Recurring Savings Goals year over year/ability to restart Goals (edited)

Comments

-

I am doing the exact same thing and searched before suggesting this myself.

Dan

Simplifi (2024-Present)

RocketMoney (2023-2024)

Simplifi (2022-2023)

YNAB (2014-2022)

Mint (2010-2014)

Quicken (1999-2010)1 -

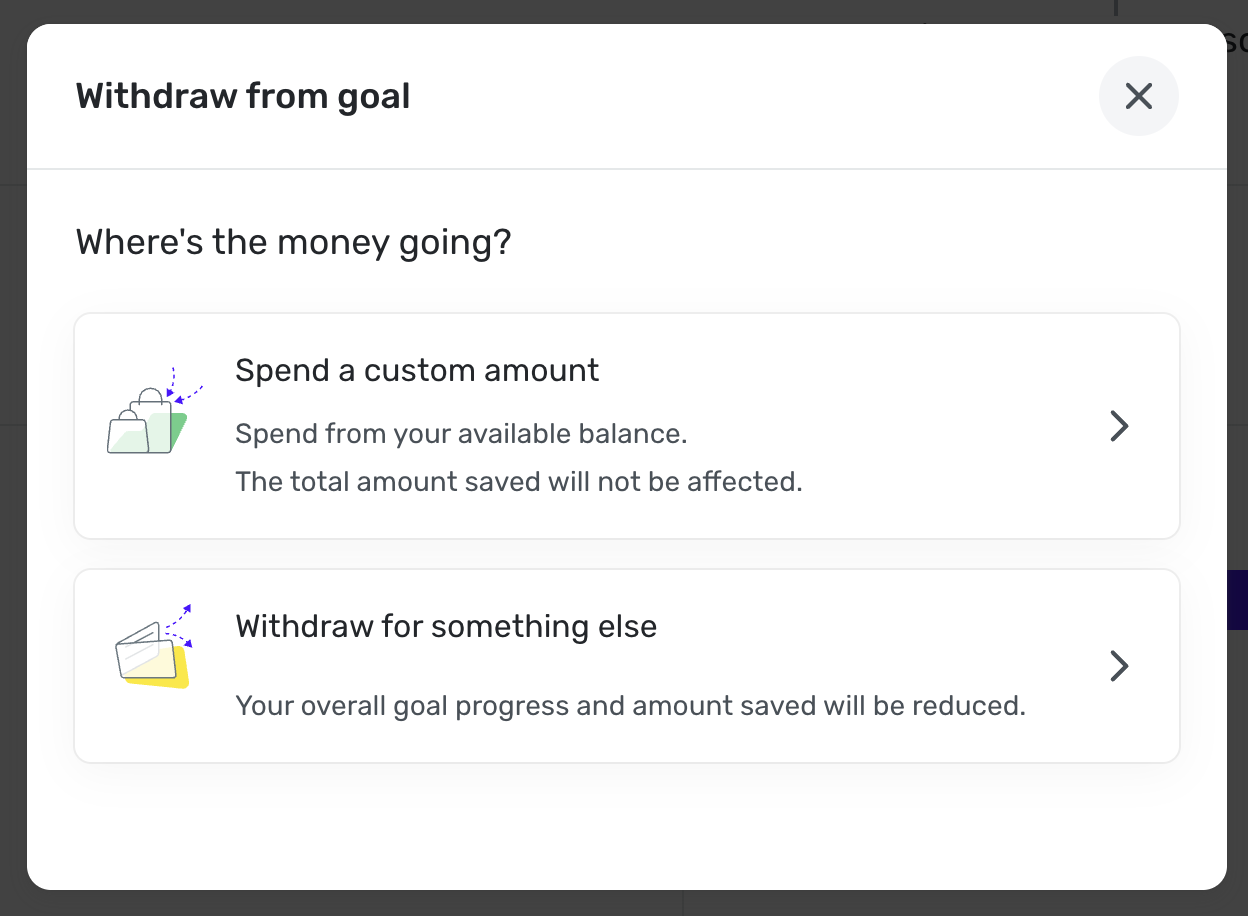

With Savings Goals, you have two options when it comes time to withdraw from your saved funds.

When you select "Withdraw to spend for goal", it shows you the amount of money spent which is nice as a point of reference. HOWEVER, because of what I've documented below, the only thing I can see the "Withdraw to spend for goal" button being useful for is for truly one-off or one-time purchases (Birth of Child #1, Birth of Child #2, 2023 Vacation Fund, 2024 Vacation Fund, New Home @ ___ Address, etc.). I don't see it being all that useful for recurring generic purposes like Christmas, B-Days, New Car, etc. that - once spent - will just be started over again. For those, I see "Withdraw for another purpose" being more useful.

MY IDEA: Give us a way to reset the Savings Goals. That way, we don't have to create a never ending series of Savings Goals that I can't get rid of (ex. Christmas 2022, Christmas 2023, Christmas 2024, Christmas 2025, etc.).

DOCUMENTATION NOTES:

Lets say I save $2,100 annually for something and I've already contributed the full amount for this year. This is what the Savings Goal would look like...

And then, later this year, I "Withdraw to spend for goal" the entire amount...

And then, next year, I contribute the entire amount again...

And then, later next year, I "Withdraw to spend for goal" the entire amount again...

And the following year, I contribute the entire amount again... And so on and so forth year after year after year.The longer you go, the more off the % grows until it just becomes laughable. Also, note that every single screenshot above shows "Goal completed" even though it is no longer completed at the points in time when the Savings Goal returns to an Available $0 balance.

And so on and so forth year after year after year.The longer you go, the more off the % grows until it just becomes laughable. Also, note that every single screenshot above shows "Goal completed" even though it is no longer completed at the points in time when the Savings Goal returns to an Available $0 balance.Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.0 -

OK, I gave this goal reset idea some thought and I'm ready to give it a thumbs up. Until rollover abilities are made available in the spending plan, having the ability to reset and reuse an existing savings goal would be very helpful.

In addition to your reset idea, I would like to also see add the ability to close out a fully completed Savings Goal and then be able to either archive/hide or delete it outright. What I mean by fully completed is a goal that has been fully funded and all funds have been spent.

Right now it looks like you can't delete a fully completed and expended goal without Simplifi releasing the originally saved funds back to the bank account they came from. Over time not being able to close out and archive or delete old goals will lead to an unwieldy Completed Goals Section.

Another thought - if rollover abilities were available in the spending play would the reset and reuse of a goal still be necessary?Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer0 -

That is a great idea @DannyB. @Coach Natalie, could you edit the name of this idea to “Ability to Reset or Archive Savings Goals”?

To answer Danny’s question, yes, I would still want this ability even if/when Simplifi adds the ability to roll over an amount in the Sending Plan from month to month.

I view this as similar to the Watchlist and Planned Sending. Each feature has similar abilities - and you can even get the same exact information from both in some cases. However, I use each one very differently…

https://community.simplifimoney.com/discussion/3012/planned-spending-vs-spending-watchlistIn a similar way, the ability to archive/reset just would make Simplifi that much more flexible to work with. I could choose to handle different situations using different approaches; some using Savings Goals and others using the Sending Plan.

As it stands, I feel that Savings Goals are one of the least developed parts of Simplifi…though they are leaps and bounds better than Quicken Desktop’s version!

I’m looking forward to seeing how they improve over time.Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.0 -

Hello @Flopbot & @DannyB,

I think having the ability to archive completed Goals is a great idea! It sounds a little different than having the ability to reset Goals, though, and I personally think a separate Idea post would be better. But totally up to you guys -- just let me know.

-Coach Natalie-Coach Natalie

2 -

Hi @Coach Natalie and @Flopbot,

I agree that these are two different functions and both would be beneficial making Savings Goals more versatile. I'll go ahead and create a separate idea post for closing out and archiving Savings Goals.

Since these two ideas are related having both to do with Savings Goals, would it be a good idea to include a link in each idea post referencing the other?Danny

Simplifi user since 01/22

”Budget: a mathematical confirmation of your suspicions.” ~A.A. Latimer2 -

For another idea to enhance Savings Goals by adding the ability to close out and archive or delete a Savings Goal see @DannyB 's idea post here:

https://community.simplifimoney.com/discussion/3833/ability-to-close-out-and-archive-or-delete-completed-savings-goals-edited#latest

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.1 -

I am looking for this feature as well. A suggestion for the reset is to make the savings goal be ongoing (maybe a setting) that allows the goal to remain incomplete with a required monthly contribution and the goal % be based on what is available, not including what was already spent. Is there any update on this?1

-

Hello All,

This Idea seems to have fallen stagnant, and due to the age of the request and lack of user votes/comments, will be archived within the next 10 business days.

If you would like to see this Idea kept alive and considered for possible future implementation in Quicken Simplifi, please be sure to add your vote and a comment explaining how this request would be beneficial for you. More details on voting for Idea posts can be found in our FAQ here.

Thank you,

Quicken Simplifi Community Support Team

-Coach Natalie

0 -

This Idea Post is the same as another one; they just are using different words to describe the same thing (restart vs. reset). Could be merged? Jumps the number of votes to 16!

Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.0 -

@MommaCma and @LtDan1912

Specifically because Simplifi doesn’t offer this ability yet, I ended up creating a completely separate Savings Account just for Christmas - my bank sets no limit on creating free Savings Accounts. Any money that finds its way into that account is automatically designated for Christmas. I have regular, automatic deposits scheduled to flow into it.

I’ve been doing this for two Christmases and really like it. The best part is that, because it’s a real world account with Recurring Deposits and relatively few transactions, Simplifi displays a very accurate Projected Balance way out into the future so I know exactly where we’ll be come Christmas.

I still want this idea to be implemented, but in the meantime, this works well.Chris

Spreadsheet user since forever.

Quicken Desktop user since 2014.

Quicken Simplifi user since 2021.0 -

-

To budget for long term expenses such as a yearly subscription, I create savings goals. That way, when it comes time to pay for the large item, I'm able to continue my monthly spending habits without worrying about covering the large subscription bill. Once I've completed the goal and its time to pay the subscription, I would like to be able to withdraw from the goal and start the goal over. However, since the start date is only settable when creating the goal, it causes the goal to be in a weird state claiming I'm months behind.

When editing a savings goal, I would like to also be able to edit the start date for the goal.

I believe the proposed functionality would be easy to implement since the field already exists. I saw a similar proposal but the requested feature there only covered editing the start date when creating savings goals with starting funds and not editing them.

0 -

I am used to creating savings goals for this purpose with the year in the name, but this might also be useful. +1

—

Rob Wilkens

0 -

@RobWilk I'm not a frequent visitor/poster but it looks like my post was merged here.

While I do see the relevance to this discussion chain for my specific use case, I believe the feature I proposed can stand on its own merits separate from this. Editing a goals start date would be useful for any of the goals, not just recurring use cases like mine.0 -

@Aviian, thanks for posting your suggestion to the Community!

I have merged your request with this existing request for the ability to restart Savings Goals. Your request was merged because it's the same as this existing one, and we don't allow duplicate Idea posts in the Community. Your example is a great use-case to add to this existing request that already has 22 votes.

I hope this helps!

-Coach Natalie

0 -

Wouldn't Withdraw for another purpose achieve this? You can already edit the target dates and monthly saving amounts.

By withdrawing for another purpose, you also reset the saved so far amount, so it effectively zero's it out.

Clearly, the verbiage around the Spend for the purpose vs spend for another purpose may need rethought and rewritten.

I recently made a giant confusing mess for myself because I picked the wrong one for withdrawal so it kept the saved so far amount the same.

But in so doing, it does seem like you can reset the savings goal by "Withdrawing for something else" which would drain the available and the saved so far amounts. You can then edit the end goal dates and adjust the overall target amount as well. It's not as easy as a button to do it all and if the amount changes you don't get the same handy wizard you do when you create it to give you the amount you need to based on the target date. But it does seem possible.

0 -

I'm not sure if the following suggestion is all that different from what's above, but…

I suggest enhancing Savings Goals by allowing us to set up automatically recurring Savings Goals.

For example, I would like to be able to create a semi-annual property tax savings goal for a certain amount with a duration of 6 months and have it recur (start a new goal) in November and in May. I could then just adjust the amount each year based on new tax assessments.

The recurrence cycle would need to be flexible to accommodate bi-monthly, quarterly, semi-annually, annually, or even irregular dates.

DryHeat

-Quicken Classic (1990-2020), CountAbout (2021-2024), Simplifi (2025-…)3 -

I really like both the idea of archiving completed (non-annual) goals and also the separate idea of ways to handle ongoing annual goals. For me, I am trying to continue paying ahead once I complete an annual goal.

For example, if I plan a real estate tax expense for 12/2025, but end up completing it early, say in September, I would like to simply continue adding to it and have the “overage” simply apply to the next year. Not sure if there’s a. Intuitive way to do this, so yo-date, I’ve simply been creating a new goal for the new year.0 -

@DryHeat I would love to use Savings goals for Property Taxes, but have found SG process to be either incomplete or needing work arounds. This was back before rollovers were put in place which I now use to save for Property Taxes. It's been a while and am wondering if I should try SG's again. If its easy for you to post, I'd like to see how you set yours up and how you spend for it and what workaround you do to make it recurring.

Using the saved money is confusing too. I've seen people's suggestion on the Withdraw box below, and the wording of "Withdraw for something else" is confusing if i'm withdrawing for the intended goal.

Thanks in advance!

0