Retirement Planner: Share your feedback here!

The Retirement Planner is a new tool for Quicken Simplifi where you can explore different retirement scenarios and plan for your retirement. The Retirement Planner is being rolled out to Early Access in stages and has been released to a small percentage. For those who have access, you will see a new tab in the Savings Goals section!

We want to hear from our Early Access users! Please share your feedback, issues, concerns, or suggestions by commenting below!

UPDATE 5/22/25: The Retirement Planner is out of Early Access and is live to all users on the Web App!

-Coach Natalie

Comments

-

I just checked, I don't yet have access to this. I will note that I've been on a kind of retirement since my 20s (SSDI). Still, I would like to experiment with a tool like this if I had access, as I did with the original Quicken Classic years ago.

I have a minor problem where to keep medicaid, I have to keep my assets below $20k, and medicaid (combined with Medicare) has paid for a lot. For exaxmple, in late October, I went to an ER and I think the bill was like $15,000-30,000 - and the sleep study i did last week was like $12,500 (and that's only part of the process). For both of these medical events, I paid $0. Plus with medicaid I only pay typically less than $2 for any prescription (to put in perspective, for a short while this year I was on a drug that cost $4000/month+ normally). It pays to keep my assets low, in other words.

-Rob

—

Rob W.

0 -

I checked today and I do not yet have access to this. Will it be available under investments, reports, or some other area?

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

0 -

-

I think this is a good first step. It's obviously pretty basic, but I like the option to see the results in inflation-adjusted dollars. As time goes on I'd like to see more specific inputs, like pension and social security, the ability to set an inflation growth rate for both, and specific spousal inputs. I'd also expect to see data populate automatically from Simplifi, like our other assets (home, etc) and expenses.

2 -

The Retirement Planner has been pushed to all of Early Access!

-Coach Natalie

1 -

The new Retirement Planner is now live for all early access users. Sweet.

When I noticed the tab yesterday on the Goals Page, I took a bit of time to fill in the data and make appropriate adjustments to the variables and criteria fields. Yep, it looks like the Mrs., and I will run out of years before we run out of moola… all things being equal of course.

As @mikeeB observes this is a pretty basic tool as presented.

One observation from first impression: Since I don't have my retirement accounts connected or manually set up in QS I don't know if that account data is automatically imported into the Planner. I didn't see anything that suggested it was, nor did I see any option to select or designate which accounts to pull data from to be included in the Planner nor was I "invited" to connect to my retirement accounts if not currently present in QS.

For those with connected or manual entered retirement accounts, I imagine this question will come up. Personally, I would expect this to be one of the first upgrades of this feature. I would be less or even unlikely to use this feature if I have to manually add up all my retirement savings and investment accounts in order to keep the Planner up to date over time.

Ditto to @mikeeB "

As time goes on I'd like to see more specific inputs, like pension and social security, the ability to set an inflation growth rate for both, and specific spousal inputs. I'd also expect to see data populate automatically from Simplifi, like our other assets (home, etc) and expenses."Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0 -

I am happy to see a simple retirement planner! Thank you!

My retirement accounts are in sync with Simplifi so why would they not automatically update with the retirement planner? (My accounts are already listed as "IRA" or "ROTH IRA" and the only one that is not auto-detectable is the 403-B where I make after tax contributions and my employer matching is with pre-tax contributions. Simplifi would not be able to tell what portion is pre and post tax. I would assume that Simplifi would treat a 401K or 403B as pre-tax with the ability to edit the totals or percent.)

Why does the Retirement Planner NOT save other demographics that I enter like Age, Retirement Age, Life Expectancy, Annual Living Expenses, Annual Retirement Income, Returns and Tax Rates?

There are things that I would love to see in the Retirement Planner: First is the ability to specify a time frame for select incomes or expenses, like the start date for social security which is not the retirement date in my case. Someone may have a mortgage for only a few more years and then expenses may change drastically once the home is paid off. In the case of married couples, the social security income will change drastically when one person dies so they need to know that they can live off of the survivor benefit alone. These are all financial events that have different time frames through retirement. In addition to the growth of assets, I would like to see the monthly "income" vs. expenses. Lastly, I think that a retirement calculator should show the figures in monthly terms rather than annual terms as this is a mind shift in retirement.

I hope some of these are already on the drawing board for a future improvement.

Lots 1-2-3 (1984-1988)

MYM (Managing Your Money by Andrew Tobias) for DOS (1988-1994)

Quicken for Windows user since (1994-2024) (Still wanting to IMPORT!)

Simplifi by Quicken since (2023-Today)2 -

Appreciate the initial scope of the new tool! Lots of potential here. Couple of thoughts:

- Near-term: It would be nice to be able to have the manual entries we make get saved, so we don't have to re-enter everything each time. Today, it doesn't een

Future desirable enhancements:

- As others have noted, in the future, being able to select our accounts to map into the tool in the correct area(s).

- Clarifying what the entries mean will be helpful…..in other words - when I enter my expected expenses in retirement - should that be using today's dollars, but then clicking "use inflation adjusted" in the chart applies the rate of inflation I've entered? Or - do we start with the inflation adjusted expense number?

- Automatically pulling in Social Security estimates from the Social Security Dept would be helpful.

- Allowing more refined assumptions for income during retirement would be nice. For example - allowing additional income for a specific period of time - like: Person retires, but doesn't take social security right away. Or person retires, but works part time for the first XX years in retirement, then claiming social security.

- Allowing more refinement in expected expense numbers will be critical. For most people, retirement expenses will likely have a "bathtub curve" in which they spend more early in retirement when they are healthy enough to travel, then a bit lower as they age-out of traveling and high-dollar entertainment, and then higher at the end as medical expenses and perhaps nursing home care are needed.

5 -

As a user of dedicated retirement planning tool to help model whether I'm "on track" for retirement, I'm excited to see Simplifi dip its toes in the retirement planning waters.

Lots of potential for this to be built out into a valuable feature! Some initial feature considerations that would help it grow into a lightweight but still effective planning tool:

- Save user inputs. I input my data a few days ago but it's now reset to default values. Having to reenter data every time I want to tweak the model and check progress puts me off of using it entirely.

- Allow the user to select specific accounts for automatic balance tracking. My retirement savings include a mix of dedicated retirement account types like 401k & Roth IRA and other account types like a specific brokerage and savings account. I'd want to be able to select which specific accounts to include for automatic tracking toward the Retirement Planning balance.

- Allow the user to specify % of a specific account that is pre-tax vs. post-tax. As another user pointed out, many 401ks report only the total balance without breaking down the proportion of Traditional pre-tax vs. Roth post-tax assets inside that account unless you dig for it in the provider site (Fidelity certainly doesn't make it easy). This would also improve projections for Brokerage accounts - if we can estimate how much of our brokerage assets are post-tax principal vs. unrealized gains, the models could be greatly improved. I'd periodically update the %s for each account to match the latest breakdowns.

- Better guidance for inputs. Is "income in retirement" entry supposed to be exclusive of any retirement account withdrawals, only capturing supplemental income like Social Security, part time work/hobby income, etc.? Also, more explicit guidance around what fields to enter in today's dollars vs. future dollars would be helpful.

- More granularity around expected expenses in retirement. As others have rightly noted, just entering in a flat $ value for expected expenses across multiple decades of retirement is much too generalized to make the output models useful. Without going to an extremely granular expenses-and-dates-applicable degree that other purpose-built retirement modeling tools offer, to make this Simplifi Retirement Planner even moderately useful for projections, we'd need to at least be able to enter an annual expense estimate for each year in retirement.

- Say I expect a 30-year retirement - being able to enter a different expense $ total for each of those years allows me to better estimate expenses corresponding to life stages and events: higher annual expenses during the first X years in retirement until my mortgage is paid off and while I'm traveling during early retirement "go go" years, followed by lower expenses for subsequent "slow go" years where travel tapers off, and finally sharply increased expenses in my final "no go" years where higher costs of assisted living and medical care enter the picture. Giving the user the ability to tailor annual expense inputs for their retirement duration is a lightweight and customizable way to approximate the changing expense needs for their specific life events and retirement plans.

- Ability to factor in expected catch-up contributions for retirement accounts. Would be great to set in how much additional we expect to contribute during catch-up contribution-eligible years (50 → user's set retirement age) separately from the regular annual contribution field. For users with longer runways to retirement, only being able to set a flat annual contribution rate (rising by X%) across decades leading up to retirement doesn't capture the potentially large impact of being able to save extra during those specific catch-up contribution years from 50 on.

Cheers, K.

5 -

While I like having this feature, I feel there needs to be some clarifications on the main part of this, what does the following 3 things mean:

- Hight Estimate

- Expected Net Investment

- Low Estimate

More importantly, how are these calculated, what model type is being used (ie. the Monte Carlo method).

This makes a huge impact on how someone would interpret the data.

4 -

I would like to be able to add all of my accounts that i have a 401k tied to instead of just one general account. Would love to see a feature for children 529 accounts as well

0 -

All of these thoughts, especially the one related to automatically using data already in Simplifi.

TiggerTrainer

Quicken Simplifi user since January 2025

Quicken Classic (Premier) user since 2004 - 2025 (21 years)

1 -

I agree with the post above.

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

0 -

I'd love to be able to lock in personal goals and milestones within the retirement planner.

1 -

Coach Natalie,

Great first start! Can you add the ability to place "one-time" events (with dates) into the analysis, both an income or an expense? Most other planners have this ability - Fidelity, Wealthfront, Empower, etc.

These events would be things such as:

- Inheritance

- Lump sum payout such as business sale, deferred income, sale of asset

- Car purchase in retirement

- Annual vacation in retirement

- Home purchase in retirement (with cash)

- Cash proceeds from Asset Sale

- etc.

0 -

Nice simple tool. Great start. fyi, my entries are being saved.

Some thoughts.

Current Investments: Allow to select accounts to contribute towards Current investments (image below), so that they stay up to date. But this means the Investments section of QS needs to be more robust than it currently is. QS currently has some transaction duplication bugs. But here would be a nice way to tie a "simple" investment feature to Retirement planning. The ability to change this manually is still needed unless 100% of QS uses have linked 100% of their investment accounts. I guess you could have two input boxes. "Linked investments" and "other investments" manually entered.

Annual Living Expenses: It would be nice is to show the last 12 months of spending. Maybe a check box in Settings to allow "Annual living expenses" to pull the total from last 12 months. Unchecked would allow for manual entry. Here is a mock of what it might look like. Red text is used to show new info, it doesnt have to be red in execution.

Future based events: To address some of the ideas about "one time" events, it would be nice to link a given Savings goal to Annual living expenses. Unfortunately, I do not use savings goals as it lacks some features like this one. But this would be one way to capture a planned purchase of a Car for instance.

Planning income might be nice per @NavyGolf. To stay consistent with the idea of planning tools, maybe an "Income Goals/Planner" could be part of the Planning section in QS. These could link to future income events that you are planning, e.g a sale of a house.

If a Planned Income section were to exist, in the Retirement tool, it could look like this where "Recurring annual retirement income" are relatively set items, like Social Security, a Pension, etc. Then "Planned Income" is based off the Income Goals/Planner.

my 2 cents.

4 -

It's nice, but until it utilizes data already synced with Simplifi, I don't see any use for it. I would like it to use synced data but then allow overrides for each input with a manual entry to do "what if" scenarios.

I don't have any other wants for an integrated retirement planner.

0 -

Thank you all for the feedback!

-Coach Natalie

0 -

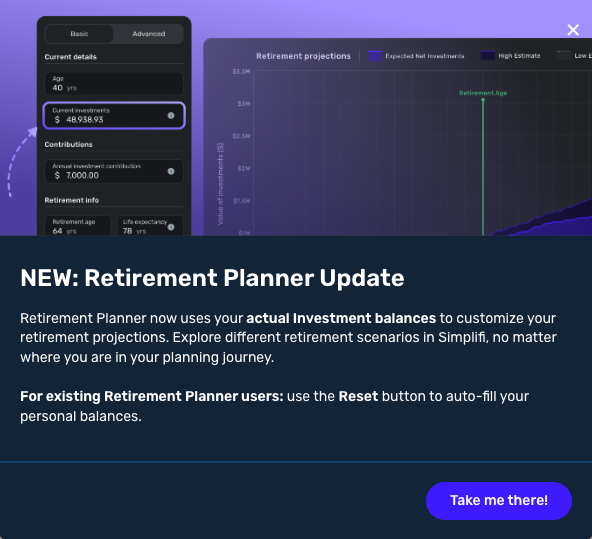

Retirement Planner Update – Now Using Your Real Investment Data

The Retirement Planner is still in Early Access, but it just got a major upgrade that we’re excited to share!

Starting today, the Retirement Planner will automatically use your actual investment data from within the program to build your plan—no more relying on generic, pre-filled numbers. This means your retirement projections will now be based on real-time, personalized information, making it easier to plan for different scenarios with greater accuracy and confidence.

Important Note:

If you're an existing Retirement Planner user, you’ll need to use the “Reset” option to start fresh and ensure your plan reflects your current account balances.This update brings you:

- Real-time planning based on your real investments

- More accurate retirement scenarios

- Less manual input, more insight

We hope this update makes your retirement planning smarter, faster, and more personalized than ever.

We'd love to hear from you all on how this change enhances your use of the Retirement Planner. Let us know by commenting below!

-Coach Natalie

2 -

Hi @Coach Natalie, thanks for the update. Auto-updating balances is a nice step forward, but there are a couple more essential features of this functionality still needed to make it accurate/usable for me. Perhaps the team can revisit these as enhancements (more details in my earlier feedback post):

Allow the user to select specific accounts for automatic balance tracking. My retirement savings include a mix of dedicated retirement account types like 401k & Roth IRA and other account types like a specific brokerage and savings account. I'd want to be able to select which specific accounts to include for automatic tracking toward the Retirement Planning balance, and conversely, exclude some accounts that should not be included in projections because they're earmarked for short-term upcoming spending purposes, not long-term retirement savings.Allow the user to specify % of a specific account that is pre-tax vs. post-tax. The current auto-calculations don't show what's being factored into the pre- and post-tax buckets, so we're left guessing if Simplifi's allocated everything right (for example, is 100% of a brokerage balance being included in post-tax, while 100% of a 401k account is in pre-tax?). For most of us, unrealized gains in brokerages and a mix of Roth 401k/Traditional 401k divisions within a single 401k balance number make this landscape much less cut and dry, leading to inaccurate projections from the current auto-assignment. If Simplifi can't get this granularity of data from the source financial institutions to calculate those cost basis & Roth/Trad breakdowns, I'd at least want to estimate the % of each account that's pre- vs. post-, even if it's a manual exercise.

Looking forward to seeing more work done on this! For now, I'll keep manually calculating to factor in only the specific accounts that are for retirement & the current pre- and post-tax breakdowns.

0 -

I second the comment above. Then only projection makes sense.

0 -

Natalie,

Great start on the automatic feed of values. I did notice that it only brings in "Brokerage" and "Investment" account balances. Any Savings or Checking is excluded from these two buckets. I would recommend that a "Banking" balance box be created to factor in. In our current state of High Yield Checking/Savings accounts, I would assume that people have non-trivial amounts of money in their Banking accounts which would be significant in their Retirement Planning.

1 -

The great data from the Simplified made it painless to get Started with Boldin. Which led me retire 4 years early.

Anyone else have some thoughts on Boldin?

0 -

The Retirement Planner is out of Early Access and is live to all users on the Web App!

See our official announcement here!

-Coach Natalie

0 -

Regrettably I don't see much value in the retirement planner. FICalc (https://ficalc.app) and plenty of other free options give more transparent analysis.

I'd rather the development team spend their effort on implementing TOTP MFA or fixing the renaming and categorization bugs.

2 -

Hello, feedback- I would like the option to exclude educational/529 accounts from the planner automatically. These accounts are for my children and have nothing to do with retirement and are not classified under retirement in the main simplifi view but for some reason the balances are included in the retirement planner

1 -

I agree with others on this thread. This feature is nice to have but I will prefer to get complete CSV exports for cash transactions with check numbers, averages in reports, and investment transactions exports and imports. I have upvoted and commented on the relevant requests.

Simplifi User Since Nov 2023

Minter 2014-2023

Questionable Excel before 2014 to present

0 -

In addition to what @UrsulaA desires, since my Investments transactions creates issues with my Spending Plan, I have deleted all my Investment Accounts, hence making any retirement planning a non starter. IF QS were to configure Investments to reflects balances only and omit transactions, then if anyone else is having Investment transactions issues, a Simple Balance feature might work as well.

The Simple Investments discussion

and the discussion that covers duplicate and mislabelled Investment transactions

1 -

It looks quite nice! One comment above about bathtub curved retirement expenses was also my only suggestion. It does seem to save my input, contrary to the experience of some posters. Thanks to the team for adding this.

Long time Mint user jumping into Simplifi-world!

0 -

The retirement planner should allow for adding in one other person (your spouse) to make it make sense to me.

0