Using splits (multiple categories) in Recurring Transactions (4 Merged Votes)

Comments

-

I do the gross amount for the paycheck and keep up with the taxes and health insurance as planned category expenses.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

@DannyB "I don't think you need to change the recurring deposit series amount from net to gross."

If I create the recurring paycheck deposit using the net amount it seems to throw off the "available" and "per day" amounts in the Spending Plan. Here's what I mean:

For simplicity, assume that the only transaction in the month is the deposit on the 15th of a paycheck with gross=10,000, withholding=1,500, and net amount=8,500.

Using the net amount, I would create a recurring transaction for the 15th of the month called "Paycheck" for a deposit of 8,500 and a planned spending expense called "Withholding" of 1,500 (as you suggested earlier). Prior to downloading the transaction on the 15th, the "available" amount will show 7,000 (reflecting the 8,500 minus the 1,500). But after the deposit comes in and I split it to show gross income of 10,000 and withholding of 1,500, the "available" amount will suddenly change to the true amount of 8,500.

And when I look at the spending plan for any future month, the "available" amount will again be off by the same 1,500 for the same reason. Which makes things look bleaker than they are.

@SRC54 "I do the gross amount for the paycheck…"

Does that cause any problem with automatically matching the recurring transaction to the downloaded transaction from your bank? (I'm planning to do the same as you and want to know what to look out for.)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)3 -

@DryHeat I am glad you asked this because I probably should clarify what I do.

My wife's recurring retirement check is for the gross pay. Let's say it is $5000 dollars. The net ends up around $4300. When the transaction comes in, Simplifi connects it (I had to manually link it a few times but with some fiddling, it now matches). I then do a split where I change the $4300 Income back to $5000 and subtract Health Insurance and Federal Tax. She doesn't have to pay FICA or State Income tax any longer.

The deductions will end up as Other Spending unless you do what I do and have Planned Spending categories for withholdings and another for Health Insurance, which I have set in advance to take the $700 into account.

For my Social Security, it is simple, I have a reminder for the gross and only have to split it for Medicare payment, which is in a Planned Spending category for Health Insurance.

Oh and BTW, I do "limited range" matching in the recurring and it seems to work ok.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I tried your method (recurring paycheck at gross amount, Planned Spending for deductions). But the deposit transactions always fai;ed to match the recurring transactions. (Perhaps because the gross and net are over $1000 apart.) So I end up having to manually link the transactions and then — like you — split them to match what is in Planned Spending.

So I fell back to making the recurring transaction for the net amount (which always matches the download). After the match, I split the transaction — setting the income to the gross and adding sub-transactions for the deductions (which then show up in Other Spending in stead of Planned Spending).

Either way, the Spending Plan status both before and after the transaction downloads correctly reflects how much I have available to spend. But this way I don't have to maintain Planned Spending amounts matching the deductions or manually match the transaction. And I'm lazy.

This whole issue would go away if we could have recurring split transactions, but that's another story…

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

This whole issue would go away if we could have recurring split transactions, but that's another story…

Yep. Don't give up on their matching. Mine do now, but didn't at first. Make sure that you have a rule for the Payee. And it's only once or twice a month. @DryHeat

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

I have two different bills (home insurance and auto insurance) coming out in the same payment. I'd like to be able to categorize them separately somehow? I want the site to recognize when my payment of say $200 comes in from that specific payee, that $150 of it is categorized to my home insurance category and $50 is auto insurance for example. Or a way to split the bill category so it recognizes it and splits it automatically

4 -

I have moved back to "Quicken Classic Business & Personal", because it is NOT the same product, and not the same processes being used by the online "Quicken Business & Personal"

It would be better called "Simplifi for Business & Personal", that alone would have saved me 100+ hours of labor.

1 -

Still nothing on this? :(

6 -

this is what i'm talking about, this issue was mentioned in 2019. Ridiculous that it's been nearly 6 years…. Simplifi needs to seriously figure out its dev bottleneck.

4 -

This request has 326 updates and was last updated over 3 years ago!!!

6 -

I want the system to automatically SAVE and SPLIT reoccurring (split) transactions so I don't have to do it manually each month on reoccurring transactions.

8 -

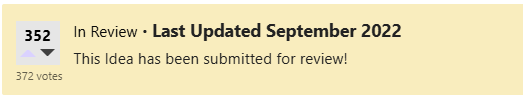

I have to admit that this was one of the first things I expected to find in Quicken Simplifi when I first subscribed back in January 2022 and was surprised by its absence. I added my 👍vote to this request when I first came across this post shortly after joining this forum. Seeing this feature request go into review later that year in September when the vote count was at 103 👍 (out of 105) led to an expectation that the feature would be forthcoming. Today the vote count is up to 333👍 (out of 351) and counting and the request remains in "review."

Now, I am a procrastinator. One glaring piece of evidence as to how badly I procrastinate: in my personal library I have two- and one-half shelves filled with books on the subject of procrastination and those who practice it, and I swear, I'm going to read every last one of them… One. Of. These. Days!

This feature has been requested in this forum with plenty of support and comments, since 2019 when QS was in Beta. This request went into review in 2022 - three years after it was first mentioned. And here it is another 3 years since this request was submitted for review and still nothing has happened to bring this feature to the user base or even to let the user base know of any progress (Not blaming our amazing Coaches for this, they only know what they are told and remain in the dark with the rest of us),

At any rate, this is some master class procrastination!

Here's to hoping that spits will be added to recurring transactions… sooner rather than later (though in this situation one must wonder about what "later" could mean).

Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer8 -

Yes. I want my insurance payment to split between home and auto.

This feels like a basic function. I'd love to understand why it's been difficult for the product team. There's also a similar request here to upvote:

https://community.simplifimoney.com/discussion/1884/ability-to-split-categories-in-category-rules-edited

6 -

I agree that this a basic functionality that should have always been included. I can see some difficulty for how to handle when amounts are variable and the reoccurring transaction definition total doesn't match the actual transaction total. But there are ways to deal with the matching. Please implement this feature.

2 -

This would save a lot of time for paycheck splits, and mortgage payments with PI&T. Quicken Classic for Mac does a good job at this. Would love to have it here.

2 -

This suggestion has already been submitted for consideration. We've been asking for this and we hope soon to get it. Thanks.

[removed link to merged thread]

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

We have recurring transactions that each month I have to split to several accounts. It would be a great benefit/time saver if Simplifi could do this for me each month.

1 -

I've been using Simplifi for about two years. We have a retirement annuity (with tax and health insurance deductions), Social Security benefits (with Medicare deductions) and a mortgage (with PITI splits). Except for the mortgage, the income deposits have the same amounts for the splits for an entire year. And although the mortgage splits change from month to month, it would still be easier to edit the splits rather than to create them. It's long overdue that Quicken/Simplifi should have the functionality to make these recurring splits.

3 -

I agree with this. Also. When the transaction. Is flagged or marked reviewed,the splits are marked the same no matter which type of account.

Dick Davis

Wanting to Migrate from Quicken Classic Premier to Simplifi

1 -

I've been waiting a long time for this as well as the other commenters here. I have written before too. Cajoling the folks at Simplifi seems not to work for this request (which should be a logical item any financial software).

[removed - disruptive]

3 -

I have a process question. I think the answer will help me (and maybe others) understand where things stand with this and other requests/suggestions.

When I see a banner like this on a request, does the "Last Updated" date mean that the idea was submitted for review in September 2022? (I have always understood it that way, but now I'm not so sure.)

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)1 -

@DryHeat, correct. That date is the last time the status was updated, and the status at that time is that the Idea was submitted for review. 🙂

-Coach Natalie

1 -

@Coach Natalie I imagine it has gotten a lot of votes 'since' it was submitted for review, 3-ish years ago. Is there a way you or @Coach Jon could re-flag the issue for further/updated review, or consider it for a priority bump?

This one seems to be one of the bigger vote getters here, and might help keep some users longer. I feel like this should be easy, but since matches aren't exact, maybe it should always add/remove the extra/missing amount from the last split(s) and/or proportionally add/remove the extra amongst all splits if it's not an exact match.

—

Rob Wilkens

4 -

No. What he was asking was, does that mean that the idea was submitted for review IN September of 2022, or that it already HAD been submitted for review at a date PRIOR to September of 2022.

(The answer being, by the way, that the idea had already been submitted for review quite a while before September of 2022.)

You didn’t think you’d get away with that one, did you?

4 -

Agree with RobWilk, can someone provide the community an update. A 3yr review period doesn’t instill much confidence that Quicken is treating this product as a serious priority.

4 -

It's hard to tell how priorities are assigned in Simplifi development.

QBP recently added a Mileage Tracker. Maybe I missed a post somewhere, but it appears mileage tracking was proposed about 9 months ago and has a total of 5 votes and 4 comments. (See post linked below.)

In contrast, Splits in Recurring Transactions was proposed 6 years ago and has a total of 359 votes and 6 pages of related comments.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)3 -

[removed - accuracy] but that has been blown out of the water.

Dick Davis

Wanting to Migrate from Quicken Classic Premier to Simplifi

0 -

I assume it is because of the programming in Simplifi that would necessitate a total rewrite of reminders. But boy is it needed. Quicken Classic has it. We needs splits, paychecks and ability to one-click a reminder into a transaction.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)4 -

I'm new user to Quicken Simplifi, but a long time user of Quicken Classic and decided to switch to Quicken Simplifi mainly because it connects to the Apple accounts in Apple Wallet.

However, I have just discovered that Quicken Simplifyi doesn't accommodate category splits in recurring transactions. This is a non-starter for me. As a retired person, I have multiple recurring income sources, each with their own recurring deductions, and I also have recurring bills that have recurring category splits.

It would difficult for me to accept that I would have to spend time editing each of these transactions every month to properly categorize their associated deductions and expenses.

Unless the Quicken Simplifi Team has a near term solution for this issue that appears to be outstanding for quite sometime, I will have to return to using Quicken Classic until something can be done.

4