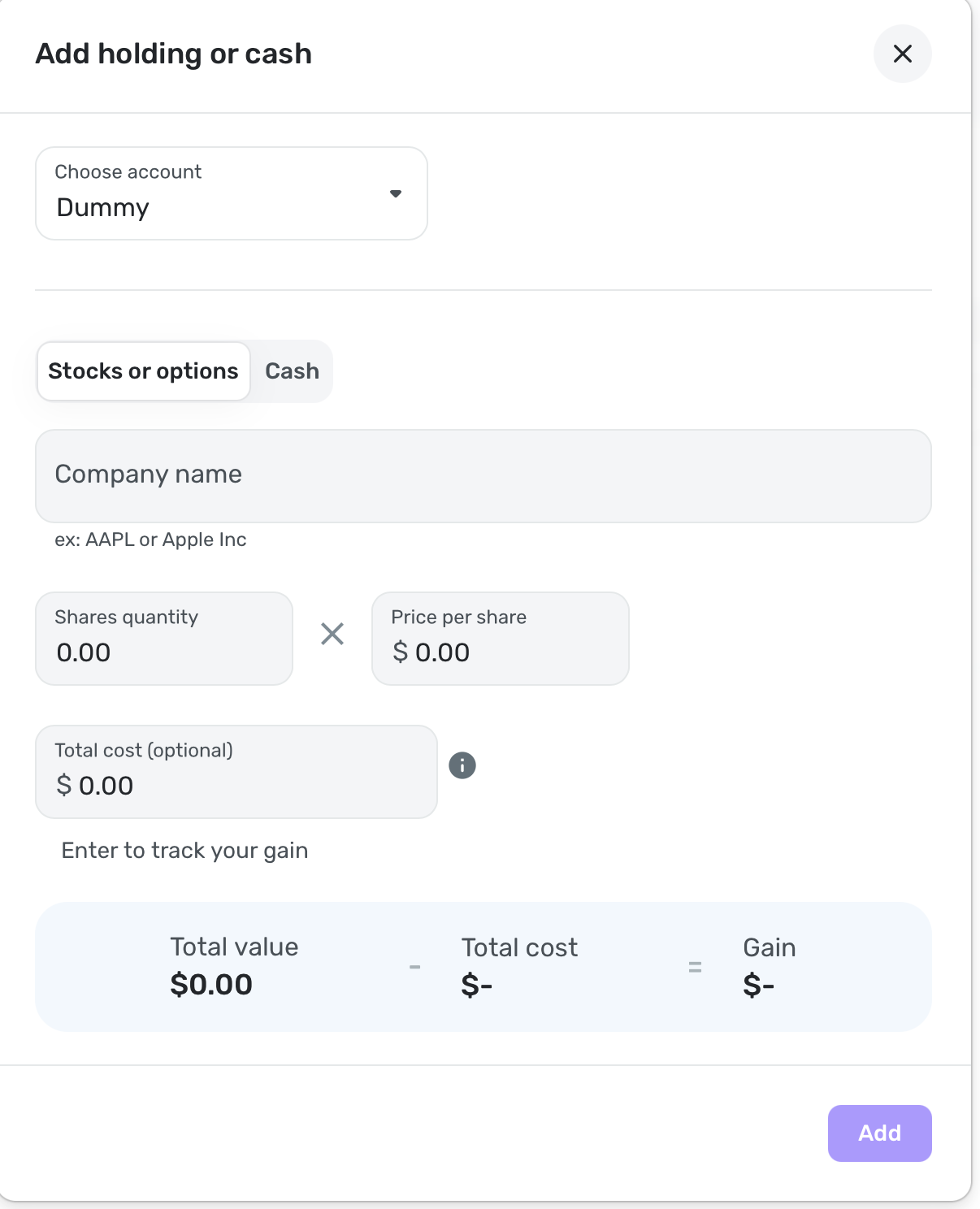

But you could add a temporary holding or cash amount I think? In a manual account, when you make a transfer, you would have the change the holding yourself whether it be Cash or a Fund. Even though the prices get updated for you, the holdings don't, right?

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

No response from anyone @ Simplifi support?

0 -

Hello @nrp06,

Thanks for reaching out! We haven't jumped into this thread because we felt that you have received sufficient and accurate information from the other users helping here. I can confirm that investment transactions do not interact with your investment Portfolio or account balances. These are designed to be a behind-the-scenes type of scenario without impacting your actual Portfolio value.

In your case, I would suggest, as @SRC54 suggested previously, to add holdings, not investment transactions, so that it could impact your balance and Net Worth in the way you want it to. More information on how to add/edit holdings can be found in our support article here: Tracking Investments in Quicken Simplifi | Quicken Simplifi Help Center and Tracking Investments in Quicken Simplifi | Quicken Simplifi Help Center

We also have a great idea post you can vote for here that requests the ability for investment transactions to impact manual account balances:

I hope this helps!

-Coach Jon

2 -

How can I add holdings on a specific date, in order to eliminate the artificial bump in investments balance?

0 -

(In case Coach Jon has left for the day), you cannot add a holding for a connected account. I mentioned manual accounts in another post so I may be to blame for that confusion.

As I said earlier, you can add a cash amount in some other account to keep your net worth right. Brainstorming, you could create a dummy manual investment account and add the temporary holding there or just add a temporary cash amount (even easier). Then you could delete this cash, but keep the dummy account at 0.00 for later use when you need it. At least this would keep your Investment Accounts value where they should be.

Probably easier just to wait for your accounts to catch up. I would try to schedule these transfers on a Monday so it is fixed by the weekend.

Edit: I see Coach Jon is here! 😄

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

-

ok @Coach Jon, so how do I fix this? that wrong spike will mess up all reports, return analysis etc.

I'm not worried about net worth. My concern is investments balance.0 -

The only fix is waiting for both sides of the transfer to clear. The other things were just workarounds.

The product is working as designed so all you can do at this point is either make your accounts manual so you can update the holdings when you want to. If you keep them connected, you just have to wait a few days and accept that the reports will be wrong in-between.

Don't forget to vote on feature requests or make one of your own. All you can do at this point is ask for a change in how Simplifi works.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I think you said earlier that changing the dates on the cleared transactions so that both "occur" on the same day didn't help. To me, that indicates that Simplifi is not updating historical balances based on transactions.

An alternative approach (to fix the existing balance spike) would be to figure out what the balance should be for the days where the spike occurs and to import the correct historical balances for those days. This should force the balance for those days to be what it is supposed to be.

This method is discussed in the thread below and in some help articles.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

How can I buy you a beer?

I think you've identified a new niche crypto market … soon to be filled by BeerCoin!

BeerCoin will be a blockchain based, tokenized, NFT compatible, [insert your favorite crypto buzzwords here] DeFi ecosystem allowing fully anonymous transfer of unregulated beer credits across political boundaries.

Investment welcome…

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1