Good and Bad after a month of using

Hello -

I've been using Simplifi for a month and here is my initial feedback. I have 2 checking accounts, 3 credit cards, mortgage, 1 investment account and several retirement accounts. I think, quite common setup.

The biggest thing I wanted to have was to see all accounts in one place. I was able to do that, with most accounts linked automatically and 2 set up manually (1 pension account, and mortgage). I also contacted support a few times, and with one exception, staff was knowledgeable and helpful. Calling yourself couches feels a little annoying. I am Comp Sci Professor, but I find introducing myself as Professor Felix comes across condescending.

Finally, I am GenX and probably some features resonate better with younger audience.

With that introduction, here are two main things that I don't like. First, most of the applets on the dashboard are absolutely useless. 5 spending applets, Savings, Achievements - all look like coming from computer game or high-school class project; not from real financial program. I may be totally wrong, and maybe other people love them - so my real problem is that I can't remove them from my dashboard!

Second terrible thing is that I can't save parameters on my report. I found most useful report - net worth for my "liquid" accounts - that is, banking and brokerage. Whatever I have in retirement or mortgage doesn't matter - I can't use this. I can create such report (although, I can't use Category; I have to list individual accounts) but when I come to that report tomorrow, all settings (date range and filter) are gone. There are some annoying limitations in the chart itself; but I can live with those as long as I could save the settings.

These are high-priority limitations for me. If those were fixed, I would love to have this "favorite" report right there on the dashboard.

I also came across half-dozen medium priority limitations. Happy to share those, but I don't want to waste time if they are going to end in "thank you for your feedback" bucket.

In summary, I would give the program 3 stars (of 5); but with relatively low price maybe I shouldn't expect more.

Comments

-

I enjoyed reading your post. Your complaints are common ones shared by many, and probably most, users here. Please peruse through the Feature Requests to add your votes if you haven't already.

Here's a couple:

.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I saw both of these issues in feature requests (that's why I was sure it wasn't me unable to find the way). However, I don't see any progress on either of them. Which also discourages me from spending time to describe less important limitations - if Quicken doesn't have time or resources for high-priority enhancements, what are the chances that they will pay attention to others!

0 -

Well, some of them are under review. The more who vote and comment, the more likely it will happen.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

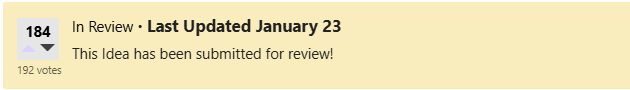

It looks like the "Saved Filters in Reports and Registers" suggestion has been "In Review" for 2.5 years. I realize that is not very encouraging, as this suggestion has lots of support and new requests for it are frequent. We can always hope that it will rise to the top of the priority heap, but I don't think anyone commenting here has much insight into how the development team prioritizes things.

Personally, my guess is that a lot of development resources were consumed to enable the recent release of Quicken Business & Personal and broaden the potential new user base. My hope is that, now that they have done that, they may be able to get back to issues that current users need to see addressed.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)2 -

@DryHeat - I've been in software development for 35 years. This for me seems like a critical product defect; and obviously, many other users agree. It says a lot about the vendor (lack of resources, misplaced priorities). I signed up for a year (as I said before, having all accounts in one place is the main reason I use it), but if I find anybody else better, I will switch in a heartbeat. Goes way beyond hope.

0 -

It is difficult to fathom sometimes why these things take so long.

I think the name Simplifi says a lot. Quicken designed this program to be fast and fairly light and without all the bells and whistles of the often slow and ponderous Classic. I think their attitude is that the target customer for this program doesn't need to print or save nice reports.

I know that is generally true for me although I would like from time to time to send a report by email to my wife, and this requires that you save it in some form. Simply sending the URL will not work. So I have to say, "come here and look at this". OTOH, she really doesn't care. LOL

In another thread, we discuss why features are missing from Investment accounts. Again, it was designed just to show the bottom line and not to be a tool for investing and analyzing. I agree that now that they decided to bring transactions to Investments, Quicken must bite the bullet and bring splits, check writing, etc. to these accounts. But there is a certain inertia or resistance to doing this. Maybe it is the complications of programming. Maybe it goes against the philosophy of the marketers.

We have asked for splits in reminders, especially paychecks, and this is being considered as well. Not sure why this is taking so long either. I am not excusing them; just trying to understand. Because we all share these frustrations.

I think it has taken a while for Quicken to accept the fact that a lot of Classic users would like to leave Quicken Classic and use Simplifi. I think the price equalization between the programs is one indication that they are beginning to do so. So I expect that sooner or later, they will bring these most requested features to Simplifi.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

@virshu - I developed a number of software products for use by lawyers in high-volume practices. And I agree that one should budget development time so that it is possible to address issues reported by the current user base in addition to adding new features to attract new users.

But some of the existing features (e.g., the Spending Plan) are useful enough to me to keep with with the product, even if improvement in other areas is a long time coming. I have found it more helpful in managing my spending than any other product I have tried.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)3 -

@SRC54 @DryHeat - every software company targets certain marketplace segment. That segment has certain priorities in the features. I just may not be the target audience for Simplifi.

We are frugal to begin with; so we don't need software to create "saving goals". And I know better than to show my wife "spending plan". Sometimes it's better to be happy than right ("Honey, last month our "clothing expenses" category went up 649 percent compared to the same period last year" may lead to a night on the couch 🤣 ). Also, Spending applet in Simplifi has a major flaw, making it quite useless even if I wanted to use it.

The only metric that is useful is "net worth for liquid accounts over time". I would trade any other feature (other than ability to see all accounts in one place, of course!) for this. Or switch to another vendor in a heartbeat.

1 -

I have the same problems with Savings Goals because we too are frugal and save every month, and then splurge once or twice a year (but most would not consider these splurges.) I have tried using the Spending Goals mainly so I can understand users' questions about them, but it just doesn't work for me. I have a recurring transaction from checking to savings at the end of every month instead.

You piqued my interest. What's your flaw in the Spending applet? My main flaws is lack lack of splits in recurring items and the fact that you cannot mark it paid and turn it into a transaction immediately.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

@SRC54 - and speaking of lack of splits in recurring items. One of my medium-priority gripes (I won't switch because of that; but it just may be the last straw):

My mortgage provider (newrez) is not supported by Simplifi, so I have set it up manually. Obviously, I have a monthly payment. It includes mortgage portion that is supposed to decrease my liability; and also interest and escrow portions that don't. I wish I could set up home loan (initial amount, term, interest) and Simplifi knows how much to apply to the loan. I can do it in Excel!!!

Unfortunately, it is not possible and I need to get the amount to apply to the loan manually - from their website, or from aforementioned Excel 😎. And also manually split the recurring payment. If I were Simplifi product manager, I would find this limitation embarrassing. But obviously, I am not 🤷♂️

0 -

Yep, and you cannot set up paychecks. I have a workaround that I keep meaning to share. It is a kludge but works for me in the Spending Plan.

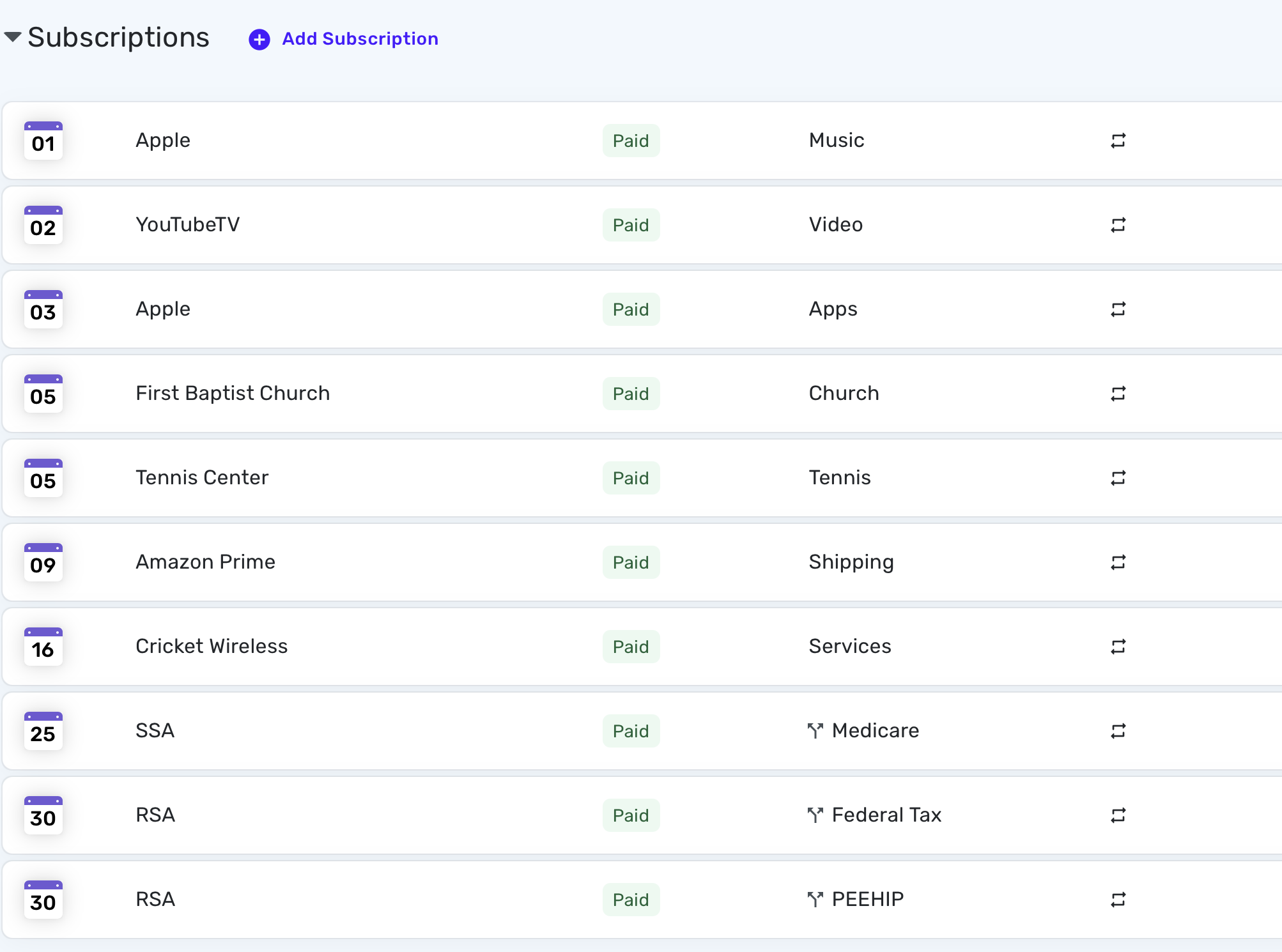

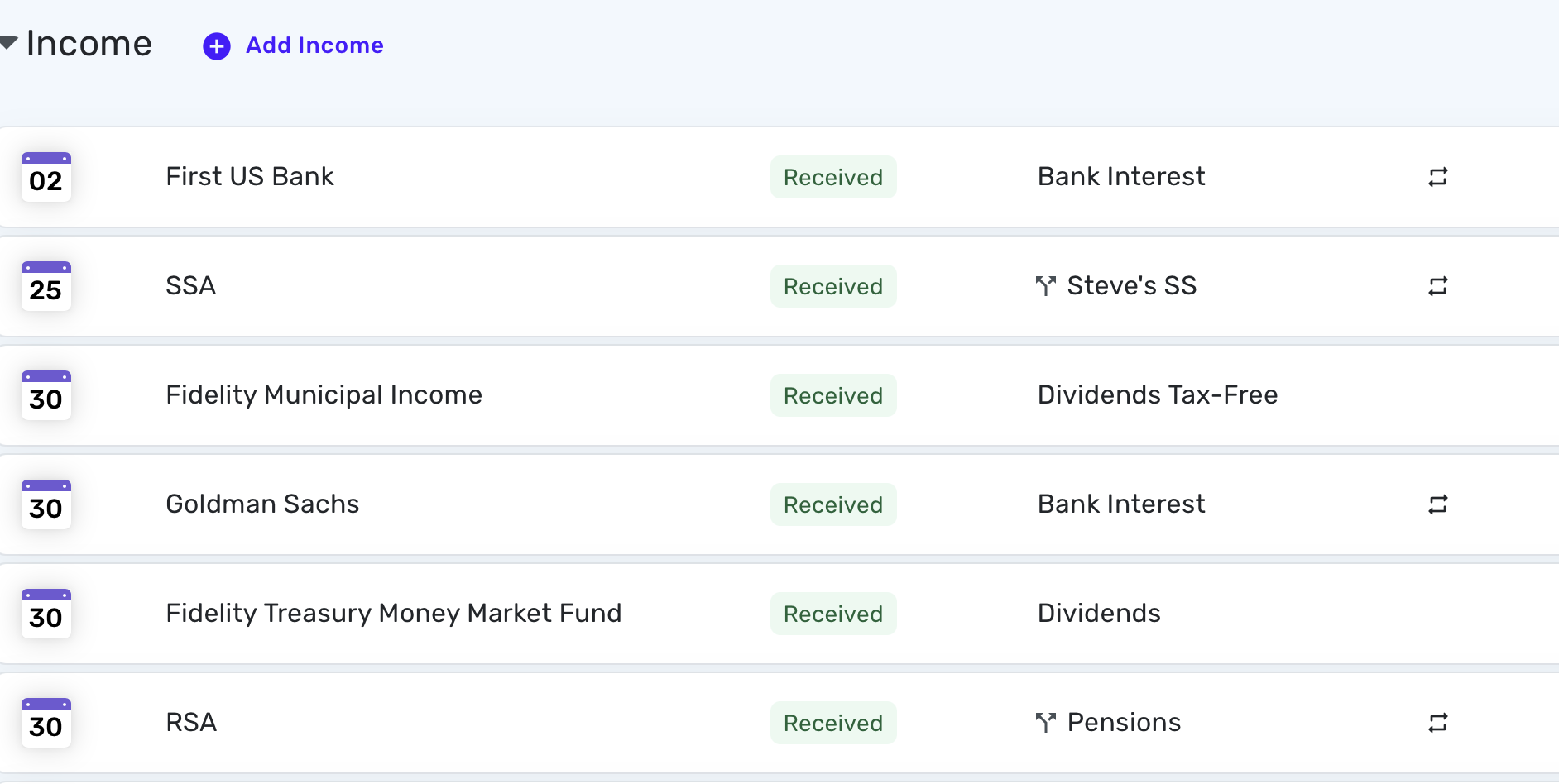

Basically, I have two recurring; one Expense for Withholdings and one Income for the salary (pension or Social Security). When the income comes in, I un-match it from the Income and split it with the taxes first, then health insurance with income last. I then match this to the recurring Withholdings. It keeps the payee name I give it (either SSA or RSA). Then I delete the now redundant unused Income.

Now Spending Plan will show the Federal Tax, Medicare or Peep insurance in the subscription section and the income amount as income (Incomes automatically go into income without a recurring!). Fortunately, Alabama does not tax gov't pensions and unless you have high IRA distributions, they aren't taxed either.

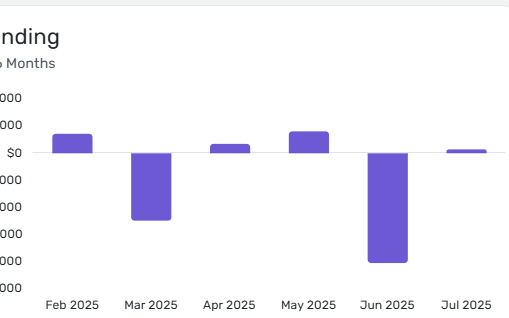

Here are the results (with the sordid coin removed so as not to embarrass myself)

Before I had to used Planned Spending for healthcare and withholdings. Of course, we should be able to set up one recurring income with splits.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

I need to study this; there must be a way to make this work better. If it is showing up as negative spending, you are using a Spending category, right? Can you not make it an income category instead?

My wife's pension is a defined plan so we just get a check every month that I treat like a paycheck. I'll have to decide how to do Distributions from my IRA next winter when I reach 73. But I think it will be straightforward and every cent taxable.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

@SRC54 - you must be a retired accountant 🤣. I don't care about all those details. All I care is net that hits my bank account! Maybe at 72 I'll pay more attention to details 🤔. I am 59, almost eligible for 401K, but not planning to withdraw for several years. Maybe, in few years will retire in Huntsville or Mobile - but for now trying to avoid California taxes.

And as far as fixing the spending applet, I also don't care much because I am unlikely to use it even if it were perfect. It isn't really income - it is rebalancing money across the funds. I see that for few minutes Merryll Lynch move it to "cash" pseudo-fund, and then use that cash to purchase shares of some other fund. It's all automatic, based on some criteria. Not particularly interested in details - I can see that whatever they are doing, got my 401K growth about double S&P rate. That's all I care about.

Speaking of 401K… another annoying observation. Let's say I have $10,000 in bank / investment ("liquid") accounts, and $100K in 401K ("sordid coin" is just for example). Net worth at the top of the dashboard shows $110,000 which is hugely misleading. Because $10K is indeed $10K, but $100K will be much less after taxes. Simplifi knows that these are Retirement accounts. It could ask me for SWAG tax rate (say, 30%) and deduct it from net worth. Not the end of the world - but another sign of sloppy product design.

0 -

I plead guilty. 😎 Retired bookkeeper and retired teacher of Spanish, History, Government and Economics. Took one course in accounting at UA. Huntsville and Dothan are the goto places for government retirees. Huntsville is close to mountains and Redstone Arsenal (lots of Germans and Yankees, but is there a difference?) while Dothan is more for the military types close to Fork Rucker and the beach.

Florida has no income tax at all but oh my those property taxes! DeSantis tried to reform the property tax but Legislature (like Alabama's) loves, loves, loves revenue. Well, I guess this is true of them all.

Don't take Yankee (anyone outside South) comment too seriously. We are way, way over that. 😆

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

The ability to split recurring transactions (for example, for loans or paychecks) is one of the most requested improvements. There are pages of posts on this and nearly 350 users have voted for the idea. But it appears to have been "submitted for review" for almost 3 years. (See discussion linked below.) I have moved on and am using a workaround.

I'm beginning to think there my be something in the architecture of the software that makes this difficult to do. Or it may be that they are wanting to handle this and a different request (that splits be treated in many ways like separate transactions — with split-specific dates, notes, attachments, etc.) at the same time.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)2 -

"I'm beginning to think there my be something in the architecture of the software that makes this difficult to do."

This is my thinking as well.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

The only functional problem that occurs to me is… What do you do if the matching downloaded transaction doesn't equal the total of the splits?

When the recurring reminder has only one value, the answer is obvious; you alter that value to match the downloaded value. That's what they do now.

When there are splits, it's not obvious which split value(s) to alter.

But it doesn't seem too hard to just add one more split with whatever +/- value is needed to match the download, using some built-in category like "Split Adjustment." Users reviewing the transaction could then find out what had changed and make the necessary adjustment in the current transaction and the reminder series. And occasionally searching for "Split Adjustment" transactions would find any that had gone unnoticed.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

@DryHeat Yep, once per year (usually) when the splits change, you have to change the recurring. If you download a transaction that is different, you have to make corrections. This happens with Quicken Classic all the time. Taxes change annually. If you get SS payment, there is a COLA every January and the Medicare payment generally goes up.

In Classic, I change these in advance. But if you don't, you can edit the transaction and the recurring after the fact.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

@SRC54 - I think my post was unclear. You seem to have thought I was talking about what the user does when amounts don't match exactly. I was talking about what Simplifi does automatically. And suggesting how it could continue to act automatically if reminders contained splits.

I have edited my post to make what I was talking about clearer (I hope).

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)0 -

Your assumption of a split adjustment is about right. I would assume that Simplifi's recurring splits would work exactly the way they do in Quicken Classic, where the difference is recorded as either a positive or negative uncategorized expense.

Recurring Paycheck:

$4200 Transaction

5000 Salary

400 Fed Tax

300 Health Plan

100 State TaxSo if you receive a paycheck for $4250, Simplifi would add a $+50.00 Uncategorized Expense to the transaction. You would then need to edit the transaction manually and perhaps edit the future recurring as well. I am pretty proactive with this so it hasn't happened in a while, but I am pretty sure that is how classic handles extra income in this case.

Obviously people who work hourly and whose paychecks change every two weeks would always have to edit the transaction. But it would just be a matter of editing the splits already there instead of starting from scratch.

Recurring Insurance Premium

$1500 Transaction

$550 House

$500 Car #1

$450 Car #2Of course, the premium changes every 6 months and would go up say to $1600 and Simplifi would add a $100 uncategorized expense to the transaction.

But, as I say, I generally get a notice of the new bill and a notice of the new income each year with deductions, so that I shall have already updated the bill and income splits beforehand.

But there are always surprises so Simplifi would handle it as above. Fortunately, most bills are not splits so those increases just get charged to the expense category you've chosen as Simplifi currently does it.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

I am very honored and humbled that my very first post on Simplifi started an amazing discussion between two experienced superusers.

However, in the unlikely case that this thread is actually read by Simplifi staff, I want to point out that this discussion veered to the topics that I did not bring up in my post, and in fact, that are not very important to me 😉

In other words, if I switch to another vendor it will be because of two problems that I experienced; namely, inability to configure applets on the dashboard and to save report settings. Not because of inability to split recurring transactions - regardless of how important it is to many other users.

0 -

Wow - my biggest gripe has been addressed! 🙇

2 -

@virshu Glad for you. Simplifi continues to astound. Sometimes the changes seem to come at a glacier's pace. And then something happens when least expected.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)1 -

I too am pleased by today's feature announcement, but am admittedly baffled at Simplifi's lack of advance notice around it. Hundreds of users have voted on this feature for years, recently conversations like this thread have had users expressing frustration, and yet, zero heads up from the Coaches that Simplifi has been working on this in the background? If it was delivered today, the feature must have been in planning/design and subsequently under development likely for months now, but the main feature request thread still shows the generic stage "In Review."

Coaches, any reason why you weren't able to give the community a heads up that this was in the works? I've seen this happen with a number of feature launches and it has always confused me. I understand not wanting to promise delivery by a certain timeline in case delays happen, but still, complete silence about upcoming features that the community's clamoring for followed by surprise launches doesn't seem like an ideal tactic either.

1 -

Most of the time this stuff comes in Early Access, and so those with that feature turned on can try it out and others learn that it's coming. It appears that this new feature came without early access. My guess: it wasn't too complicated to deploy.

Anyhow, I enjoy waking up to surprises. As long as it's not a nasty one. But no, they don't give warnings. Sometimes you'll see that a feature request is coming but not always.

Steve

Quicken Simplifi (Safari & iOS) Since 2021

Quicken Classic (MacOS) Since 2009

MS Money (1991-2009) and Dollars & Sense (1987-1991)0 -

Even features in Early Access can be missed if you don't go looking for them. I think that if we were told that X feature is on the way and coming within 1-2 months, or some other not-too-specific timeline, it'd get people excited and help show them that their feedback is indeed useful.

In general it would be great to see some kind of timeline of upcoming features that we can look forward to.

Thanks Simplifi for the new features by the way!

2